The message at Thursday’s NCPSSM/AARP town hall in Las Vegas was: the government may temporarily shut down on September 30th, but Social Security is here to stay. The town hall, entitled “Social Security: Here Today, Here Tomorrow,” was an opportunity for nearly 100 Las Vegas residents to hear from some of the nation’s leading experts about the enduring value of Social Security — and to receive reassurance that benefits still will be paid during a shutdown.

“We believe it is especially important to be holding this town hall here in Las Vegas,” said AARP Nevada State Director, Maria Moore. “Nevada has 565,000 Social Security beneficiaries, including over 30,000 children.” Moore also pointed out that Social Security benefits inject $9 billion each year into the state’s economy.

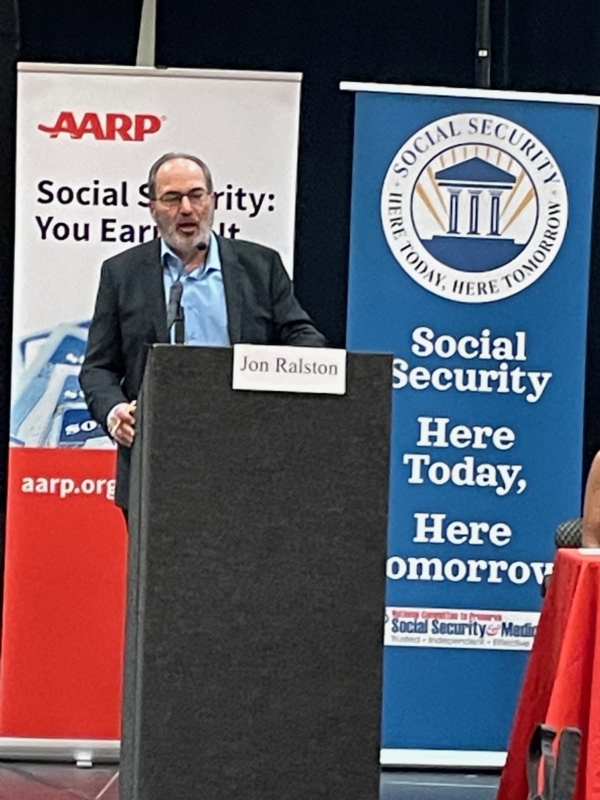

The Las Vegas event was one of a series of town halls that AARP and NCPSSM are holding across the country this year as part of a public education campaign to enhance Americans’ knowledge about the program. “Social Security isn’t only a retirement program,” said moderator Jon Ralston (of the Nevada Independent) in welcoming the audience to the town hall. “It is social insurance for families, providing financial support after the loss of a family breadwinner’s income through retirement, disability, or death.”

Jon Ralston, founder of the Nevada Independent, moderated the town hall

The town hall came as time was running short for Congress to avert a likely government shutdown on September 30. A shutdown would not directly impact Social Security benefits, but could put additional strain on the already underfunded Social Security Administration (SSA). Annie Walters, public affairs specialist at the SSA Nevada office and a panelist at the town hall, said that making sure benefits are paid is a “priority” for SSA. “Our plan is that benefits will go out,” she told the audience.

Walters said that SSA’s contingency plan is designed to ensure that critical customer service issues still are addressed during a shutdown. However, she said, it may be difficult for beneficiaries to obtain benefit verification letters if the government shuts down, because that is not considered a “critical” service.

SSA has been struggling to provide adequate customer service for more than a decade thanks to chronic underfunding that began with the Tea Party-fomented debt limit crisis in 2011. Former acting Social Security Commissioner Carolyn Colvin told the town hall audience that SSA needs more funding to better serve the public.

NCPSSM President and CEO Max Richtman busted several myths about Social Security, such as “Social Security is going bankrupt”; “Illegal immigrants are collecting Social Security”; or that Social Security is an “entitlement.” “It is not an ‘entitlement.’ It’s an earned benefit,” he said.

Richtman warned against proposals in Congress that would cut Social Security benefits, including raising the retirement age to 69 or 70. “Just because some people are living longer doesn’t mean all Americans can work longer. Raising the age is a benefit cut, plain and simple,” he said.

He also pushed back against Congressional proposals to create a special commission to scrutinize Social Security on the false assumption that it contributes to the debt. (Social Security is completely self-funded and does not add a penny to the debt.) Speaker Kevin McCarthy reportedly is including a fiscal commission in the House Republicans’ stopgap funding bill.

“If recommendations from a commission are bundled together and enacted quickly, it allows Congress to avoid political accountability,” Richtman told the audience. He said that some members of Congress want “political cover” to cut benefits, knowing that Social Security is enormously popular with voters.

Nearly 100 Nevadans attended the AARP/NCPSSM town hall in Las Vegas on 9/28/23

Attendees of the town hall included retirees and Nevadans who are still working. Rebecca McDuffie, an inventory control clerk, said she attended in hopes of finding out “What is the right time to claim benefits?” She also seeks reassurance that Social Security will be around by the time she retires.

Davina Koehler, a retired kitchen manager for the county school system, had questions about the amount of her Social Security survivor’s benefit. Others asked, “If I collect VA benefits, does it affect my Social Security benefits.” (The answer: no.) Also: “Do I get a lower benefit if I continue working?” (Before full retirement age, benefits can be reduced if you’re working; after full retirement age, there are no limits on how much you can earn through employment.)

Representatives from the offices of Senator Catherine Cortes Masto (D-NV) and Rep. Dina Titus’ (D-NV) were on hand to respond to attendees’ questions. Former Commissioner Colvin urged everyone to set up a My Social Security account for more information about their current or future benefits.

The final “Social Security: Here Today, Here Tomorrow” town hall will take place in Milwaukee, WI on November 1, 2023.

For more information about the campaign, visit www.socialsecurityheretoday.org