National Committee Volunteer Talks Seniors’ Issues at the Democratic Convention

Modern-day political conventions have always been more about the show than substance. But when you look at the speakers’ chosen and the messages delivered you can at least get a good idea about each party’s core values. That’s why we were especially glad to see the Democrats extend an invitation to West Palm Beach senior and National Committee volunteer, Carol Berman, to address convention delegates last night.

Carol’s story is one that resonates for many American seniors who have worked hard and saved for their retirement years and are anything but the “greedy geezers” portrayed by many conservatives so eager to slash already modest Social Security and Medicare benefits. Carol took to the podium last night and eloquently described how important preserving these programs are to millions of American families just like hers.

I’m so proud to be at the Democratic National Convention from Florida. I’m one of the seniors who retired to this piece of heaven on earth and I’m as happy as a clam. It’s not just the sunshine…it’s Obamacare.

I’m getting preventive care for free and my prescription drugs for less. It’s pretty great.But the Romney-Ryan plan has me terrified…not just for me but for my three daughters who are in their 50’s.

If Mitt Romney gets into office, the Medicare that they’ve earned will turn into Vouchercare. Seniors will get a voucher to purchase health insurance …but the voucher won’t keep up with the costs, which could push people into private insurance plans. And even though many seniors are on fixed incomes, it could add up to $6400 more a year in out-of-pocket costs. And on top of that, he’s promised to repeal Obamacare on day one.

Thousands of dollars might be pocket change to Mitt Romney – but that’s a lot of money in my family…it’s birthday presents for my grandkids and a flight to visit them. Republicans are trying to end Medicare as we know it but we’re not going to let them.

We have worked for our Medicare; we have paid for our Medicare; and we have earned our Medicare. I’m proud to have been born the same year that Social Security was. It was the most important law of my lifetime. Medicare was pretty great too. And now we have Obamacare, which preserves the promise of Medicare and a secure retirement.

So like I tell my daughters, let’s vote like our lives depend on it…because they do.

Politically, candidates hope voters will hear something they like at these conventions and provide the party’s presidential ticket the “bounce” needed to create momentum going into the fall.

While the GOP convention provided a small 1% bounce overall, what is worth noting is how different voting blocks reacted. CNN summarizes here:

“The poll indicates Romney may have picked up support among men, but there was no change at all among women, keeping in place a double-digit gender gap. And there’s an interesting movement among age groups. Romney gained a bit among younger voters and among senior citizens, but Obama was the big winner among voters between 50 and 64 years old.‘It’s possible that senior citizens who are already on Medicare have accepted the GOP assurances that their benefits will not be affected, but the group of Americans who are approaching retirement – who will be the first ones affected by the GOP-proposed changes in the Medicare system – are getting worried about what’s in store for them,’ added Holland.

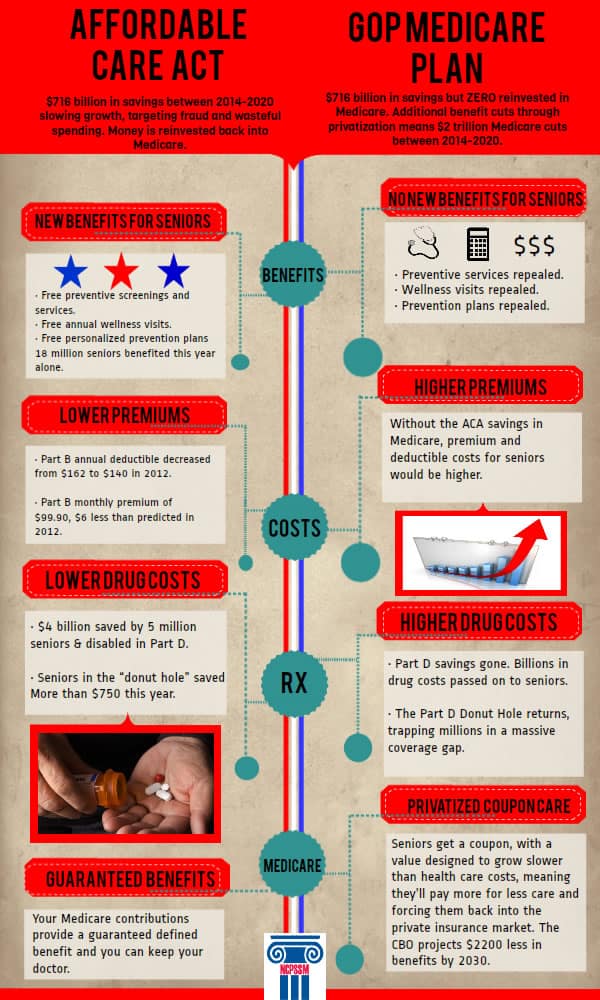

The problem with those cynical GOP “assurances” to seniors that their reform won’t hurt current retirees is that those are simply empty promises. If elected, the Romney/Ryan repeal of healthcare reform will immediately strip benefits from 32 million seniors who have already used the new preventive screenings and benefits through the Affordable Care Act. There’s also $3.1 billion dollars in real savings that seniors have already seen in their prescription drug coverage that will also be taken away. The Part D donut hole will return, private insurers get their massive subsidies back and Medicare will be insolvent by the end of Romney’s first term.

So much for convention promises.

Social Security: Not Just My Grandparents’ Program

I’m a 2009 college graduate who recently started working at the National Committee. I may be new to the organization but Social Security and Medicare have always been interests of mine. And, the older I get, the more I realize how important these programs are to the American people. Additionally, I have a personal connection due to my own family members receiving benefits from one or more of these programs.

For most young people, odds are, at least one person they know is relying upon Social Security or Medicare. But, do these same young people know that these are two of the most successful government programs ever created? Social Security is the most effective anti-poverty system in the United States. Medicare provides coverage to older Americans who previously were not able to find or afford healthcare from private insurance companies. This is very important to remember. Why? Because the upcoming elections have put the nation’s debt and deficit under the microscope and Social Security and Medicare have become convenient targets for a debt, deficit they didn’t create.

I believe it is our responsibility to make sure the correct facts about Social Security are told. I had the privilege of attending a National Academy of Social Insurance (NASI) conference on Social Security for young people. There was a great report being passed around: A Young Person’s Guide to Social Security. I highly recommend reading this awesome piece of information.

As the Social Media Coordinator for the National Committee, I constantly see comments posted such as, “It’s not like Social Security will be there for me” or “Social Security? That’s just for old people.” If I had a dime for every time I read or heard that, I think I could extend the solvency of the program by another decade. Social Security is not just for seniors. The program, “Pays monthly survivors’ benefits to seven million Americans, including almost two million children”.

“CHILDREN?! Did you say children receive Social Security?” Yes!

“It does this by protecting our most vulnerable citizens from falling into poverty, raising the standard of living for lower-income workers, and providing financial security to the spouses and dependent children in the event of a worker’s disability or death.”

“So, it’s a pretty good deal, but, what about the program’s financing?”

Social Security has enough income and assets to pay full benefits through 2033. It’s on solid financial ground. With just a few modest changes Social Security’s solvency can be extended beyond 2033 without cutting benefits. For instance, workers pay FICA, or the payroll tax, on income up to $110,000. That’s the cap, meaning that any income over $110,000 is not subject to the tax. Lifting that cap would extend the solvency of Social Security by decades.

“We should privatize it, that’ll fix it!”

Not exactly. Putting that money in personal accounts for Wall Street to manage isn’t really the ideal plan. We’ve seen Wall Street manage funds before. Sorry, I mean, “mis-manage”. It’s a good idea to have individual savings through a 401k or savings account but it should be in addition to Social Security. Depending on how Wall Street is doing, a 401(k) plan could hit a slump which means you get less money. But Social Security doesn’t hit slumps. Once you start collecting, your monthly benefit amount is guaranteed. And since young people aren’t able to save much these days due to unemployment, student loans, and the high cost of living, it is even more important for a program like Social Security to be there for us.

And, let’s get something else cleared up. People are not getting rich off Social Security. Seniors are not living lavish lifestyles because of their monthly checks. The average annual income is only $14,000. That’s why our grandparents and parents can’t afford cuts to their Social Security benefits. Do these leaders in Washington who want to cut Social Security not have elderly relatives or are they all so wealthy they’ve lost touch with middle class Americans? Politicians use this idea of seniors living lavish life styles to do one thing, pit the young vs. the old. They try to make it seem like it’s good policy to cut benefits because the elderly can afford it.

As young people, Social Security is a program we have a vested interest in protecting. When we’re working, we’re paying into Social Security. That’s our money and why wouldn’t we want it there to protect us too? We need to stay informed by connecting with organizations like the National Committee to Preserve Social Security and Medicare, the Roosevelt Institute, Young Invincibles or National Academy of Social Insurance. Learning the facts, exchanging ideas or taking action against proposals to cut future benefits, this is how we can help protect our future because counting on the next person to do something just won’t get it done.

Breaking Down the GOP Mediscare Myth

This latest strategy is really not all that different than in the last election cycle when the GOP promised “death panels” were coming after grandma, regardless of the abundance of hard factual evidence to the contrary. Just as there were no death panels – then or now—the “Obamacare robs Medicare” myth is yet another political Mediscare tactic designed to deflect attention away from the real damage not-so- hidden in the Romney/Ryan plan for Medicare.

The problem for the GOP is that Americans don’t want to privatize Medicare. They simply don’t believe that giving seniors a coupon of diminishing value to go shopping for private insurance is a good plan for millions of middle-class Americans who depend on Medicare’s guaranteed benefits to keep them healthy. It’s an especially hard sell, once seniors find out these coupons are designed NOT to cover their full health care costs:

Under Chairman Paul Ryan’s budget resolution, the annual growth in Medicare spending is limited to the gross domestic product (GDP) + 0.5 percent, a rate likely to be lower than the growth in health costs. If spending exceeds this amount, beneficiaries would be subject to additional out-of-pocket costs since their voucher likely would not cover the cost of traditional Medicare or the private plan that includes their doctors. The Congressional Budget Office projects that government spending per beneficiary would be $2200 less under the Ryan Medicare plan in 2030 than under current law. (The Long-Term Budgetary Impact of Paths for Federal Revenues and Spending Specified by Chairman Ryan, https://www.ncpssm.org/wp-content/uploads/2012/08/03-20-Ryan_Specified_Paths_2.pdf, pg 8).

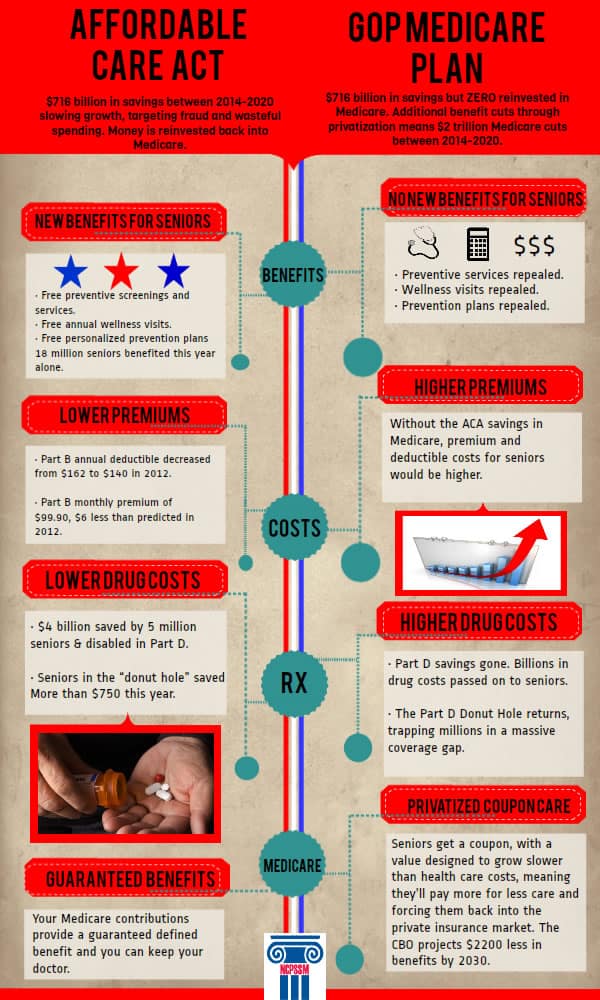

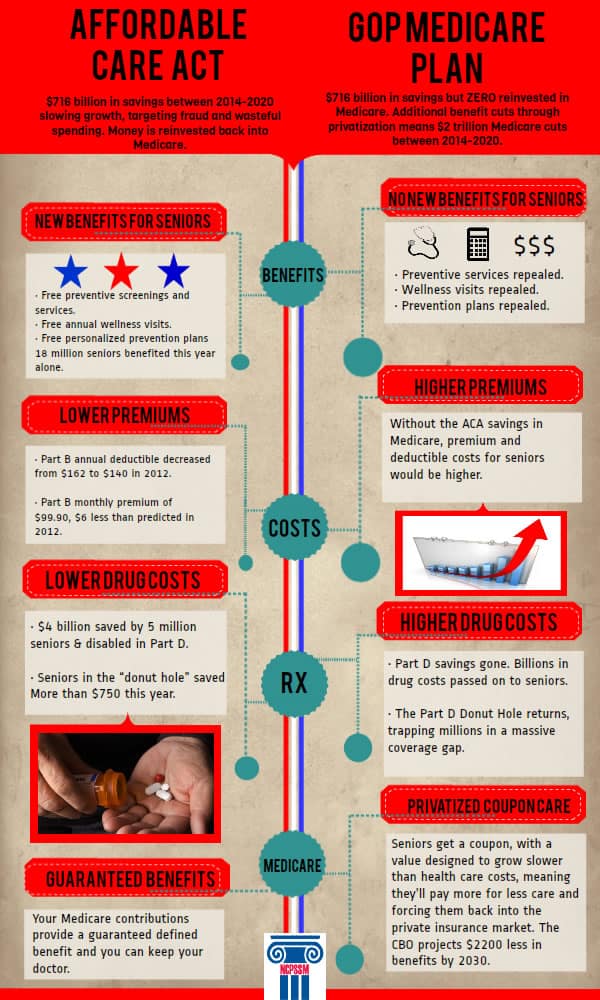

The National Committee has prepared an analysis of the “Obamacare Robs Medicare” myth. The $716 Billion Question – Strengthen Medicare, or Tax Breaks for the Wealthy?

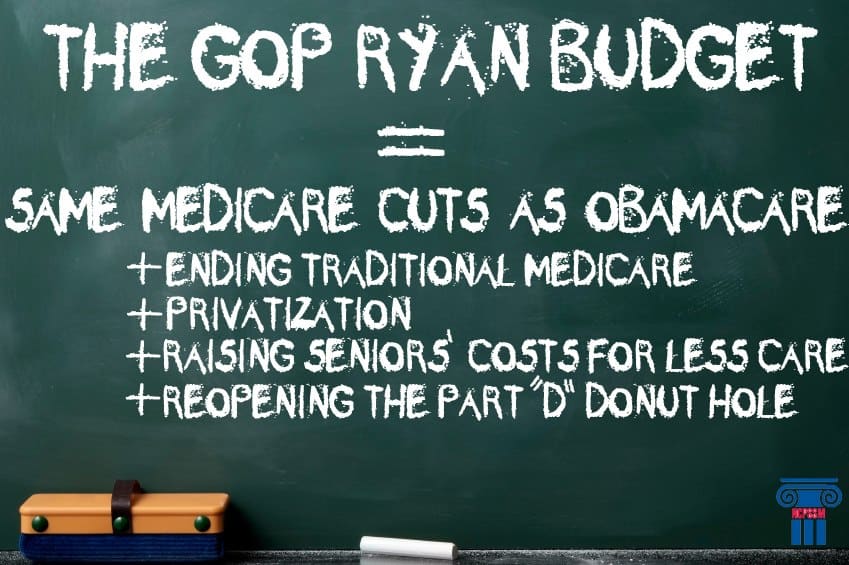

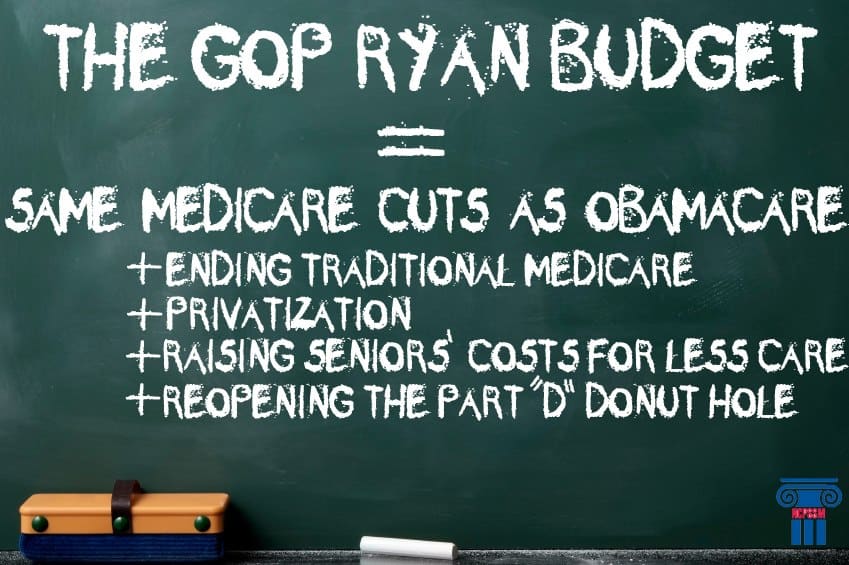

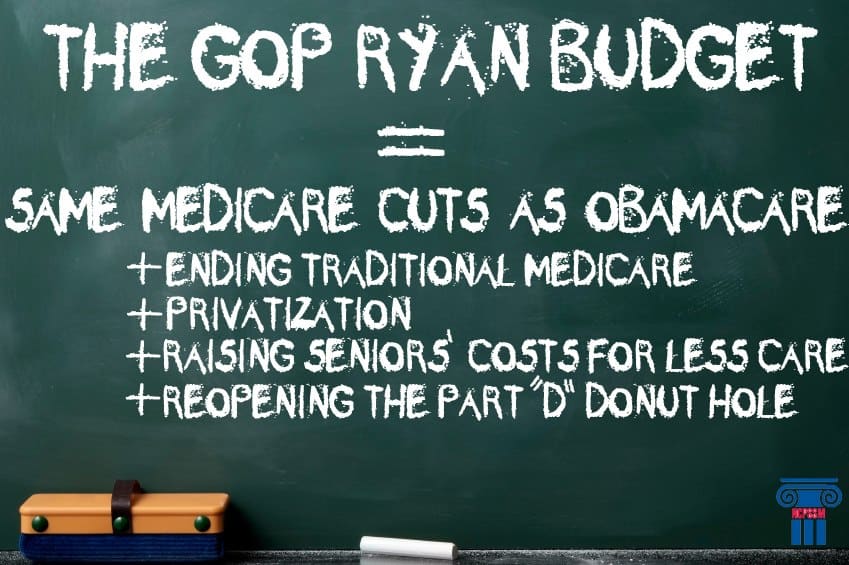

Since passage of the Affordable Care Act (ACA), Republicans have accused Democrats who voted for health care reform of “cutting” Medicare. At the same time, Republicans in the House of Representatives have supported two Republican budget resolutions, introduced by House Budget Committee Chairman Paul Ryan (R-WI), that retain the same savings in Medicare spending while repealing the Affordable Care Act’s Medicare improvements.

The analysis breaks down both the Affordable Care Act and the Ryan Budget plan’s impact on Medicare. It’s important information for middle-class seniors in Medicare who are clearly the primary targets of the ongoing campaign to confuse and deflect attention away from GOP plans to end traditional Medicare, repeal new benefits saving seniors billions of dollars in health care costs while cutting taxes for the wealthy and increasing the debt at the same time.

That will be a truly tough sell…especially once Americans get beyond the political spin and ask the tough questions about the GOP plan for Medicare.

Why the Medicare Dodge and Deflect Won’t Be Enough

Originally posted on Huffington Post.

There’s a simple question American seniors should ask candidates who claim to want to protect Medicare: “Did you oppose Obamacare because it ‘cuts’ Medicare while also voting for those same Medicare spending cuts in the GOP/Ryan Budget plan? For 277 members of the House, that answer was yes.

Paul Ryan’s selection as Governor Romney’s Vice-Presidential running mate has Republican Party leaders understandably worried that voters will now get a good look at the radical plans for Medicare in the GOP budget and a tally of those candidates who supported it. A memo and campaign how-to video from the National Republican Congressional Committee provides an incredibly clear and cynical look behind their political curtain, as the NRCC gives Republican candidates tips on how to dodge the discussion they really don’t want to have about the votes they’ve already cast on Medicare:

“Do not say: ‘entitlement reform,’ ‘privatization,’ ‘every option is on the table,’ … Do say: ‘strengthen,’ ‘secure,’ ‘save,’ ‘preserve, ‘protect.’” NRCC Medicare Memo

These GOP operatives say they want this Medicare fight. Truth is, they really hope to refight health care reform so they can avoid talking about Paul Ryan’s plan for Medicare. The proof is in the memo. In ten minutes of YouTube tutoring on how GOP candidates should talk about Medicare, there is not one reference on how candidates can effectively persuade voters that the GOP/Ryan plan is the right policy for Americans. Not one word on how candidates should campaign to convince voters that privatizing Medicare and making it harder for seniors to choose their own doctor is the right thing. Not one word on why seniors’ should pay much more for less coverage, why the retirement age should be raised, why the prescription drug donut hole should be reinstated or, why Medicare and Medicaid should be cut to pay for more tax cuts for the wealthy.

The GOP strategy for their candidates is clear — simply don’t talk about the GOP plans for seniors in Medicare. Talk about the Affordable Care Act, instead. If you get a question about the Ryan budget? “Obamacare robs Medicare”. Get a question about the GOP plan to end Medicare? “Obamacare robs Medicare”. What about raising seniors’ preventative care and prescription costs? “Obamacare robs Medicare”. You get the idea. The strategy is to continue to tell seniors their benefits were cut, even though they weren’t. Ignore the fact that health care reform preserves every dime of Medicare benefits while the GOP/Ryan plan uses that money to pay for millionaire tax breaks. Disregard the 32 million seniors who have already received new preventive benefits through ACA. Don’t talk about the closing of the Part D donut hole or the $3.1 billion dollars in real savings seniors have already seen in their prescription drug coverage. And whatever you do, absolutely never, ever, let on that the same GOP candidates — decrying Medicare reforms falsely labeled as benefit cuts in the Affordable Care Act — voted for those same provisions when they passed the GOP/Ryan budget. At the same time by the way, Republicans also voted to end Medicare leaving seniors at the mercy of private insurers to face higher costs for less coverage.

However, what this divert and deflect strategy ignores is how much easier it was to fool voters before the ACA was implemented. I predict this year will be different. It’s simply a lot harder now to believe a political candidate who’s telling you your Medicare benefits were slashed when you remember taking your $250 drug rebate check to the bank, you paid $600 less in drug costs this year, didn’t fall into the donut hole, and received your first free mammogram in Medicare. Now that seniors are seeing first hand their benefits were not cut, and were in fact improved, this Medicare myth can finally be laid to rest next to the infamous (and also false) “death panels” claim made by Republicans.

The GOP “Obamacare Robs Medicare” myth will finally be exposed and with the selection of Paul Ryan it should get the national attention needed to put a stop to it once and for all. Just as with President Bush’s campaign to privatize Social Security, the more the American people find out what the Ryan/GOP plan for Medicare contains the less they’ll like it. That process has just begun and it will be a real eye-opener for the millions of American retirees who continue to be the targets of one of most cynical Mediscare campaigns in political history.

Stop the War on Medicare

There’s a simple question American seniors should ask candidates who hate health care reform and want your vote:

“Did you oppose the Medicare cuts in Obamacare but vote for those same cuts in the GOP/Ryan Budget plan? If your candidate is a Republican member of the House, that answer is likely yes.