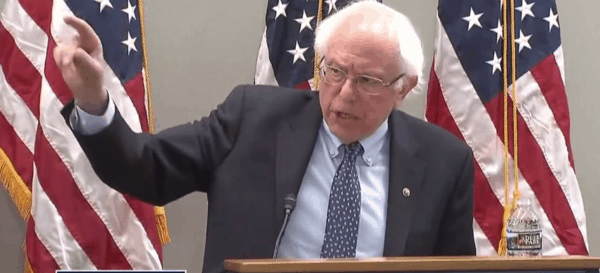

Sen. Bernie Sanders re-introduced the Social Security Expansion Act on Capitol Hill Wednesday

It truly has been an encouraging couple of weeks for Social Security. On January 30th, Congressman John Larson (D-CT) re-introduced his sweeping Social Security 2100 Act. Yesterday, Senator Bernie Sanders (I-VT) and Rep. Peter DeFazio (D-OR) officially revived their Social Security Expansion Act. Both bills (which went nowhere in the formerly GOP-dominated Congress) would boost Social Security benefits and keep the system solvent for the foreseeable future.

At a time when millions of seniors are struggling to stay financially afloat – with pensions disappearing and retirement savings dwindling – these bills are welcome news for current and future retirees.

“We are here today to stand with seniors and to say that at a time when so many are hurting we are going to do everything we can to protect and expand Social Security.” – Sen. Bernie Sanders, 2/13/19

“I think the time has come, especially now that people don’t have pensions anymore and their 401K’s are subject to the vicissitudes of the market.” – Rep. Peter DeFazio, 2/13/19

The Social Security Expansion Act, which is endorsed by the National Committee to Preserve Social Security and Medicare, would:

- Increase benefits by about $1,300 a year for seniors now making less than $16,000 annually;

- Boost cost-of-living adjustments (COLAs) by adopting the Consumer Price Index for the Elderly (CPI-E);

- Restore student benefits that help educate children of deceased or disabled parents.

These benefit increases would be paid for by eliminating the payroll tax cap after $250,000 in annual income so that wealthier Americans pay their fair share. Currently, taxpayers stop contributing to Social Security after $132,900 in income. In fact, next Monday marks the date when millionaires stop paying into Social Security for the entire year. The Sanders-DeFazio bill (and Larson’s, too) would fix that once and for all.

Altogether, these provisions would provide much-needed financial relief to seniors, disabled Americans, and their families who are having difficulty making ends meet. The average Social Security retirement benefit is a modest $1,461 per month – or just under $18,000 annually. Two-thirds of beneficiaries depend on Social Security for most of their income. One third of recipients rely on their monthly benefits for nearly all of their income.

“Minus Social Security, approximately 40 percent of the recipients would live below the official poverty line. Older Americas, as a rule, aren’t frivolous spenders, buying computers, large-screen televisions, and the like. They spend their money on food, housing, and medical services.” – Helaine Olen, Washington Post columnist

It’s reasonable to assume that Social Security champions like Sanders, DeFazio, Larson, and their hundreds of co-sponsors believe that the political climate is shifting in seniors’ favor. In the wake of the Trump/GOP tax cuts and the $2 trillion they are adding to the debt, leading Republicans demanded that Social Security (and Medicare) be cut. But after winning back the House in 2018, Democrats know that the public overwhelmingly supports expanding – not cutting – earned benefits by demanding the wealthy pay more.

It’s only appropriate that higher income earners make a greater contribution to Social Security, as income inequality has contributed to the program’s financial challenges. A cogent analysis by the Center for American Progress cited three factors that have weakened Social Security during the past few decades, all related to income inequality:

1) Weak wage growth for everyday workers has reduced payroll tax revenues;

2) An increasing share of wealthy Americans’ earnings has escaped payroll taxes because of the widening income gap;

3) Because Social Security benefits are structured progressively, the increasing number of low-wage workers have put a strain on the system.

– Rachel West, Center for American Progress

The good news is that Sanders’ and Larson’s bills would correct these inequities and put Social Security on a sound financial footing for generations to come.

“So many Americans are depending on this rock, this contract between generations, this Social Security foundation, to have a decent retirement.” – Sen. Jeff Merkley (D-OR), co-sponsor of the Social Security Expansion Act

As President Franklin Roosevelt made clear when he signed Social Security into law, the program is a “cornerstone in a structure… which is by no means complete.” He knew that Social Security would have to be expanded over time to meet the nation’s growing needs. Current and future beneficiaries can be gratified that the legislation proposed during the past two weeks can shore up the foundation on which American’s retirement security is built.