VP Vance and Mehmet Oz Turn Medicaid into a Weapon in Minnesota

In a move of partisan pettiness, the Trump administration has “temporarily halted” $260 million in Medicaid reimbursements owed to the state of Minnesota, weaponizing allegations of fraud within the program in order to punish its political opponents. This decision will put hundreds of thousands of low‑income, older, and disabled Minnesotans at risk.

Last week, Vice President JD Vance and CMS Administrator Mehmet Oz announced the moratorium as part of a larger “war on fraud.” In reality, the administration has singled out Minnesota, using Vance to probe how far they can push the limits of political retaliation under the guise of “reform.” The Minnesota Department of Human Services warns that a funding freeze could last several quarters and cost the state’s General Fund more than $1 billion this year alone.

Anne Montgomery, Senior Health Policy Expert at NCPSSM, put it bluntly:

“The only way Trump and his allies know how to negotiate is by causing pain — deep pain. This move is nothing more than payback and a pressure tactic.” – Anne Montgomery, NCPSSM

Vance framed the freeze as a necessary step to force Minnesota to “take its obligations seriously.” But in practice, the White House is taking a bad-faith approach, looking to punish a state that is already grappling with fraud investigations and Trump/Vance/Miller’s unlawful ICE invasion.

Under the direction of Vance and Oz, CMS has departed from its usual enforcement process, which should be more reactive (carefully assessing allegations of fraud) than proactive. Instead, the administration is freezing money for:

- Personal care services,

- Home and community‑based services

- In‑home and provider‑based supports

These services are lifelines that help older adults and people with disabilities live with dignity. Furthermore, this abrupt stoppage will throw medical staffers with these programs into a period of financial turmoil. Montgomery points out that “The providers who serve them are ordinary people, generally working for modest wages, who go into people’s homes to provide supportive services that keep them out of the hospital and out of nursing homes, and they may not be paid.”

We don’t expect this “war on fraud” playbook to be unique to Minnesota. It seems as though Vance and Oz are taking the baton from Musk and DOGE, whose rampage through the federal bureaucracy last year unleashed trauma and chaos at the Social Security Administration (SSA).

Vance’s Medicaid freeze in Minnesota, framed as protecting taxpayers, in practice advances Trump’s broader political agenda, scapegoating Somali‑Americans and exerting political pressure on Governor Tim Walz, while putting at risk the older adults, people with disabilities, and low‑income families who depend on Medicaid for essential care.

Trump himself knows the optics are toxic, which is why he’s handed Vance the thankless job of managing the political fallout. The VP has proven to be a convenient spokesperson for policies even some Republicans see as risky and cruel. GOP strategists in Minnesota have expressed fears of “blowback,” especially after two residents of the state — Renee Good and Alex Pretti — were killed by federal immigration authorities.

In a midterm election year, voters will have a clear choice: support leaders who weaponize health care to punish a blue state, or elect those who treat Medicaid, Social Security, and Medicare as lifelines, not bargaining chips.

Listen to our podcast HERE

Read the Minnesota DHS’ press release HERE

Trump Offers Seniors Lies & Empty Promises in State of the Union Speech

Last night, Donald Trump delivered a bloated, hyper-partisan spectacle that did nothing to allay the concerns of older Americans. In fact, the president attempted to mislead seniors about the administration’s policies that most seriously affect them.

“The state of the union speech was theatrics over substance. And it was patently partisan,” said NCPSSM president and CEO, Max Richtman. “Trump’s brand of political performance art is no substitute for leadership that improves the lives of Americans of all ages, including our nation’s seniors.”

Here are some of the lowlights:

“No more taxes on Social Security benefits”

Trump’s mumbling, bumbling diatribe (which broke the record for the longest State of the Union ever) contained countless lies and exaggerations, some old and some brand new. He boasted that the administration has “eliminated taxes on Social Security,” which is patently false.

The president’s “Big, Ugly Bill” did NOT cut or eliminate taxes on Social Security benefits. It did contain a limited tax deduction for seniors until 2028 that phases out at higher income levels. But he continues to lie about changing taxation on benefits.

Millions of Social Security beneficiaries will still owe federal income tax on their Social Security benefits this year, just as they did under Presidents Biden, Trump 1.0, Obama, W. Bush, et al.

“Protecting” seniors’ programs

Trump also grossly misled Americans by saying that his administration will “protect Social Security, Medicare, and Medicaid.” First of all, the Big, Ugly Bill cut nearly $1 trillion from Medicaid — which will result in millions of Americans of all ages losing health coverage when the law kicks in. Hospitals and clinics in underserved areas already are closing because of the coming cuts in federal funding.

As for Social Security and Medicare, Trump has been a poor steward of both as their trust funds approach depletion between 2030 and 2040, absent any corrective action. Trump/GOP policies have made the situation worse, not better. As Fortune’s Nick Lichtenberg wrote in response to Trump’s speech:

“Sweeping legislative changes spearheaded by his administration have drastically shortened the financial lifespans of both Medicare and Social Security, accelerating their (trust funds’) paths toward insolvency.” – Fortune, 2/24/26

Meanwhile, the Trump administration has undermined Social Security through reckless cuts in staffing and customer service at the Social Security Administration. Seniors’ advocates have rightly called these maneuvers a “back door approach” to cutting Social Security.

TrumpRx and Other Prescription Drug Hooey

We also saw Trump try to dodge another reality he can’t escape: Americans, young and old, continue to face high prescription drug costs. Instead of being honest with the public last night, Trump focused not on inflated prices, but serving his inflated ego:

“I am ending the wildly inflated cost of prescription drugs. Other presidents tried to do it, but they never could. They didn’t even come close.” – Donald Trump, 2/24/2026

Really? Here’s the truth: President Biden and congressional Democrats enacted real reform via the Inflation Reduction Act, which, among other things, empowered Medicare to negotiate prices with Big Pharma — a provision which already is lowering prices for several life-saving drugs.

NBC News notes that Biden’s 2022 law:

- Capped insulin at 35 dollars a month for people on Medicare.

- Created a 2,000 dollar annual cap on out‑of‑pocket Medicare drug costs.

- For the first time, allowed Medicare to negotiate prices on some of its most expensive medicines.

By contrast, Trump has relied on sketchy, back-room deals with a handful of drugmakers, plus his TrumpRx “self‑pay” platform that offers cash prices on a limited number of medications. These discounts generally don’t apply to people with Medicare or employer-provided insurance, don’t count toward deductibles, and often can’t beat the prices of existing generics. Trump simply re-branded existing manufacturers’ coupons on his own site.

For all its bloat, last night’s speech did nothing to address the challenges facing America’s seniors. Overheated rhetoric and lies do not make up for the potentially devastating effects of Trump’s wrongheaded policies.

“Hopefully, America will soon forget last night’s bizarre ‘reality show’ that has little relation to the reality of day-to-day life in America,” said Max Richtman. “But we will remind voters this election year of this administration’s myriad failures to protect older Americans and their families.”

The Dystopian Future is Now at Trump’s Social Security Administration

Getty Images

A combination of incompetence and extremism is once again on display at Trump’s Social Security Administration (SSA). On Friday, two disturbing stories broke. Wired reported that the Trump administration is demanding that SSA employees inform ICE about appointments made for in-person service at Social Security field offices, presumably so that agents can nab suspected undocumented immigrants. Meanwhile, according to Government Exec, SSA staffers were told to advise callers to the agency’s 1-800 number that “suicide is an option” for people considering ending their lives.

These two stories may seem unrelated; but they are not. Both can be understood in in the context of Trump’s grossly misusing SSA to advance his extreme ideological agenda — against immigrants and against a federal workforce that truly serves the public.

“Suicide is an option”

The administration has slashed some 7,000 jobs at the Social Security Administration, creating a tremendous ‘brain drain’ and weakening an agency that serves a growing senior population.

Government Exec reports that, because of understaffing, SSA recently began “shifting new swaths of its workforce to phone answering duty,” providing those employees with only a brief, three-hour training.

In that training, employees were told to advise distressed callers expressing suicidal ideations that “suicide is only one option.” Employees in the room reportedly were “taken aback” and expressed “disbelief that it was just said.” Mental health experts roundly criticized the SSA training:

The National Action Alliance for Suicide Prevention maintains a best practices framework for suicide crisis lines, which emphasizes that suicide should not be presented as “acceptable.” – Government Exec, 2/13/26

When asked for his response to this news, former Social Security Commissioner Martin O’Malley told us, “For 90 years, the mission of Social Security field offices has been to promote, protect and defend the dignity of every human life. There must be some mistake. I cannot believe that anyone would try to teach the compassionate human beings of (SSA) to tell beneficiaries that taking their own lives is an option.”

This is only one of the latest in a series of outrages at Trump’s SSA, demonstrating that the purposely understaffed agency is awash in incompetence, poor judgement, and immoral leadership from the very top.

Reporting SSA field office appointments to ICE

The other recent outrage is the disclosure in Wired that workers at the Social Security Administration have been told to share information about in-person appointments with agents of Immigration and Customs Enforcement (ICE).

Wired quotes an unnamed SSA employee who fears retaliation for speaking out:

“If ICE comes in and asks if someone has an upcoming appointment, we will let them know the date and time,” an employee with direct knowledge of the directive says. – Wired, 2/13/26

This directive is well outside the mission of SSA, which is to administer Americans’ earned benefits – not to snitch on visitors to field offices who in some cases are non-citizens in the U.S. legally. (Some non-citizens can be eligible for Social Security benefits, while undocumented workers are not.)

“From the first moment that DOGE marched into Social Security, greenlighted by the (Trump) regime… we’ve seen them misuse Social Security in ways that can inflict pain and… suffering on others,” former commissioner O’Malley says. “We now see that they’re trying to turn the agency into a dragnet for the greatest internment of human beings on US soil in the modern history of America.”

Former acting Social Security commissioner under Trump, Leland Dudek, says that SSA is meant to be a “safe space” for Social Security applicants and beneficiaries. It’s important, he told Wired, for customers of SSA to feel that “SSA is there for them and no harm will come to them.” If this policy is kept in place, he says, “Why would the public trust SSA anymore?”

Fmr. Social Security Commissioner O’Malley says Trump is trying to turn SSA into “a dragnet for the greatest internment of human beings on US soil in the modern history of America.”

Reps. John Larson (D-CT) and Richard Neal (D-MA) of the House Ways and Means Committee responded with alarm to Friday’s reporting:::

“Under this administration, ICE has been transformed into Donald Trump’s secret police force – accountable to nobody. (Now) ICE is attempting to infiltrate the Social Security Administration… using field offices to further round up and detain people, and scaring people out of getting the benefits they need.”

NCPSSM’s senior Social Security policy expert, Maria Freese, points out that SSA is not the only agency the Trump regime has misused in pursuit of its anti-immigrant agenda. As Wired reports, a federal district judge in Massachusetts ruled that the IRS and SSA could not share taxpayer data with DHS or ICE – though this administration is not well known for complying with court orders.

‘The Dystopian Future is Now’

These latest revelations come on the heels of news that members of DOGE offered a conservative political advocate access to Americans’ personal Social Security data to “overturn election results.”

At an event on Capitol Hill last week, Reps. Larson, Neal, and other Democratic lawmakers demanded an investigation into DOGE misuse of Social Security data. Rep. Larson said that “this data belonging to you and your children, relating to this program that you put your trust in,” must be protected. “There will be justice!” he promised.

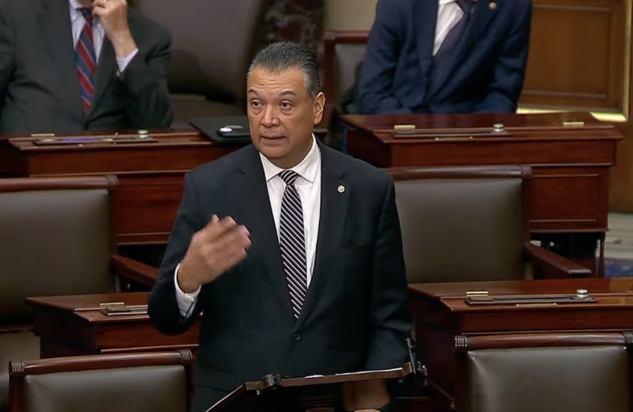

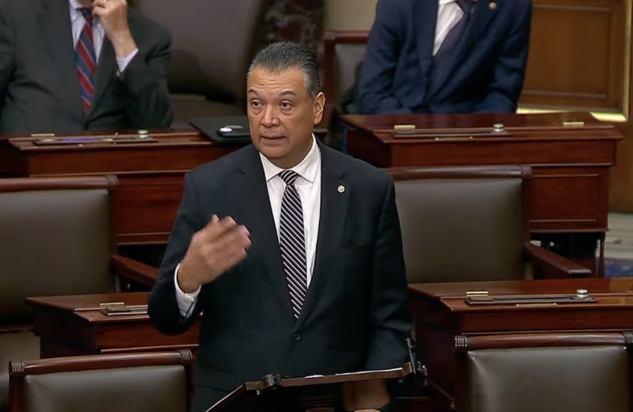

An angry Rep. John Larson (D-CT) demands an investigation into DOGE misuse of Social Security data

The administration seems to be doing everything in its power to foster public distrust in the SSA. Trump’s dystopian policies are contrary to the mission of the agency, which exists solely to deliver Americans’ earned benefits. Its operations are paid for by workers’ Social Security payroll contributions. SSA truly belongs to the American people. President Biden once called Social Security “a sacred trust.” But clearly nothing is sacred to the Trump administration. The dystopian future is now.

TrumpRx is Prescription Drug Snake Oil

Donald Trump’s latest gesture toward lowering prescription drug prices — and it is mostly an empty gesture — is the ‘branded’ website, TrumpRx, which the prez unveiled last week with great fanfare. It purports to save Americans money on drugs. But it is largely another Trump gimmick, joining Trump Steaks, Trump University, Trump Sneakers, and a myriad of other schemes.

Trump Rx simply re-directs users to underwhelming (and already existing) manufacturer’s ‘discounts’ on brand‑name drugs – and is nowhere close to a serious plan to lower Americans’ drug costs. In fact, Medicare beneficiaries cannot even use these manufacturer’s discounts, and few people with private health insurance policies will benefit, either.

Senator Alex Padilla (D-CA) basically gave the site zero stars:

“This is just another Donald Trump pet project to rebrand something that already exists, take credit for it, and do nothing to actually lower healthcare prices.” – Sen. Alex Padilla (D-CA)

The playbook used to unveil Trump’s latest gimmick is the same one he has used for decades. Whether it’s his (now defunct) casinos, wine, or university, the order of operations is simple: Slap the Trump name on it (preferably in gold!), declare it the best thing ever, and abandon the venture for something else before the shine wears off.

In a press conference, Senator Ron Wyden (D-OR), excoriated the launch of TrumpRx:

“TrumpRx is nothing more than a glorified coupon book, and it will advance the Republican agenda to undermine affordable health care for American families.” – Senator Ron Wyden (D-OR), Ranking Member of the Senate Finance Committee

Senator Wyden (who was a guest on our podcast last year) nailed it. TrumpRx covers just a few dozen high-priced brand-name drugs like weight-loss meds and fertility treatments, steering uninsured patients to direct-to-consumer portals that were already out there on GoodRx or specific drug company websites.

Sen. Alex Padilla calls TrumpRx a “pet project to rebrand something that already exists and do nothing to lower prices.”

For Medicare Part D (drug coverage) enrollees — who fill most prescriptions with less expensive but equally effective generic meds — Trump Rx is basically useless. The TrumpRx discounts also don’t work with most other insurances, won’t count toward deductibles or out-of-pocket caps, and leave the real problem untouched: list prices that Big Pharma keeps jacking up. (Drugmakers welcomed the New Year by raising the prices of some 350 medications.)

While Trump Rx is a joke, President Biden’s 2022 Inflation Reduction Act – while not a cure all – enables the Medicare program to negotiate drug prices directly with Big Pharma. These negotiations have so far lowered the prices of ten high-cost prescription drugs by up to 79%, which go into effect the year following each round of negotiations. As a bonus, lower drug prices in Medicare can have a positive ripple effect on costs for everyone.

The Trump administration deserves credit for following the law and initiating the next round of negotiations with drugmakers, having announced the next 15 drugs to be put on the table for price reductions. These are real, rather than imagined, savings.

Medicare negotiations with Big Pharma under Biden’s Inflation Reduction Act have already yielded significant savings

Meanwhile, critics say that Trump’s own drug pricing gimmicks benefit Big Pharma (and perhaps his own family) more than consumers. TrumpRx, for example, exists to funnel patients to direct-to-consumer (DTC) sites and the websites of drug manufacturers. Notably, Donald Trump, Jr. sits on the board of a DTC website called BlinkRx, which offers brand-name drugs.

“BlinkRx stands to benefit from a shake-up of how patients buy drugs after President Trump urged pharmaceutical companies to sell their medicines directly to consumers. BlinkRx helps drugmakers do exactly that with a service that promises to set up direct-to-patient sales programs.” – Wall Street Journal, October 2025

Trump knows that he has failed to deliver on his “great healthcare plan.” Instead of taking bold action to truly reduce drug costs (rather than peddling so-called ‘discounts’ on exorbitant Big Pharma prices), he’s resorted to old tricks. Americans – and especially seniors on fixed incomes — deserve real relief at the pharmacy counter instead of a giant bottle of snake oil.

Cato Really Wants to Cut Your Social Security Benefits

Conservative think tanks are working full-time to destroy Social Security as we know it. This week, Cato Institute’s Romina Boccia is peddling the fiction that Social Security doesn’t work and must be “re-designed.” In a recent post on Cato’s blog, she rolls out the “greatest hits” from a time-worn catalogue of conservative talking points to justify altering the program beyond recognition. While it might benefit the financial elites who fund Cato to shrink Social Security, it would hurt working Americans. We asked our senior Social Security expert, Maria Freese, to fact-check some of Boccia’s key claims. Let’s start with the headline:::

BOCCIA: “Social Security Isn’t a Retirement Account — and Congress Must Stop Pretending It Is.”

FREESE: Boccia is correct. Social Security is not a personal retirement account like a 401k. Perhaps some in Congress are “pretending” that it’s an individual retirement account, but anyone who knows Social Security understands that it is social insurance. Workers’ and employers’ payroll contributions are pooled, with benefits payable upon retirement, disability, or death of a family breadwinner. Those insurance benefits are calculated to replace a portion of workers’ incomes based on their earnings history.

If anything, conservatives ignore the program’s disability and survivors’ benefits, framing Social Security as purely a retirement program. In fact, some 3.5 million children collect Social Security benefits because a parent has died or become disabled.

It’s also important to remember that Social Security was never intended to be the only source of income in retirement. Rather, it was expected to be combined with employer-provided pensions and personal savings as part of the old “three-legged stool.” But most non-governmental employers have eliminated pensions — kicking out one leg of the stool. Growing wealth inequality and rising costs have prevented many Americans from saving for retirement on their own. (Only 50% of workers participate in 401K plans!) There goes another leg of the stool — making Social Security all the more crucial.

BOCCIA: “Politicians routinely describe Social Security payroll taxes as ‘contributions,’ speak of a ‘trust fund’ as if it held real savings, and define benefits as ‘earned.’”

FREESE: Yes, they do, and they are correct. The Social Security Trust Fund is invested in treasury bonds backed by the full faith and credit of the United States government. These assets are as “real” as any portfolio of Treasury bonds. College endowments and overseas investors would be shocked to learn that their US-backed assets are somehow fake! (In fact, you can watch our CEO and President, Max Richtman, debunk Boccia’s ‘trust funds aren’t real’ argument in a 2025 debate.) Right now, there are more than $2 trillion in assets in the Social Security trust fund.

Benefits are very much earned. Social Security benefits are tied to workers’ payroll contributions. The benefit formula links monthly Social Security checks to lifetime earnings. Social Security benefits are progressive in nature — meaning lower-income workers receive proportionally higher benefits. Americans understand that Social Security is a social contract: People pay in during their working years, and receive benefits upon retirement, disability, or the death of a family breadwinner. Social Security is fundamentally different from a means-tested welfare benefit.

BOCCIA: “When Social Security is framed as a retirement account, any benefit reduction sounds like unfair confiscation.”

FREESE: Workers rightly see benefit cuts as unfair, not because they mistake Social Security for a 401(k), but because they have kept their end of the bargain with every paycheck. Contributions are deducted automatically (and matched by employers), with the explicit promise that Social Security benefits will be paid in full.

Boccia’s own polling shows that Americans are wary of large benefit cuts once the real dollar amounts are spelled out. Younger workers, who Boccia casts as unfairly burdened by Social Security, are facing a future with fewer pensions, more unstable jobs, and displacement; for them, a robust, predictable Social Security benefit will be even more important, not less.

BOCCIA: “Lifting the payroll tax cap becomes a decision to raise taxes on higher earners to fund redistribution.”

FREESE: When Social Security was created, payroll taxes applied to roughly 92% of all wage income; after the 1983 reforms, about 90% of wage earnings were subject to the tax. Today, due to the widening wealth gap (the rich getting richer), only about 83% of the nation’s total wage income is subject to Social Security taxes. An adjustment of the payroll wage cap (now set at $184,500 in annual wages) would ensure that high earners contribute their fair share, just like everyone else. In the meantime, Elon Musk and Jeff Bezos stop paying into Social Security shortly after January 1 while the rest of us contribute all year.

It’s also important to remember that the highest-income individuals have found ways to reclassify their income so it doesn’t appear as wages — a luxury most workers do not have. Private equity managers, for example, convert compensation into “carried interest,” to avoid paying their fair share.

This is why the polling consistently indicates that large majorities of Americans across party lines prefer that high earners contribute more, rather than cutting benefits or raising the retirement age for those who rely on Social Security.

BOCCIA: “Congress should stop pretending Social Security is a contribution-based retirement account and design it accordingly. The most straightforward approach is a flat benefit: a uniform, anti-poverty payment for eligible seniors.”

FREESE: Sorry, but a “flat benefit” would hurt middle class workers. According to a 2022 analysis, while the lowest quintile (20%) of working families would see a lifetime benefit increase from a flat benefit, the middle quintile would see benefit cuts. Lower income workers already benefit from the progressive structure of Social Security (and can also receive Supplemental Security Income or SSI), but middle class beneficiaries would have a hard time withstanding the cut from a flat benefit. A flat benefit would subvert the fundamental nature of Social Security, where benefits are based on workers’ lifetime earnings — and turn it into a welfare program that could be demonized and cut over time.

************************************************

Read our review of Romina Boccia’s book “Re-Imagining Social Security.”

Listen to our podcast episode about recent public polling showing overwhelming support for Social Security.

Listen to our podcast episode about the spike in anti-Social Security propaganda from the political right.

Watch our documentary about the 90-year history of Social Security!