Wisconsin’s MAGA Senate Candidate in Hot Water again re. Nursing Homes

MAGA Senate Candidate Eric Hovde (from campaign ad)

We blogged a couple of weeks ago about Wisconsin GOP Senate candidate Erik Hovde’s head-scratching comments suggesting that seniors in nursing homes don’t have the mental capacity to vote. Now, the New York Times has reported, Hovde is financially entangled with a nursing home that is being sued for mistreating patients:

The bank he leads, Utah-based Sunwest, last month was named as a co-defendant in a California lawsuit that accuses a senior living facility partly owned by the bank of elder abuse, negligence and wrongful death. – NY Times, 4/20/24

The story added a new dimension to the public’s understanding of Hovde, a Trump-endorsed MAGA candidate who is trying to unseat incumbent Democratic Senator Tammy Baldwin. (NCPSSM’s PAC endorsed Baldwin in March.) On Tuesday, NCPSSM president and CEO Max Richtman criticized Hovde as being out of touch with older voters… in a press call organized by Wisconsin’s Democratic party:

“Eric Hovde is obviously very comfortable among wealthy bankers, but not so much with the people of Wisconsin — and certainly not with the state’s seniors. The contrast with Senator Baldwin could not be clearer.” – Max Richtman, NCPSSM President & CEO, 4/23/24

According to Wisconsin Democratic Party chair Ben Wilker, Hovde has managed to insult not only seniors — but several other constituencies. Wilker quotes Hovde as saying that farmers spend all their time driving around on tractors and don’t do real physical labor; that young Wisconsinites lack a work ethic and are “so stupid”; and that people struggling with obesity should pay more for their health care. Five months before the general election, Hovde is certainly off to an auspicious start!

Read on… here is our original blog post from 4/11/24::::

Seniors’ advocates and their political allies are criticizing recent comments by Wisconsin U.S. Senate candidate Eric Hovde suggesting that nursing home residents can’t – or shouldn’t – vote. Hovde, who is running to unseat incumbent Senator Tammy Baldwin (D-WI), told Fox News’ Guy Benson:::

“We had nursing homes where you had 100 percent voting… Well, if you’re in a nursing home, you only have a five, six-month life expectancy. Almost nobody in a nursing home is in a point to vote. And you had children, adult children showing up saying, ‘Who voted for my 85 or 90-year-old father or mother?’” – GOP Senate candidate Eric Hovde

These comments by the Trump-endorsed, MAGA Republican candidate drew sharp rebukes as blatantly ageist and fact-free. “Hovde said that people living in nursing homes usually die after a few months,” Senator Baldwin’s campaign responded. “Everyone deserves the freedom to vote, so they can make their voices heard in our elections. But Eric Hovde wants to take that away for seniors living in nursing homes.”

NCPSSM, which has endorsed Baldwin’ re-election bid, blasted Hovde’s comments. “Senators are supposed to represent ALL of their voters, and it is a total insult to the basic dignity of Wisconsin’s seniors to suggest that they are too old to vote,” said Luke Warren, director of the NCPSSM political action committee (PAC). “Hovde should be celebrating high voter turnout among nursing home residents, not griping about it.”

Anne Montgomery, NCPSSM’s senior health policy expert, added, “Hovde is basically suggesting that people in nursing homes are unworthy of voting, and that they are all about to die, which is not true.” Montgomery corrected several false or misleading arguments in Hovde’s comments:::

*The average life expectancy of nursing home residents is years, not months.

*There’s ZERO evidence that fraudulent ballots were cast in Wisconsin nursing homes in 2020.

*Nursing home residents, on average, are trending younger. The percentage of patients under 65 years of age in nursing homes grew from 10% in 2000 to 16% in 2017.

The Independent offered some additional fact-checking, indicating that voter participation in Wisconsin nursing homes was nowhere near “100%” in 2020, as Hovde claimed. “A review… by the Wisconsin State Journal found just one nursing home in the state had a 100% voter turnout. (It had just 12 registered voters).” Other facilities ranged from 42-91%, the paper reported.

Hovde’s remarks are not random for a MAGA candidate; they are part of Trump’s larger (and false) narrative about the 2020 election being “rigged.” (Hovde disagrees that the election was “stolen,” but said “things happened in that election that were very troublesome.”) Wisconsin was crucial to Joe Biden’s electoral victory in 2020, and the MAGA movement can’t abide that he won the state fairly, claiming that “thousands of crooked votes” came out of nursing homes in Wisconsin — a falsehood that has been completely discredited.

“Instead of trying to disenfranchise seniors living in nursing homes,” NCPSSM’s Anne Montgomery says, “We should be continuing to try to make it easier for nursing home residents to vote. They are just as entitled to participate in our democratic system as everyone else.”

Montgomery points out that lawmakers over the years have tried to reduce barriers to voting access for this population, including mail balloting and accommodations for people with disabilities at polling places. Montgomery cited the Help America Vote Act of 2002 — and a series of GAO reports highlighted by then-Senator and Baldwin’s predecessor, Herb Kohl (D-WI), acknowledging efforts to facilitate voting access and calling for further improvements.

When Badger State seniors cast ballots in 2024, they will have to take stock of the two Senate candidates, MAGA Republican Eric Hovde vs. Democrat Tammy Baldwin, who NCPSSM praised as a “champion of Wisconsin seniors.” As PAC director Luke Warren says, “It takes little imagination to picture how a ‘Senator Hovde’ would treat older constituents if he were in office. He has praised plans to gut Medicare and supports cutting Social Security. These latest comments are a stark reminder of the stakes in November for Wisconsin seniors.”

Listen to our podcast about ageism in culture and politics: Part 1 and Part 2 with expert S. Jay Olshanksy.

MAGA Wisconsin Senate Candidate Rebuked for Nursing Home Comments

Seniors’ advocates and their political allies are criticizing recent comments by Wisconsin U.S. Senate candidate Eric Hovde suggesting that nursing home residents can’t – or shouldn’t – vote. Hovde, who is running to unseat incumbent Senator Tammy Baldwin (D-WI), told Fox News’ Guy Benson:::

“We had nursing homes where you had 100 percent voting… Well, if you’re in a nursing home, you only have a five, six-month life expectancy. Almost nobody in a nursing home is in a point to vote. And you had children, adult children showing up saying, ‘Who voted for my 85 or 90-year-old father or mother?’” – GOP Senate candidate Eric Hovde

These comments by the Trump-endorsed, MAGA Republican candidate drew sharp rebukes as blatantly ageist and fact-free. “Hovde said that people living in nursing homes usually die after a few months,” Senator Baldwin’s campaign responded. “Everyone deserves the freedom to vote, so they can make their voices heard in our elections. But Eric Hovde wants to take that away for seniors living in nursing homes.”

NCPSSM, which has endorsed Baldwin’ re-election bid, blasted Hovde’s comments. “Senators are supposed to represent ALL of their voters, and it is a total insult to the basic dignity of Wisconsin’s seniors to suggest that they are too old to vote,” said Luke Warren, director of the NCPSSM political action committee (PAC). “Hovde should be celebrating high voter turnout among nursing home residents, not griping about it.”

Anne Montgomery, NCPSSM’s senior health policy expert, added, “Hovde is basically suggesting that people in nursing homes are unworthy of voting, and that they are all about to die, which is not true.” Montgomery corrected several false or misleading arguments in Hovde’s comments:::

*The average life expectancy of nursing home residents is years, not months.

*There’s ZERO evidence that fraudulent ballots were cast in Wisconsin nursing homes in 2020.

*Nursing home residents, on average, are trending younger. The percentage of patients under 65 years of age in nursing homes grew from 10% in 2000 to 16% in 2017.

The Independent offered some additional fact-checking, indicating that voter participation in Wisconsin nursing homes was nowhere near “100%” in 2020, as Hovde claimed. “A review… by the Wisconsin State Journal found just one nursing home in the state had a 100% voter turnout. (It had just 12 registered voters).” Other facilities ranged from 42-91%, the paper reported.

Hovde’s remarks are not random for a MAGA candidate; they are part of Trump’s larger (and false) narrative about the 2020 election being “rigged.” (Hovde disagrees that the election was “stolen,” but said “things happened in that election that were very troublesome.”) Wisconsin was crucial to Joe Biden’s electoral victory in 2020, and the MAGA movement can’t abide that he won the state fairly, claiming that “thousands of crooked votes” came out of nursing homes in Wisconsin — a falsehood that has been completely discredited.

“Instead of trying to disenfranchise seniors living in nursing homes,” NCPSSM’s Anne Montgomery says, “We should be continuing to try to make it easier for nursing home residents to vote. They are just as entitled to participate in our democratic system as everyone else.”

Montgomery points out that lawmakers over the years have tried to reduce barriers to voting access for this population, including mail balloting and accommodations for people with disabilities at polling places. Montgomery cited the Help America Vote Act of 2002 — and a series of GAO reports highlighted by then-Senator and Baldwin’s predecessor, Herb Kohl (D-WI), acknowledging efforts to facilitate voting access and calling for further improvements.

When Badger State seniors cast ballots in 2024, they will have to take stock of the two Senate candidates, MAGA Republican Eric Hovde vs. Democrat Tammy Baldwin, who NCPSSM praised as a “champion of Wisconsin seniors.” As PAC director Luke Warren says, “It takes little imagination to picture how a ‘Senator Hovde’ would treat older constituents if he were in office. He has praised plans to gut Medicare and supports cutting Social Security. These latest comments are a stark reminder of the stakes in November for Wisconsin seniors.”

Listen to our podcast about ageism in culture and politics: Part 1 and Part 2 with expert S. Jay Olshanksy.

Republican Study Committee Budget Cuts Earned Benefits; Keeps Trump Tax Cuts

For solid clues as to what the Republicans would do to Americans’ earned benefits if they maintain power in the House and recapture the Senate and/or the White House, look no further than the House Republican Study Committee (RSC) 2025 budget blueprint. For the second year in a row, the RSC proposes cutting Social Security and Medicare. Rep. Brendan Boyle, Ranking member of the House Budget committee, estimated at a hearing today that these cuts amount to $1.5 trillion for Social Security and $1 trillion for Medicare.

On the Social Security side, the RSC calls for raising the full Social Security retirement age from its current level of 67 (for anyone born in 1960 or later) to an unspecified older age. “Raising the retirement age is a huge benefit cut,” explains NCPSSM President and CEO, Max Richtman, “because you’d be receiving less money as a beneficiary during your lifetime.”

Republicans say that because (on average) people are living longer, they should be forced to work longer before collecting full Social Security benefits. They neglect to mention that workers in physically demanding jobs cannot always work into their late 60s — or that living longer means having to stretch what may be scant retirement savings over a longer period of time.

The RSC also proposes reducing benefits for “upper income earners.” This would put Social Security on a slippery slope toward means testing. “Means testing means Social Security would no longer be an earned benefit, but a welfare program,” says Richtman.

An analysis by the Center for American Progress estimates if the RSC proposal were in effect today, anyone whose lifetime wages averaged over $85,000 would be considered ‘wealthy’ and have their benefits cut — including the elimination of crucial spousal benefits. “We don’t usually consider people earning $85,000 per year wealthy,” says Maria Freese, NCPSSM’s senior legislative representative. “Making matters worse, in order to save the program any significant amount of money, benefits would have to be reduced for people earning even less than $85,000, cutting deep into the heart of the middle class.”

The RSC stresses that their spending plan “does not cut or delay retirement benefits for any senior in or near retirement.” But it would cut benefits for younger Gen Xers, Millennials, and Gen Z. “These younger workers will need every dollar of their Social Security benefits when they retire. Like the older generations, they earned these benefits and shouldn’t have them cut,” says Richtman.

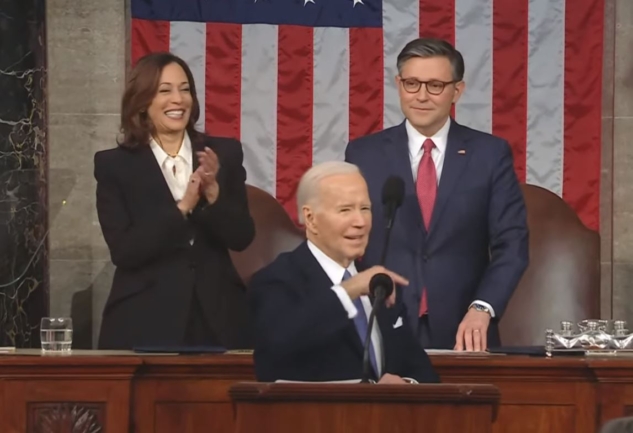

Trump told CNBC he’d cut “entitlements.” Biden said: “Not on my watch!”

Republicans may deny it, but cutting Social Security IS their fiscal plan, claiming that the government can’t afford to strengthen the program without cuts. At the same time, the RSC budget would make the Trump/GOP tax cuts for the wealthy and big corporations permanent. They will not entertain, however, raising taxes on high income earners in order to bring more revenue into Social Security, which is the preferred solution of many congressional Democrats, President Biden, and advocates including NCPSSM.

The RSC blueprint not only threatens retirees’ and families’ financial security, but their health security, too, by undermining the Medicare program. It calls for converting Medicare to a “premium support model” — meaning guaranteed benefits would be replaced with vouchers. As Rep. Boyle pointed out, “Seniors would be left to fend for themselves in the insurance marketplace with nothing more than a coupon.”

With the 2024 elections looming, House Republicans couldn’t have put a finer point on their true priorities: shower the rich and corporations with huge tax breaks and cut the programs that working Americans rely on for financial and health security. This comes a week after Donald Trump told CNBC that there is “a lot to be done” in cutting “entitlements” (Social Security and Medicare), only to try to walk back that statement a few days later.

President Biden’s campaign tweeted in response to Trump’s CNBC comments, “Not on my watch.” On March 11, the President released his budget for the next fiscal year, which called for strengthening Social Security by adjusting the payroll tax cap so that anyone earning over $400,000 in wages would continue contributing to the system. In the past, the president advocated bolstering Medicare’s finances by leveraging some of the net investment tax paid by wealthier individuals.

TIRED OF READING… and want to listen instead? Check out our “You Earned This” podcast! 15-minute episodes about topics important to seniors and their families! LISTEN HERE.

Biden: The Wealthy Will Pay Their Fair Share into Social Security

In Thursday night’s State of the Union address, President Biden put himself unequivocally on the side of American seniors and the programs they rely on. He redoubled his commitment to protecting Social Security after confronting congressional Republicans in last year’s speech. The president went beyond taking seniors’ earned benefits “off the table” for cuts as he did last year — by declaring, “I will protect and strengthen Social Security and make the wealthy pay their fair share.”

Referring to the payroll wage cap – currently set at $168,600 – the President said that “working people who built this country pay more into Social Security than millionaires and billionaires do. It’s not fair.” We applaud his call for Congress to “stand up for seniors” — and defend Social Security against proposed GOP cuts, warning “If anyone tries to cut Social Security or raise the retirement age. I will stop you!”

The House Republican Study Committee called for raising the Social Security retirement age in its 2024 budget blueprint. Former presidential candidate Nikki Haley campaigned on raising the age, even though it would represent a massive benefit cut — if not for today’s seniors, then for future generations.

The President also affirmed his leadership role in lowering prescription drug prices, another issue of supreme importance to American seniors. Millions of seniors have been forced by Big Pharma price gouging to ration crucial medications — or to choose between filling prescriptions and paying for other essentials.

The President wants to supercharge Medicare’s new power to negotiate drug prices (via the Inflation Reduction Act) by increasing the number of medications subject to negotiations — from 10 this first year to 50 per year — or 500 medications over a decade. (The current law allows for 20 drugs to be negotiated next year). The President said that it’s vital that Medicare be able to negotiate prices for “the major drugs that seniors rely on, like those used for treating heart disease, cancer, and diabetes.”

“This State of the Union speech reminds us that the two parties’ positions on the federal government’s role in seniors’ financial and health security could not be more different. The President reinforced tonight that while the other side does the bidding of Big Pharma and their wealthy donors, he will continue to fight for seniors and their families.” – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

The President echoed the administration’s proposed new rule that would establish minimum levels for staffing of nursing homes to “make sure your loved ones get the care they deserve and that they expect.” We strongly support the rule and object to Republican attempts to block it. The President also called for extending the Inflation Reduction Act’s $2,000 out of pocket cap on Medicare drug costs to all Americans covered by private insurance.

Tonight’s speech reinforced the stark contrast between the President’s approach to seniors’ programs and the Republican approach — which emphasizes benefit cuts and privatization. The House Republican Study Committee recommended raising the retirement age, means testing, and a more miserly COLA formula for Social Security. House Republicans have been pushing the creation of a fiscal commission that could fast-track cuts to seniors’ earned benefits. Meanwhile, not a single Republican member of Congress supported the President’s Inflation Reduction Act, which is already providing seniors with relief from soaring drug costs — and having a positive effect on the consumer market as a whole.

Seniors’ advocates joined NCPSSM in applauding the President’s speech. Yael Lehmann, interim executive director of Families USA, praised Biden’s “stalwart defense of programs like… Social Security, Medicaid, and Medicare.” Rich Fiesta, Executive Director of the Alliance for Retired Americans, gave kudos to the President for stating “his firm opposition to any legislation that will cut the benefits Americans earn over a lifetime of work, including a so-called ‘fiscal commission’ to meet behind closed doors and do Congress’ dirty work.” Nancy Altman, President of Social Security Works, concluded that “Biden and Democrats are fighting to protect and expand Social Security and Medicare, while Donald Trump and Republicans are scheming to gut them behind closed doors.”

Millionaires Are Done Paying Into Social Security for 2024

Millionaires stop paying into Social Security for the year on March 1st — and billionaires already stopped contributing wages to the program in January. The rest of us continue paying into the system for the entire year. Is it fair that Elon Musk, Rupert Murdoch, Charles Koch, and Tim Cook of Apple don’t have to contribute to Social Security for the rest of the year while most Americans do? We don’t think so. Our Social Security expert, Maria Freese, explains why we need to scrap — or adjust — the payroll wage cap.

Q: For those who don’t know, what is the Social Security “payroll wage cap?”

FREESE: Most people have no idea that there’s a limit on how much of your wages are subject to Social Security payroll taxes because they don’t make enough money to ever reach the cap. This year the cap is $168,600. Once you reach that amount in wages, you stop paying into Social Security for the rest of the year.

Q: So the slogan is: “Scrap the Cap” and we support adjusting the payroll wage cap. Why? Why do we support that?

FREESE: High-income earners pay a significantly smaller percentage of their wages into Social Security than the rest of us. That’s not only patently unfair; it deprives Social Security of much-needed revenue, and we believe that the best way to infuse new revenue into Social Security is to ask the wealthiest among us to pay their fair share.

Q: In years past, 90% of wages in this country fell below the cap, so that income was captured. Today, only about 83% of those earnings are subject to the Social Security payroll tax. That’s because of widening wealth inequality, correct?

FREESE: While middle-income workers’ wages have been stagnating for the last couple of decades, the earnings of the highest paid workers in the country have continued to grow disproportionately. This imbalance means that more and more of the income earned by the wealthy is exempt from paying into Social Security, while workers who are already suffering because their wages haven’t kept up with the cost of living over the past decades they continue contributing on every dollar they earn.

Q: Senator Bernie Sanders and Representative John Larson have offered legislation that would adjust the payroll wage cap, which would go a long way toward keeping the Social Security trust fund solvent beyond its projected depletion date in 2034. Tell us more about how these bills would do that.

FREESE: Both bills ask the wealthiest among us to pay their fair share. They just start at different thresholds. The bill by Senator Sanders reinstates Social Security payroll taxes for wages over $250,000 a year. The bill by Congressman Larson, on the other hand, begins the Social Security payroll taxes again for those earning over $400,000 a year. They did that intentionally, so that it would line up with President Biden’s commitment not to raise taxes on anyone earning under $400,000.

In addition to raising the wage cap, they also both impose a tax on investment income for the wealthiest, who, more and more, are living on the income produced by stocks and bonds rather than wages.

Q: In return for the wealthy contributing more, which they would under this legislation, they would get a higher benefit? Is that right?

FREESE: We believe they should, and in Congressman Larson’s bill, they do. Social security is an earned benefit. The taxes we contribute have a direct relationship to the amount of benefits we earn. For those who earn the least over their lifetimes, Social Security provides a higher proportionate benefit either in retirement or in case of disability — as a percentage of what they earned while they were working.

Q: We’re calling on President Biden to include in his next fiscal year budget a proposal for Social Security that would have people earning more than $400,000 per year contribute to the program and not hit a cap. And that would be in keeping with his pledge that you mentioned earlier, not to raise taxes on anyone making less than that, right?

FREESE: That’s exactly right. And in fact, as I mentioned earlier, the bill by Congressman Larson does exactly that. It does not affect taxes paid by anyone earning under $400,000 a year. And that was done intentionally to align the proposal with the president’s commitment not to raise taxes for anyone earning under that amount.

Q: If the Republicans oppose bringing in new revenue to Social Security by having the wealthy contribute a little more, what do the Republicans propose instead?

FREESE: That’s actually a very good question. Republicans have generally been unwilling to put any of their proposals on paper for obvious reasons. Cutting Social Security is extremely unpopular, and they don’t want voters to see how they would cut benefits. So instead, they’ve resorted to calling for a so-called fiscal commission that would design a reform proposal that would then be fast-tracked through Congress before the public could even find out what was in it. That way, they hope to avoid political accountability for cutting the country’s most successful and popular program.

So we don’t really know what they would propose. They hope that they can sneak through significant benefit cuts and probably not do a whole lot of revenue raising — if they use this configuration of a fiscal commission to do their dirty work for them, basically.

Q: A recent survey that we did of our members and supporters indicates 96% support for raising the payroll wage cap. So I ask you again, if this is so popular, why hasn’t it been done?

FREESE: Republicans don’t support and have not supported in the past any proposals to raise taxes on their wealthy contributors or on corporations. So you can’t get any Republican support. You couldn’t get a bill through the Senate. It would be hard enough to get it through the House, but you certainly couldn’t get it through the Senate.

Q: We have been beating this drum for many years now about adjusting the payroll wage cap. What do you think the likelihood is of this happening anytime soon?

FREESE: It’s really hard to get members of Congress to agree on anything unless they’re faced with a deadline or a crisis. And even then, it’s not easy to find consensus these days. Social Security doesn’t face that deadline until the trust funds become insolvent, which currently, as you mentioned, is projected to happen in the mid 2030s. It would be better for everyone if they were able to do it sooner rather than later, but Congress just doesn’t tend to work that way.

Wisconsin’s MAGA Senate Candidate in Hot Water again re. Nursing Homes

MAGA Senate Candidate Eric Hovde (from campaign ad)

We blogged a couple of weeks ago about Wisconsin GOP Senate candidate Erik Hovde’s head-scratching comments suggesting that seniors in nursing homes don’t have the mental capacity to vote. Now, the New York Times has reported, Hovde is financially entangled with a nursing home that is being sued for mistreating patients:

The bank he leads, Utah-based Sunwest, last month was named as a co-defendant in a California lawsuit that accuses a senior living facility partly owned by the bank of elder abuse, negligence and wrongful death. – NY Times, 4/20/24

The story added a new dimension to the public’s understanding of Hovde, a Trump-endorsed MAGA candidate who is trying to unseat incumbent Democratic Senator Tammy Baldwin. (NCPSSM’s PAC endorsed Baldwin in March.) On Tuesday, NCPSSM president and CEO Max Richtman criticized Hovde as being out of touch with older voters… in a press call organized by Wisconsin’s Democratic party:

“Eric Hovde is obviously very comfortable among wealthy bankers, but not so much with the people of Wisconsin — and certainly not with the state’s seniors. The contrast with Senator Baldwin could not be clearer.” – Max Richtman, NCPSSM President & CEO, 4/23/24

According to Wisconsin Democratic Party chair Ben Wilker, Hovde has managed to insult not only seniors — but several other constituencies. Wilker quotes Hovde as saying that farmers spend all their time driving around on tractors and don’t do real physical labor; that young Wisconsinites lack a work ethic and are “so stupid”; and that people struggling with obesity should pay more for their health care. Five months before the general election, Hovde is certainly off to an auspicious start!

Read on… here is our original blog post from 4/11/24::::

Seniors’ advocates and their political allies are criticizing recent comments by Wisconsin U.S. Senate candidate Eric Hovde suggesting that nursing home residents can’t – or shouldn’t – vote. Hovde, who is running to unseat incumbent Senator Tammy Baldwin (D-WI), told Fox News’ Guy Benson:::

“We had nursing homes where you had 100 percent voting… Well, if you’re in a nursing home, you only have a five, six-month life expectancy. Almost nobody in a nursing home is in a point to vote. And you had children, adult children showing up saying, ‘Who voted for my 85 or 90-year-old father or mother?’” – GOP Senate candidate Eric Hovde

These comments by the Trump-endorsed, MAGA Republican candidate drew sharp rebukes as blatantly ageist and fact-free. “Hovde said that people living in nursing homes usually die after a few months,” Senator Baldwin’s campaign responded. “Everyone deserves the freedom to vote, so they can make their voices heard in our elections. But Eric Hovde wants to take that away for seniors living in nursing homes.”

NCPSSM, which has endorsed Baldwin’ re-election bid, blasted Hovde’s comments. “Senators are supposed to represent ALL of their voters, and it is a total insult to the basic dignity of Wisconsin’s seniors to suggest that they are too old to vote,” said Luke Warren, director of the NCPSSM political action committee (PAC). “Hovde should be celebrating high voter turnout among nursing home residents, not griping about it.”

Anne Montgomery, NCPSSM’s senior health policy expert, added, “Hovde is basically suggesting that people in nursing homes are unworthy of voting, and that they are all about to die, which is not true.” Montgomery corrected several false or misleading arguments in Hovde’s comments:::

*The average life expectancy of nursing home residents is years, not months.

*There’s ZERO evidence that fraudulent ballots were cast in Wisconsin nursing homes in 2020.

*Nursing home residents, on average, are trending younger. The percentage of patients under 65 years of age in nursing homes grew from 10% in 2000 to 16% in 2017.

The Independent offered some additional fact-checking, indicating that voter participation in Wisconsin nursing homes was nowhere near “100%” in 2020, as Hovde claimed. “A review… by the Wisconsin State Journal found just one nursing home in the state had a 100% voter turnout. (It had just 12 registered voters).” Other facilities ranged from 42-91%, the paper reported.

Hovde’s remarks are not random for a MAGA candidate; they are part of Trump’s larger (and false) narrative about the 2020 election being “rigged.” (Hovde disagrees that the election was “stolen,” but said “things happened in that election that were very troublesome.”) Wisconsin was crucial to Joe Biden’s electoral victory in 2020, and the MAGA movement can’t abide that he won the state fairly, claiming that “thousands of crooked votes” came out of nursing homes in Wisconsin — a falsehood that has been completely discredited.

“Instead of trying to disenfranchise seniors living in nursing homes,” NCPSSM’s Anne Montgomery says, “We should be continuing to try to make it easier for nursing home residents to vote. They are just as entitled to participate in our democratic system as everyone else.”

Montgomery points out that lawmakers over the years have tried to reduce barriers to voting access for this population, including mail balloting and accommodations for people with disabilities at polling places. Montgomery cited the Help America Vote Act of 2002 — and a series of GAO reports highlighted by then-Senator and Baldwin’s predecessor, Herb Kohl (D-WI), acknowledging efforts to facilitate voting access and calling for further improvements.

When Badger State seniors cast ballots in 2024, they will have to take stock of the two Senate candidates, MAGA Republican Eric Hovde vs. Democrat Tammy Baldwin, who NCPSSM praised as a “champion of Wisconsin seniors.” As PAC director Luke Warren says, “It takes little imagination to picture how a ‘Senator Hovde’ would treat older constituents if he were in office. He has praised plans to gut Medicare and supports cutting Social Security. These latest comments are a stark reminder of the stakes in November for Wisconsin seniors.”

Listen to our podcast about ageism in culture and politics: Part 1 and Part 2 with expert S. Jay Olshanksy.

MAGA Wisconsin Senate Candidate Rebuked for Nursing Home Comments

Seniors’ advocates and their political allies are criticizing recent comments by Wisconsin U.S. Senate candidate Eric Hovde suggesting that nursing home residents can’t – or shouldn’t – vote. Hovde, who is running to unseat incumbent Senator Tammy Baldwin (D-WI), told Fox News’ Guy Benson:::

“We had nursing homes where you had 100 percent voting… Well, if you’re in a nursing home, you only have a five, six-month life expectancy. Almost nobody in a nursing home is in a point to vote. And you had children, adult children showing up saying, ‘Who voted for my 85 or 90-year-old father or mother?’” – GOP Senate candidate Eric Hovde

These comments by the Trump-endorsed, MAGA Republican candidate drew sharp rebukes as blatantly ageist and fact-free. “Hovde said that people living in nursing homes usually die after a few months,” Senator Baldwin’s campaign responded. “Everyone deserves the freedom to vote, so they can make their voices heard in our elections. But Eric Hovde wants to take that away for seniors living in nursing homes.”

NCPSSM, which has endorsed Baldwin’ re-election bid, blasted Hovde’s comments. “Senators are supposed to represent ALL of their voters, and it is a total insult to the basic dignity of Wisconsin’s seniors to suggest that they are too old to vote,” said Luke Warren, director of the NCPSSM political action committee (PAC). “Hovde should be celebrating high voter turnout among nursing home residents, not griping about it.”

Anne Montgomery, NCPSSM’s senior health policy expert, added, “Hovde is basically suggesting that people in nursing homes are unworthy of voting, and that they are all about to die, which is not true.” Montgomery corrected several false or misleading arguments in Hovde’s comments:::

*The average life expectancy of nursing home residents is years, not months.

*There’s ZERO evidence that fraudulent ballots were cast in Wisconsin nursing homes in 2020.

*Nursing home residents, on average, are trending younger. The percentage of patients under 65 years of age in nursing homes grew from 10% in 2000 to 16% in 2017.

The Independent offered some additional fact-checking, indicating that voter participation in Wisconsin nursing homes was nowhere near “100%” in 2020, as Hovde claimed. “A review… by the Wisconsin State Journal found just one nursing home in the state had a 100% voter turnout. (It had just 12 registered voters).” Other facilities ranged from 42-91%, the paper reported.

Hovde’s remarks are not random for a MAGA candidate; they are part of Trump’s larger (and false) narrative about the 2020 election being “rigged.” (Hovde disagrees that the election was “stolen,” but said “things happened in that election that were very troublesome.”) Wisconsin was crucial to Joe Biden’s electoral victory in 2020, and the MAGA movement can’t abide that he won the state fairly, claiming that “thousands of crooked votes” came out of nursing homes in Wisconsin — a falsehood that has been completely discredited.

“Instead of trying to disenfranchise seniors living in nursing homes,” NCPSSM’s Anne Montgomery says, “We should be continuing to try to make it easier for nursing home residents to vote. They are just as entitled to participate in our democratic system as everyone else.”

Montgomery points out that lawmakers over the years have tried to reduce barriers to voting access for this population, including mail balloting and accommodations for people with disabilities at polling places. Montgomery cited the Help America Vote Act of 2002 — and a series of GAO reports highlighted by then-Senator and Baldwin’s predecessor, Herb Kohl (D-WI), acknowledging efforts to facilitate voting access and calling for further improvements.

When Badger State seniors cast ballots in 2024, they will have to take stock of the two Senate candidates, MAGA Republican Eric Hovde vs. Democrat Tammy Baldwin, who NCPSSM praised as a “champion of Wisconsin seniors.” As PAC director Luke Warren says, “It takes little imagination to picture how a ‘Senator Hovde’ would treat older constituents if he were in office. He has praised plans to gut Medicare and supports cutting Social Security. These latest comments are a stark reminder of the stakes in November for Wisconsin seniors.”

Listen to our podcast about ageism in culture and politics: Part 1 and Part 2 with expert S. Jay Olshanksy.

Republican Study Committee Budget Cuts Earned Benefits; Keeps Trump Tax Cuts

For solid clues as to what the Republicans would do to Americans’ earned benefits if they maintain power in the House and recapture the Senate and/or the White House, look no further than the House Republican Study Committee (RSC) 2025 budget blueprint. For the second year in a row, the RSC proposes cutting Social Security and Medicare. Rep. Brendan Boyle, Ranking member of the House Budget committee, estimated at a hearing today that these cuts amount to $1.5 trillion for Social Security and $1 trillion for Medicare.

On the Social Security side, the RSC calls for raising the full Social Security retirement age from its current level of 67 (for anyone born in 1960 or later) to an unspecified older age. “Raising the retirement age is a huge benefit cut,” explains NCPSSM President and CEO, Max Richtman, “because you’d be receiving less money as a beneficiary during your lifetime.”

Republicans say that because (on average) people are living longer, they should be forced to work longer before collecting full Social Security benefits. They neglect to mention that workers in physically demanding jobs cannot always work into their late 60s — or that living longer means having to stretch what may be scant retirement savings over a longer period of time.

The RSC also proposes reducing benefits for “upper income earners.” This would put Social Security on a slippery slope toward means testing. “Means testing means Social Security would no longer be an earned benefit, but a welfare program,” says Richtman.

An analysis by the Center for American Progress estimates if the RSC proposal were in effect today, anyone whose lifetime wages averaged over $85,000 would be considered ‘wealthy’ and have their benefits cut — including the elimination of crucial spousal benefits. “We don’t usually consider people earning $85,000 per year wealthy,” says Maria Freese, NCPSSM’s senior legislative representative. “Making matters worse, in order to save the program any significant amount of money, benefits would have to be reduced for people earning even less than $85,000, cutting deep into the heart of the middle class.”

The RSC stresses that their spending plan “does not cut or delay retirement benefits for any senior in or near retirement.” But it would cut benefits for younger Gen Xers, Millennials, and Gen Z. “These younger workers will need every dollar of their Social Security benefits when they retire. Like the older generations, they earned these benefits and shouldn’t have them cut,” says Richtman.

Trump told CNBC he’d cut “entitlements.” Biden said: “Not on my watch!”

Republicans may deny it, but cutting Social Security IS their fiscal plan, claiming that the government can’t afford to strengthen the program without cuts. At the same time, the RSC budget would make the Trump/GOP tax cuts for the wealthy and big corporations permanent. They will not entertain, however, raising taxes on high income earners in order to bring more revenue into Social Security, which is the preferred solution of many congressional Democrats, President Biden, and advocates including NCPSSM.

The RSC blueprint not only threatens retirees’ and families’ financial security, but their health security, too, by undermining the Medicare program. It calls for converting Medicare to a “premium support model” — meaning guaranteed benefits would be replaced with vouchers. As Rep. Boyle pointed out, “Seniors would be left to fend for themselves in the insurance marketplace with nothing more than a coupon.”

With the 2024 elections looming, House Republicans couldn’t have put a finer point on their true priorities: shower the rich and corporations with huge tax breaks and cut the programs that working Americans rely on for financial and health security. This comes a week after Donald Trump told CNBC that there is “a lot to be done” in cutting “entitlements” (Social Security and Medicare), only to try to walk back that statement a few days later.

President Biden’s campaign tweeted in response to Trump’s CNBC comments, “Not on my watch.” On March 11, the President released his budget for the next fiscal year, which called for strengthening Social Security by adjusting the payroll tax cap so that anyone earning over $400,000 in wages would continue contributing to the system. In the past, the president advocated bolstering Medicare’s finances by leveraging some of the net investment tax paid by wealthier individuals.

TIRED OF READING… and want to listen instead? Check out our “You Earned This” podcast! 15-minute episodes about topics important to seniors and their families! LISTEN HERE.

Biden: The Wealthy Will Pay Their Fair Share into Social Security

In Thursday night’s State of the Union address, President Biden put himself unequivocally on the side of American seniors and the programs they rely on. He redoubled his commitment to protecting Social Security after confronting congressional Republicans in last year’s speech. The president went beyond taking seniors’ earned benefits “off the table” for cuts as he did last year — by declaring, “I will protect and strengthen Social Security and make the wealthy pay their fair share.”

Referring to the payroll wage cap – currently set at $168,600 – the President said that “working people who built this country pay more into Social Security than millionaires and billionaires do. It’s not fair.” We applaud his call for Congress to “stand up for seniors” — and defend Social Security against proposed GOP cuts, warning “If anyone tries to cut Social Security or raise the retirement age. I will stop you!”

The House Republican Study Committee called for raising the Social Security retirement age in its 2024 budget blueprint. Former presidential candidate Nikki Haley campaigned on raising the age, even though it would represent a massive benefit cut — if not for today’s seniors, then for future generations.

The President also affirmed his leadership role in lowering prescription drug prices, another issue of supreme importance to American seniors. Millions of seniors have been forced by Big Pharma price gouging to ration crucial medications — or to choose between filling prescriptions and paying for other essentials.

The President wants to supercharge Medicare’s new power to negotiate drug prices (via the Inflation Reduction Act) by increasing the number of medications subject to negotiations — from 10 this first year to 50 per year — or 500 medications over a decade. (The current law allows for 20 drugs to be negotiated next year). The President said that it’s vital that Medicare be able to negotiate prices for “the major drugs that seniors rely on, like those used for treating heart disease, cancer, and diabetes.”

“This State of the Union speech reminds us that the two parties’ positions on the federal government’s role in seniors’ financial and health security could not be more different. The President reinforced tonight that while the other side does the bidding of Big Pharma and their wealthy donors, he will continue to fight for seniors and their families.” – Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare

The President echoed the administration’s proposed new rule that would establish minimum levels for staffing of nursing homes to “make sure your loved ones get the care they deserve and that they expect.” We strongly support the rule and object to Republican attempts to block it. The President also called for extending the Inflation Reduction Act’s $2,000 out of pocket cap on Medicare drug costs to all Americans covered by private insurance.

Tonight’s speech reinforced the stark contrast between the President’s approach to seniors’ programs and the Republican approach — which emphasizes benefit cuts and privatization. The House Republican Study Committee recommended raising the retirement age, means testing, and a more miserly COLA formula for Social Security. House Republicans have been pushing the creation of a fiscal commission that could fast-track cuts to seniors’ earned benefits. Meanwhile, not a single Republican member of Congress supported the President’s Inflation Reduction Act, which is already providing seniors with relief from soaring drug costs — and having a positive effect on the consumer market as a whole.

Seniors’ advocates joined NCPSSM in applauding the President’s speech. Yael Lehmann, interim executive director of Families USA, praised Biden’s “stalwart defense of programs like… Social Security, Medicaid, and Medicare.” Rich Fiesta, Executive Director of the Alliance for Retired Americans, gave kudos to the President for stating “his firm opposition to any legislation that will cut the benefits Americans earn over a lifetime of work, including a so-called ‘fiscal commission’ to meet behind closed doors and do Congress’ dirty work.” Nancy Altman, President of Social Security Works, concluded that “Biden and Democrats are fighting to protect and expand Social Security and Medicare, while Donald Trump and Republicans are scheming to gut them behind closed doors.”

Millionaires Are Done Paying Into Social Security for 2024

Millionaires stop paying into Social Security for the year on March 1st — and billionaires already stopped contributing wages to the program in January. The rest of us continue paying into the system for the entire year. Is it fair that Elon Musk, Rupert Murdoch, Charles Koch, and Tim Cook of Apple don’t have to contribute to Social Security for the rest of the year while most Americans do? We don’t think so. Our Social Security expert, Maria Freese, explains why we need to scrap — or adjust — the payroll wage cap.

Q: For those who don’t know, what is the Social Security “payroll wage cap?”

FREESE: Most people have no idea that there’s a limit on how much of your wages are subject to Social Security payroll taxes because they don’t make enough money to ever reach the cap. This year the cap is $168,600. Once you reach that amount in wages, you stop paying into Social Security for the rest of the year.

Q: So the slogan is: “Scrap the Cap” and we support adjusting the payroll wage cap. Why? Why do we support that?

FREESE: High-income earners pay a significantly smaller percentage of their wages into Social Security than the rest of us. That’s not only patently unfair; it deprives Social Security of much-needed revenue, and we believe that the best way to infuse new revenue into Social Security is to ask the wealthiest among us to pay their fair share.

Q: In years past, 90% of wages in this country fell below the cap, so that income was captured. Today, only about 83% of those earnings are subject to the Social Security payroll tax. That’s because of widening wealth inequality, correct?

FREESE: While middle-income workers’ wages have been stagnating for the last couple of decades, the earnings of the highest paid workers in the country have continued to grow disproportionately. This imbalance means that more and more of the income earned by the wealthy is exempt from paying into Social Security, while workers who are already suffering because their wages haven’t kept up with the cost of living over the past decades they continue contributing on every dollar they earn.

Q: Senator Bernie Sanders and Representative John Larson have offered legislation that would adjust the payroll wage cap, which would go a long way toward keeping the Social Security trust fund solvent beyond its projected depletion date in 2034. Tell us more about how these bills would do that.

FREESE: Both bills ask the wealthiest among us to pay their fair share. They just start at different thresholds. The bill by Senator Sanders reinstates Social Security payroll taxes for wages over $250,000 a year. The bill by Congressman Larson, on the other hand, begins the Social Security payroll taxes again for those earning over $400,000 a year. They did that intentionally, so that it would line up with President Biden’s commitment not to raise taxes on anyone earning under $400,000.

In addition to raising the wage cap, they also both impose a tax on investment income for the wealthiest, who, more and more, are living on the income produced by stocks and bonds rather than wages.

Q: In return for the wealthy contributing more, which they would under this legislation, they would get a higher benefit? Is that right?

FREESE: We believe they should, and in Congressman Larson’s bill, they do. Social security is an earned benefit. The taxes we contribute have a direct relationship to the amount of benefits we earn. For those who earn the least over their lifetimes, Social Security provides a higher proportionate benefit either in retirement or in case of disability — as a percentage of what they earned while they were working.

Q: We’re calling on President Biden to include in his next fiscal year budget a proposal for Social Security that would have people earning more than $400,000 per year contribute to the program and not hit a cap. And that would be in keeping with his pledge that you mentioned earlier, not to raise taxes on anyone making less than that, right?

FREESE: That’s exactly right. And in fact, as I mentioned earlier, the bill by Congressman Larson does exactly that. It does not affect taxes paid by anyone earning under $400,000 a year. And that was done intentionally to align the proposal with the president’s commitment not to raise taxes for anyone earning under that amount.

Q: If the Republicans oppose bringing in new revenue to Social Security by having the wealthy contribute a little more, what do the Republicans propose instead?

FREESE: That’s actually a very good question. Republicans have generally been unwilling to put any of their proposals on paper for obvious reasons. Cutting Social Security is extremely unpopular, and they don’t want voters to see how they would cut benefits. So instead, they’ve resorted to calling for a so-called fiscal commission that would design a reform proposal that would then be fast-tracked through Congress before the public could even find out what was in it. That way, they hope to avoid political accountability for cutting the country’s most successful and popular program.

So we don’t really know what they would propose. They hope that they can sneak through significant benefit cuts and probably not do a whole lot of revenue raising — if they use this configuration of a fiscal commission to do their dirty work for them, basically.

Q: A recent survey that we did of our members and supporters indicates 96% support for raising the payroll wage cap. So I ask you again, if this is so popular, why hasn’t it been done?

FREESE: Republicans don’t support and have not supported in the past any proposals to raise taxes on their wealthy contributors or on corporations. So you can’t get any Republican support. You couldn’t get a bill through the Senate. It would be hard enough to get it through the House, but you certainly couldn’t get it through the Senate.

Q: We have been beating this drum for many years now about adjusting the payroll wage cap. What do you think the likelihood is of this happening anytime soon?

FREESE: It’s really hard to get members of Congress to agree on anything unless they’re faced with a deadline or a crisis. And even then, it’s not easy to find consensus these days. Social Security doesn’t face that deadline until the trust funds become insolvent, which currently, as you mentioned, is projected to happen in the mid 2030s. It would be better for everyone if they were able to do it sooner rather than later, but Congress just doesn’t tend to work that way.