One of the favorite poll-tested messages used widely by Washington’s billion dollar anti-entitlement lobby is that America’s “greedy geezers” are stealing from their grandchildren. They claim that if we allow retirees to collect the Social Security benefits they’ve contributed throughout their working lives, then somehow our children will suffer. This flawed argument assumes that every dollar these anti-Social Security crusaders would cut from Social Security benefits would then be sent to funding children’s programs, rather than reducing the deficit or cutting taxes. Which do you think is more likely?

This mythological link between funding for seniors programs and children’s programs makes for good propaganda but there’s literally no basis in reality for such linkage. We could just as easily say military spending, transportation spending or tax expenditures for the wealthy are stealing dollars from children’s programs. In fact, new research by the Center for Economic and Policy Research shows that real linkage may exist between the dollars spent on our nation’s top 1% and reduced spending on children.

Economist Dean Baker asks: Do Wall Street and the 1 Percent Thrive at the Expense of Our Kids?

“A

s a practical matter, if we look across countries we find that there is actually a positive relationship between spending on the elderly and spending on children. Countries that have been willing to commit a larger share of their output to ensuring that seniors enjoy a decent standard of living also seem willing to commit the necessary resources to ensure that their children have a good start in life.

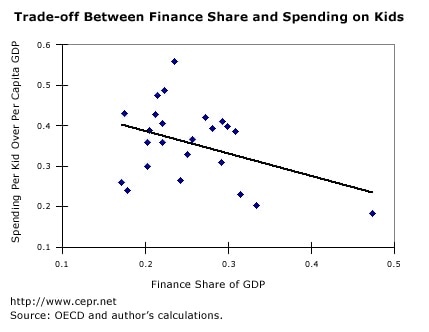

While there may actually be no tradeoff between spending on seniors and spending on kids, there do appear to be other tradeoffs. For example, if we look at the share of GDP devoted to finance we find solid evidence of an inverse relationship with the willingness to support children.

Figure 1 graphs government spending per kid divided by per capita GDP against the share of GDP originating in the financial sector. There is a significant negative relationship, meaning the larger the share of the financial sector in the economy the less money is spent on kids. (The countries are all the OECD countries for which data is available, excluding former Soviet bloc countries.)

The chart clearly shows that countries with larger financial sectors are less generous to their children. While this hardly proves causation (it could be that if countries spend more money on their kids they won’t go into finance), it certainly should raise questions as to whether financial interests are hostile to public spending on kids.

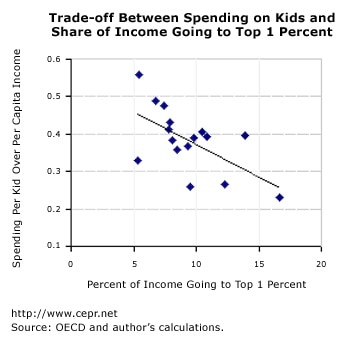

In fact, we also look at the question about the wealthy more broadly. Figure 2 shows government spending per kid divided by per capita GDP against the share of income going to the richest 1 percent. The chart includes all the countries for which data is available. In this case there is also a negative relationship with an even stronger statistical fit. The downward slope to the line is just slightly short of being significant at the 1.0 percent level.

This chart again shows a clear negative relationship, this time between the share of income going to the richest 1 percent and the amount of money that governments are willing to spend on kids. This may suggest that the richest 1 percent are not happy about supporting other people’s children through the government. In that case, the more money they are able to control, the less is likely to go to kids.”

We highly recommend you read the full analysis here. Thanks to CEPR for backing up what most American families understand intuitively. Cutting benefits to generations of middle-class families won’t help the children, parents and grandparents in those families. The Recession Generation and beyond will need Social Security as much, if not more, than current generations. It’s time to reverse a 40 year trend of income inequality and redistribution to the wealthy while reigniting the American dream for middle-class families which benefits young and old alike.

s a practical matter, if we look across countries we find that

s a practical matter, if we look across countries we find that  The chart clearly shows that countries with larger financial sectors are less generous to their children. While this hardly proves causation (it could be that if countries spend more money on their kids they won’t go into finance), it certainly should raise questions as to whether financial interests are hostile to public spending on kids.

The chart clearly shows that countries with larger financial sectors are less generous to their children. While this hardly proves causation (it could be that if countries spend more money on their kids they won’t go into finance), it certainly should raise questions as to whether financial interests are hostile to public spending on kids.