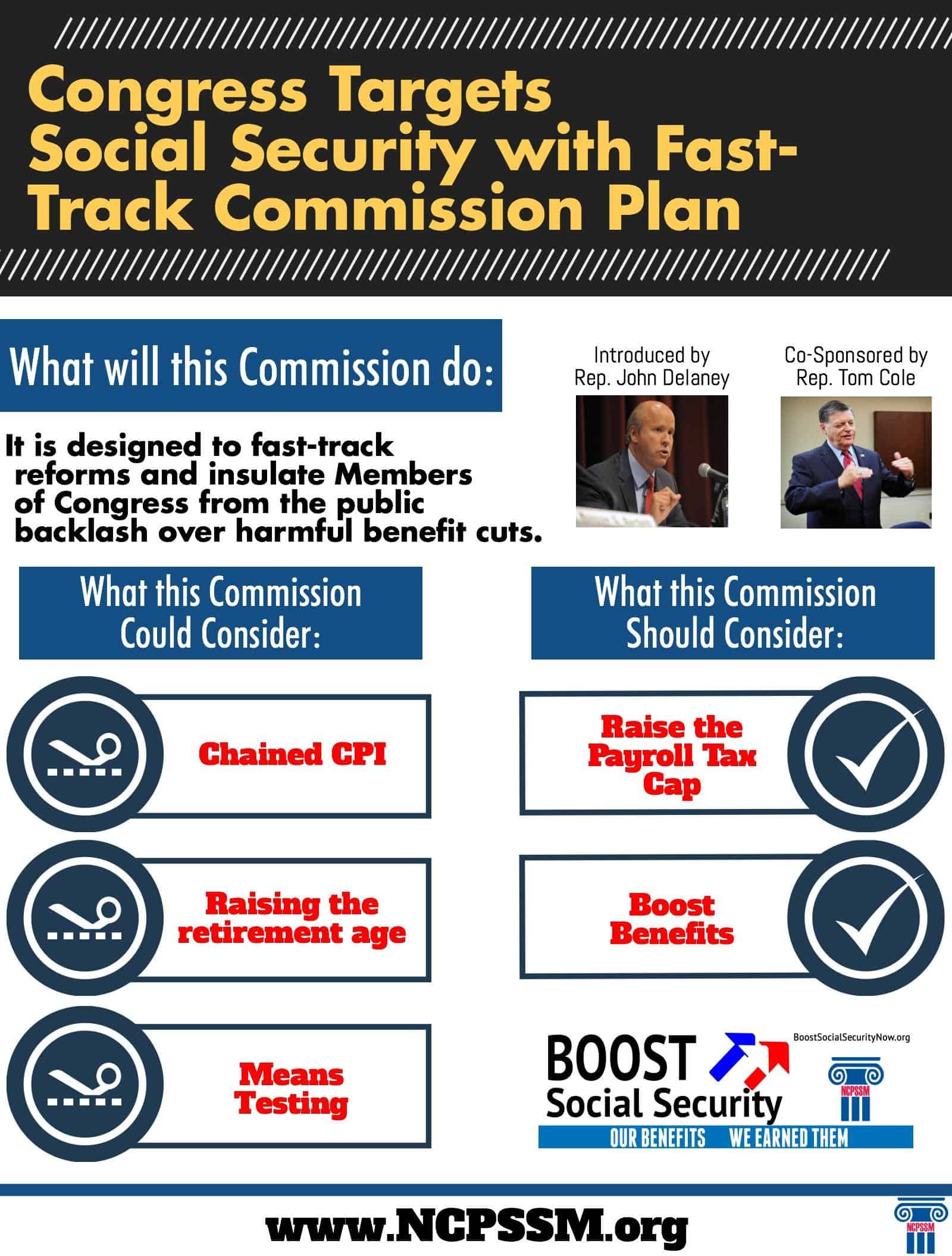

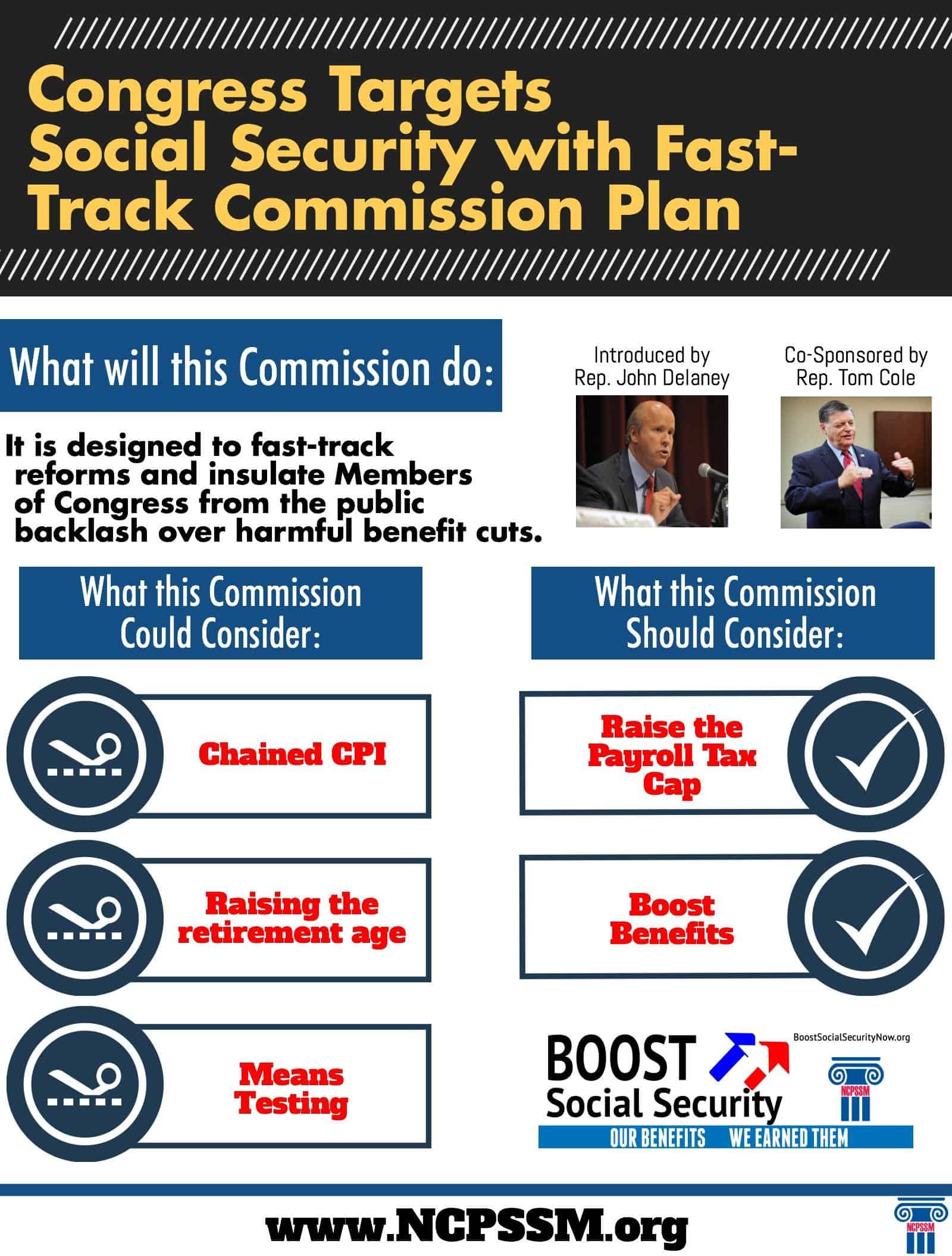

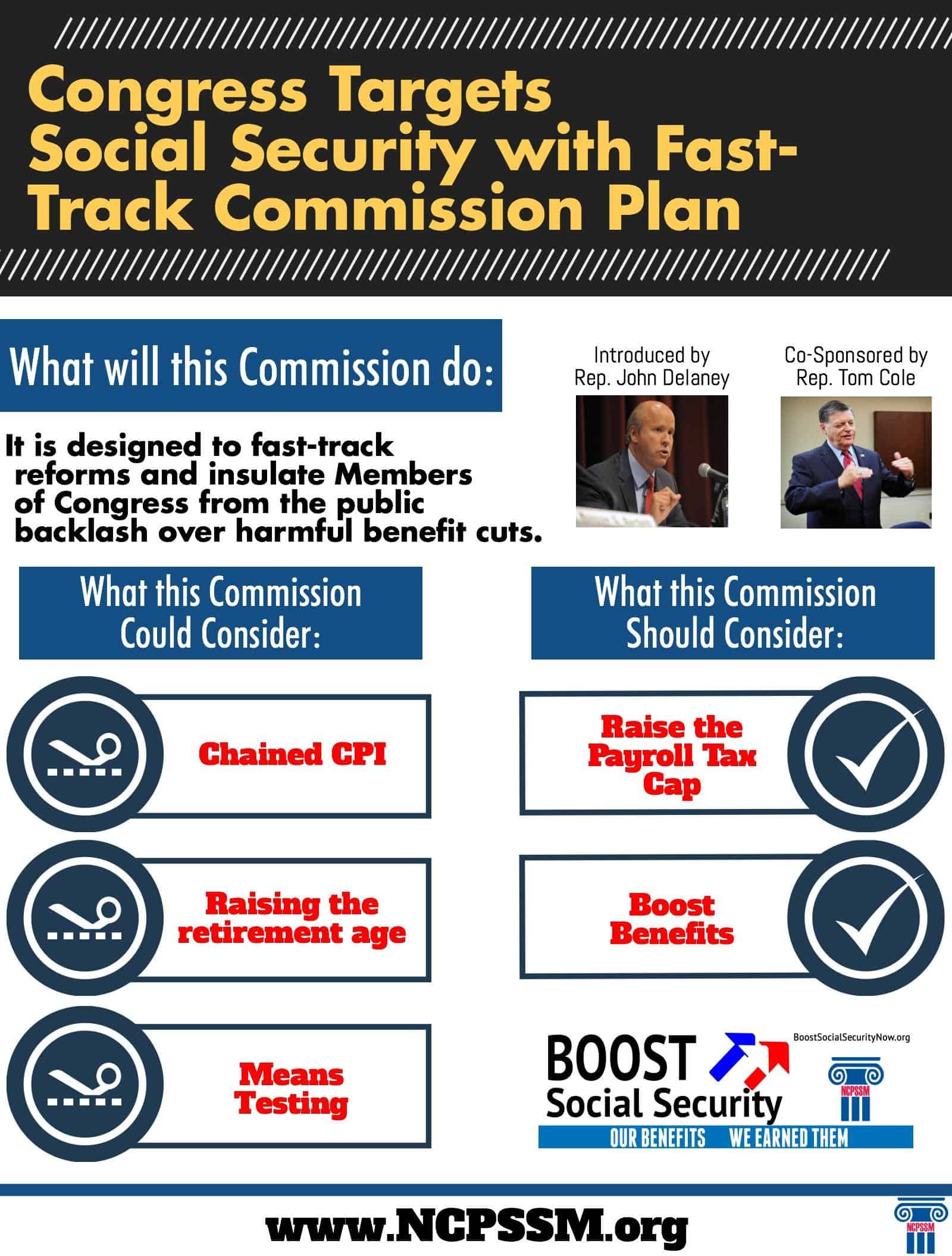

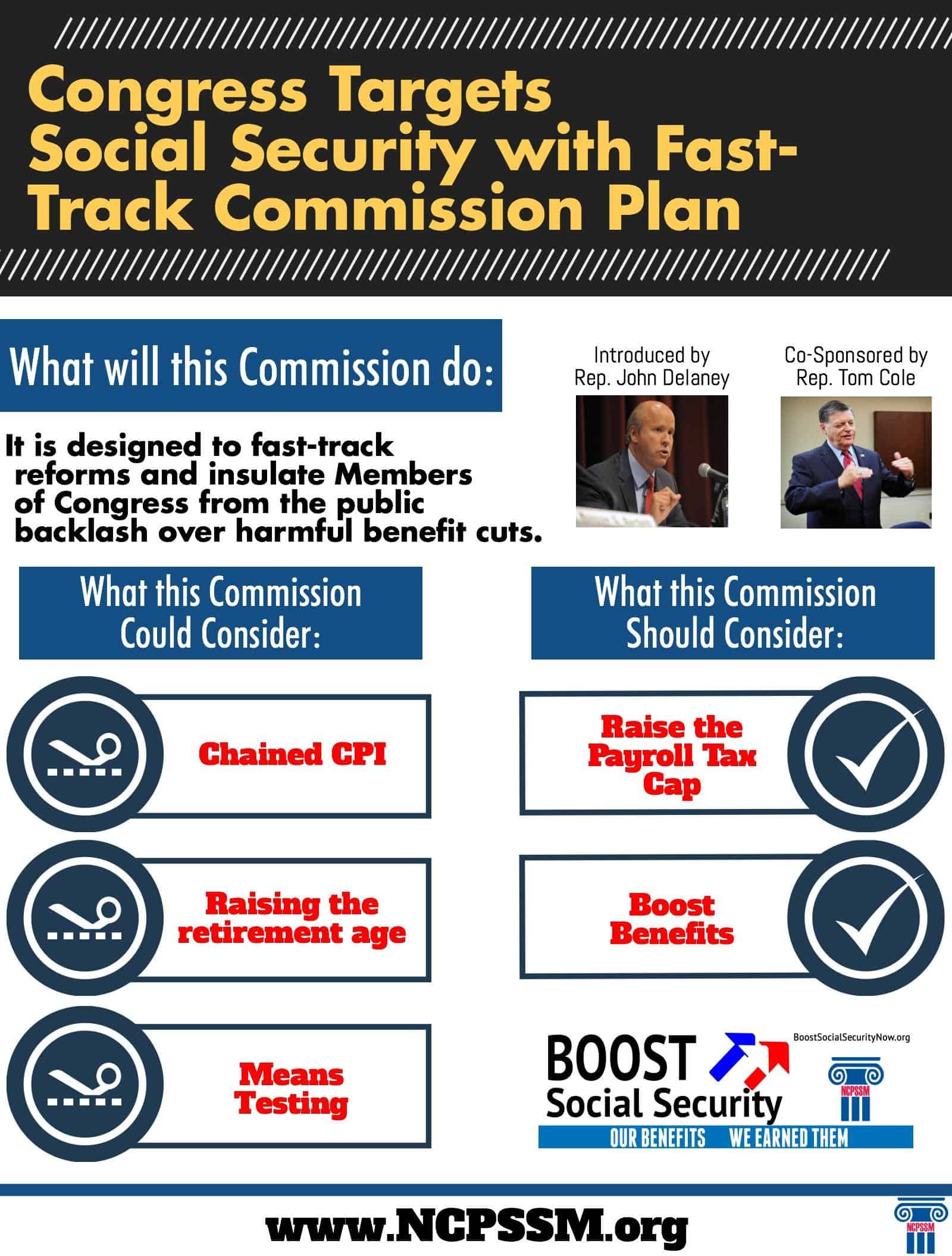

Congress Targets Social Security with Fast-Track Commission Plan

“Reps. Tom Cole (R-OK) and John Delaney (D-MD) plan to introduce a bill this Congress that would create a Social Security commission to propose changes to the program, Cole’s office confirmed to TPM on Monday.” – Talking Points Memo.

“The commission would probably gradually raise retirement age, it would probably look at chained CPI, would probably look at means-testing and probably look at some sort of revenue, or reduce benefits for upper-income people,” Cole said. “Then you have to vote.” – The Hill.

“We are troubled that H.R. 1578 takes several steps to circumvent a deliberative public process, limiting the participation of Social Security stakeholders and advocates. For example, the Committees of jurisdiction over the Social Security program — the Senate Committee on Finance and the House Committee on Ways and Means — would have limited input in the development of the Commission’s recommendations. Under “fast track” procedural rules in your bill, the legislation embodying the Commission’s recommendations would be considered by Congress on an expedited, “take-it-or-leave-it” basis. No amendments to the Commission’s bill could be offered and it could be passed in both the House and Senate by a simple majority vote. Normally, Section 310(g) of the Budget Act and the Senate’s “Byrd rule” require 60 votes in the Senate to approve legislation which changes Social Security.” – Max Richtman.

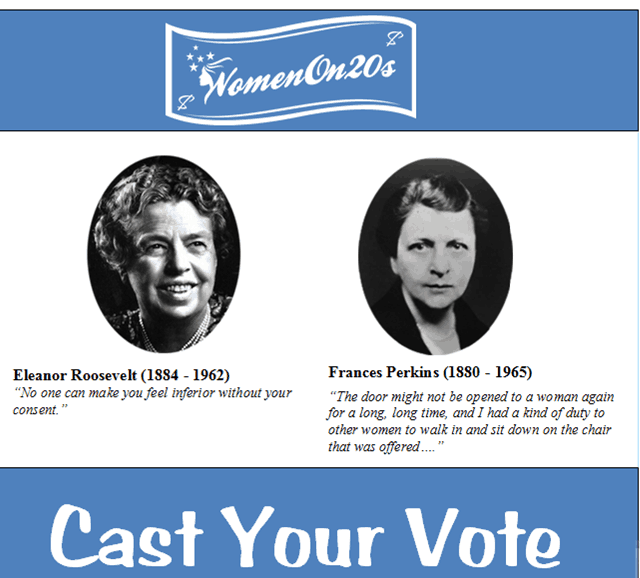

Women on 20s and the Social Security Connection

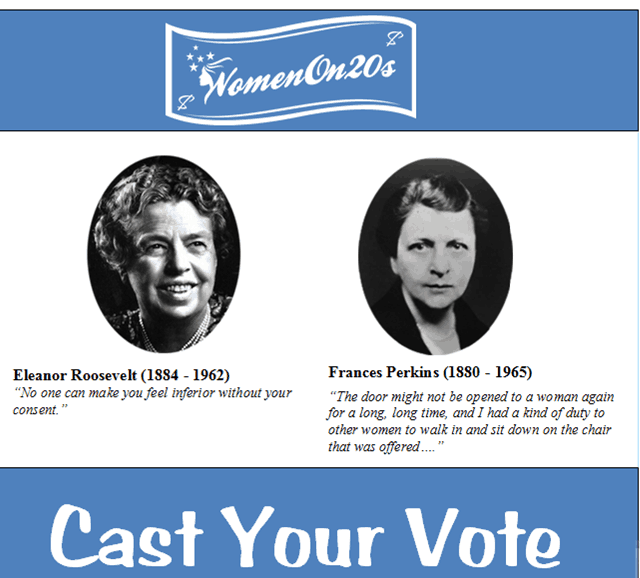

“A woman’s place is on the money” is the catchy tagline of a growing national movement to put an American woman trail blazer on the $20 bill. It’s pretty fitting timing given that it’s Women’s History month and a long overdue improvement if you consider that the Susan B. Anthony and Sacagawea dollars (when’s the last time you used one of those?) are the only places women are represented on our currency.

Reading through the list of women candidates is a walk through America’s history and a reminder of how many strong, smart and brave women have impacted our nation. We couldn’t help but take note of two nominees who played vital roles in the creation of Social Security – First Lady Eleanor Roosevelt and the first female U.S. Cabinet member, and the longest-serving labor secretary in history, Frances Perkins. Both women played critical roles in ensuring America’s retirees would have an income security lifeline as they age. Eleanor Roosevelt is also the inspiration for our “Eleanor’s Hope” initiative which is raising awareness, recruiting and training new Social Security activists while also bolstering Congressional leaders who are making a difference on women’s health and retirement security issues. We’re also advocating for legislation that addresses the inequities threatening millions of retired women and working to elect lawmakers who share our vision of retirement equity for women.

Without Social Security, over half of all older Americans would fall into poverty. More than many other federal programs, Social Security does exactly what it was designed to do – it gives retired people a secure, basic income for as long as they live. We think that’s a really great reason to cast our Women on 20’s vote for Eleanor and Frances (plus you get to pick one more too!)

Congress Trades Bad Deal for Doctors for Bad Deal for Seniors in Medicare

“Contrary to claims by supporters, on both sides of the aisle, this ‘doc fix’ does not impact only ‘wealthy seniors’. Millions of beneficiaries who depend on a Medigap plan to help pay their health care bills – no matter their income — will be hit with higher costs. Given that 46% of all Medigap policy holders had incomes of $30,000 or less, it’s clear this deal impacts far more than the wealthy, as the bill’s proponents have claimed. What’s more, Medicare beneficiaries will be forced to contribute nearly $60 billion in premiums over the next decade to replace the SGR.

No doubt, we’ll hear today that this ‘compromise’ Medicare doc-fix plan must be a success because there are concessions from all sides. Unfortunately, that political trope is just as flawed as the SGR itself because it ignores the financial reality facing Medicare beneficiaries just as the SGR ignored the reality facing doctors. Trading a bad deal for doctors for a bad deal for seniors is not a legislative victory and it is a surprising move from some in Congress who have previously vowed to protect Medicare from cuts and seniors from cost-shifting.

It’s no surprise that anti-“entitlement” lobbyists on Capitol Hill and their allies in Congress are celebrating this deal for the benefit cuts they know will ‘grow like an avalanche over time’. That avalanche will be headed straight for American retirees, current and future, as Congress continues to push Medicare down the slippery slope of means testing, raising costs for more and more seniors, including the middle-class.”…Max Richtman, NCPSSM President/CEO

House Democrats Introduce Social Security 2100 Act

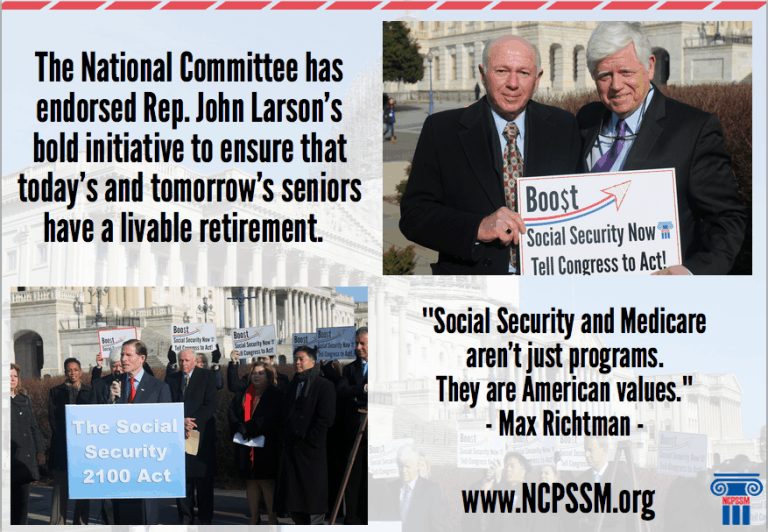

NCPSSM joined a terrific coalition of Congressional Democrats on Capitol Hill today to lend our support for important new Social Security legislation introduced by Rep. John Larson (D-CT).

The “Social Security 2100 Act” provides a desperately needed dose of political sanity in the House, where the GOP leadership has devoted most of its energies in cutting benefits to seniors, certainly not strengthening them.

Here are some of the benefit improvements in this legislation:

- An across-the-board increase for all beneficiaries of about 2 percent, a change that is projected to yield an annual increase for the typical retiree of $300;

- Adoption of the Consumer Price Index for the Elderly (CPI-E) for the purpose of determining cost-of-living adjustments for Social Security beneficiaries;

- Tax relief for Social Security beneficiaries due to an increase in the threshold for taxation of Social Security benefits to $50,000 for individuals and $100,000 for joint filers, up from $25,000 and $32,000 respectively; and

- An increase in the special minimum benefit so that it equals up to 125 percent of the poverty level for an individual. This would be indexed in future years by increases in the average wage level prevailing in the national economy.

This legislation mirrors the approach supported by the vast majority of Americans, of all ages and political persuasions, who do not support cutting Social Security to pay down the deficit…even though that’s the only approach ever offered by conservatives in Congress these days.

Congress Targets Social Security with Fast-Track Commission Plan

“Reps. Tom Cole (R-OK) and John Delaney (D-MD) plan to introduce a bill this Congress that would create a Social Security commission to propose changes to the program, Cole’s office confirmed to TPM on Monday.” – Talking Points Memo.

“The commission would probably gradually raise retirement age, it would probably look at chained CPI, would probably look at means-testing and probably look at some sort of revenue, or reduce benefits for upper-income people,” Cole said. “Then you have to vote.” – The Hill.

“We are troubled that H.R. 1578 takes several steps to circumvent a deliberative public process, limiting the participation of Social Security stakeholders and advocates. For example, the Committees of jurisdiction over the Social Security program — the Senate Committee on Finance and the House Committee on Ways and Means — would have limited input in the development of the Commission’s recommendations. Under “fast track” procedural rules in your bill, the legislation embodying the Commission’s recommendations would be considered by Congress on an expedited, “take-it-or-leave-it” basis. No amendments to the Commission’s bill could be offered and it could be passed in both the House and Senate by a simple majority vote. Normally, Section 310(g) of the Budget Act and the Senate’s “Byrd rule” require 60 votes in the Senate to approve legislation which changes Social Security.” – Max Richtman.

Women on 20s and the Social Security Connection

“A woman’s place is on the money” is the catchy tagline of a growing national movement to put an American woman trail blazer on the $20 bill. It’s pretty fitting timing given that it’s Women’s History month and a long overdue improvement if you consider that the Susan B. Anthony and Sacagawea dollars (when’s the last time you used one of those?) are the only places women are represented on our currency.

Reading through the list of women candidates is a walk through America’s history and a reminder of how many strong, smart and brave women have impacted our nation. We couldn’t help but take note of two nominees who played vital roles in the creation of Social Security – First Lady Eleanor Roosevelt and the first female U.S. Cabinet member, and the longest-serving labor secretary in history, Frances Perkins. Both women played critical roles in ensuring America’s retirees would have an income security lifeline as they age. Eleanor Roosevelt is also the inspiration for our “Eleanor’s Hope” initiative which is raising awareness, recruiting and training new Social Security activists while also bolstering Congressional leaders who are making a difference on women’s health and retirement security issues. We’re also advocating for legislation that addresses the inequities threatening millions of retired women and working to elect lawmakers who share our vision of retirement equity for women.

Without Social Security, over half of all older Americans would fall into poverty. More than many other federal programs, Social Security does exactly what it was designed to do – it gives retired people a secure, basic income for as long as they live. We think that’s a really great reason to cast our Women on 20’s vote for Eleanor and Frances (plus you get to pick one more too!)

Congress Trades Bad Deal for Doctors for Bad Deal for Seniors in Medicare

“Contrary to claims by supporters, on both sides of the aisle, this ‘doc fix’ does not impact only ‘wealthy seniors’. Millions of beneficiaries who depend on a Medigap plan to help pay their health care bills – no matter their income — will be hit with higher costs. Given that 46% of all Medigap policy holders had incomes of $30,000 or less, it’s clear this deal impacts far more than the wealthy, as the bill’s proponents have claimed. What’s more, Medicare beneficiaries will be forced to contribute nearly $60 billion in premiums over the next decade to replace the SGR.

No doubt, we’ll hear today that this ‘compromise’ Medicare doc-fix plan must be a success because there are concessions from all sides. Unfortunately, that political trope is just as flawed as the SGR itself because it ignores the financial reality facing Medicare beneficiaries just as the SGR ignored the reality facing doctors. Trading a bad deal for doctors for a bad deal for seniors is not a legislative victory and it is a surprising move from some in Congress who have previously vowed to protect Medicare from cuts and seniors from cost-shifting.

It’s no surprise that anti-“entitlement” lobbyists on Capitol Hill and their allies in Congress are celebrating this deal for the benefit cuts they know will ‘grow like an avalanche over time’. That avalanche will be headed straight for American retirees, current and future, as Congress continues to push Medicare down the slippery slope of means testing, raising costs for more and more seniors, including the middle-class.”…Max Richtman, NCPSSM President/CEO

House Democrats Introduce Social Security 2100 Act

NCPSSM joined a terrific coalition of Congressional Democrats on Capitol Hill today to lend our support for important new Social Security legislation introduced by Rep. John Larson (D-CT).

The “Social Security 2100 Act” provides a desperately needed dose of political sanity in the House, where the GOP leadership has devoted most of its energies in cutting benefits to seniors, certainly not strengthening them.

Here are some of the benefit improvements in this legislation:

- An across-the-board increase for all beneficiaries of about 2 percent, a change that is projected to yield an annual increase for the typical retiree of $300;

- Adoption of the Consumer Price Index for the Elderly (CPI-E) for the purpose of determining cost-of-living adjustments for Social Security beneficiaries;

- Tax relief for Social Security beneficiaries due to an increase in the threshold for taxation of Social Security benefits to $50,000 for individuals and $100,000 for joint filers, up from $25,000 and $32,000 respectively; and

- An increase in the special minimum benefit so that it equals up to 125 percent of the poverty level for an individual. This would be indexed in future years by increases in the average wage level prevailing in the national economy.

This legislation mirrors the approach supported by the vast majority of Americans, of all ages and political persuasions, who do not support cutting Social Security to pay down the deficit…even though that’s the only approach ever offered by conservatives in Congress these days.