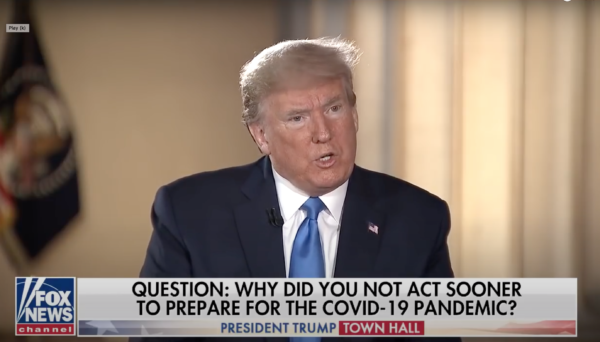

President Trump set off alarm bells for America’s seniors on a Sunday FOX town hall by insisting once again on eliminating Social Security payroll taxes – both employer and worker contributions. The President even threatened to block the next phase of badly-needed Coronavirus relief legislation unless he gets his risky payroll tax cuts. Make no mistake: by pushing to cut off the program’s funding stream, President Trump is taking the first step toward dismantling Social Security.

“I want to see a payroll tax cut on both sides, a very strong one… and I told [Treasury Secretary] Steve [Mnuchin] just today, we’re not doing anything unless we get a payroll tax cut. That is so important to the success of our country.” – President Trump, FOX town hall, 5/3/20

While providing tax relief to working and middle-class Americans is an important consideration as our leaders respond to the Coronavirus pandemic, cutting, eliminating or deferring the Social Security payroll tax is an ill-advised way to do it. Any reductions to the program’s revenue stream would threaten Social Security’s ability to continue paying benefits to the 64 million Americans who depend on those benefits for their economic survival. In light of the recent Social Security Trustees report, it is clear that Social Security needs more revenue – not less.

“Social Security is an earned benefit fully funded by the contributions of workers throughout their working lives. Payroll tax cuts are an assault on that fundamental idea. This is equally true even if the funds are replaced by general revenues from the Treasury.” – Max Richtman, National Committee president, 4/24/20

There are better ways to stimulate the economy and provide relief for financially struggling Americans during the Coronavirus pandemic – including additional rounds of cash payments (the same kind included in the CARES Act that are currently being sent to households around the country). Meanwhile, payroll tax cuts are an ineffectual means of stimulus because they benefit employers and upper-income earners the most, leaving poorer workers with only a few hundred dollars in annual relief. Eliminating payroll taxes puts zero dollars in the hands of the unemployed – or public service workers at all levels of government who do not pay into Social Security.

Social Security, on the other hand, provides some $1.6 trillion annual economic stimulus as beneficiaries spend their benefits on essential goods and services. Reducing payroll taxes undermines Social Security – and its stimulus effect on the economy, making President Trump’s proposals even more nonsensical.

Despite it being such a patently bad idea, President Trump appears to be obsessed with obliterating the payroll contributions that fund Social Security. He was pitching this fraught idea well before the pandemic. Last August he floated the idea as a means of stimulating what he feared was a stalling economy. The push to cut payroll taxes can be seen as part of a pattern of proclaiming support for Social Security while pushing proposals to undermine it, including the administration’s repeated calls to cut Social Security Disability Insurance (SSDI), and the establishment of new rules that can strip people with disabilities of their benefits.

All of these actions blatantly violate Trump’s repeated promises to seniors “not to touch” Social Security. The complete elimination of payroll tax cuts goes way beyond “touching.” Choking off Social Security’s funding stream is an existential threat to Americans’ earned benefits. Seniors and their advocates, like the National Committee, must continue to push back against the President’s harmful proposals – by letting Congress and the White House know that payroll tax cuts are not acceptable. NCPSSM president and CEO Max Richtman sent President Trump a letter last week imploring him to consider the damage that payroll tax cuts would do to Social Security. Concerned citizens can call the National Committee’s legislative hotline at 1-800-998-0180 and tell our leaders “No” to payroll tax cuts – and “Hands off of Social Security!”