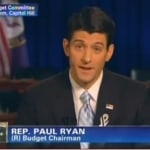

The Republican Party?s chosen speaker to follow-up the President?s State of the Union has finally said out-loud what has been kept on the down-low for a year… the GOP will embrace Rep. Paul Ryan?s budget ?roadmap? to dismantle Social Security and Medicare.We?ve already written a long post detailing Ryan?s plan and the CBO analysis of it, when it was unveiled. Now that it’s the heart of the Republican Budget approach we think it’s worth another look:

The Republican Party?s chosen speaker to follow-up the President?s State of the Union has finally said out-loud what has been kept on the down-low for a year… the GOP will embrace Rep. Paul Ryan?s budget ?roadmap? to dismantle Social Security and Medicare.We?ve already written a long post detailing Ryan?s plan and the CBO analysis of it, when it was unveiled. Now that it’s the heart of the Republican Budget approach we think it’s worth another look:

In short, it is a budget plan which decimates Social Security and Medicare in the name of deficit reduction. The only thing new about this strategy, is the fact that Rep. Ryan isn?t shy about acknowledging that he believes seniors should foot the bill for our current economic nightmare. As for Social Security, the GOP Roadmap leads to the same privatization dead-end for seniors, who are already reeling from Wall Street excesses and collapse which have decimated their nest-eggs. Once again, just as we saw in President Bush?s failed privatization plan, long-term solvency isn?t the goal. The goal is to turn Social Security over to Wall Street through thecreation of Social Security private accounts.

Of course, we know unraveling the nation?s safety net is a policy dream for some in Washington and unfortunately last night?s speech provided much of the same tired ?us versus them? language we?ve come to expect. Especially from those who care more about tax cuts for millionaires than seniors who dare to collect an average $14,000 annual retirement benefit they?ve worked to contribute over their entire working lives. Harkening back the ?good old days? of Ronald Reagan?s attack on ?welfare queens?, last night Rep. Ryan suggested collecting Social Security will somehow lead to a future of welfare-like dependency:

?a future in which we will transform our social safety net into a hammock, which lulls able-bodied people into lives of complacency and dependency.?

Of course, this kind of language is really nothing new. Consider Fiscal Commission Co-Chair Alan Simpson:

“And yes, I?ve made some plenty smart cracks about people on Social Security who milk it to the last degree. You know ?em too. It?s the same with any system in America. We?ve reached a point now where it?s like a milk cow with 310 million tits! “

And then there?s America?s leading anti-Social Security campaigner, billionaire Pete Peterson:

“We will no longer be able to afford a system that equates the last third or more of one’s adult life with a publicly subsidized vacation.”

This campaign to convince Americans that we can?t afford Social Security?even though we can afford tax cuts for billionaires–is now far more than just political rhetoric. It is at the heart of the Budget debate beginning in earnest in Washington today.Please take a moment and educate yourself about the Ryan Roadmap and the GOP proposals for Social Security and Medicare. These futures of these programs will likely be determined in this Congress and it?s vital that you know just what?s at stake.Here are a few links to read and share:Ryan?s Plan Would Convert Medicare to a Voucher Program, Vastly Cutting Benefits. ?People who become eligible for Medicare after 2020 would no longer have access to a defined set of benefits from any participating health care provider. Instead, they would receive a voucher worth $11,000 (on average) to be used to purchase private health insurance? Moreover, the Ryan plan imposes no requirement that private insurers actually offer health coverage to Medicare beneficiaries at an affordable price, or at all. Some beneficiaries, particularly the frail elderly, people with disabilities, and those with very modest incomes, could end up uninsured or heavily underinsured.? [Congressional Budget Office, 1/27/10; Center on Budget and Policy Priorities, 7/7/10 <http://www.cbpp.org/cms/index.cfm?fa=view&id=3114> ]Ryan?s Plan Would Eliminate the Children?s Health Insurance Program. ?The Ryan proposal would eliminate most of Medicaid and all of the Children?s Health Insurance Program. Low-income families with children would receive a health insurance tax credit and some additional low-income assistance and be pushed into the private health insurance market to fend for themselves.? [Center on Budget and Policy Priorities, 7/7/10 <http://www.cbpp.org/cms/index.cfm?fa=view&id=3114> ]Ryan?s Roadmap Would Raise Middle-Class Taxes While Handing Giveaways To Millionaires.Ryan?s Plan Would Give More Than $500,000 to Millionaires While Raising Taxes for Middle Class Families. Households with incomes of more than $1 million would receive an average annual tax cut of $502,000, while the wealthiest one-tenth of one percent of Americans would receive an average tax cut of $1.7 million a year. At the same time, about three-quarters of Americans ? those with incomes between $20,000 and $200,000 ? would face tax increases. For example, households with incomes between $50,000 and $75,000 would face an average tax increase of $900. [Center on Budget and Policy Priorities, 7/7/10 <http://www.cbpp.org/cms/index.cfm?fa=view&id=3114> ; Urban Institute and Brookings Institution?s Tax Policy Center, 3/9/10 <http://www.taxpolicycenter.org/numbers/displayatab.cfm?Simid=359> ]Under Ryan?s Plan, Wealthiest Americans Would Pay Lower Tax Rate Than Middle-Class Families. ?The Roadmap would lead to the wealthiest Americans paying a lower average tax rate than most Americans. Eliminating taxes on capital gains, dividends, and interest, as the Roadmap proposes, would overwhelmingly help taxpayers at the top of the income distribution, who receive most or all of their income from capital. For example, Wall Street financiers could shelter all of their income as tax-free stock options or carried interest.? [Economic Policy Institute, 1/20/11 <http://www.epi.org/publications/entry/paul_ryans_plan_for_millionaires_gain_and_middle-class_pain/> ]