Congress Investigates Skyrocketing Rx Drug Prices

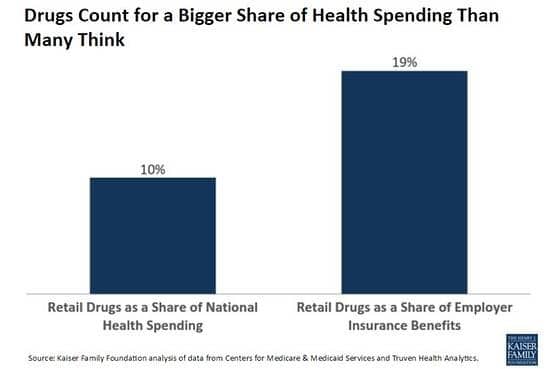

It’s certainly no surprise to Medicare beneficiaries that America’s prescription drug industry continues to take a growing share of the average American’s health care costs. A new survey by Kaiser Family Foundation shows drug expenses actually takes an even bigger bite than experts previously thought.

“High drug prices have been in the news because of costly drugs to treat Hepatitis C, among other illnesses, and because elected officials and political candidates have been talking about drug costs. Rising drug prices, expanded coverage of the uninsured under the Affordable Care Act, and an improving economy have also contributed to an uptick in the rate of increase in health spending. But depending on what you count and how you count, drug spending may be an even larger problem than many thought. It clearly is for employers, who foot a large share of the nation’s health-care bills.”…Drew Altman, Kaiser Family Foundation

The Senate Special Committee on Aging has launched an investigation into recent cases in which pharmaceutical companies acquired a decades-old drug and then increased the price significantly.

The committee singled out four companies: Turing, Valeant, Rodelis and Retrophin. USA Today detailed some of the outrageous price hikes and their impact on Americans who needed life-saving prescription drugs:

Spiraling costs for two heart drugs owned by drugmaker Valeant Pharmacueticals International increased the Cleveland Clinic’s total drug budget by $8.6 million, hearing testimony showed.

North Carolina doctors treating a baby for toxoplasmosis were unable to get the Daraprim medication that targets the parasitic disease because Turing Pharmaceuticals had raised the price 40 times beyond its original cost. The doctors instead had to use an alternative medication.

Erin Fox, director of the drug information service at the University of Utah Health System, testified that a price hike from $440 to $2,700 forced her to keep a Valeant heart drug locked up after removing it from medication carts where it previously had been available.

Sen. Claire McCaskill, D-Mo., the committee’s ranking minority member, said the committee’s continuing investigation had found a pharmaceutical industry “market failure.”

“And when there’s a market failure, the government has a role in addressing it,” said McCaskill.

In Medicare’s case, the government also has the ability to address the high costs of prescription drugs, saving the program and seniors money. One simple solution is to allow Medicare to negotiate prices for prescription drugs which could save the program and its beneficiaries billions of dollars.

“The law that established Medicare Part D explicitly prohibits the prescription drug program from negotiating lower drug costs for beneficiaries. The major pharmaceutical companies adamantly defend this rule, contending that the higher prices are necessary to support the industry’s investment in research and development. However, a comparison of the prices paid by Part D with those paid by the Department of Veterans Affairs (VA) and other agencies shows that Part D could save billions of dollars through the use of additional negotiation techniques. Our analysis finds that the VA attains drug prices that, on average, are 48 percent lower than Part D plan prices for the top 10 drugs covered by the program.” …”Price Negotiation for the Medicare Drug Program: It is Time to Lower Costs for Seniors,” NCPSSM Issue Brief

UPDATE: Congress Funds 9-11 First Responders Without Targeting Medicare

The Omnibus Budget bill came out late last night and it appears Congress did the right thing. It will provide about $3.5 billion for the vitally important World Trade Center Health Program, guaranteeing that more than 72,000 known responders and survivors will have access to health care for 75 years. Another $4.6 billion will go to extend the 9/11 Victims Compensation Program for five more years. Huffington Post reports:

The major battles were focused on the question of how the bill would be paid for, with a number of the sponsors’ offers being rejected. Ultimately the bill used funding that had been earmarked for other measures that were running into opposition. One of the funding streams used for the 9/11 compensation fund will also provide over $1 billion to compensate U.S. victims of the Iran hostage crisis, the 1983 attacks on the U.S. Marine barracks in Lebanon and the 1996 bombing of the Khobar Towers in Saudi Arabia. That was a key goal of House Judiciary Chairman Bob Goodlatte (R-Va.).

Congress still has to pass the spending bill, but Republican leaders expect that to happen by Thursday.

As always, the devil is in the details and advocates are pouring through the legislation now to ensure there are no other “surprises” hidden there. However, news that Congress will reauthorize the 9-11 Fund without using Medicare and Medicaid as an ATM (once again) is good news for our brave 9-11 first-responders and also millions of Americans and their families who depend on Medicare and Medicaid for their healthcare.

GOP Pitting 9-11 First Responders vs. Seniors & Disabled

Congressional Republicans are once again holding vital federal programs hostage in order to exact cuts they can’t get otherwise to programs like Social Security and Medicare. This time it’s, unbelievably, America’s 9-11 first-responders who are being told the fund which provides health care benefits and compensation won’t be reauthorized without cuts coming from Medicare and Medicaid budgets to pay for it.

This year alone, there have been multiple attempts by Congress to use Social Security and/or Medicare as an ATM to pay for completely unrelated – yet very important – national priorities. Already this year, Medicare sequester cuts have been extended into 2024. Then Medicare was cut again to help pay for the Trade bill. There was also a failed attempt this summer to fund the highway bill with Social Security cuts. Now, the absolutely vital need to provide for 9-11 first responders is being held-up because the GOP hopes to use that leverage to get nearly $3 billion dollars in cuts from Medicare and Medicaid.

New York Senators Chuck Schumer (D) and Kirsten Gillibrand (D) stood with 9/11 responders at a Capitol Hill news conference yesterday. CBS reported:

“They carried bodies, ran into towers and dug in the rubble for remains,” Gillibrand said. “We’re reminded that more police officers have died since 9/11 than on 9/11 and we’re reminded how shameful it is that Congress has not passed a permanent reauthorization of the health and compensation programs.”

Schumer said Democrats are optimistic Congress will reauthorize the programs, but said negotiating over it is not an option.

“To hear some of my colleagues use Zadroga as a trading piece, like some bargaining piece…the lives of our first responders are not a bargaining chip and can never be. You don’t trade it…no way,” Schumer said.

As if holding 9-11 first-responders hostage in order to cut programs serving millions of seniors, people with disabilities and the poor isn’t cynical enough, here’s the real kicker — GOP negotiators are simultaneously pushing for $800 billion in tax breaks without ANY pay-fors. Apparently, so-called “fiscal responsibility” only matters when it involves funding programs for average Americans. As Sen. Robert Menendez, (D-NJ) noted tax cuts for huge corporations are exempt:

“While budget hawks have expressed concern about paying for it, Menendez pointed out that a group of senators is simultaneously negotiating a bill that would extend around $800 billion in tax breaks (for instance, it would extend write-offs for business investments and repeal a specific tax in the Affordable Care Act) — and that would go unpaid for.

“I don’t understand how the rules don’t apply to large corporations that will reap billions of dollars, but somehow those rules are asserted when we are trying to take care of the men and women who responded on that fateful day,” Menendez said. “We should accept our profound, collective responsibility — not charity — but responsibility to act on this legislation.” …CBS News

The bulk of the Medicare cuts proposed ($1.9 billion) would come from continuing the GOP trend of means-testing, ultimately converting Medicare into a welfare program in which only lower income beneficiaries receive full benefits. Years of means-testing in Medicare, begun during the Bush administration, continues to erode the benefit for millions of seniors who contribute to the program yet who Republicans say should pay more and more. Seniors who pay into Medicare and Social Security have earned their benefits. Severing that tie and turning these programs into welfare is part of the larger political goal to undermine the programs over time and a disaster for generations of seniors who will depend on them.

It?s Definitely Not the Kind of Greeting Card Beneficiaries Want This Holiday Season

Each year the Social Security Administration reviews beneficiaries’ benefits and sends out millions of notices to ensure you know what to expect in next year’s Social Security check. Unfortunately, as was announced last month, there will be NO cost of living increase in 2016.

“We review Social Security benefits each year to make sure they keep up with the cost of living. The law does not permit an increase in benefits when there is no increase in the cost of living. So your benefit will stay the same in 2016. There was no increase in the cost of living during the past year based on the Consumer Price Index (CPI) published by the Department of Labor. The CPI is the Federal government’s official measure used to calculate cost of living increases.”…Social Security Administration 2016 Benefit mailing

Since 2009, Social Security beneficiaries have seen a 0% COLA increase three times (2009, 2010, 2016) with an average of just 1.2% increase over those years, confirming yet again, that the current Social Security COLA formula isn’t accurately measuring seniors’ expenses. Seniors across this nation understand how important having an accurate measure of the increase in their real costs is to their day-to-day survival. While there has been a lot of talk in Washington about the need to find a more accurate COLA formula; unfortunately, that attention has largely focused on ways to cut the COLA even further. Leaving many Americans to wonder what’s less than zero? If accurate inflation protection for seniors is truly our goal, Congress needs to adopt a fully developed CPI for the elderly (CPI-E).

Research has shown that spending patterns differ between the elderly and the general population, especially on health care. Seniors 65 and older spend more than twice as much on health care, and those 75 and older spend nearly three times more than younger consumers. Not only do health care expenditures steadily increase with age but health care costs consistently rise much faster than general inflation. The current price index (CPI-W) does not take these critical differences in the elderly population into consideration. The chained CPI doubles-down on that flaw. Even worse, the proposed chained CPI will cut COLAs immediately for current and future retirees, veterans, the poor and people with disabilities.

GOP Presidential candidates Republican Congressional leaders continue to support adoption of the so-called “Chained” CPI because they claim the current COLA formula is too generous and should be reduced. Reduced?!?

Senator Elizabeth Warren has proposed legislation to address the immediate need by providing a $580 Social Security boost. NCPSSM supports Warren’s efforts and will continue to fight for a fully developed cost of living formula geared to America’s elderly.

High RX Drug Prices Certainly Not News to Seniors

The federal Health and Human Services Department has signaled they’re looking for a way to curb rising prescription drug prices. They need to do so because rising drug costs have now overtaken a long stretch of stable premiums. In other words, while Medicare has successfully controlled premiums those successes are lost when seniors in Part D continue to face growing prescription costs.

“Andy Slavitt, acting administrator for the Centers for Medicare and Medicaid Services, said his agency spent $140 billion on prescription drugs and that spending on medicines increased 13 percent in 2014 while overall health spending grew 5 percent.” ….HHS Airs Concerns About Rising Drug Prices, Congressional Quarterly

“Spending on medicines increased 13 percent in 2014, compared to 5 percent for health care overall, Slavitt said. It was the highest rate of drug spending growth since 2001.”…Obama administration sets stage for a debate on drug costs, Associated Press

One simple solution is to allow Medicare to negotiate prices for prescription drugs which could save the program and its beneficiaries billions of dollars.

“The law that established Medicare Part D explicitly prohibits the prescription drug program from negotiating lower drug costs for beneficiaries. The major pharmaceutical companies adamantly defend this rule, contending that the higher prices are necessary to support the industry’s investment in research and development. However, a comparison of the prices paid by Part D with those paid by the Department of Veterans Affairs (VA) and other agencies shows that Part D could save billions of dollars through the use of additional negotiation techniques. Our analysis finds that the VA attains drug prices that, on average, are 48 percent lower than Part D plan prices for the top 10 drugs covered by the program.” …”Price Negotiation for the Medicare Drug Program: It is Time to Lower Costs for Seniors,” NCPSSM Issue Brief

It’s time to hold America’s drug makers accountable.

“Heather Block, a breast cancer patient from Lewes, Delaware, told the forum that her costs have been so high she could face bankruptcy if she beats the odds against her advanced disease. ‘Innovation is meaningless if nobody can afford it,’ she said”… Associated Press