Celebrating Social Security’s Success on 78th Anniversary

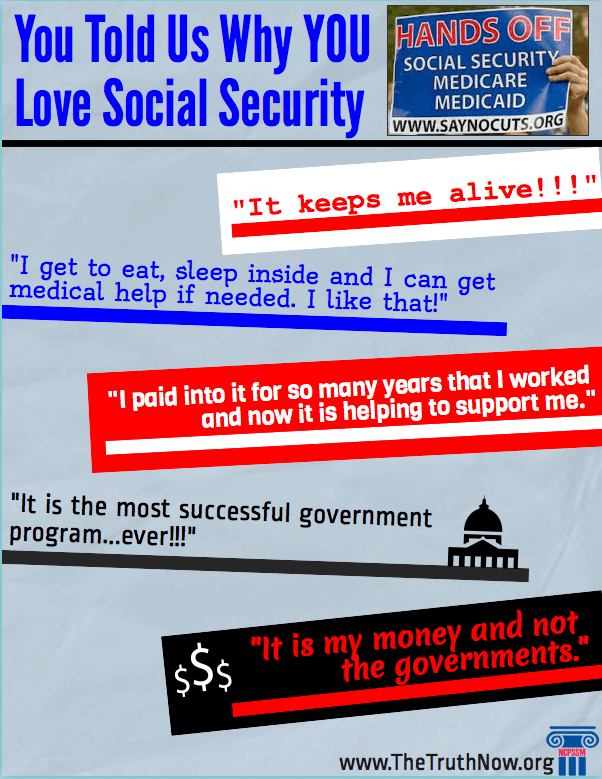

“As we celebrate Social Security’s 78th birthday on August 14th, it’s important to remember the real-life impact America’s most successful program has on millions of Americans each year. Unfortunately, too many in Washington continue to view Social Security benefits as little more than a political bargaining chip in an austerity campaign targeting middle class families to reduce our deficits. The current economic crisis has shown us that future generations will need Social Security every bit as much as, if not more than, today’s retirees.

Only one-half of today’s work force has a retirement plan of any kind. Traditional pension plans have virtually disappeared for the recession generation and the homes many planned to use as a nest egg for retirement have plummeted in value. In spite of all this, Social Security has been a stable and secure source of income for millions who desperately need it. This economic recession has clearly demonstrated the billion dollar anti-Social Security lobby has, once again, gotten it completely backwards. We should be searching for ways to improve Social Security’s benefits not cut them. That’s why a proposal such as the chained CPI, which would cut Social Security now to help pay for failed policies of the past, is simply not an option for current or future retirees.”…Max Richtman, NCPSSM President/CEO

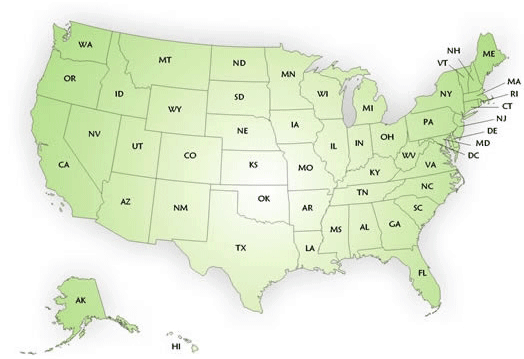

New State Snapshots Show America Can’t Afford to Lose Economic Benefits

Social Security’s economic impact reaches well beyond individual wallets to the ledgers of local businesses and merchants. Families spend $775 billion in Social Security benefits nationwide each year. When 57 million Americans use the purchasing power of those benefits, they are supporting local businesses and state economies with billions of dollars they simply wouldn’t have without Social Security. The National Committee to Preserve Social Security and Medicare has released state-by-state snapshots of how much revenue Social Security contributes to the economy of every Congressional District in each state and US territory. How much does your state and community stand to lose if Social Security benefits are cut? Check out NCPSSM’s Social Security Snapshots for the answer.

Social Security Begins Processing Claims to Same Sex Couples

“The recent Supreme Court decision on Section 3 of the Defense of Marriage Act, made just over a month ago, helps to ensure that all Americans are treated fairly and equally, with the dignity and respect they deserve.

We continue to work closely with the Department of Justice. In the coming weeks and months, we will develop and implement additional policy and processing instructions. We appreciate the public’s patience as we work through the legal issues to ensure that our policy is legally sound and clear.

I encourage individuals who believe they may be eligible for Social Security benefits to apply now, to protect against the loss of any potential benefits. We will process claims as soon as additional instructions become finalized.”

Buzzfeed details the limits of this announcement:

“The Social Security Administration is limiting payment of claims for same-sex married couples currently to those couples who were married in a state the allows same-sex couples to marry and are “domiciled,” or live, in a state that recognizes same-sex couples’ marriages.

The decision means claims from same-sex couples married where such couples can legally marry but who live in a state that does not recognize such marriages are having their applications put on hold for the time being.”

In our report, “Living Outside the Safety Net” we have urged Washington to change the law so that same sex couples who contribute to Social Security are no longer discriminated against. We have urged SSA to fully implement benefit changes, which come after the Supreme Court’s decision on the Defense of Marriage Age, to ensure that benefit discrimination ends.

Can Your State Afford to Lose Millions of Social Security Dollars?

While some in Washington claim America can’t afford programs like Social Security and Medicare, the truth is states simply can’t afford to lose the economic benefits these programs provide to every community in our nation. We’ve released state-by-state snapshots of how much revenue Social Security contributes to the economy of every Congressional District in each state and US territory.

Families spend $775 billion in Social Security benefits nationwide each year. When 57 million Americans use the purchasing power of those benefits, they are supporting local businesses and state economies with billions of dollars they simply wouldn’t have without Social Security. Unfortunately, this economic reality has been ignored by Washington’s well financed anti-Social Security lobby as it continues to try and convince Congress to cut middle-class benefits.

“You don’t have to be an economist to understand that cutting Social Security benefits, whether through the Chained CPI or other proposals, means less income for families — less money they can spend in their communities and less revenue for businesses coast-to-coast. Targeting families who rely on vital programs like Social Security ignores our real economic problems in favor of a political strategy to cut safety net programs. Members of Congress need to take a look at these state-by-state breakdowns and ask themselves, ‘Can my community afford to lose millions of dollars from our economy? Can my neighbors and families afford to lose the retirement and economic stability Social Security provides?’ Step outside Capitol Hill and the answer is a resounding ‘No.’ ”….Max Richtman, NCPSSM President/CEO

Check out your state’s stats here and the next time someone tell you we can’t afford Social Security, ask them — Can our economy really afford to lose it?

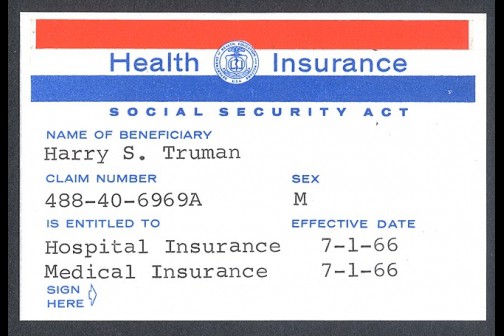

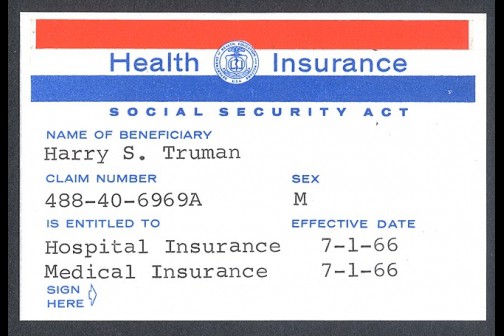

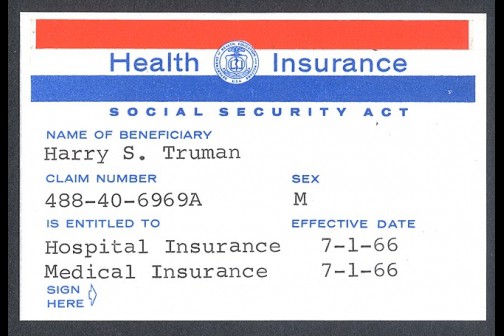

Celebrating Medicare’s Anniversary

Protecting this lifeline benefit for the future is why National Committee to Preserve Social Security and Medicare activists in 50+ cities and towns across the country, have converged on more than 40 Congressional district offices and every single Congressional office on Capitol Hill to deliver Medicare anniversary signs. We’ve asked members of Congress to display the sign on their office door this week to show their support for protecting Medicare’s life-saving benefits.

We’ve also given each Member a special anniversary card reminding them of what millions of average American families already know…exactly why we love Medicare.

Top Ten Reasons Americans LOVE Medicare

1. Medicare provides comprehensive health care coverage for seniors. Since its creation in 1965, Medicare has provided universal health care to millions of seniors.

2. Without Medicare, America’s seniors would lack insurance coverage due to high costs or preexisting conditions. Before Medicare, more than half of seniors lacked hospital insurance. Today, virtually all people ages 65 and over are covered by Medicare.

3. Medicare provides free preventive health screenings. Seniors do not have to pay for Mammograms, Diabetes or Cancer screenings thanks to new provisions in the Affordable Care Act.

4. Medicare provides 36 million seniors prescription drug coverage through Part D. The program will be even better when, thanks to the ACA, the Part D coverage gap known as the “donut hole” will be phased out by 2020.

5. 9 million disabled Americans receiving Social Security benefits also receive health coverage through Medicare.

6. Medicare’s costs rise slower than private insurance. Medicare spending per beneficiary rose more than 400 percent from 1969 to 2009 but inflation-adjusted premiums on private health insurance rose more than 700 percent.

7. Medicare is efficient. Only 1% of traditional Medicare’s spending is overhead compared to 9% for private insurance and 6% for privatized Medicare.

8. Medicare saves lives. Research shows Medicare patients are 20 percent less likely to die within a week of hospital admission than slightly younger patients who do not yet qualify for government insurance.

9. We earn our Medicare coverage. Medicare isn’t welfare. American workers’ payroll taxes fund hospital, skilled nursing, home health and hospice care and premiums cover a portion of the costs for physician visits, outpatient visits and preventive services.

10. Medicare is a social insurance program that works. Perhaps one of the biggest reasons why Medicare is universally cherished is that in return for the contributions we make during our working years, we receive guaranteed health benefits.

You can find all of our Medicare anniversary celebration material on our Anniversary website here.

Seniors to Ask Congress “Do You Really Support Medicare?”

Medicare’s 48th anniversary is next week on July 30th. NCPSSM activists will mark the event by visiting Congressional offices in 50+ cities and towns across the country. Advocates will also be delivering Medicare anniversary signs to every House and Senate office on Capitol Hill.

Members will be asked to display the sign on their office door on July 30th to show their support for Medicare. Included in the delivery will be special cards listing the National Committee’s Top 10 reasons why Americans love Medicare.

“In spite of Medicare’s success in keeping America’s seniors healthy and out of poverty, Medicare’s guaranteed coverage is under nearly constant attack in Washington. The budget plan passed in the House would end traditional Medicare, privatize it and leave seniors on their own to negotiate with private insurance companies. It would require seniors to pay $6,000 more each year for fewer benefits, making it harder to choose their own doctors while also giving the wealthiest Americans a massive tax break. Too many Members of Congress who’ve advocated the dismantling of Medicare camouflage their plans with promises to “save” the program. However, the American people know you don’t have to destroy Medicare to strengthen it. That’s the message our activists are delivering directly to Congress on this 48th anniversary.”…Max Richtman, NCPSSM President/CEO

Let’s see how many join our celebration and proudly display their pledge to support Medicare not cut it.