The nearly 67 million Americans who depend on Medicare will ring in the new year with an unwelcome cost increase. The Centers for Medicare and Medicaid Services (CMS) has announced that Part B premiums will rise to $203 per month from $185 in 2025. That $18 (or 10%) increase will consume about one-third of the average Social Security Cost-of-Living Adjustment (COLA).

“The average COLA will be $56 per month before the $18 Medicare Part B premium hike, leaving the average Social Security beneficiary with an effective monthly increase of $36 next year” noted our President and CEO Max Richtman in a news release.

Advocates and health care experts alike are worried about the impact on seniors’ ability to make ends meet. The meager COLA, less the Medicare Part B premium hike, leaves millions of seniors struggling to cover basic necessities like food, transportation, and utilities — let alone out‑of‑pocket health expenses.

“This premium jump will really pinch older Americans where it hurts,” says Anne Montgomery, our senior health policy expert. “An almost $18 premium increase may not sound huge on paper, but for people on fixed incomes, it’s a big chunk of their limited budgets.”

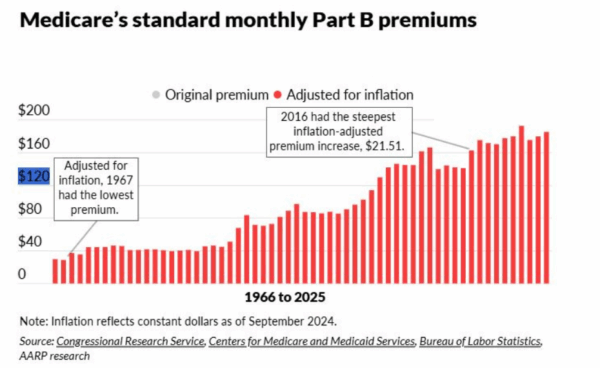

This one of the largest spikes in Part B premiums since 2016. While not entirely unexpected, it underscores deeper issues. As Montgomery points out, “Part B premiums are rising in part because of broader medical inflation and the cost of moving many treatments out of hospitals and into doctors’ offices and outpatient settings.”

At the same time, for–profit Medicare Advantage (MA) plans continue to exert cost pressures on the entire Medicare system. “We need to take a closer look at how Medicare Advantage is influencing overall spending,” Montgomery notes. “The way some MA plans game the system to boost profits drives up Medicare costs by billions, and those higher costs trickle down to beneficiaries in the form of higher premiums.”

A 2024 study from USC concluded that Medicare Advantage plans cost taxpayers an extra 22% per enrollee, to the tune of $83 billion a year.

We and other advocates have backed legislation to give seniors’ more relief from inflation by changing the outdated COLA formula, the CPI-W, which is based on the spending habits of urban wage earners. The current formula “undercounts the costs that weigh most heavily on older adults—especially health and prescription expenses,” says Anne Montgomery.

For years, NCPSSM has urged Congress to adopt the Consumer Price Index for the Elderly (CPI‑E) to calculate annual COLAs. The CPI‑E tracks how inflation uniquely affects Americans over 62, making it a more accurate reflection of retirees’ financial reality.

“The CPI‑E would base cost-of-living adjustments on the actual spending patterns of seniors,” says Montgomery. “An adjustment tied to the CPI‑E would more accurately protect seniors against rising healthcare costs year after year.”

“We support legislation that would adopt the CPI-E for determining COLAs, but Congress has yet to act on it. This would be a more than reasonable step toward expanding benefits to truly meet the needs of 21st century seniors.” -Max Richtman, President and CEO, NCPSSM

We urge our readers to contact their elected representatives and demand action: adopt the CPI-E formula for COLAs and curb Medicare Advantage abuses that continue to drive up health care costs for ourselves and our older loved ones.