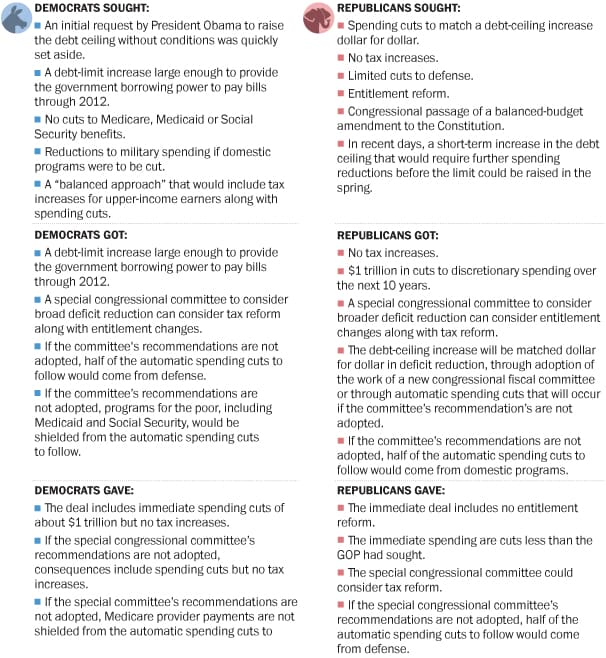

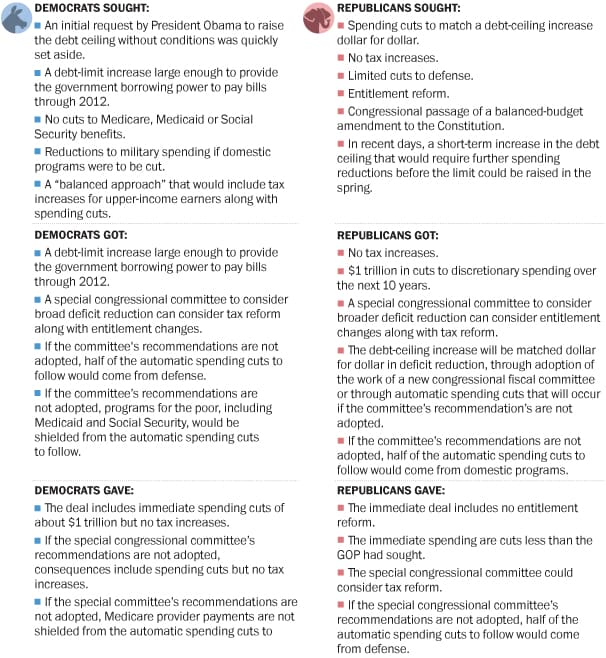

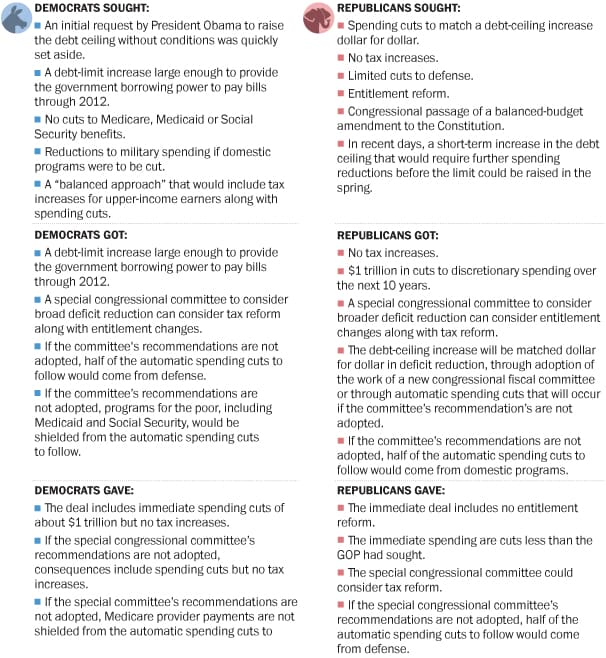

Debt Deal Detailed

Who got what?

A look at what the Democrats and Republicans wanted and what they got in the deal provided by the Washington Post. Today?s timing looks like this:

Today?s timing looks like this:

The House is in at 10 a.m., with first votes possible at noon. On the agenda are four non-controversial votes under suspension of the rules; the House is also likely to consider the debt-ceiling bill, according to House Majority Leader Eric Cantor?s (R-Va.) office.In the late morning and early afternoon, the parties in both chambers are holding caucus meetings to work through the debt-ceiling framework. In the Senate, which comes in at 10:30 a.m., Democrats and Republicans will meet separately at 11 a.m. (Democrats in the Mansfield Room off the Senate floor, Republicans in the LBJ Room).House Republicans and Democrats will hold meetings in the afternoon, as well, likely at noon. The Congressional Black Caucus may hold a news conference later in the afternoon after a 1 p.m. meeting on the debt-ceiling developments.Senators will wrap up their party lunches around 12:30 p.m. and resume consideration of the debt-limit legislation. After 2 p.m., the Senate could vote on ending debate on the debt-ceiling bill, setting up a final-passage vote for later Monday.Assuming there are no snags in either chamber ? and that?s a fairly big assumption to make ? the House could then potentially take up the debt-ceiling bill as early as Monday night.

Are We Celebrating Medicare’s Last Birthday?

Sometimes the ?good old days? really weren?t all that good and turning back the clock actually means turning our back on progress. This is especially important to remember as we celebrate Medicare?s 46th birthday. When President Johnson signed Medicare into law on July 30th, 1965, 51% of America?s seniors were uninsured and 30% lived in poverty. Healthcare was unavailable for millions of retirees who private insurers wouldn?t cover because they were considered too big a risk. Today, the senior poverty rate is at 7.5% thanks to Social Security and the Medicare program which American retirees can count on to help keep them healthy. Unfortunately, these simple facts are largely ignored in Washington?s current race to gut our social safety net in the name of deficit reduction. As we celebrate Medicare?s 46 years of success, the threat to the program?s future has never been as serious as it is today.The current atmosphere in Washington is one in which decimating programs like Medicare has become a fiscal litmus test for being considered an ?adult?, ?serious? or even a political badge of honor. However, once you step outside Washington it is clear Americans of all ages understand we don?t have to destroy vital programs like Medicare to be fiscally responsible. That message has been delivered loud and clear in town halls nationwide and in poll after poll. Politicians who ignore the real-life impact these cuts, caps and coupon proposals will have on beneficiaries and their families will certainly find they will not be rewarded for their supposed ?political courage? come Election Day.The fact is Medicare isn’t broken but it is plagued by the same problems confronting our healthcare system nationwide. Rising health care costs are eroding family resources, undermining our ability to compete in the global economy and creating fiscal burdens that crowd out other important investments of social capital.That’s not a Medicare problem, that’s a healthcare problem. Yet, many conservatives in Congress continue to urge repeal of the only law to reform our healthcare system in a generation. They?d prefer “reforms” that shift the burden to seniors rather than address the real issues of cost-containment.The GOP/Ryan budget plan would replace the current Medicare program with vouchers and leave seniors and the disabled ? some of our most vulnerable Americans ? hostage to the whims of the private marketplace. Over time, this will destroy the only health insurance program available to 47 million Americans. Vouchers are strategically designed not to keep up with the increasing cost of health insurance — that is why they save money.Rather than destroying Medicare and replacing it with vouchers, raising the eligibility age and barring a growing number of retirees from enrolling in the program, or shifting even more costs directly to seniors, Washington?s goal should be to provide the healthcare retirees need at a cost we can afford. We should continue the course laid out in healthcare reform legislation, which adds 8 years of solvency to Medicare by reducing massive overpayments to private insurers, while also eliminating the doughnut hole in the prescription drug program, and providing other valuable improvements for beneficiaries. Medicare is already far more efficient than private insurance and without it millions of America?s seniors simply could not afford health coverage. Some might die prematurely and many more would suffer needlessly due to a lack of health insurance.Medicare is truly an American success story and one we should be celebrating this July. Unfortunately, these facts are seldom voiced by those in Washington all too eager to make this year Medicare?s final birthday.

Boehner Plan = Class Warfare

The Center of Budget and Policy Priorities issued a new analysis last night on Speaker Boehner’s budget proposal. It’s final conclusion is a blistering description of just how the GOP hopes to continue making the rich richer and the rest of us pay for it:

House Speaker John Boehner?s new budget proposal would essentially require, as the price of raising the debt ceiling again early next year, a choice between deep cuts in the years immediately ahead in Social Security and Medicare benefits for current retirees, repeal of health reform?s coverage expansions, or wholesale evisceration of basic assistance programs for vulnerable Americans.The plan is, thus, tantamount to a form of ?class warfare.? If enacted, it could well produce the greatest increase in poverty and hardship produced by any law in modern U.S. history.This may sound hyperbolic, but it is not. Both the mathematics and the politics are clear.

- The Boehner plan calls for large cuts in discretionary programs of $1.2 trillion over the next ten years, and it then requires additional cuts that are large enough to produce another $1.8 trillion in savings to be enacted by the end of the year as a condition for raising the debt ceiling again at that time.

The Boehner plan envisions no tax increases, with its entire $1.8 trillion in additional deficit reduction coming from budget cuts. Speaker Boehner gave documents to House Republican caucus members stating that the $1.8 trillion would come from ?entitlement reforms and savings? and that the plan ?includes no tax hikes.? In addition, Speaker Boehner told radio talk show host Rush Limbaugh that Republicans appointed to the special committee that will craft the $1.8 trillion in savings won?t support tax increases and, in the unlikely event that that committee proposed a plan with tax increases, House Republicans would vote it down anyway.[1] A House GOP aide toldNational Review more bluntly: ?We appoint members to the committee, and we?re not appointing any Republicans who will vote for tax hikes.? [2]

You can read the full report on the CBPP website…and we highly recommend you do.Following is the letter we at the National Committee sent to Congress last night:

July 26, 2011United States House of RepresentativesWashington, DC 20515Dear Representative:On behalf of the millions of members and supporters of the National Committee to Preserve Social Security and Medicare, I urge you to raise our nation?s debt limit while protecting Social Security, Medicare and Medicaid ? three programs essential to the health and financial well-being of America?s elderly and most vulnerable citizens.Social Security has not contributed to the federal deficit, and in fact cannot contribute to the deficit by law ? it therefore has no place in a deficit discussion. Medicare and Medicaid are health insurance programs and are subject to the same inflationary pressures that have made health insurance increasingly unaffordable for workers and their employers. Cutting the federal health programs without reducing health care costs system-wide will result in access limitations for seniors.The proposal submitted by Speaker Boehner represents a ?stealth attack? on Social Security, Medicare and Medicaid, while protecting the wealthiest Americans from making even the smallest contribution toward reducing our mountain of debt by excluding any increase in revenue on their part. Shared sacrifice cannot be limited to the poor and middle-class, as the Boehner proposal suggests. We certainly agree that it would be the height of irresponsibility not to increase the public debt ceiling. However, by conditioning that increase in the nation?s debt limit on passage of legislation reducing the deficit by $1.8 trillion, Speaker Boehner?s substitute holds the nation?s economic future hostage in order to force deep cuts in the programs our seniors depend on.Although Speaker Boehner?s proposal does not cut Social Security, Medicare or Medicaid directly, deep cuts in these programs are the inevitable result of the legislative process his amendment creates. We at the National Committee will make sure our millions of members and supporters are fully informed about the consequences of this proposal, and consider a vote for Speaker Boehner?s substitute to S. 627 the same as a vote to impose deep cuts in Social Security, Medicare and Medicaid.We urge you to vote against Speaker Boehner?s debt limit proposal.Sincerely,Max RichtmanExecutive VicePresident and Acting CEO

Competing Debt Plans Compared-What Do They Mean for Social Security and Medicare?

The National Journal has a great breakdown of the key differences between Senator Reid’s Democratic Debt Plan in the Senate and Speaker Boehner’s GOP plan in the House.

Details of the Democratic Debt Proposal

by Dan Friedman

Updated: July 25, 2011 | 5:53 p.m.July 25, 2011 | 4:05 p.m.

The following are some details of the Democratic debt-ceiling plan offered on Monday by Senate Majority Leader Harry Reid, D-Nev., according to a summary prepared by his office:

- Cuts $1.2 trillion from discretionary spending through measures Democrats say were already agreed to by House Speaker John Boehner, R-Ohio, before he withdrew from negotiations with the White House.

- Includes $100 billion in mandatory savings that will not impact Medicare, Medicaid, or Social Security. Savings would come from farm subsidies ($10-15 billion); reduced fraud and abuse in various mandatory programs ($40 billion); Fannie Mae and Freddie Mac reforms ($30 billion); broadcast-spectrum sales and universal service fund reforms ($15 billion); and student-loan changes (no savings specified).

- Assumes $1 trillion in savings from winding down wars in Iraq and Afghanistan.

- Includes $400 billion in savings from reduced interest payments.

- Creates a joint congressional committee, with 12 members, to recommend future deficit cuts by the end of 2011. The recomendations would receive an up-or-down Senate vote, with no filibusters or amendments allowed.

Details of the House Republican Debt Proposal

by Billy House

Updated: July 25, 2011 | 5:55 p.m.July 25, 2011 | 3:31 p.m.

Here are some key elements of the House Republicans’ two-step deficit-reduction plan:

- Cuts and caps discretionary spending immediately, saving $1.2 trillion over 10 years (figure subject to Congressional Budget Office confirmation).

- Raises the debt ceiling initially by up to $1 trillion.

- Creates a Joint Committee of Congress required to report legislation that would produce a plan to reduce the deficit by at least $1.8 trillion over 10 years. Each chamber would consider the proposal in an up-or-down basis without any amendments; if the proposal is enacted, the president would be authorized to request a debt-limit increase of $1.5 trillion.

- Imposes spending caps that would establish clear limits on future spending. Failure to remain below these caps would trigger automatic across-the-board cuts.

- Requires the House and Senate vote on a balanced-budget amendment after October 1 and before the end of the year. It does not require that such a bill be forwarded to the states.

- Includes no tax hikes.

Now is the time Americans of all ages MUST engage their members of Congress. Even if you’ve never written a letter or email, or made a phone call to Washington before–your representatives need to hear from you now. Holding vital safety net programs like Social Security, Medicare and Medicaid hostage while preserving tax cuts for the rich is not fiscal responsibility.Use our Legislative Action Center to connect to your Congressional members. Use our sample letter or craft your own.TODAY is the day to take ACTION!

The Debt Debate Got You Confused? Join the Club

While each day provides new, and often conflicting, headlines on Washington conservatives’ continuing refusal to raise the debt ceiling we think it’s important to provide some basic information about the role (or lack thereof) Social Security, Medicare and Medicaid play in the debt.

Too many in Washington seem ready, willing and eager to trade away life

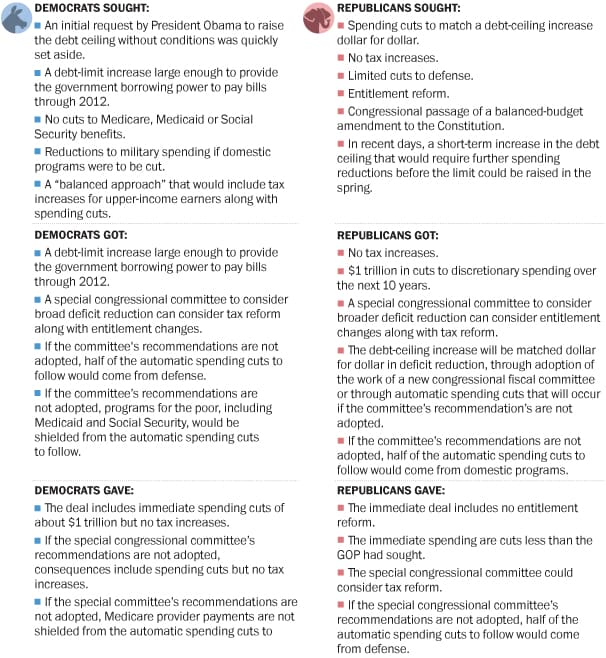

Debt Deal Detailed

Who got what?

A look at what the Democrats and Republicans wanted and what they got in the deal provided by the Washington Post.

The House is in at 10 a.m., with first votes possible at noon. On the agenda are four non-controversial votes under suspension of the rules; the House is also likely to consider the debt-ceiling bill, according to House Majority Leader Eric Cantor?s (R-Va.) office.In the late morning and early afternoon, the parties in both chambers are holding caucus meetings to work through the debt-ceiling framework. In the Senate, which comes in at 10:30 a.m., Democrats and Republicans will meet separately at 11 a.m. (Democrats in the Mansfield Room off the Senate floor, Republicans in the LBJ Room).House Republicans and Democrats will hold meetings in the afternoon, as well, likely at noon. The Congressional Black Caucus may hold a news conference later in the afternoon after a 1 p.m. meeting on the debt-ceiling developments.Senators will wrap up their party lunches around 12:30 p.m. and resume consideration of the debt-limit legislation. After 2 p.m., the Senate could vote on ending debate on the debt-ceiling bill, setting up a final-passage vote for later Monday.Assuming there are no snags in either chamber ? and that?s a fairly big assumption to make ? the House could then potentially take up the debt-ceiling bill as early as Monday night.

Are We Celebrating Medicare’s Last Birthday?

Sometimes the ?good old days? really weren?t all that good and turning back the clock actually means turning our back on progress. This is especially important to remember as we celebrate Medicare?s 46th birthday. When President Johnson signed Medicare into law on July 30th, 1965, 51% of America?s seniors were uninsured and 30% lived in poverty. Healthcare was unavailable for millions of retirees who private insurers wouldn?t cover because they were considered too big a risk. Today, the senior poverty rate is at 7.5% thanks to Social Security and the Medicare program which American retirees can count on to help keep them healthy. Unfortunately, these simple facts are largely ignored in Washington?s current race to gut our social safety net in the name of deficit reduction. As we celebrate Medicare?s 46 years of success, the threat to the program?s future has never been as serious as it is today.The current atmosphere in Washington is one in which decimating programs like Medicare has become a fiscal litmus test for being considered an ?adult?, ?serious? or even a political badge of honor. However, once you step outside Washington it is clear Americans of all ages understand we don?t have to destroy vital programs like Medicare to be fiscally responsible. That message has been delivered loud and clear in town halls nationwide and in poll after poll. Politicians who ignore the real-life impact these cuts, caps and coupon proposals will have on beneficiaries and their families will certainly find they will not be rewarded for their supposed ?political courage? come Election Day.The fact is Medicare isn’t broken but it is plagued by the same problems confronting our healthcare system nationwide. Rising health care costs are eroding family resources, undermining our ability to compete in the global economy and creating fiscal burdens that crowd out other important investments of social capital.That’s not a Medicare problem, that’s a healthcare problem. Yet, many conservatives in Congress continue to urge repeal of the only law to reform our healthcare system in a generation. They?d prefer “reforms” that shift the burden to seniors rather than address the real issues of cost-containment.The GOP/Ryan budget plan would replace the current Medicare program with vouchers and leave seniors and the disabled ? some of our most vulnerable Americans ? hostage to the whims of the private marketplace. Over time, this will destroy the only health insurance program available to 47 million Americans. Vouchers are strategically designed not to keep up with the increasing cost of health insurance — that is why they save money.Rather than destroying Medicare and replacing it with vouchers, raising the eligibility age and barring a growing number of retirees from enrolling in the program, or shifting even more costs directly to seniors, Washington?s goal should be to provide the healthcare retirees need at a cost we can afford. We should continue the course laid out in healthcare reform legislation, which adds 8 years of solvency to Medicare by reducing massive overpayments to private insurers, while also eliminating the doughnut hole in the prescription drug program, and providing other valuable improvements for beneficiaries. Medicare is already far more efficient than private insurance and without it millions of America?s seniors simply could not afford health coverage. Some might die prematurely and many more would suffer needlessly due to a lack of health insurance.Medicare is truly an American success story and one we should be celebrating this July. Unfortunately, these facts are seldom voiced by those in Washington all too eager to make this year Medicare?s final birthday.

Boehner Plan = Class Warfare

The Center of Budget and Policy Priorities issued a new analysis last night on Speaker Boehner’s budget proposal. It’s final conclusion is a blistering description of just how the GOP hopes to continue making the rich richer and the rest of us pay for it:

House Speaker John Boehner?s new budget proposal would essentially require, as the price of raising the debt ceiling again early next year, a choice between deep cuts in the years immediately ahead in Social Security and Medicare benefits for current retirees, repeal of health reform?s coverage expansions, or wholesale evisceration of basic assistance programs for vulnerable Americans.The plan is, thus, tantamount to a form of ?class warfare.? If enacted, it could well produce the greatest increase in poverty and hardship produced by any law in modern U.S. history.This may sound hyperbolic, but it is not. Both the mathematics and the politics are clear.

- The Boehner plan calls for large cuts in discretionary programs of $1.2 trillion over the next ten years, and it then requires additional cuts that are large enough to produce another $1.8 trillion in savings to be enacted by the end of the year as a condition for raising the debt ceiling again at that time.

The Boehner plan envisions no tax increases, with its entire $1.8 trillion in additional deficit reduction coming from budget cuts. Speaker Boehner gave documents to House Republican caucus members stating that the $1.8 trillion would come from ?entitlement reforms and savings? and that the plan ?includes no tax hikes.? In addition, Speaker Boehner told radio talk show host Rush Limbaugh that Republicans appointed to the special committee that will craft the $1.8 trillion in savings won?t support tax increases and, in the unlikely event that that committee proposed a plan with tax increases, House Republicans would vote it down anyway.[1] A House GOP aide toldNational Review more bluntly: ?We appoint members to the committee, and we?re not appointing any Republicans who will vote for tax hikes.? [2]

You can read the full report on the CBPP website…and we highly recommend you do.Following is the letter we at the National Committee sent to Congress last night:

July 26, 2011United States House of RepresentativesWashington, DC 20515Dear Representative:On behalf of the millions of members and supporters of the National Committee to Preserve Social Security and Medicare, I urge you to raise our nation?s debt limit while protecting Social Security, Medicare and Medicaid ? three programs essential to the health and financial well-being of America?s elderly and most vulnerable citizens.Social Security has not contributed to the federal deficit, and in fact cannot contribute to the deficit by law ? it therefore has no place in a deficit discussion. Medicare and Medicaid are health insurance programs and are subject to the same inflationary pressures that have made health insurance increasingly unaffordable for workers and their employers. Cutting the federal health programs without reducing health care costs system-wide will result in access limitations for seniors.The proposal submitted by Speaker Boehner represents a ?stealth attack? on Social Security, Medicare and Medicaid, while protecting the wealthiest Americans from making even the smallest contribution toward reducing our mountain of debt by excluding any increase in revenue on their part. Shared sacrifice cannot be limited to the poor and middle-class, as the Boehner proposal suggests. We certainly agree that it would be the height of irresponsibility not to increase the public debt ceiling. However, by conditioning that increase in the nation?s debt limit on passage of legislation reducing the deficit by $1.8 trillion, Speaker Boehner?s substitute holds the nation?s economic future hostage in order to force deep cuts in the programs our seniors depend on.Although Speaker Boehner?s proposal does not cut Social Security, Medicare or Medicaid directly, deep cuts in these programs are the inevitable result of the legislative process his amendment creates. We at the National Committee will make sure our millions of members and supporters are fully informed about the consequences of this proposal, and consider a vote for Speaker Boehner?s substitute to S. 627 the same as a vote to impose deep cuts in Social Security, Medicare and Medicaid.We urge you to vote against Speaker Boehner?s debt limit proposal.Sincerely,Max RichtmanExecutive VicePresident and Acting CEO

Competing Debt Plans Compared-What Do They Mean for Social Security and Medicare?

The National Journal has a great breakdown of the key differences between Senator Reid’s Democratic Debt Plan in the Senate and Speaker Boehner’s GOP plan in the House.

Details of the Democratic Debt Proposal

by Dan Friedman

Updated: July 25, 2011 | 5:53 p.m.July 25, 2011 | 4:05 p.m.

The following are some details of the Democratic debt-ceiling plan offered on Monday by Senate Majority Leader Harry Reid, D-Nev., according to a summary prepared by his office:

- Cuts $1.2 trillion from discretionary spending through measures Democrats say were already agreed to by House Speaker John Boehner, R-Ohio, before he withdrew from negotiations with the White House.

- Includes $100 billion in mandatory savings that will not impact Medicare, Medicaid, or Social Security. Savings would come from farm subsidies ($10-15 billion); reduced fraud and abuse in various mandatory programs ($40 billion); Fannie Mae and Freddie Mac reforms ($30 billion); broadcast-spectrum sales and universal service fund reforms ($15 billion); and student-loan changes (no savings specified).

- Assumes $1 trillion in savings from winding down wars in Iraq and Afghanistan.

- Includes $400 billion in savings from reduced interest payments.

- Creates a joint congressional committee, with 12 members, to recommend future deficit cuts by the end of 2011. The recomendations would receive an up-or-down Senate vote, with no filibusters or amendments allowed.

Details of the House Republican Debt Proposal

by Billy House

Updated: July 25, 2011 | 5:55 p.m.July 25, 2011 | 3:31 p.m.

Here are some key elements of the House Republicans’ two-step deficit-reduction plan:

- Cuts and caps discretionary spending immediately, saving $1.2 trillion over 10 years (figure subject to Congressional Budget Office confirmation).

- Raises the debt ceiling initially by up to $1 trillion.

- Creates a Joint Committee of Congress required to report legislation that would produce a plan to reduce the deficit by at least $1.8 trillion over 10 years. Each chamber would consider the proposal in an up-or-down basis without any amendments; if the proposal is enacted, the president would be authorized to request a debt-limit increase of $1.5 trillion.

- Imposes spending caps that would establish clear limits on future spending. Failure to remain below these caps would trigger automatic across-the-board cuts.

- Requires the House and Senate vote on a balanced-budget amendment after October 1 and before the end of the year. It does not require that such a bill be forwarded to the states.

- Includes no tax hikes.

Now is the time Americans of all ages MUST engage their members of Congress. Even if you’ve never written a letter or email, or made a phone call to Washington before–your representatives need to hear from you now. Holding vital safety net programs like Social Security, Medicare and Medicaid hostage while preserving tax cuts for the rich is not fiscal responsibility.Use our Legislative Action Center to connect to your Congressional members. Use our sample letter or craft your own.TODAY is the day to take ACTION!

The Debt Debate Got You Confused? Join the Club

While each day provides new, and often conflicting, headlines on Washington conservatives’ continuing refusal to raise the debt ceiling we think it’s important to provide some basic information about the role (or lack thereof) Social Security, Medicare and Medicaid play in the debt.

Too many in Washington seem ready, willing and eager to trade away life