Cato Really Wants to Cut Your Social Security Benefits

Conservative think tanks are working full-time to destroy Social Security as we know it. This week, Cato Institute’s Romina Boccia is peddling the fiction that Social Security doesn’t work and must be “re-designed.” In a recent post on Cato’s blog, she rolls out the “greatest hits” from a time-worn catalogue of conservative talking points to justify altering the program beyond recognition. While it might benefit the financial elites who fund Cato to shrink Social Security, it would hurt working Americans. We asked our senior Social Security expert, Maria Freese, to fact-check some of Boccia’s key claims. Let’s start with the headline:::

BOCCIA: “Social Security Isn’t a Retirement Account — and Congress Must Stop Pretending It Is.”

FREESE: Boccia is correct. Social Security is not a personal retirement account like a 401k. Perhaps some in Congress are “pretending” that it’s an individual retirement account, but anyone who knows Social Security understands that it is social insurance. Workers’ and employers’ payroll contributions are pooled, with benefits payable upon retirement, disability, or death of a family breadwinner. Those insurance benefits are calculated to replace a portion of workers’ incomes based on their earnings history.

If anything, conservatives ignore the program’s disability and survivors’ benefits, framing Social Security as purely a retirement program. In fact, some 3.5 million children collect Social Security benefits because a parent has died or become disabled.

It’s also important to remember that Social Security was never intended to be the only source of income in retirement. Rather, it was expected to be combined with employer-provided pensions and personal savings as part of the old “three-legged stool.” But most non-governmental employers have eliminated pensions — kicking out one leg of the stool. Growing wealth inequality and rising costs have prevented many Americans from saving for retirement on their own. (Only 50% of workers participate in 401K plans!) There goes another leg of the stool — making Social Security all the more crucial.

BOCCIA: “Politicians routinely describe Social Security payroll taxes as ‘contributions,’ speak of a ‘trust fund’ as if it held real savings, and define benefits as ‘earned.’”

FREESE: Yes, they do, and they are correct. The Social Security Trust Fund is invested in treasury bonds backed by the full faith and credit of the United States government. These assets are as “real” as any portfolio of Treasury bonds. College endowments and overseas investors would be shocked to learn that their US-backed assets are somehow fake! (In fact, you can watch our CEO and President, Max Richtman, debunk Boccia’s ‘trust funds aren’t real’ argument in a 2025 debate.) Right now, there are more than $2 trillion in assets in the Social Security trust fund.

Benefits are very much earned. Social Security benefits are tied to workers’ payroll contributions. The benefit formula links monthly Social Security checks to lifetime earnings. Social Security benefits are progressive in nature — meaning lower-income workers receive proportionally higher benefits. Americans understand that Social Security is a social contract: People pay in during their working years, and receive benefits upon retirement, disability, or the death of a family breadwinner. Social Security is fundamentally different from a means-tested welfare benefit.

BOCCIA: “When Social Security is framed as a retirement account, any benefit reduction sounds like unfair confiscation.”

FREESE: Workers rightly see benefit cuts as unfair, not because they mistake Social Security for a 401(k), but because they have kept their end of the bargain with every paycheck. Contributions are deducted automatically (and matched by employers), with the explicit promise that Social Security benefits will be paid in full.

Boccia’s own polling shows that Americans are wary of large benefit cuts once the real dollar amounts are spelled out. Younger workers, who Boccia casts as unfairly burdened by Social Security, are facing a future with fewer pensions, more unstable jobs, and displacement; for them, a robust, predictable Social Security benefit will be even more important, not less.

BOCCIA: “Lifting the payroll tax cap becomes a decision to raise taxes on higher earners to fund redistribution.”

FREESE: When Social Security was created, payroll taxes applied to roughly 92% of all wage income; after the 1983 reforms, about 90% of wage earnings were subject to the tax. Today, due to the widening wealth gap (the rich getting richer), only about 83% of the nation’s total wage income is subject to Social Security taxes. An adjustment of the payroll wage cap (now set at $184,500 in annual wages) would ensure that high earners contribute their fair share, just like everyone else. In the meantime, Elon Musk and Jeff Bezos stop paying into Social Security shortly after January 1 while the rest of us contribute all year.

It’s also important to remember that the highest-income individuals have found ways to reclassify their income so it doesn’t appear as wages — a luxury most workers do not have. Private equity managers, for example, convert compensation into “carried interest,” to avoid paying their fair share.

This is why the polling consistently indicates that large majorities of Americans across party lines prefer that high earners contribute more, rather than cutting benefits or raising the retirement age for those who rely on Social Security.

BOCCIA: “Congress should stop pretending Social Security is a contribution-based retirement account and design it accordingly. The most straightforward approach is a flat benefit: a uniform, anti-poverty payment for eligible seniors.”

FREESE: Sorry, but a “flat benefit” would hurt middle class workers. According to a 2022 analysis, while the lowest quintile (20%) of working families would see a lifetime benefit increase from a flat benefit, the middle quintile would see benefit cuts. Lower income workers already benefit from the progressive structure of Social Security (and can also receive Supplemental Security Income or SSI), but middle class beneficiaries would have a hard time withstanding the cut from a flat benefit. A flat benefit would subvert the fundamental nature of Social Security, where benefits are based on workers’ lifetime earnings — and turn it into a welfare program that could be demonized and cut over time.

************************************************

Read our review of Romina Boccia’s book “Re-Imagining Social Security.”

Listen to our podcast episode about recent public polling showing overwhelming support for Social Security.

Listen to our podcast episode about the spike in anti-Social Security propaganda from the political right.

Watch our documentary about the 90-year history of Social Security!

“Fox Guarding the Henhouse”: Social Security Whistleblower Fears Trump/DOGE Have Put Americans’ Data at Risk

Social Security Administration whistleblower Chuck Borges on PBS NewsHour

An attorney for whistleblower Chuck Borges says that DOGE accessing Americans’ sensitive Social Security information is like “the fox guarding the henhouse” — as her client appeared on PBS NewsHour responding to the latest news about data mishandling at the Social Security Administration (SSA). The attorney goes on to say that the “government is lying to us” about DOGE’s malfeasance.

Borges, who was the Social Security Administration’s chief data officer until being forced to resign, told NewsHour that a court filing from the Trump administration confirms some of his worst fears about DOGE’s abuse of beneficiaries’ personal data. The interview comes on the heels of reporting last week that DOGE employees shared sensitive Social Security data with a third party to ‘overturn election results.’

Borges filed a formal complaint about DOGE activities last summer, before being pushed out of SSA. His reporting flagged three specific concerns, which have now been partially validated by the recent court disclosure from the Trump administration’s very own Department of Justice (DOJ):

*DOGE employees were granted inappropriate access to SSA data.

*DOGE employees violated a temporary restraining order after sharing this data through “Voter Data Agreement” with an unnamed conservative advocacy group.

*DOGE employees uploaded sensitive Social Security data to an internet cloud server without adequate security controls.

Borges told PBS, “This court filing validates the first two pieces of that puzzle. The third piece has not yet been validated or refuted yet with any documentation. But if the first two allegations are correct, I’m very concerned about the third.”

This third issue involves a database called “The Numident,” the master log of all personal information connected to Social Security numbers dating back to 1936.

“To put that personally identifiable information (in the cloud) that can be used to propagate identity theft, mortgage fraud, steal small business loans, impersonate dead people… It’s a risk to literally every American’s ability to have a daily life” – Chuck Borges, Former Chief Data Officer, SSA

The Trump administration’s court filing downplays the breach as affecting only 1,000 people, but Borges questions that figure. “Americans can’t be sure (their data is safe) until the agency releases documentation that proves or refutes my allegations one way or the other. To date, they have released zero.”

“Because the government’s not telling us the truth. I still don’t think we know the full story. The allegations that Mr. Borges raised are quite serious. And he raised them with the federal agency that is responsible, Office of Special Counsel, for investigating his disclosures. And rather than investigating it, they have kicked it to a different agency. They haven’t investigated at all.” – Debra Katz, attorney for whistleblower Charles Borges

These brazen violations of privacy have become par for the course in Trump 2.0. As Politico recently reported, ChatGPT-style AI experiments have already exposed sensitive data at other agencies, akin to what DOGE is accused of doing at SSA.

“The government is lying to us,” Says Borges’ attorney, Debra Katz

From brutal workforce cuts to unnecessary hurdles for beneficiaries, Trump and Musk’s DOGE team unleashed trauma and chaos at the Social Security Administration shortly after the president took office. Even as Musk left the federal government and his relationship with Trump has waivered, the damage done to Social Security is coming into sharper focus.

The National Committee to Preserve Social Security and Medicare has joined Democratic members of Congress in calling for a probe into DOGE malfeasance:

“We stand with Congressmen John Larson (D-CT) and Richard Neal (D-MA) in demanding ‘a full criminal investigation into DOGE leaks of private Social Security data to Elon Musk’s associates and immediate congressional action to safeguard Americans’ privacy,’” said Max Richtman, President & CEO, National Committee to Preserve Social Security and Medicare.

******************

Listen to our podcast interview with SSA whistleblower Laura Haltzel.

Find the full interview of Chuck Borges on the PBS NewsHour here.

Medicare Advantage Keeps Gaming The System, New Data Reveals

Artwork by medicareresources.org

Over the years, we’ve have talked a lot about the disadvantages of Medicare Advantage (MA). These plans — which have become a gold mine for profit-oriented insurers and their Wall Street backers — cover over half of Medicare beneficiaries, and are sold as a cheaper alternative to traditional Medicare. New reporting confirms that these private plans are bleeding taxpayers for billions of dollars more than traditional Medicare would cost for comparable enrollees.

Fresh reporting by MedPage — drawing from data provided by the Medicare Payment Advisory Commission (MedPAC) — highlights MA’s broken promises.

Despite reforms like the V28 risk adjustment model, MA payments still will exceed traditional Medicare by 14% per enrollee this year. Of the projected $76 billion overage, $22 billion stems directly from “upcoding” – where insurers exaggerate patients’ diagnoses in order to reap higher payments from the government.

Medicare Advantage insurers have been cited for exaggerating patients’ diagnoses & denying care

Our policy team sounded the alarm on these abuses in a March 2024 comment letter, in which NCPSSM President Max Richtman called out insurers’ nefarious practices. The letter demanded better oversight by the Center for Medicare and Medicaid Services (now led by Trump-appointee Dr. Mehmet Oz). Richtman urged the agency to take action to protect Medicare’s integrity, such as tougher coding standards and a ban on ‘abusive health risk assessments.’

“Systematic upcoding reduces the accuracy of MA payments by making the enrollee population appear sicker and costlier.” – Max Richtman, President and CEO, NCPSSM

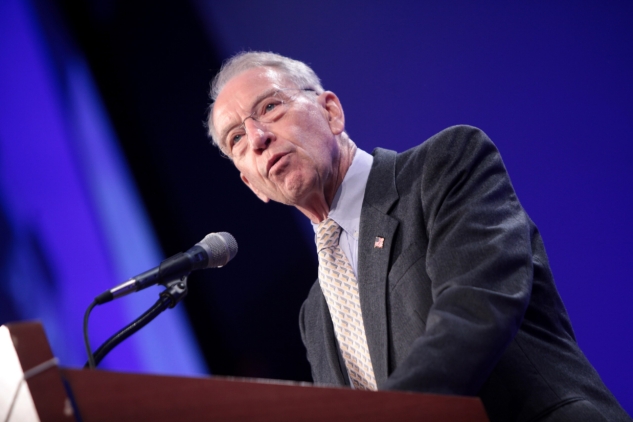

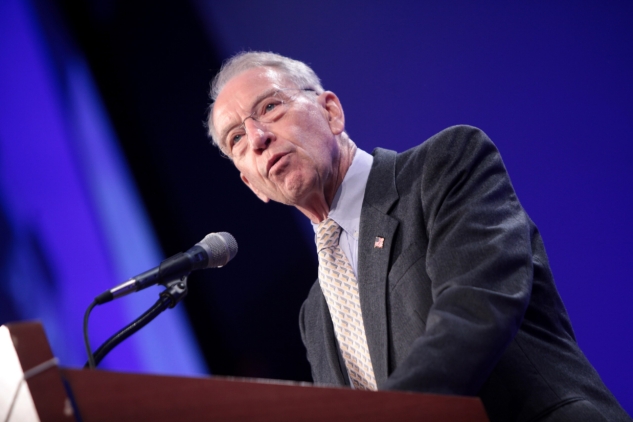

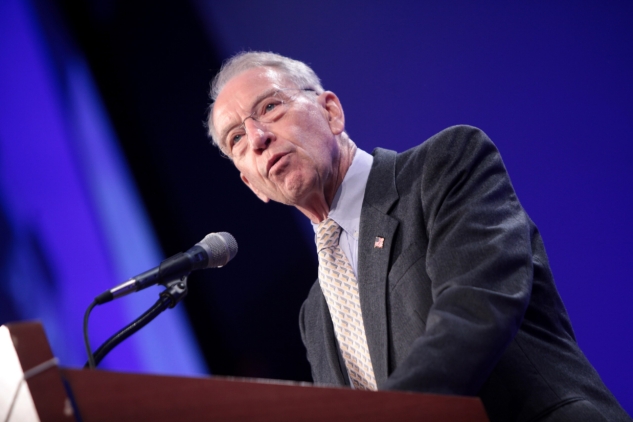

The upcoding has become so egregious that even some Republicans have started to scrutinize major insurers. Last year, staffers for Iowa Republican Senator Chuck Grassley (who appears in our new Social Security documentary) were granted access to over 50,000 pages of United Health Care (UHC) documents. Their findings — which were released earlier this month — exposed UHC’s commitment to what Senator Grassley called “gaming the system and abusing the risk adjustment process to turn a steep profit.”

While United Health Care has emerged as the worst offender, it’s abundantly clear that many MA insurers are engaged in these shady practices. Look no further than insurers’ reliance on prior authorizations for procedures and treatments that normally would be automatically covered in traditional Medicare. This includes denying skilled nursing care that jeopardizes older patients who have nowhere else to turn.

Sen. Chuck Grassley (R-IA) accused Medicare Advantage insurers of “gaming the system.”

Patients can appeal non-coverage rulings from the prior authorization process. Appeals are triggered when patients receive Notices of Medicare Non-Coverage (NOMNC), effectively denying them care. It was reported that one patient received 12 non-coverage notices — even after winning previous appeals.

Last week, Acentra Health exposed how the prior authorization process specifically targets seniors receiving skilled nursing care. After combing through 25,000 appeals, Acentra found that 83% of coverage denials involved skilled nursing care patients. Of those, a staggering 93% related to Medicare Advantage patients, despite that group representing roughly half of the Medicare market. While it’s long overdue that the federal government crack down on these abuses by MA insurers, it’s also important to remember that seniors can avoid denials of care (and other MA-related headaches) by enrolling in traditional Medicare instead.

************************************

Read our comment letter from 2024 here

Read more about the disadvantages of Medicare Advantage here

Listen to our podcast here.

Trump & Musk Created a Culture Where Social Security Data Could be Abused

AP/Getty Images

New reporting that DOGE abused Americans’ private Social Security data should come as no surprise. We have warned from the beginning that DOGE had no business accessing this data and that no good could come of it. Last June, the Supreme Court overturned a lower court order that barred DOGE from accessing Americans’ Social Security data. This gave DOGE carte blanche to misuse Americans’ personal information that it never should have had in the first place.

Now, the Trump administration is attempting to single-out and scapegoat two DOGE staffers because of the latest breach. No doubt, any DOGE employees who misused Americans’ personal Social Security data (in this case, reportedly by promising to share it with a third-party in order to ‘overturn election results’) should be held accountable for their actions. But this reported malfeasance was enabled by a culture created by the Trump Administration, Elon Musk, and DOGE soon after the president took office — a culture of recklessly interfering in the legitimate functions of the federal government with questionable intent and zero accountability.

ProPublica

DOGE’s supposed mission, as directed by the White House, was to root out alleged ‘fraud’ at the Social Security Administration. It found no significant fraud but hobbled SSA’s ability to serve the 70 million people who rely on Social Security — by slashing the workforce and erecting new hurdles for beneficiaries simply trying to access their earned benefits.

“The reported abuses of Social Security data are part of this relentless attack on the functioning of the Social Security Administration, under the phony cover of hunting for ‘waste, fraud, and abuse’ at what was among the most efficient federal agencies,” says NCPSSM president and CEO Max Richtman.

This week’s reports of DOGE malfeasance are not isolated. In August, DOGE team members were found to have uploaded the personal information of hundreds of millions of Americans to a ‘vulnerable cloud server’ without any credible explanation.

The disclosure mirrors what Chuck Borges, the former chief data officer at the SSA, said in his whistleblower complaint, warning that the private data of more than 300 million Americans was at risk after DOGE employees uploaded a copy of the Social Security Administration’s database to a cloud environment. – MarketWatch, 1/21/26

“We stand with Congressmen John Larson (D-CT) and Richard Neal (D-MA) in demanding ‘a full criminal investigation into DOGE leaks of private Social Security data to Elon Musk’s associates and immediate congressional action to safeguard Americans’ privacy,'” says Richtman.

Elon Musk recently donated $10M to Kentucky GOP Senate candidate & Trump supporter Nate Morris (AP/Mark Humphrey)

“If people can’t trust Social Security to keep their privacy inviolate, confidence in the entire program may well be shattered,” writes L.A. Times columnist Michael Hiltzik. “Sadly, that would be consistent with conservatives’ long war against this most popular and important government program, but maybe that’s what Trump has wanted all along.”

It is probably not coincidental that the two DOGE staffers reportedly promised to share Social Security data with an unnamed political advocacy group, ostensibly to challenge election results. Their ultimate boss, Donald Trump, is still peddling the lie that he won the 2020 elections; their former boss and ex-leader of DOGE, Elon Musk, just donated a whopping $10 million to the campaign of a Trump-supporting Senate candidate in Kentucky, who was endorsed by the late Charlie Kirk last year. (Musk, the world’s richest man, was the biggest donor in the 2024 election cycle — spending $300 million, mostly on behalf of Trump.)

The Social Security Administration claims to have had no knowledge of the data abuse by DOGE employees. The Department of Justice refuses to investigate DOGE, only the two employees in question. Meanwhile, anyone with a Social Security number has reason to be alarmed that their data has been leveraged by the unholy convergence of DOGE’s phony efficiency campaign and the radical political agenda of Trump and Musk.

******************

Listen to our podcast interview with former Social Security Commissioner Martin O’Malley on the Trump administration’s devastating actions at the Social Security Administration.

Conservatives Won’t Stop Dividing the Generations over Social Security, Medicare

Americans of all ages face a crushing affordability crisis. Rather than blame the billionaire class and their political servants – or wealth inequality in general – conservatives have continued trying to pit the generations against each other.

Look no further than this week’s misleading op-ed in the Los Angeles Times,The Financial Engine Behind Millennial and Gen Z Malaise. This is only the latest in a gaggle of mainstream media pieces blaming younger adults’ economic struggles on older people – otherwise known as the “greedy geezer” myth.

These screeds barely ever mention that the rising cost of college tuition, mounting student debt, and unaffordable housing could be mitigated by more progressive federal policies that favor everyday people instead of financial elites. See: almost every other Western-style democracy. Instead, it’s all supposedly older people’s fault.

“Medicare programs are paying for golf balls, greens fees, social club memberships, horseback riding lessons, and pet food,” writes columnist Veronique de Rugy of the right-leaning Mercatus Center at George Mason University.

In reality, Medicare covers medically necessary services like doctor visits, hospital stays, and preventive care… not luxury goods. Far from living in luxury, most seniors are reliant on Social Security to cover some or all of their living expenses. In fact, without Social Security, some 40% of seniors would fall into poverty!

Conservative think tanks are trying awfully hard to divide the generations

The Mercatus-authored piece also mirrors Koch-funded groups like the American Enterprise Institute (AEI) by claiming that retirees are receiving “37% more in Social Security benefits than they paid in (payroll) taxes.”

This statement completely ignores the true nature of Social Security. It was never designed to be an investment program or to generate profits for contributors, nor was it designed to pay out only as much as a worker contributed.

“Social Security is social insurance and like any insurance program, it spreads risk among those who contribute. If you have home insurance, you don’t expect to get your premiums back if your house doesn’t burn down, but you do expect to collect much more than you contributed if disaster strikes.” – Maria Freese, NCPSSM senior Social Security policy expert

With Social Security, you contribute during your working years so you have a source of income if you become disabled, your family is protected if you die, and you can maintain some level of standard of living if you are fortunate enough to enjoy a long life. Once you qualify for benefits, they last as long as you live – benefits don’t stop at an arbitrary number tied to your contributions.

What’s more, Social Security benefits are progressively structured — meaning lower-income seniors receive higher proportional benefits than their wealthier counterparts.

Meanwhile, the op-ed makes the claim that Social Security is the “biggest driver of our government debt.” This is another conservative trope. Social Security is self-funded and does not contribute to debt. (The program also is legally barred from borrowing money.) As conservative hero Ronald Reagan himself said, “Social Security has nothing to do with the deficit.”

President Reagan acknowledged that Social Security does not contribute to the federal debt

In fact, the biggest driver of federal debt is ‘tax expenditures’ — windfalls for the wealthy like the Trump/GOP tax cuts, which added some $3 trillion in red ink. Conservatives don’t seem to mind debt if it’s driven by tax breaks for the rich.

The L.A. Times piece also misleads readers with a “gotcha,” using the basic economic reality that Americans generally are worth more at the end of their lives than they are at the beginning or middle:

“American heads of households younger than 35 now have a median net worth of about $39,000 and an average net worth of more than $183,000`. Those over age 75 have a median net worth of roughly $335,000 and an average net worth exceeding $1.6 million.” – Veronique de Rugy, L.A. Times

Typically, Americans have built up wealth over their lifetimes as they save for retirement or pay off their home mortgages. And until recently, each generation tended to be wealthier than the ones before it. However, thanks to regressive economic policies, that trend has now been reversed.

Conservative narratives seem designed to pave the way for benefit cuts and privatization of Social Security. Although the Times op-ed does not explicitly mention means testing Social Security and Medicare – which would fundamentally alter these programs – the author strongly hints at it:

“Treating every elderly person, no matter how well-off, as a member of a protected class entitled to increasingly unaffordable benefits will eventually destroy a system that progressives in particular cherish.” – Veronique de Rugy, L.A. Times

These social insurance programs are earned benefits based (in part) on lifetime payroll contributions. They are not a ‘handout’ to seniors, people with disabilities, or their families. Implementing means-testing breaks this decades-long compact with workers, and would disproportionately target modest earners making $50,000-$70,000 annually.

This is all part of a broader, well-funded effort to turn generations against each other and soften the ground for degrading Social Security and Medicare. Framing seniors as “greedy geezers” living large on “boomer luxury communism” is designed to distract from the real culprits behind our affordability crisis.