Social Security – Just the Facts

Thanks to YES Magazine for this terrific infographic which lays out the truth about Social Security in such a simple, common sense, way!

Death by a Thousand (or more) Cuts to Social Security Services

“The Social Security Administration is finalizing plans to resume mailing paper Social Security statements to some workers in September 2014. Statements will be sent to workers every five years in the year they attain ages 25, 30, 35, 40, 45, 50, 55 and 60, if they are not registered to receive online statements or already receiving benefits.” US News & World Report

But, as reported in labornotes, SSA employees are concerned there is much worse news still to come for SSA offices across the nation if a proposed strategic plan called Vision 2025 is adopted:

“Bureaucrats are mulling closure of most of SSA’s more than 1,000 community field offices in the U.S., where 43 million people sought services last year.

Even as the number of visitors continues to grow, Vision 2025 would virtually eliminate face-to-face service, replacing it with Internet services and an 800 phone number.

Thirty thousand field office employees would be laid off—following nearly 11,000 positions already eliminated. When SSA sought its employees’ input for Vision 2025, they responded overwhelmingly that field offices were vital to the agency’s mission.”

Front line SSA workers understand the importance of person-to-person contact and worry about replacing it with a website:

“… according to surveys of SSA employees, many claimants who file on the internet make decisions that could lead to the permanent loss of benefits. SSA employees are trained to catch those mistakes.

Ryan Gurganious, a claims rep for the disabled in North Carolina, cited an example: “When a disabled person is working, we’ll ask them, ‘In your job do you have any special expenses you have to pay to be able to work?’ They might say, ‘I have to get the county transportation service to come pick me up in my wheelchair, and that’s a $40 fee every month.’

“We know that that $40 comes out of the equation when we’re figuring their benefit, so they’ll get a larger SSI check. But the computer’s not going to ask them that.”

Labor Notes staffer Jenny Brown cites a personal example. Her father was originally told he was just shy of the required work credits to get Social Security benefits. He’d worked for many years for a state college that wasn’t part of the system at the time.

But an alert field office worker realized that he was also a World War II combat veteran—and a special rule for those vets put him over the limit to get a monthly check.

David Sheagley, an AFGE representative and SSA teleservice-center representative in Cleveland, notes that SSA workers “assist folks during stress-filled transitions whether it be death, disability, or retirement. In other words, our mission at SSA absolutely requires that human beings be available to talk with the public.”

We couldn’t agree more about the importance of person-to-person service for Social Security beneficiaries and hope any long-range planning at SSA keeps this at the heart of it’s mission.

Still looking for a Mother’s Day Gift?

Mark Miller at Reuters provides an interesting spin on the traditional gift for our mothers…how about sitting down and talking about retirement planning?

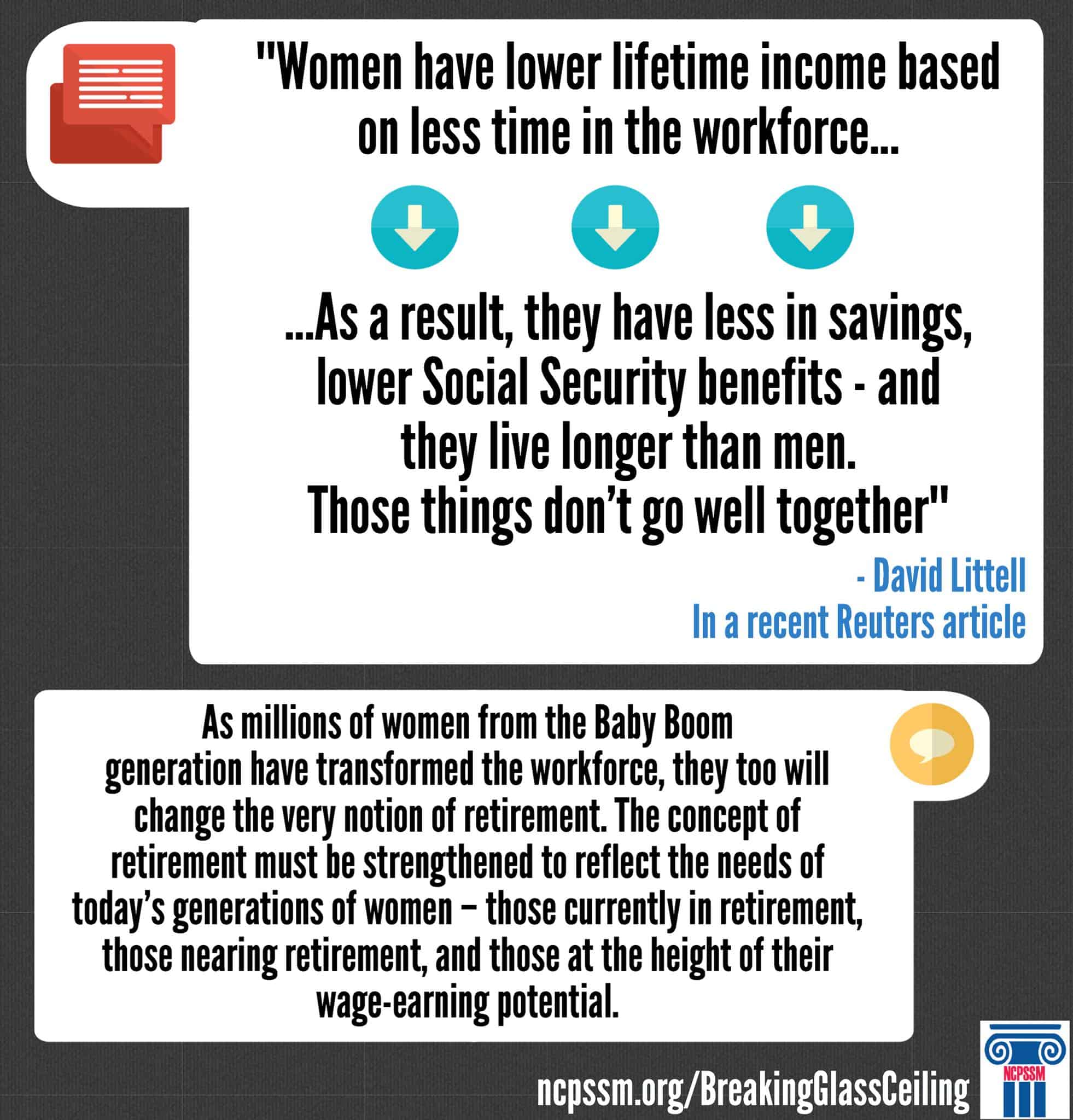

” ‘Women have lower lifetime income based on less time in the workforce,’ says David Littell, who directs a program focused on retirement income at the American College in Bryn Mawr, Pennsylvania. “As a result, they have less in savings, lower Social Security benefits – and they live longer than men. Those things don’t go well together.”

Many women still earn lower wages than men: On average, women made about 81 percent of the median earnings of men in 2012, according to the U.S. Bureau of Labor Statistics.

They’re also more likely than men to work part-time, often because of caregiving responsibilities for aging parents or children. That cuts into earnings, but it also means they are less likely to have access to workplace retirement plans.”

Reuters’ advice is straightforward and on the mark. They suggest women maximize Social Security, get an early start and make a plan.

“The most important step women can take to improve their retirement prospects is to get the most out of Social Security. For most, that will mean waiting to claim benefits until full retirement age (currently 66) or longer. Each year of delayed filing (up to age 70) translates to roughly 8 percent additional annual income.”

We also tackled the issue of Women and Social Security in our report: Breaking the Glass Ceiling.

Real Retirement Security Solutions or More of the Same?

It’s easy to become cynical if watching Washington work (or not work, as is often the case) is your job. So forgive us for not popping a cork in celebration of the Bipartisan Policy Center’s new Personal Savings Initiative. Don’t get us wrong, it’s the right idea for the right time. We’ve been saying for a long time that our nation is facing a retirement crisis far greater than the fiscal Armageddon promised by conservatives if we refused to take their advice to slash middle-class benefits. As NCPSSM President/CEO, Max Richtman, has written before:

“Three decades of stagnant middle-class incomes, disappearing pensions, limited ability to start and maintain personal savings, and the failure of the 401K experiment lay the foundation for a retirement crisis that could further threaten millions of older Americans and their families.

According to the New School for Social Research, 75 percent of Americans nearing retirement have less than $30,000 in their retirement accounts. Almost half of middle-class workers will be poor or near poor in retirement and living on a $5-per-day food budget. The National Institute for Retirement Security reports four out of five working families have retirement savings less than one times their annual income and 45 percent do not have any retirement assets at all.

While Washington has been obsessed with the federal budget deficit, there’s been virtually no Congressional conversation about the $6.8 trillion retirement savings deficit. What will happen to the millions of American families who are ill-prepared for retirement? There’s almost no conversation about how to prevent this retirement crisis from impoverishing our families or about how younger generations will handle parents and grandparents who cannot support themselves. In spite of this current and growing retirement crisis, Social Security and Medicare, programs vital to a basic secure retirement, continue to be the favored targets for some in Congress who are determined to use benefit cuts to reduce the federal deficit.”

While the Pete Peterson funded Bipartisan Policy Center’s stated goal is to address personal savings, Social Security benefits received an inordinate amount of attention in today’s kickoff event. Not so surprising when you consider that this group is chaired by former Democratic Senator and fiscal hawk Kent Conrad and Wall Streeter/former Bush appointee, Jim Lockhart. The group is dominated by conservatives and center right former politicians and staffers, Republican political appointees, industry reps and think-tankers. As was the case with the failed Bowles-Simpson Fiscal Commission, there are a few members who break that mold and will no doubt find themselves swimming against the tide once the discussion turns to Social Security. Which the Chairmen made very clear today, it will, since “everything is on the table.”

Sound familiar? It should since that’s Washington-speak for get ready for middle-class benefit cuts — but this time they’ll be wrapped in a package to increase personal savings and strengthen retirement security? It’s no wonder we’re cynical.