Washington Disconnect

In stark contrast to the hype from Capitol Hill, the President?s Fiscal Commission, conservative think tanks and Wall Street economists, a risky proposal that would force older Americans to work longer, has been rejected by Main Street America. A new poll conducted by the University of New Hampshire Survey Center for the National Committee to Preserve Social Security and Medicare Foundation shows that 78% of Americans strongly oppose raising Social Security?s normal retirement age to 70.What is wrong with working longer?aren?t we living longer? Not all of us. Studies have shown workers with higher incomes who reach age 65 enjoy most of the increase in life expectancy. This is not surprising considering they are less likely to have physically demanding jobs and more likely to have high-quality health insurance coverage. In recent decades, the richest Americans gained nearly five more years of life expectancy, compared with only one year for those at the bottom of the income ladder. So when someone says, ?we are all living longer?, I?d suggest it?s clearly not that simple. The truth is the rich are living longer, the poor much less so, and whites vastly outlive other racial groups. A white female born today can expect to live to 80.6 years while an African American male can expect to live to be 69.7. In 1940, men who survived to age 65 had a remaining life expectancy of 12.7 years. For a 65-year-old man today, that projection has increased by just 5 years. This is not the longevity boom some in Washington would like us to believe as they try to sell Americans on raising Social Security?s retirement age.While many older workers may be healthy enough to work, jobs for them may simply not exist. I hear from seniors every day who?ve lost their jobs in this economy and can?t find another one. The Bureau of Labor Statistics confirms workers between ages 55 and 64 are unemployed much longer than their younger competition in the workforce as they fight for jobs in short supply. The Equal Employment Opportunity Commission saw a 33% increase in the number of age discrimination complaints in the past two years as seniors feel the pressure of aging in the workforce.For older workers in the elite classes of jobs, it?s easy enough to say– Americans should just work longer– but what about everyone else? Will our nation make the investment necessary to prepare for an older workforce? That seems highly unlikely in these troubled economic times.In addition to physical hardships, raising the retirement age even higher creates financial strains by forcing another form of a benefit cut. The normal retirement age is already rising to age 67. Raising it yet again will mean most workers who are forced to retire early at age 62 will see a cut in benefits of about 45%. The average annual benefit today is less than $14,000 ? cutting it almost in half will result in millions of today?s workers living out their retirement years in poverty; breaking the promise that has kept generations secure for 75 years.This post also ran in the Tennessean; Sunday, July 18, 2010

In stark contrast to the hype from Capitol Hill, the President?s Fiscal Commission, conservative think tanks and Wall Street economists, a risky proposal that would force older Americans to work longer, has been rejected by Main Street America. A new poll conducted by the University of New Hampshire Survey Center for the National Committee to Preserve Social Security and Medicare Foundation shows that 78% of Americans strongly oppose raising Social Security?s normal retirement age to 70.What is wrong with working longer?aren?t we living longer? Not all of us. Studies have shown workers with higher incomes who reach age 65 enjoy most of the increase in life expectancy. This is not surprising considering they are less likely to have physically demanding jobs and more likely to have high-quality health insurance coverage. In recent decades, the richest Americans gained nearly five more years of life expectancy, compared with only one year for those at the bottom of the income ladder. So when someone says, ?we are all living longer?, I?d suggest it?s clearly not that simple. The truth is the rich are living longer, the poor much less so, and whites vastly outlive other racial groups. A white female born today can expect to live to 80.6 years while an African American male can expect to live to be 69.7. In 1940, men who survived to age 65 had a remaining life expectancy of 12.7 years. For a 65-year-old man today, that projection has increased by just 5 years. This is not the longevity boom some in Washington would like us to believe as they try to sell Americans on raising Social Security?s retirement age.While many older workers may be healthy enough to work, jobs for them may simply not exist. I hear from seniors every day who?ve lost their jobs in this economy and can?t find another one. The Bureau of Labor Statistics confirms workers between ages 55 and 64 are unemployed much longer than their younger competition in the workforce as they fight for jobs in short supply. The Equal Employment Opportunity Commission saw a 33% increase in the number of age discrimination complaints in the past two years as seniors feel the pressure of aging in the workforce.For older workers in the elite classes of jobs, it?s easy enough to say– Americans should just work longer– but what about everyone else? Will our nation make the investment necessary to prepare for an older workforce? That seems highly unlikely in these troubled economic times.In addition to physical hardships, raising the retirement age even higher creates financial strains by forcing another form of a benefit cut. The normal retirement age is already rising to age 67. Raising it yet again will mean most workers who are forced to retire early at age 62 will see a cut in benefits of about 45%. The average annual benefit today is less than $14,000 ? cutting it almost in half will result in millions of today?s workers living out their retirement years in poverty; breaking the promise that has kept generations secure for 75 years.This post also ran in the Tennessean; Sunday, July 18, 2010

New National Poll Finds 78% of Americans Oppose Raising Social Security’s Retirement Age

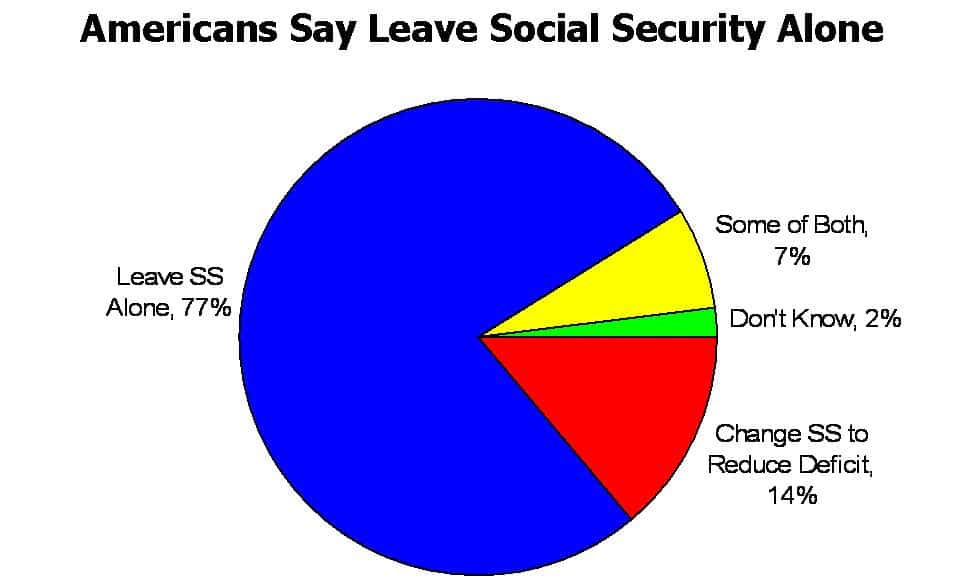

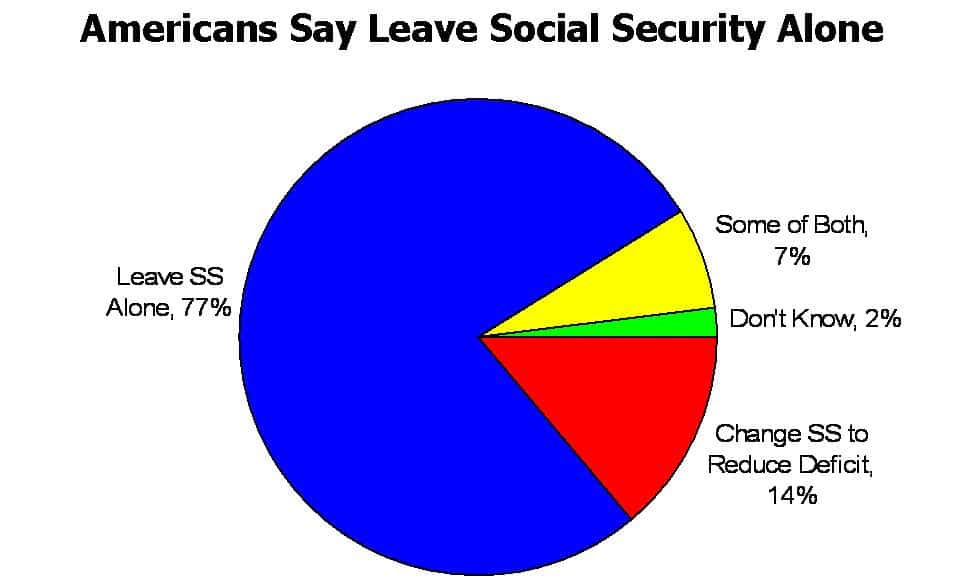

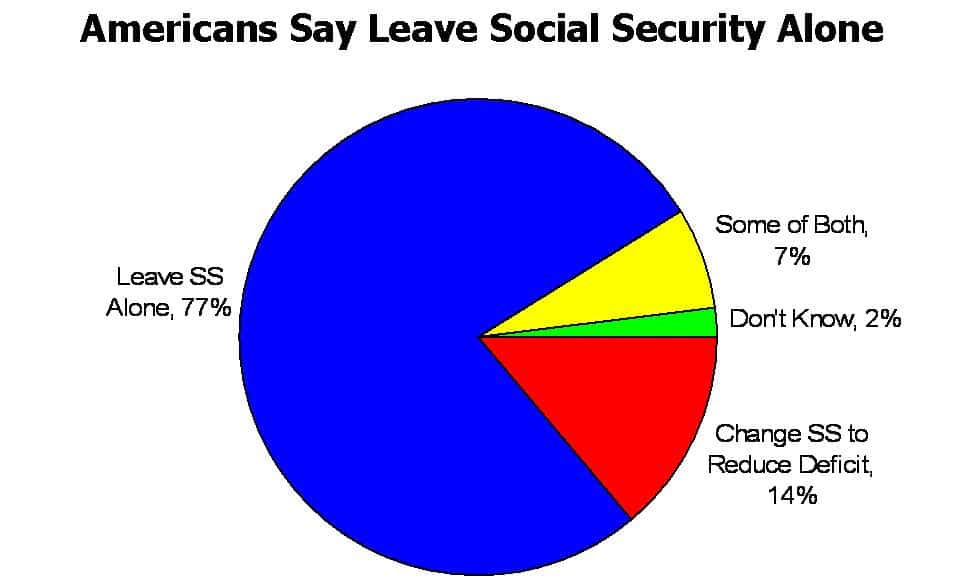

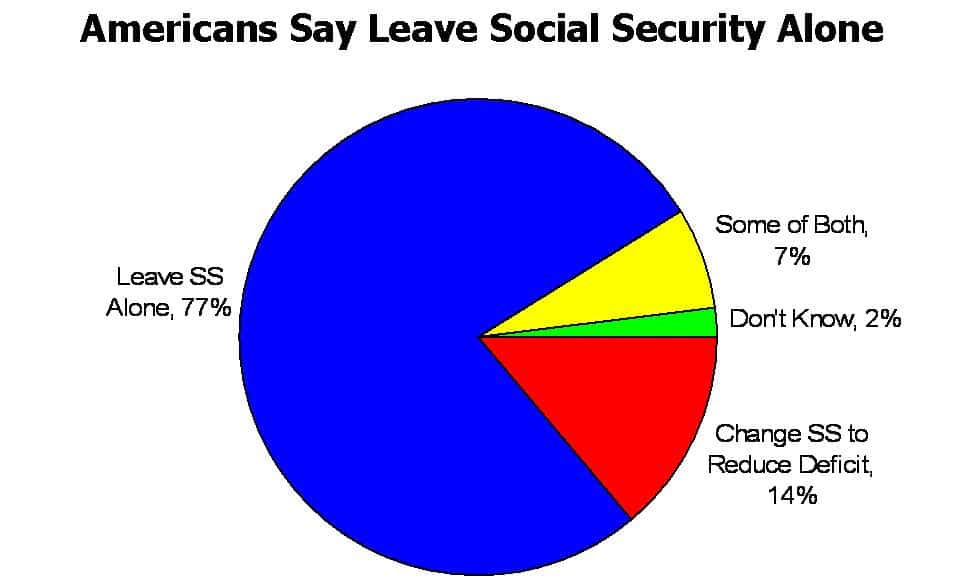

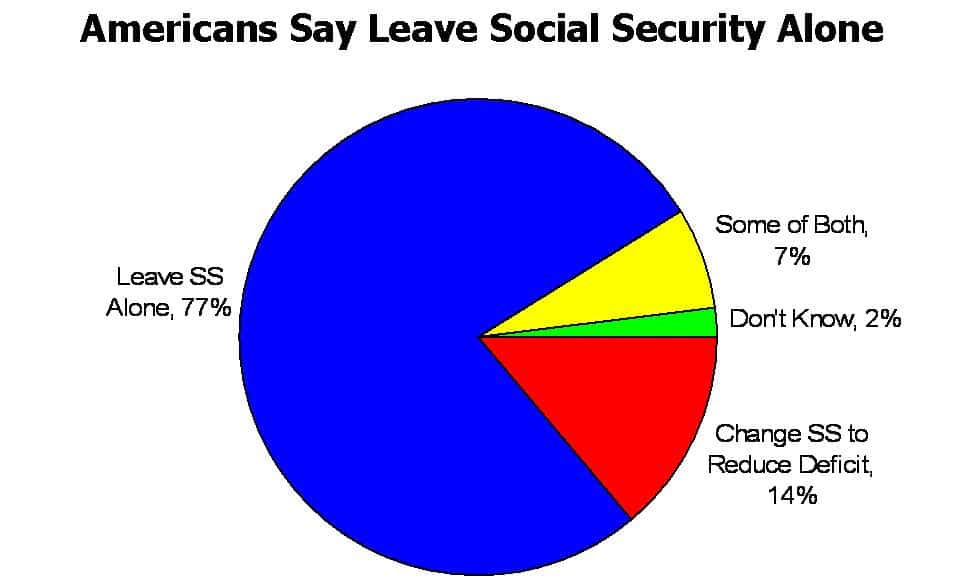

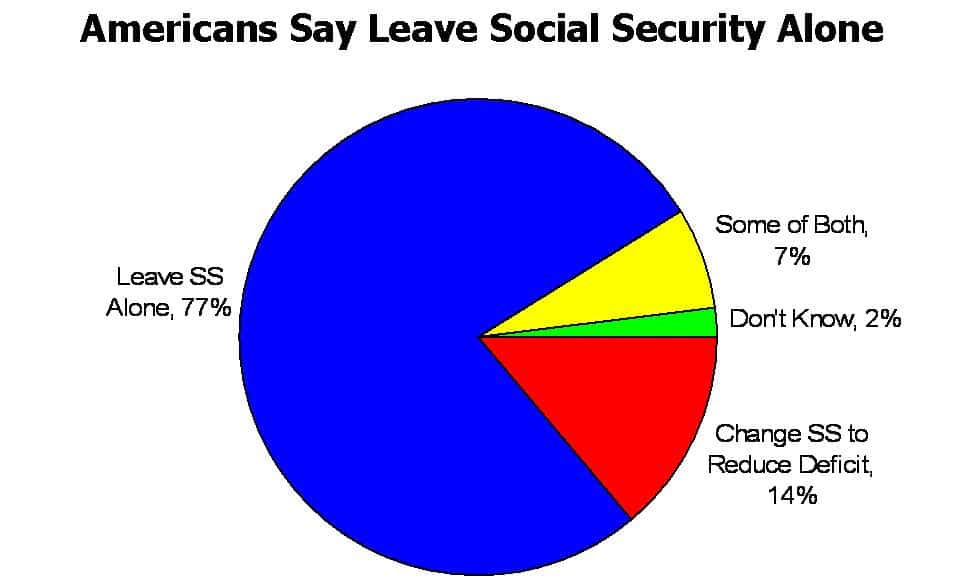

- Only 2% of Americans believe Social Security is a major cause of the deficit with 77% opposing any changes in Social Security as part of a deficit reduction plan.

- Two out of three Americans (64%) think Social Security provides security and stability to our economy while only 20% see the program as a drain on the economy. 70% believe this recession underscores the critical role Social Security fills for families.

- Virtually all Americans polled (98%) believe Social Security funds belong to the people who contributed them and their beneficiaries and a majority (71%) say Social Security is a promise made to all generations that should not be broken.

?Next month, we will celebrate the 75th anniversary of Social Security, a national treasure that has only improved with age,? said Rep. Jan Schakowsky (D-IL), Co-Chair of the Congressional Seniors Task Force.?The poll released today shows that Social Security is cherished by the vast majority of Americans of all ages. They believe it is critical for their economic well-being and that its essential protections must not be reduced. I agree. The poll also made clear that the American public knows Social Security is not a contributor to today?s deficits. The program is not in crisis; while we will need to act ensure its solvency throughout this century and beyond, we can do so without making cuts in critical benefits.?Rep. Earl Pomeroy (D-ND) is Chairman of the Social Security Subcommittee and warned against efforts to cut or privatize Social Security benefits, ?There are those, even in the aftermath of the failed efforts by President Bush to privatize Social Security, who would take those changes right into the benefit structure today with a rationale of long term solvency without looking at other options. They never fully discuss that we are taking away the legacy of the program for our children.?Congressman Ron Klein (D-FL), a strong advocate for Social Security who represents over 130,000 seniors in South Florida said, ?Social Security is a contract we have with our seniors, and they have lived up to their end of the bargain. It?s essential that we live up to our end. That?s why I am here today to say that I will not stand for any attempts to weaken Social Security benefits for our seniors, or any reckless efforts to balance our nation?s books on the backs of our seniors.? The poll ?U.S. Attitudes Toward Social Security? is now available on the National Committee Foundation?s website.

Social Security at 75 — Keeping the Promise

- Capitol Hill News Conference releasing the results of a new National Committee Foundation poll on American?s views of Social Security, its future and proposals to change the program.

- Two week radio ad campaign reminding Washington?s leaders of the vital role Social Security plays in Americans? lives.

- Culmination of a National Committee postcard campaign scheduled to deliver nearly 100,000 postcards to the President?s Fiscal Commission Co-Chairs urging them to reject plans to balance our budget with Social Security benefit cuts.

- The National Committee joins the Alliance for Retired Americans in co-hosting Social Security birthday parties in towns and cities across the country.

- 4 part video series highlighting what Social Security really means for the average American and the real-world implications of cutting benefits, raising the retirement age and other harmful proposals being planned in Washington.

- The National Committee?s Facebook Community will lead our ?Fill in the Blank? campaign. Their answers to the question ?Cutting Social Security benefits will mean __________? will comprise our final anniversary video.

- We’ll host guest bloggers throughout the month writing on our theme: ?Social Security at 75 ? Keeping the Promise?.

- A ?Did You Know?? series on Twitter and Facebook will provide important facts and interactive quizzes about Social Security throughout the month.

- Social Security Anniversary E-cards will be available for supporters, beneficiaries and their families to email to theirfriends, family, and co-workers to invite others to celebrate the program?s 75 years of success keeping Americans secure.

New information and activities will be posted for each day during the celebration on our National Committee website?s ?Keeping the Promise? anniversary page.

Tilting at Windmills

The Washington Post has once again confused fiscal opportunism for bravery and sensibility (Sense and Social Security, July 1, 2010). Raising Social Security?s retirement age ? another way of inflicting a benefit cut on people who have paid into Social Security their entire working lives — places undue financial and employment burdens on workers, especially near-retirees. Cutting Social Security benefits while defending tax cuts we can?t afford, bailouts we can?t pay for and wars with no end is neither brave norsensible.Social Security belongs to the American workers who?ve funded it, not Washington politicians who?ve spent decades spending it. Americans of all ages want fiscal responsibility returned to Congress; however, taking money from Social Security while telling American workers they need to stay on the job longer is not fiscal responsibility.The Post editorial ignores the fundamental fact that the rich are living longer, the poor are not, and whites vastly outlive other racial groups. A white female born today can expect to live to 80.6 years while an African American male can expect to live to be 69.7. In recent decades, the richest Americans gained five more years of life expectancy, compared with only one year for those at the bottom. While working until 70 might be a ?modest social cost? for the six-figure salaried, largely white writers, think-tankers, and politicians in Washington it?s a much bigger cost for millions of middle and lower income Americans who will not live as long as those making these key retirement age decisions for them.I hear from seniors every day who?ve lost their jobs in this economy and can?t find another one. The Bureau of Labor Statistics confirms workers between ages 55 and 64 are unemployed much longer than their younger competition in the workforce as they fight for jobs in short supply. The Equal Employment Opportunity Commission saw a 33% increase in the number of age discrimination complaints in the past two years as seniors feel the pressure of aging in the workforce. For older workers in the elite classes of jobs, it?s easy enough to say– Americans should just work longer– but what about everyone else? Will our nation make the investment necessary to prepare for an older workforce? Would the Washington Post consider that investment brave and sensible governing? Given this current budget environment that seems highly unlikely.Barbara B. Kennelly, President/CEO, The National Committe to Preserve Social Security and Medicare

More Donut Hole Checks on the Way

?The Affordable Care Act starts to close the donut hole this year, giving much-needed relief to millions of seniors. In 2011, the Affordable Care Act takes an additional step for Medicare beneficiaries in the donut hole by providing them with a 50 percent discount on their brand name medications. Every year from 2012 until 2020, the Affordable Care Act will take progressive steps to close the donut hole.? HHS Secretary Kathleen Sebelius.

Unfortunately, whenever there?s something new in the Medicare program scammers come out of the woodwork. CMS offers this advice:

?Seniors also need to know that they will just receive their check at their usual address – they don’t have to take any extra steps,? said Centers for Medicare & Medicaid Services Deputy Administrator and Director for the Center for Medicare, Jonathan Blum. ?And they should never give out their personal information. If someone asks for your personal Medicare information over the phone who isn’t a trusted resource like Medicare, please don’t provide it. Seniors or family members should contact us at 1-800-MEDICARE to report any of these types of calls or go to www.stopmedicarefraud.gov to learn more about efforts to fight fraud and scams against seniors.?

Washington Disconnect

New National Poll Finds 78% of Americans Oppose Raising Social Security’s Retirement Age

- Only 2% of Americans believe Social Security is a major cause of the deficit with 77% opposing any changes in Social Security as part of a deficit reduction plan.

- Two out of three Americans (64%) think Social Security provides security and stability to our economy while only 20% see the program as a drain on the economy. 70% believe this recession underscores the critical role Social Security fills for families.

- Virtually all Americans polled (98%) believe Social Security funds belong to the people who contributed them and their beneficiaries and a majority (71%) say Social Security is a promise made to all generations that should not be broken.

?Next month, we will celebrate the 75th anniversary of Social Security, a national treasure that has only improved with age,? said Rep. Jan Schakowsky (D-IL), Co-Chair of the Congressional Seniors Task Force.?The poll released today shows that Social Security is cherished by the vast majority of Americans of all ages. They believe it is critical for their economic well-being and that its essential protections must not be reduced. I agree. The poll also made clear that the American public knows Social Security is not a contributor to today?s deficits. The program is not in crisis; while we will need to act ensure its solvency throughout this century and beyond, we can do so without making cuts in critical benefits.?Rep. Earl Pomeroy (D-ND) is Chairman of the Social Security Subcommittee and warned against efforts to cut or privatize Social Security benefits, ?There are those, even in the aftermath of the failed efforts by President Bush to privatize Social Security, who would take those changes right into the benefit structure today with a rationale of long term solvency without looking at other options. They never fully discuss that we are taking away the legacy of the program for our children.?Congressman Ron Klein (D-FL), a strong advocate for Social Security who represents over 130,000 seniors in South Florida said, ?Social Security is a contract we have with our seniors, and they have lived up to their end of the bargain. It?s essential that we live up to our end. That?s why I am here today to say that I will not stand for any attempts to weaken Social Security benefits for our seniors, or any reckless efforts to balance our nation?s books on the backs of our seniors.? The poll ?U.S. Attitudes Toward Social Security? is now available on the National Committee Foundation?s website.

Social Security at 75 — Keeping the Promise

- Capitol Hill News Conference releasing the results of a new National Committee Foundation poll on American?s views of Social Security, its future and proposals to change the program.

- Two week radio ad campaign reminding Washington?s leaders of the vital role Social Security plays in Americans? lives.

- Culmination of a National Committee postcard campaign scheduled to deliver nearly 100,000 postcards to the President?s Fiscal Commission Co-Chairs urging them to reject plans to balance our budget with Social Security benefit cuts.

- The National Committee joins the Alliance for Retired Americans in co-hosting Social Security birthday parties in towns and cities across the country.

- 4 part video series highlighting what Social Security really means for the average American and the real-world implications of cutting benefits, raising the retirement age and other harmful proposals being planned in Washington.

- The National Committee?s Facebook Community will lead our ?Fill in the Blank? campaign. Their answers to the question ?Cutting Social Security benefits will mean __________? will comprise our final anniversary video.

- We’ll host guest bloggers throughout the month writing on our theme: ?Social Security at 75 ? Keeping the Promise?.

- A ?Did You Know?? series on Twitter and Facebook will provide important facts and interactive quizzes about Social Security throughout the month.

- Social Security Anniversary E-cards will be available for supporters, beneficiaries and their families to email to theirfriends, family, and co-workers to invite others to celebrate the program?s 75 years of success keeping Americans secure.

New information and activities will be posted for each day during the celebration on our National Committee website?s ?Keeping the Promise? anniversary page.

Tilting at Windmills

The Washington Post has once again confused fiscal opportunism for bravery and sensibility (Sense and Social Security, July 1, 2010). Raising Social Security?s retirement age ? another way of inflicting a benefit cut on people who have paid into Social Security their entire working lives — places undue financial and employment burdens on workers, especially near-retirees. Cutting Social Security benefits while defending tax cuts we can?t afford, bailouts we can?t pay for and wars with no end is neither brave norsensible.Social Security belongs to the American workers who?ve funded it, not Washington politicians who?ve spent decades spending it. Americans of all ages want fiscal responsibility returned to Congress; however, taking money from Social Security while telling American workers they need to stay on the job longer is not fiscal responsibility.The Post editorial ignores the fundamental fact that the rich are living longer, the poor are not, and whites vastly outlive other racial groups. A white female born today can expect to live to 80.6 years while an African American male can expect to live to be 69.7. In recent decades, the richest Americans gained five more years of life expectancy, compared with only one year for those at the bottom. While working until 70 might be a ?modest social cost? for the six-figure salaried, largely white writers, think-tankers, and politicians in Washington it?s a much bigger cost for millions of middle and lower income Americans who will not live as long as those making these key retirement age decisions for them.I hear from seniors every day who?ve lost their jobs in this economy and can?t find another one. The Bureau of Labor Statistics confirms workers between ages 55 and 64 are unemployed much longer than their younger competition in the workforce as they fight for jobs in short supply. The Equal Employment Opportunity Commission saw a 33% increase in the number of age discrimination complaints in the past two years as seniors feel the pressure of aging in the workforce. For older workers in the elite classes of jobs, it?s easy enough to say– Americans should just work longer– but what about everyone else? Will our nation make the investment necessary to prepare for an older workforce? Would the Washington Post consider that investment brave and sensible governing? Given this current budget environment that seems highly unlikely.Barbara B. Kennelly, President/CEO, The National Committe to Preserve Social Security and Medicare

More Donut Hole Checks on the Way

?The Affordable Care Act starts to close the donut hole this year, giving much-needed relief to millions of seniors. In 2011, the Affordable Care Act takes an additional step for Medicare beneficiaries in the donut hole by providing them with a 50 percent discount on their brand name medications. Every year from 2012 until 2020, the Affordable Care Act will take progressive steps to close the donut hole.? HHS Secretary Kathleen Sebelius.

Unfortunately, whenever there?s something new in the Medicare program scammers come out of the woodwork. CMS offers this advice:

?Seniors also need to know that they will just receive their check at their usual address – they don’t have to take any extra steps,? said Centers for Medicare & Medicaid Services Deputy Administrator and Director for the Center for Medicare, Jonathan Blum. ?And they should never give out their personal information. If someone asks for your personal Medicare information over the phone who isn’t a trusted resource like Medicare, please don’t provide it. Seniors or family members should contact us at 1-800-MEDICARE to report any of these types of calls or go to www.stopmedicarefraud.gov to learn more about efforts to fight fraud and scams against seniors.?