Let’s Protect & Expand Medicare and Medicaid as They Turn 55

President Johnson signs Medicare and Medicaid into law on July 30, 1965

On this 55th anniversary of Medicare and Medicaid, not only are both programs succeeding in fulfilling their original missions, they have adapted to the health care challenges of the past five decades and proven themselves anew during the unprecedented COVID crisis. Medicare is saving seniors’ lives by providing affordable, accessible care in the face of a disease that has hit older Americans particularly hard. Medicaid continues to provide this nation’s only dependable long-term care program – while its expansion under the Affordable Care Act covers vulnerable, lower-income Americans, many of whom have lost health coverage during the pandemic.

President Lyndon B. Johnson signed Medicare and Medicaid into law on July 30, 1965. Of the new Medicare program, he promised, ‘No longer will illness crush and destroy the savings that (older Americans) have so carefully put away over a lifetime so that they might enjoy dignity in their later years.’ While that promise has been met, both programs are at a critical pivot point in history.

There is a movement in Congress to expand both programs to meet the diverse and growing needs of seniors and lower-income Americans. The National Committee to Preserve Social Security and Medicare supports the House-passed bill (H.R. 3) that would add limited hearing, dental, and vision coverage to traditional Medicare. Medicare must be allowed to negotiate prices with drug-makers (as authorized by H.R. 3). This is the single most effective remedy for the price gouging that afflicts seniors and all Americans. We support the Affordable Care Act, which improved Medicare benefits and helped extend the program’s solvency – and provided for the expansion of Medicaid to cover millions of the uninsured.

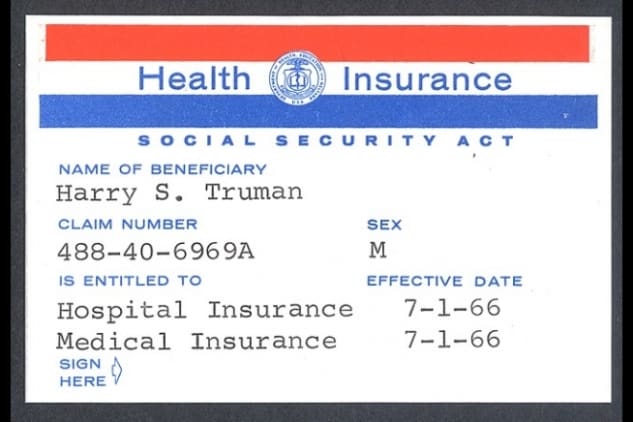

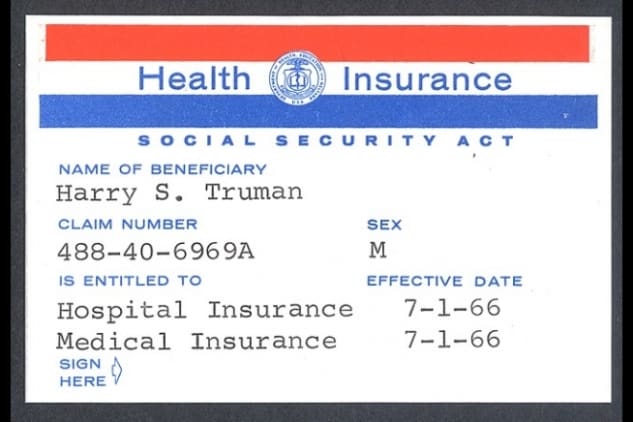

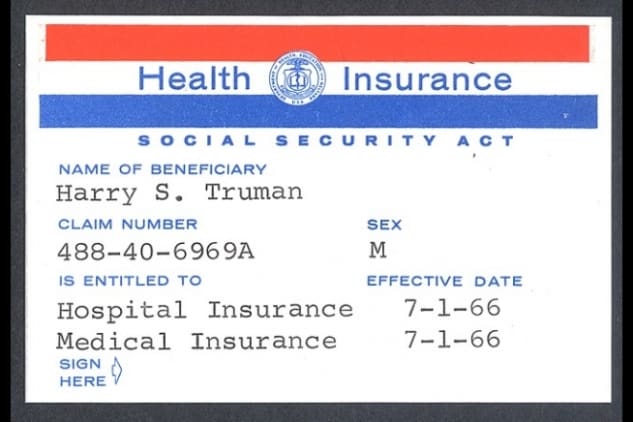

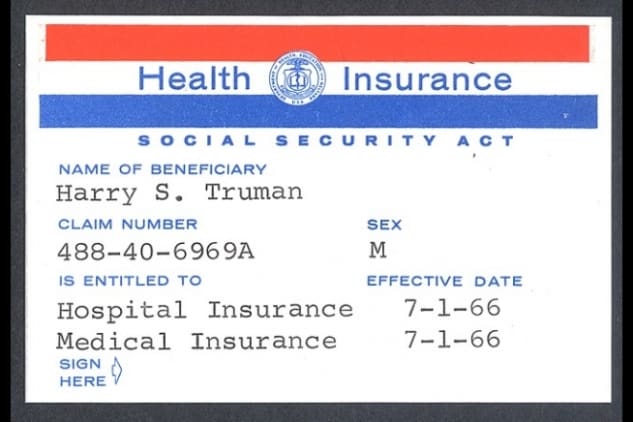

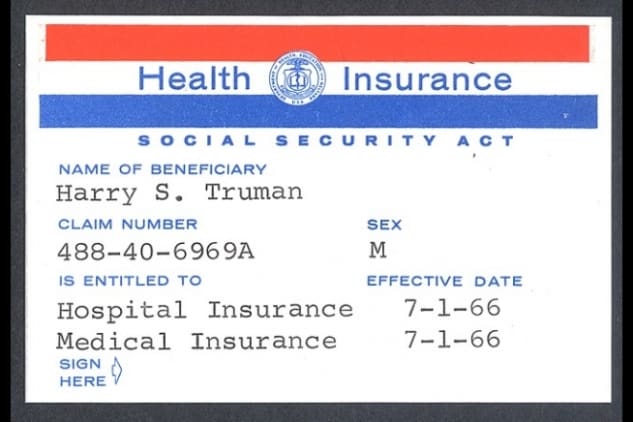

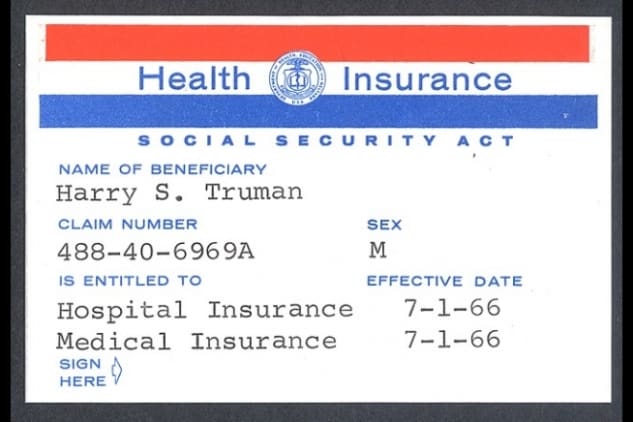

Former President Harry Truman received the first Medicare card

Unfortunately, President Trump and some of his allies in Congress are attempting to undermine both programs. Despite promising ‘not to touch’ either one, the president has called for more than $1.5 trillion in cuts over ten years to Medicare and Medicaid. His administration has tilted the playing field toward private Medicare Advantage plans, which restrict patients’ choice of doctors and have been flagged for overbilling taxpayers. The President wants the Supreme Court to strike down the Affordable Care Act (in the middle of a pandemic, no less), which would strip more than 20 million Americans of health care and reverse the law’s improvements to Medicare and Medicaid.

These attempts to dismantle health care programs that safeguard seniors, people with disabilities, and lower-income Americans makes today’s anniversary a bittersweet occasion. As we mark the decades of Medicare and Medicaid’s significance, we must continue to fight to protect and expand them in the face of attacks from their opponents. The 2020 elections present an opportunity to choose a president, senators and representatives who will champion the programs that give our citizens the quality health care and dignity they have earned and deserve.

Trump Prescription Drug Pricing Orders Too Limited, Too Late

The rhetoric President Trump used in unveiling a set of new executive orders on prescription drug pricing could not have been more bloated, nor the substance of those measures so skimpy. On Friday, the president proclaimed in dramatic fashion that the four “bold and historic” executive orders would be of “help for our great seniors,” achieve things “nobody thought could be done” and result in “massive reductions” to prescription drug prices.

That it took almost four years for the president to issue a set of orders addressing one of his highest campaign priorities in 2016 is suspect in and of itself. They were unveiled in the midst of a pandemic that has disproportionately imperiled seniors as Trump’s poll numbers with the crucial 65+ voting bloc are plummeting. It is hard not view these late-coming executive orders as a ploy to win back some of the senior vote rather than as a set of serious policy proposals.

Politico reported this weekend that the president’s orders are “rife with limitations,” despite his inflated rhetoric:

“The orders are not immediately enforceable. Health officials have been working on ways to implement some of the proposals — namely guidelines for states to implement importation plans. But it’s is unlikely that any could be finalized before the November presidential election…” – Politico, 7/24/20

Clearly, if the President wanted “bold” action on prescription drugs, he would have backed H.R. 3, The Elijah Cummings Lower Drug Costs Now Act, which allows the Medicare program to negotiate drug prices directly with Big Pharma. Not only did the president not embrace this legislation, he did not include Medicare price negotiation – the single most effective solution to the price gouging that affects so many of our seniors – in his executive orders.

“Any proposal that doesn’t include Medicare price negotiation can’t be taken seriously, because any serious policy effort must include it to address the underlying problem of price gouging.” – Max Richtman, president and CEO of the National Committee, 7/24/20

If he were serious about reducing prescription prices, the president could have pushed the GOP-controlled Senate to pass the Grassley-Wyden bill, which does not include price negotiation but represents a solid step toward controlling drug costs through inflation-indexing. Besides offering some tepid support for the bill, the president never agitated for its passage, instead claiming that he has been “waiting for Congress” to take action.

Price Caps

The first executive order would revive a long-standing proposal to link what Medicare pays for prescription drugs to the prices in other countries, which sounds like a sweeping action on face. But the order won’t go into effect immediately (if ever), because the order includes an escape clause for Big Pharma to come up with an alternative of its own.

Rebates

The second order would eliminate the rebates that pharmaceutical companies pay to insurance companies – which Stat News refers to as a “previously abandoned” plan.” The catch here is that the order would not kick-in if it affects insurance premiums.

Drug Importation

The third order instructs the Department of Health and Human Services to facilitate “grants to individuals of waivers of the prohibition of importation of prescription drugs,” meaning that individual Americans (not the federal government) could buy drugs from Canada and other countries.

Insulin and Epi-pens

The fourth order requires federal community health centers to pass discounts for insulin and epi-pens directly to patients. As Politico reports, the order only applies to approximately 1,000 community health centers nationwide, “not to hospitals that are frequently flagged as diverting the discounts away from patients toward other programs.”

Hitting Big Pharma with a Feather

The executive orders are consistent with the administration’s overall approach to soaring prescription drug prices, which has been piecemeal at best, disingenuous at worst. (Some of the president’s previous actions have been tossed out by the courts, others postponed or abandoned.) The president may talk tough about taking on Big Pharma, but his executive orders seem designed to strike the industry with the force of a feather.

Hardly “revolutionary” or “historic,” the latest executive orders “direct his administration to begin the normal, notoriously slow regulatory processes needed to reform the existing system,” Stat News observes.

National Committee president Max Richtman says that “seniors suffering from soaring prescription prices will not be fooled by grandiose pronouncements at a press conference that appear to be a ‘Hail Mary’ pass during an election year.”

Like previous Trump administration actions on this issue, the latest round of executive orders are too little, too late, and too weak to remedy the scourge of prescription price gouging.

Republicans Right to Reject Trump Payroll Tax Cuts, Wrong to Include TRUST Act in Corona Relief

The National Committee issued the following statement today in response to the latest reporting from Capitol Hill about GOP plans for the next Coronavirus relief bill.

“Republicans have jettisoned the President’s reckless payroll tax cut from their Coronavirus relief plan – at least for now. But seniors and their advocates must stay vigilant as the Trump administration remains laser-focused on payroll tax cuts, which pose a direct threat to Social Security. While Republicans did the right thing by setting aside Trump’s payroll tax cuts, they reportedly are considering injecting an equally menacing element into their relief bill.

The TRUST Act would set up special committees to decide the fate of federal trust funds, including Social Security and Medicare. This would allow benefit cuts to be fast-tracked through Congress. Seniors and people with disabilities need their benefits boosted, not slashed. Like payroll tax cuts, the TRUST Act is bad medicine for everyday Americans struggling to stay financially afloat, especially during the COVID crisis.

There is, however, some financial relief for seniors from other provisions of the GOP plan: another direct payment similar to the first relief bill, a freeze on Medicare Part B premium prices for 2021, and an extension of expanded telehealth coverage through next year. Measures like these will help protect seniors from rising costs during the financial crisis and ensure safe access to much-needed care as COVID continues to ravage our communities.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare

For more information on payroll tax cuts and Social Security, click here.

Advocates Alarmed by GOP Leaders’ Embrace of Trump Payroll Tax Cut

House GOP leader Kevin McCarthy: next COVID bill to include Trump’s payroll tax cut proposal

President Trump’s push for a payroll tax cut has received the blessing of GOP leadership on Capitol Hill, who promise that the proposal will be included in new Coronavirus relief legislation. Some Republicans – and almost all Democrats – oppose payroll tax cuts. But the proposal gaining a foothold on Capitol Hill has understandably alarmed Social Security and Medicare advocates – and is receiving fresh scrutiny in the media.

“Make no mistake: payroll tax cuts are the first step in dismantling Americans’ earned benefits. In acceding to the President’s payroll tax ploy… Republican leadership makes plain that they stand with those who least need help and against American families struggling every day to make ends meet.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare

“Trump to Social Security: Drop Dead” reads the headline for Michael Hiltzik’s recent column in the Los Angeles Times, echoing one from 45 years ago in the New York Daily News. That headline, “Ford to City: Drop Dead,” chiding President Gerald Ford for seemingly refusing to bail out New York City in the depths of a fiscal crisis, was credited (in part) with his failed re-election bid. Hiltzik clearly feels the stakes are similarly high for President Trump in pressuring Congress to cut the payroll taxes that fund Americans’ earned benefits.

“Trump has been fixed on this idea virtually since the start of his presidential term. Occasionally he has toyed with the idea of eliminating the payroll tax entirely, which would pile stupidity upon stupidity. Never has he offered a thoughtful, logical rationale for cutting the tax wholly or in part.” – Michael Hiltzik, Los Angeles Times, 7/17/20

Of course, there is no thoughtful, logical rational for cutting payroll taxes – especially as a means of stimulus during a pandemic. Payroll tax cuts are an ineffective and unfair means of stimulus that would do little for the unemployed and lower-income Americans who need the most help during the COVID crisis. But eliminating payroll taxes could be an extremely efficient way to undermine Social Security and Medicare (programs that President Trump promised to protect), as Forbes columnist Ziv Shahar noted on Monday:

“Critics fear that the real aim is to tighten the screws on Social Security Medicare by constricting their sole funding source. ” – Ziv Shahar, Forbes, 7/20/20

Analysts are unsure whether the President actively desires to dismantle these programs (a long-held dream of hardline conservatives) or whether he simply does not understand the implications of tampering with their funding streams. Either way, payroll tax cuts are dangerous for Social Security and Medicare, because they deprive the programs of much-needed revenue at a time when both face fiscal challenges.

“Since payroll taxes fund the Social Security and Medicare systems, cutting those taxes means sapping revenue from their respective trust funds, which will need to cover benefits as the number of retirees relative to current workers rises in the coming years.” – Paul Waldman, Washington Post, 7/20/20

Even if payroll taxes are temporarily replaced by general federal revenue, the policy still undermines Americans’ earned benefits. First of all, it compromises the worker-funded nature of our social insurance programs. Secondly, it allows so-called ‘fiscal hawks’ to claim that Social Security and Medicare are driving federal deficits, paving the way for potential cuts to both programs. Seniors struggling to stay financially and physically healthy cannot afford cuts to their earned benefits. If anything, these benefits need to be boosted to meet the needs of today’s and tomorrow’s seniors.

It’s telling that the Chairman of the Senate Finance Committee, Charles Grassley (R-IA), opposes Trump’s proposal – and has warned the President and fellow Republicans that messing with Americans’ earned benefits is a risky political play.

“Social Security people think we’re raiding the Social Security fund. And we are raiding it, but we have always put in general fund revenue in it so it is made whole. But that creates — it might create political problems.” – Sen. Charles Grassley, 7/20/20

He’s right. Surveys show that Americans want their earned benefits expanded and protected – not defunded and dismantled under the guise of Coronavirus relief.

Fixing the Benefit “Notch” & Boosting Social Security During COVID

Rep. John Larson greets a constituent in Connecticut

The National Committee has endorsed a bill to avoid a significant drop in Social Security benefits for future retirees turning 60 this year. Rep. John Larson’s Social Security COVID-19 Correction and Equity Act repairs a glitch in current law which, if unchecked, would result in a sizable “notch” in retirement income for this age group.

Social Security benefits are calculated according to a formula that incorporates the average wage for the year that beneficiaries reach 60 years of age. Workers born in 1960 will have their benefits determined according to the average wage for 2020, which will be lower than usual due to the COVID crisis. The average beneficiary would take a $2,000 annual hit in their future Social Security benefits – and not just once, but for life.

“Rep. Larson’s bill would spare workers turning 60 this year from a painful and permanent benefit cut. Tomorrow’s retirees will depend even more on Social Security than the current generation of seniors. Americans should not be deprived tens of thousands of dollars in retirement income simply because they were born in the wrong year. The COVID-19 Correction and Equity Act offers a commonsense fix to an unintended consequence of Social Security law.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare

Larson’s bill corrects this problem – the result of flawed legislative language in the Social Security amendments of 1977 – by ensuring that the Average Wage Index (for Social Security’s purposes) never drops below the previous year’s level.

In addition to repairing the “notch,” Larson’s bill would make improvements to Social Security that would help ease the financial pain of the COVID crisis for retirees and people with disabilities, including millions of new claimants.

Here are some of the other major provisions in the Social Security COVID-19 Correction and Equity Act:

- Increases benefits by 2 percent;

- increases the threshold to 125 percent of the poverty level for the special minimum benefit, lifting more lifelong workers out of poverty;

- Reduces taxation on benefits for lower-middle income beneficiaries who are struggling to provide for themselves and their families.

“Certainly, the seniors who would lose massive amounts in Social Security benefits will thank Rep. Larson for finding a solution to the ‘notch.’ But the broad array of program improvements that have been included in the bill will benefit all Americans. We believe that they will prove to be especially helpful to women and those in communities of color who have been hardest hit by the COVID pandemic.” – Max Richtman

If Larson’s legislation passes the House, the bill as a whole may face headwinds in the Senate, where many pieces of legislation to help everyday America’s have perished in Leader McConnell’s “graveyard.” At the same time, the provision to fix the “notch” – an important technical correction more than a sweeping policy proposal – may survive. As Social Security champions in Congress continue to boost and strengthen the program during the COVID crisis and beyond, repairing the notch would spare those turning 60 this year an arbitrary and unnecessary benefit cut.

Read the National Committee’s endorsement letter of Rep. Larson’s bill here.

Let’s Protect & Expand Medicare and Medicaid as They Turn 55

President Johnson signs Medicare and Medicaid into law on July 30, 1965

On this 55th anniversary of Medicare and Medicaid, not only are both programs succeeding in fulfilling their original missions, they have adapted to the health care challenges of the past five decades and proven themselves anew during the unprecedented COVID crisis. Medicare is saving seniors’ lives by providing affordable, accessible care in the face of a disease that has hit older Americans particularly hard. Medicaid continues to provide this nation’s only dependable long-term care program – while its expansion under the Affordable Care Act covers vulnerable, lower-income Americans, many of whom have lost health coverage during the pandemic.

President Lyndon B. Johnson signed Medicare and Medicaid into law on July 30, 1965. Of the new Medicare program, he promised, ‘No longer will illness crush and destroy the savings that (older Americans) have so carefully put away over a lifetime so that they might enjoy dignity in their later years.’ While that promise has been met, both programs are at a critical pivot point in history.

There is a movement in Congress to expand both programs to meet the diverse and growing needs of seniors and lower-income Americans. The National Committee to Preserve Social Security and Medicare supports the House-passed bill (H.R. 3) that would add limited hearing, dental, and vision coverage to traditional Medicare. Medicare must be allowed to negotiate prices with drug-makers (as authorized by H.R. 3). This is the single most effective remedy for the price gouging that afflicts seniors and all Americans. We support the Affordable Care Act, which improved Medicare benefits and helped extend the program’s solvency – and provided for the expansion of Medicaid to cover millions of the uninsured.

Former President Harry Truman received the first Medicare card

Unfortunately, President Trump and some of his allies in Congress are attempting to undermine both programs. Despite promising ‘not to touch’ either one, the president has called for more than $1.5 trillion in cuts over ten years to Medicare and Medicaid. His administration has tilted the playing field toward private Medicare Advantage plans, which restrict patients’ choice of doctors and have been flagged for overbilling taxpayers. The President wants the Supreme Court to strike down the Affordable Care Act (in the middle of a pandemic, no less), which would strip more than 20 million Americans of health care and reverse the law’s improvements to Medicare and Medicaid.

These attempts to dismantle health care programs that safeguard seniors, people with disabilities, and lower-income Americans makes today’s anniversary a bittersweet occasion. As we mark the decades of Medicare and Medicaid’s significance, we must continue to fight to protect and expand them in the face of attacks from their opponents. The 2020 elections present an opportunity to choose a president, senators and representatives who will champion the programs that give our citizens the quality health care and dignity they have earned and deserve.

Trump Prescription Drug Pricing Orders Too Limited, Too Late

The rhetoric President Trump used in unveiling a set of new executive orders on prescription drug pricing could not have been more bloated, nor the substance of those measures so skimpy. On Friday, the president proclaimed in dramatic fashion that the four “bold and historic” executive orders would be of “help for our great seniors,” achieve things “nobody thought could be done” and result in “massive reductions” to prescription drug prices.

That it took almost four years for the president to issue a set of orders addressing one of his highest campaign priorities in 2016 is suspect in and of itself. They were unveiled in the midst of a pandemic that has disproportionately imperiled seniors as Trump’s poll numbers with the crucial 65+ voting bloc are plummeting. It is hard not view these late-coming executive orders as a ploy to win back some of the senior vote rather than as a set of serious policy proposals.

Politico reported this weekend that the president’s orders are “rife with limitations,” despite his inflated rhetoric:

“The orders are not immediately enforceable. Health officials have been working on ways to implement some of the proposals — namely guidelines for states to implement importation plans. But it’s is unlikely that any could be finalized before the November presidential election…” – Politico, 7/24/20

Clearly, if the President wanted “bold” action on prescription drugs, he would have backed H.R. 3, The Elijah Cummings Lower Drug Costs Now Act, which allows the Medicare program to negotiate drug prices directly with Big Pharma. Not only did the president not embrace this legislation, he did not include Medicare price negotiation – the single most effective solution to the price gouging that affects so many of our seniors – in his executive orders.

“Any proposal that doesn’t include Medicare price negotiation can’t be taken seriously, because any serious policy effort must include it to address the underlying problem of price gouging.” – Max Richtman, president and CEO of the National Committee, 7/24/20

If he were serious about reducing prescription prices, the president could have pushed the GOP-controlled Senate to pass the Grassley-Wyden bill, which does not include price negotiation but represents a solid step toward controlling drug costs through inflation-indexing. Besides offering some tepid support for the bill, the president never agitated for its passage, instead claiming that he has been “waiting for Congress” to take action.

Price Caps

The first executive order would revive a long-standing proposal to link what Medicare pays for prescription drugs to the prices in other countries, which sounds like a sweeping action on face. But the order won’t go into effect immediately (if ever), because the order includes an escape clause for Big Pharma to come up with an alternative of its own.

Rebates

The second order would eliminate the rebates that pharmaceutical companies pay to insurance companies – which Stat News refers to as a “previously abandoned” plan.” The catch here is that the order would not kick-in if it affects insurance premiums.

Drug Importation

The third order instructs the Department of Health and Human Services to facilitate “grants to individuals of waivers of the prohibition of importation of prescription drugs,” meaning that individual Americans (not the federal government) could buy drugs from Canada and other countries.

Insulin and Epi-pens

The fourth order requires federal community health centers to pass discounts for insulin and epi-pens directly to patients. As Politico reports, the order only applies to approximately 1,000 community health centers nationwide, “not to hospitals that are frequently flagged as diverting the discounts away from patients toward other programs.”

Hitting Big Pharma with a Feather

The executive orders are consistent with the administration’s overall approach to soaring prescription drug prices, which has been piecemeal at best, disingenuous at worst. (Some of the president’s previous actions have been tossed out by the courts, others postponed or abandoned.) The president may talk tough about taking on Big Pharma, but his executive orders seem designed to strike the industry with the force of a feather.

Hardly “revolutionary” or “historic,” the latest executive orders “direct his administration to begin the normal, notoriously slow regulatory processes needed to reform the existing system,” Stat News observes.

National Committee president Max Richtman says that “seniors suffering from soaring prescription prices will not be fooled by grandiose pronouncements at a press conference that appear to be a ‘Hail Mary’ pass during an election year.”

Like previous Trump administration actions on this issue, the latest round of executive orders are too little, too late, and too weak to remedy the scourge of prescription price gouging.

Republicans Right to Reject Trump Payroll Tax Cuts, Wrong to Include TRUST Act in Corona Relief

The National Committee issued the following statement today in response to the latest reporting from Capitol Hill about GOP plans for the next Coronavirus relief bill.

“Republicans have jettisoned the President’s reckless payroll tax cut from their Coronavirus relief plan – at least for now. But seniors and their advocates must stay vigilant as the Trump administration remains laser-focused on payroll tax cuts, which pose a direct threat to Social Security. While Republicans did the right thing by setting aside Trump’s payroll tax cuts, they reportedly are considering injecting an equally menacing element into their relief bill.

The TRUST Act would set up special committees to decide the fate of federal trust funds, including Social Security and Medicare. This would allow benefit cuts to be fast-tracked through Congress. Seniors and people with disabilities need their benefits boosted, not slashed. Like payroll tax cuts, the TRUST Act is bad medicine for everyday Americans struggling to stay financially afloat, especially during the COVID crisis.

There is, however, some financial relief for seniors from other provisions of the GOP plan: another direct payment similar to the first relief bill, a freeze on Medicare Part B premium prices for 2021, and an extension of expanded telehealth coverage through next year. Measures like these will help protect seniors from rising costs during the financial crisis and ensure safe access to much-needed care as COVID continues to ravage our communities.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare

For more information on payroll tax cuts and Social Security, click here.

Advocates Alarmed by GOP Leaders’ Embrace of Trump Payroll Tax Cut

House GOP leader Kevin McCarthy: next COVID bill to include Trump’s payroll tax cut proposal

President Trump’s push for a payroll tax cut has received the blessing of GOP leadership on Capitol Hill, who promise that the proposal will be included in new Coronavirus relief legislation. Some Republicans – and almost all Democrats – oppose payroll tax cuts. But the proposal gaining a foothold on Capitol Hill has understandably alarmed Social Security and Medicare advocates – and is receiving fresh scrutiny in the media.

“Make no mistake: payroll tax cuts are the first step in dismantling Americans’ earned benefits. In acceding to the President’s payroll tax ploy… Republican leadership makes plain that they stand with those who least need help and against American families struggling every day to make ends meet.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare

“Trump to Social Security: Drop Dead” reads the headline for Michael Hiltzik’s recent column in the Los Angeles Times, echoing one from 45 years ago in the New York Daily News. That headline, “Ford to City: Drop Dead,” chiding President Gerald Ford for seemingly refusing to bail out New York City in the depths of a fiscal crisis, was credited (in part) with his failed re-election bid. Hiltzik clearly feels the stakes are similarly high for President Trump in pressuring Congress to cut the payroll taxes that fund Americans’ earned benefits.

“Trump has been fixed on this idea virtually since the start of his presidential term. Occasionally he has toyed with the idea of eliminating the payroll tax entirely, which would pile stupidity upon stupidity. Never has he offered a thoughtful, logical rationale for cutting the tax wholly or in part.” – Michael Hiltzik, Los Angeles Times, 7/17/20

Of course, there is no thoughtful, logical rational for cutting payroll taxes – especially as a means of stimulus during a pandemic. Payroll tax cuts are an ineffective and unfair means of stimulus that would do little for the unemployed and lower-income Americans who need the most help during the COVID crisis. But eliminating payroll taxes could be an extremely efficient way to undermine Social Security and Medicare (programs that President Trump promised to protect), as Forbes columnist Ziv Shahar noted on Monday:

“Critics fear that the real aim is to tighten the screws on Social Security Medicare by constricting their sole funding source. ” – Ziv Shahar, Forbes, 7/20/20

Analysts are unsure whether the President actively desires to dismantle these programs (a long-held dream of hardline conservatives) or whether he simply does not understand the implications of tampering with their funding streams. Either way, payroll tax cuts are dangerous for Social Security and Medicare, because they deprive the programs of much-needed revenue at a time when both face fiscal challenges.

“Since payroll taxes fund the Social Security and Medicare systems, cutting those taxes means sapping revenue from their respective trust funds, which will need to cover benefits as the number of retirees relative to current workers rises in the coming years.” – Paul Waldman, Washington Post, 7/20/20

Even if payroll taxes are temporarily replaced by general federal revenue, the policy still undermines Americans’ earned benefits. First of all, it compromises the worker-funded nature of our social insurance programs. Secondly, it allows so-called ‘fiscal hawks’ to claim that Social Security and Medicare are driving federal deficits, paving the way for potential cuts to both programs. Seniors struggling to stay financially and physically healthy cannot afford cuts to their earned benefits. If anything, these benefits need to be boosted to meet the needs of today’s and tomorrow’s seniors.

It’s telling that the Chairman of the Senate Finance Committee, Charles Grassley (R-IA), opposes Trump’s proposal – and has warned the President and fellow Republicans that messing with Americans’ earned benefits is a risky political play.

“Social Security people think we’re raiding the Social Security fund. And we are raiding it, but we have always put in general fund revenue in it so it is made whole. But that creates — it might create political problems.” – Sen. Charles Grassley, 7/20/20

He’s right. Surveys show that Americans want their earned benefits expanded and protected – not defunded and dismantled under the guise of Coronavirus relief.

Fixing the Benefit “Notch” & Boosting Social Security During COVID

Rep. John Larson greets a constituent in Connecticut

The National Committee has endorsed a bill to avoid a significant drop in Social Security benefits for future retirees turning 60 this year. Rep. John Larson’s Social Security COVID-19 Correction and Equity Act repairs a glitch in current law which, if unchecked, would result in a sizable “notch” in retirement income for this age group.

Social Security benefits are calculated according to a formula that incorporates the average wage for the year that beneficiaries reach 60 years of age. Workers born in 1960 will have their benefits determined according to the average wage for 2020, which will be lower than usual due to the COVID crisis. The average beneficiary would take a $2,000 annual hit in their future Social Security benefits – and not just once, but for life.

“Rep. Larson’s bill would spare workers turning 60 this year from a painful and permanent benefit cut. Tomorrow’s retirees will depend even more on Social Security than the current generation of seniors. Americans should not be deprived tens of thousands of dollars in retirement income simply because they were born in the wrong year. The COVID-19 Correction and Equity Act offers a commonsense fix to an unintended consequence of Social Security law.” – Max Richtman, president and CEO of the National Committee to Preserve Social Security and Medicare

Larson’s bill corrects this problem – the result of flawed legislative language in the Social Security amendments of 1977 – by ensuring that the Average Wage Index (for Social Security’s purposes) never drops below the previous year’s level.

In addition to repairing the “notch,” Larson’s bill would make improvements to Social Security that would help ease the financial pain of the COVID crisis for retirees and people with disabilities, including millions of new claimants.

Here are some of the other major provisions in the Social Security COVID-19 Correction and Equity Act:

- Increases benefits by 2 percent;

- increases the threshold to 125 percent of the poverty level for the special minimum benefit, lifting more lifelong workers out of poverty;

- Reduces taxation on benefits for lower-middle income beneficiaries who are struggling to provide for themselves and their families.

“Certainly, the seniors who would lose massive amounts in Social Security benefits will thank Rep. Larson for finding a solution to the ‘notch.’ But the broad array of program improvements that have been included in the bill will benefit all Americans. We believe that they will prove to be especially helpful to women and those in communities of color who have been hardest hit by the COVID pandemic.” – Max Richtman

If Larson’s legislation passes the House, the bill as a whole may face headwinds in the Senate, where many pieces of legislation to help everyday America’s have perished in Leader McConnell’s “graveyard.” At the same time, the provision to fix the “notch” – an important technical correction more than a sweeping policy proposal – may survive. As Social Security champions in Congress continue to boost and strengthen the program during the COVID crisis and beyond, repairing the notch would spare those turning 60 this year an arbitrary and unnecessary benefit cut.

Read the National Committee’s endorsement letter of Rep. Larson’s bill here.