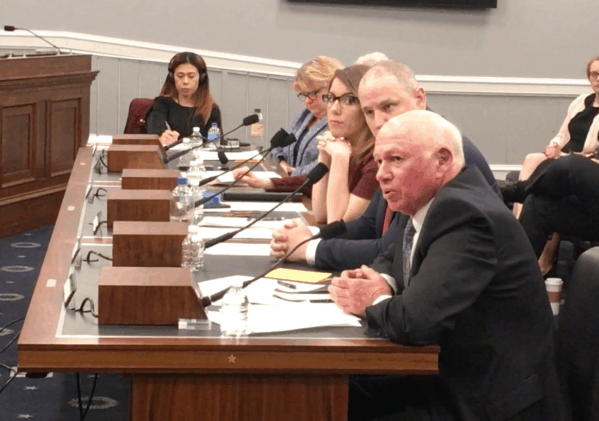

National Committee president Max Richtman pushes Social Security expansion at House hearing

Now that the Democrats have control of the U.S. House, Congress is actually holding hearings (under regular order, no less) on boosting Social Security – a topic the GOP-majority House eschewed. Congressman John Larson (D-CT) chaired a hearing of the House Social Security subcommittee Wednesday that made plain the stakes for current and future seniors – and the fundamental disagreement between the two parties about Social Security’s future.

“What the American want and deserve are solutions. The last time Congress seriously did something about Social Security, Ronald Reagan was President and Tip O’Neill was Speaker. We believe it’s long overdue for us to move forward on this issue.” – Rep. John Larson, 4/10/19

National Committee president Max Richtman joined a panel of witnesses including Diane Stone, director of the Newington, CT senior center from Rep. Larson’s home district; Shaun Castle, a veteran and Deputy Executive Director of Paralyzed Veterans of America; Steven Goss, Chief Actuary of the Social Security program; and Nancy Altman, President of Social Security Works.

Witnesses raised real-life examples of seniors living in the grey zone between true “economic security and poverty” who would be better off under Rep. Larson’s Social Security 2100 Act.

Richtman recognized Nettie Hailes, a National Committee volunteer in the audience who turned 91 on the day of the hearing. Hailes, whose husband was a Baptist pastor who helped organize Martin Luther King’s March on Washington, depends on Social Security for her income.

Max Richtman and National Committee volunteer Nettie Hailes

“After raising four children and working in real estate, Nettie claimed Social Security benefits at age 65. In addition to her own Social Security benefits, Nettie began receiving a survivor benefit after husband’s passing. She manages her money wisely to pay for her medical expenses, upkeep on her home and property taxes. She is proud to stay within her means but says it’s tough to try and keep up because the cost-of-living is so high.” – NCPSSM President Max Richtman, 4/10/19

Richtman said that the 2% across-the-board benefit increase in Congressman Larson’ bill, while modest, could make a big difference for seniors like Nettie. A two-percent boost would equal about $300 annually for the average retiree. So would the improved cost-of-living (COLA) formula in Larson’s legislation – the Consumer Price Index for the Elderly (CPI-E), to help Nettie and other seniors keep pace with inflation.

“This change in the formula for COLAs would effect millions of beneficiaries. It would allow Social Security benefits to keep up with inflation as it really impacts older people. The current formula is flawed. This legislation corrects that.” – NCPSSM President Max Richtman, 4/10/19

Congressman Larson proposes to pay for enhanced Social Security benefits by adjusting the payroll tax income cap so that earners making more than $400,000 per year would still contribute to Social Security like everyone else – and by raising payroll taxes by 1.2% over 24 years (the equivalent of 50 cents more per week for the average worker).

“It’s an insurance premium, not a tax. That’s why it’s called FICA (Federal Insurance Contribution Act). Is there any other ‘tax’ where you get disability, spousal, and pension benefits?” – Rep. John Larson, 4/10/19

Republicans on the subcommittee voiced general support for Social Security, but rejected any revenue-side solutions to improve benefits or to keep the system solvent. (Without raising additional revenue, the only other solution to Social Security’s projected shortfalls is to cut benefits – which the National Committee and most Democrats roundly reject.)

Democrats reminded Republicans that seniors cannot afford benefit cuts now or in the future, especially with employer-provided pensions disappearing and at least half of Americans not earning enough to save for retirement.

House Social Security subcommittee Democrats: We can afford to give seniors a benefit boost.

As Richtman pointed out during an exchange with Rep. Dan Kildee (D-MI), boosting Social Security benefits helps not only seniors – but the entire economy.

REP. KILDEE: Do social security beneficiaries put their earnings away for the future – or do they spend that money?

MAX RICHTMAN: The spend it and the money goes right into back into the economy. There’s a multiplier effect. Every dollar spent produces two dollars in economic stimulus.

REP. KILDEE: So, if we were to increase [benefits], that increase is going to go right back into the American economy and have a stimulus effect.

Social Security’s chief actuary, Steven Goss, affirmed that Congressman Larson’s bill would keep the system on a sound financial footing for at least the next 75 years. “The Social Security 2100 bill is the only one that does that,” he said, explaining that the legislation not only makes up for the shortfall in projected revenue, but includes enough for the modest benefit boost and some “cushion.”

Richtman testified that Larson’s legislation should help “put to rest” the “steady drumbeat of disinformation” from conservatives that Social Security is “going bankrupt” or won’t be around for future generations. “It will show clearly the program is sound and will be there for the rest of the century,” he said.

***************************************************************************************

For more on Wednesday’s hearing and Boosting Social Security, watch our Facebook Live broadcast from Capitol Hill