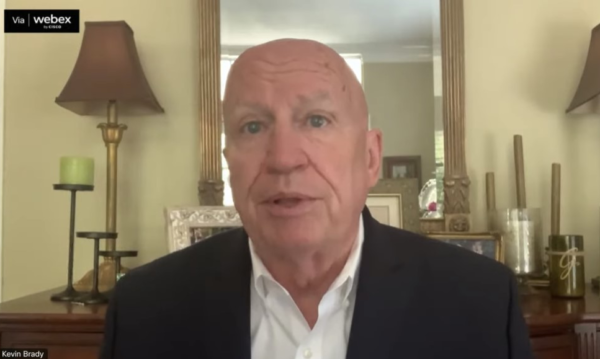

Ranking House Ways & Means Committee member Kevin Brady (R-CA) claims that Social Security “discourages work”

GOP members of the House Ways and Means Committee held an all-Republican roundtable on the future of Social Security on June 29th. That’s a little like holding an all-Red Sox roundtable on the future of the Yankees. Republicans have spent at least four decades devising ways to undermine Social Security – including their triad of terrible ideas: raising the retirement age, means-testing benefits, and privatizing the program. Now that Democrats have a viable bill (subcommittee chair John Larson’s Social Security 2100 act) to fortify the program and improve Americans’ earned benefits – Republicans are reviving tired arguments to oppose it.

“(Democrats) are more interested in crippling tax hikes and unsustainably expanding these programs – all of which will make the programs more expensive and make things harder on current and future workers,” said ranking House Ways and Means member Kevin Brady (R-CA), setting the tone for the entire roundtable.

What Brady refers to as a “crippling tax hike” is Rep. Larson’s commonsense proposal – supported by large bipartisan majorities of the American people – to adjust the Social Security payroll wage cap so that high earners pay additional contributions to the program based on wages exceeding $400,000 per year. That is hardly “crippling” to people with mid-six-figure incomes, and would bring much-needed revenue into the program, revenue that has been diminished by growing wage inequality pushing more and more people over the current $147,000 wage cap.

With that revenue, the Larson bill extends the solvency of the combined Social Security trust fund, which is projected to become depleted by 2035 if Congress takes no pre-emptive action. Equally as important, the bill improves benefits across the board – welcome news for seniors struggling to make ends meet on an average of less than $20,000 a year.

Ways and Means Republicans strained the anti-tax rhetoric further by suggesting that adjusting the payroll wage cap for people earning over $400,000 would “discourage younger individuals from participating in work,” according to ranking member David Schweikert (R-AZ). First of all, other than athletes and wildly successful tech entrepreneurs, most younger adults do not earn anywhere near $400,000 per year. Secondly, it’s unlikely that younger workers are refusing full-time jobs because Social Security contributions are deducted from their paychecks (with employers matching what the workers put in).

Those payroll contributions not only count toward young adults’ eventual retirement (and according to current projections, they are going to need every cent of Social Security benefits in old age), but provide them and their families with roughly $600,000-worth of disability and life insurance should anything happen to them in the meantime. Yet, conservatives continue to try to pit the younger and older generations against each other by suggesting that Social Security somehow is a raw deal for Millennials.

Charles Blauhaus of the Koch-backed Mercatus Center at George Mason University insisted, without citing evidence, that Social Security is a deterrent to workforce participation. “You need benefit changes, eligibility changes, a little bit of everything,” in order to reform Social Security, Blauhaus urged. By “eligibility changes,” he means raising the retirement age as high as 70, which represents a sizable cut in lifetime benefits. It’s also grossly unfair to workers in poor health or who have physically demanding jobs and cannot continue working to age 70.

Republicans reflexively reject reasonable revenue-side solutions to Social Security’s long-term funding challenges, even though payroll taxes haven’t been adjusted in roughly 40 years. The system can acquire much-needed revenue by adopting Rep. Larson’s bill, which has over 200 Democratic cosponsors in the House – and zero Republicans. Meanwhile, Senator Bernie Sanders (I-VT) and Rep. Peter DeFazio (D-OR) have offered their own bill, the Social Security Expansion Act, which is similar to Larson’s but has a lower wage cap and taxes some high-income investment gains. It would extend the solvency of the Social Security trust funds for 75 years and boost benefits.

While Democrats make good faith, pragmatic efforts to improve Social Security, conservatives’ feet are stuck in ideological cement: no new taxes of any kind, even if they only impact wealthier Americans; no expansion of federal programs regardless of the human need involved. Conservatives have never met a government program, including Social Security, that they don’t want to cut and privatize. Wealthy and powerful interests who simply want to shrink the federal government (except for Defense) at all costs, and who oppose federal programs that help everyday Americans, spend multiple millions of dollars to influence public debate.

The campaign of now-deceased plutocrat David Koch, who ran for president on the Libertarian ticket in 1980, called Social Security “the most serious threat to the future stability of our society next to the threat of nuclear war.” Today, nearly half of retirees rely on this “most serious threat” (Social Security) for all or most of their monthly income, as they struggle with the increasing cost of prescription drugs, health care premiums and co-pays, and other essential living expenses. They need a raise, plain and simple. And workers and retirees of all ages need assurance that Congress will act to strengthen the benefits they have earned over a lifetime of work. They do not need dog and pony shows on Capitol Hill offering tired platitudes from GOP committee members and conservative ideologues.