Trump-GOP Tax Bill Would Trigger Devastating Cut to Medicare

Hundred Dollar Bill Being Cut With a Scissor

In the latest in a series of “oops” moments for the GOP, Congressional leaders apparently didn’t realize that their deficit-swelling tax scheme would trigger $136 billion in automatic cuts to mandatory spending programs. This includes a $25 billion reduction in Medicare spending, which would take effect almost immediately after passage of the tax bill. Needless to say, that large a cut could be devastating to the 57 million seniors and disabled who rely on Medicare. As a consequence of cutting taxes for the wealthy and big corporations, it would also be grossly unfair.

The automatic cuts would kick-in thanks to the little-known PAYGO law, which, according to the Congressional Budget Office, “requires that new legislation enacted during a term of Congress does not collectively increase estimated deficits.” If such legislation produces a net increase in the deficit, the federal government is required to sequester enough funds to eliminate the overage; hence, the massive and instant cut to Medicare.

As we discussed on today’s Behind the Headlines on Facebook Live, seniors’ advocates are understandably alarmed. National Committee President Max Richtman issued the following wake-up call this morning:

“In their rush to enact a reckless tax bill, Congressional Republicans have overlooked a provision in federal budgetary law that would have immediate and devastating consequences for Medicare. Left uncorrected, this would not only be a bald-faced admission that tax breaks for the wealthy and big corporations are more important than medical care for seniors, but also a betrayal of President Trump’s promise not to touch Medicare.” – Max Richtman, National Committee president, 11/15/17

Richtman sent a letter to the House of Representatives today urging members to oppose the GOP’s “Robin Hood in Reverse” tax plan in its entirety – or at least stop the imminent cut to Medicare while they have the chance. The Congress can stop the sequestration – including the $25 billion hit to Medicare – when it enacts the tax plan. House Democratic Whip Steny Hoyer (D-MD) says that GOP leadership should at least have the common sense to do that.

“While it is possible to avoid the PAYGO enforcement cuts triggered by their added deficits, Republicans would need Democratic votes to do it, requiring them to abandon their go-it-alone partisan strategy, which is only leading them on a path to failure and to putting our country in danger.” – House Minority Whip Steny Hoyer, 11/14/17

Of course, the entire tax scheme – which is being rushed through Congress without regular order – is harmful to seniors’ health and retirement security either way. It eliminates the deduction for medical expenses like chronic and long-term care and balloons the deficit so that future Congresses will feel justified in raiding Social Security, Medicare and Medicaid to make up the difference. In fact, the tax plan presumes passage of the Scrooge-like Republican budget, which calls for $500 billion in Medicare cuts and slashes Medicaid by a whopping $1 trillion. In effect, Republicans are asking seniors, the disabled, and the poor to pay for the lion’s share of a cut for the super-rich. Not to mention that some 36 million middle class Americans will actually see their taxes go up under the GOP plan.

None of these groups – the poor, the middle class, the disabled, or seniors – should be asked to shoulder this burden for a tax cut the wealthy and big corporations don’t need. As Max Richtman writes in his letter to Congress:

Medicare beneficiaries cannot afford to pay more for less coverage – particularly when half of them have incomes of less than $26,200 a year and spend 25 percent of their Social Security check to pay for Medicare Parts B and D out-of-pocket costs for premiums and cost-sharing amounts.

Regarding Medicaid, middle-class Americans often rely on the program for long-term services and supports when they exhaust their savings. Nearly two-thirds of all nursing home residents’ care is financed in whole or in part by Medicaid. In addition, Medicaid provides home and community-based services that allow seniors to stay in their homes. The fiscal crisis created by the tax bill is likely to result in a [trillion-dollar] cut to Medicaid that will limit seniors’ access to long-term care services. – Max Richtman’s Letter to Congress, 11/15/17

The public seems to grasp the gross unfairness of the Republican tax scheme. A just-released Quinnipiac poll indicates that only 25% favor the GOP plan while 52% oppose it. Meanwhile, GOP leadership has made it clear that they are not beholden to ordinary Americans, but their wealthy and powerful donors: a glaring case of backward priorities on Capitol Hill.

***************************************************************************************************

Our Digital Media department created this clever graphic for our Facebook and Twitter feeds about the true nature of the GOP Tax Scam and the PAYGO cuts:

National Committee President Warns Senators About GOP Tax & Budget Scheme

“The Republican budget and tax plans allow [Congress] to slash programs critical to older Americans and people with disabilities – all to pay for massive tax cuts for the very wealthy and profitable corporations.” – Max Richtman, 11/1/17

We analyzed the harm that the GOP proposals would wreak on older Americans in a post last week, entitled GOP Budget Resolution a “Lump of Coal” for Seniors, Middle Class. Among the more heinous measures, Republicans seek to cut nearly $500 billion from Medicare, $1.3 trillion from Medicaid, more than $600 billion from Social Security Disability Insurance (SSDI), and will likely slash billions from other programs that seniors rely on for financial and health security.

Richtman told the Senators that Medicare beneficiaries “cannot afford to pay more for less coverage” – particularly when half of them have incomes of less than $26,200 a year and spend 25 percent of their Social Security check to pay for Medicare premiums and cost-sharing. “And they cannot afford cuts to Medicare such as those assumed in the House budget – turning Medicare into a voucher program and raising the eligibility age from 65 to 67,” he explained.

What’s more, the tax plan will increase the national debt and compel Republicans to cut seniors’ earned benefits more aggressively in the future – even though Social Security and Medicare Part A are self-financed and do not contribute to federal budget deficits.

“By increasing the federal budget deficit by at least $1.5 trillion, this measure would leave Social Security, Medicare and Medicaid vulnerable to benefit cuts to make up the difference.” – Max Richtman, 11/1/17

Under the tax bill supported by President Trump and congressional Republicans, the nonpartisan Tax Policy Center estimates the top one percent of Americans would receive 80 percent of the tax cuts. For the top one percent, the average annual tax cut would be over $200,000 by 2027.

The bottom 80 percent of Americans would receive 13 percent of the tax cuts. In fact, 115 million households earning less than $75,000 a year would receive a tax cut of just $190 on average. But ultimately, most Americans would lose much more in program cuts than they would gain from tax cuts.

Richtman implored Congress to resist this reckless legislation:

“The National Committee urges all Senators and Representatives to oppose legislation to enact these ‘Robin Hood-in-Reverse’ budget and tax proposals and instead work together to protect the retirement and health security commitments made to generations of Americans.” – Max Richtman, 11/1/17

GOP Budget Resolution a “Lump of Coal” for Seniors, Middle Class

While the media have been largely consumed by the latest outrages from the White House, Republicans in Congress have been quietly working to radically redesign our tax code and cut trillions in spending that benefits ordinary Americans, including and especially seniors. With little fanfare, the Senate voted 51-49 last week to pass a cynical budget resolution that’s really a Trojan Horse for tax cuts for the wealthy and big corporations. Yesterday, the House followed suit by a vote of 216-212.

Had a few votes gone the other way, these plans would have been stopped dead in their tracks, as we witnessed with Obamacare repeal. But the public wasn’t paying much attention, and the pressure on Congress to vote in the public interest was nowhere near as intense.

Even if some of the more heinous budget cuts fall away, the resolution is an unsettling declaration of priorities that can only be described as mean-spirited and immoral. As Dylan Scott keenly observes in Vox:

The budget stands as a vision of what the Republican majority wants to do, and perhaps would do if it had eight or nine more votes in the Senate. It suggests that basically every Republican in each chamber (the only senator opposed was Rand Paul, who wanted deeper cuts) is comfortable aligning himself or herself with an agenda that radically cuts the social safety net for… retirees and the middle class. – Dylan Scott in Vox, 10/26/17

The GOP budget and tax scheme, which leadership would like to pass before the holidays, has been rightly described as a “lump of coal for the middle class.” Yes, the tax plan is a big, fat Christmas gift to the wealthy, wrapped in a package of distortions. Despite President Trump’s disingenuous claim that it helps middle income earners, 80% of the tax savings goes to the wealthiest 1% of the American people. The rest get only a trickle of tax relief.

Tax policy that benefits the middle class, including deductions for state and local taxes, goes out the window in this plan. So might existing exemptions for 401K contributions, currently set at $18,000 per year. GOP leaders have talked about significantly reducing the amount of pre-tax contributions people can make, reportedly to $2,400 per year. (The exact details are secret, of course, until the plan is unveiled on November 1st.) The party of personal responsibility is actually proposing to penalize Americans for saving for retirement – as some 50 million of us now do to the tune of $67 billion in tax savings per year.

The GOP would pay for massive tax breaks for the rich by cutting essential safety net programs for seniors and other vulnerable Americans. These are among the Scrooge-like proposals in the budget plan:

*Cuts nearly $500 billion from Medicare by privatizing the program and raising the eligibility age.

*Cuts $1.3 trillion from Medicaid over ten years, jeopardizing long term care services and supports for the elderly.

*Cuts $653 in Supplemental Security Income (SSI) for some 8 million low-income seniors and people with disabilities.

*Will likely require cuts in in Older Americans Act programs (e.g., Meals on Wheels), home heating assistance for seniors, and research into diseases affecting the elderly, including Alzheimer’s and cancer.

Meanwhile, the supposedly budget-conscious GOP has voted to allow itself to deficit-fund $1.5 trillion of the tax cut package. As the hole in the deficit grows, Republicans will then be able to come after Americans’ earned benefits – Social Security and Medicare – to try to close the gap, even though Social Security and Medicare Part A are self-funded and don’t affect general revenues.

Of course, the long-planned assault on Medicare has already begun – with new viability now that Republicans control all branches of government. The budget resolution contains oft-told prevarications about the program:

“Medicare spending is on an unsustainable course… Given this untenable situation, the budget resolution supports work by the authorizing committees to recommend legislative solutions extending Medicare’s solvency in the near term, while pursuing policies that place the program on a sustainable long-term path.” – GOP 2018 Budget Resolution

The way to strengthen Medicare now and for the future is to keep the Affordable Care Act in place (which is already saving Medicare hundreds of billions) and allow the government to negotiate prescription drug prices with drug companies, for starters.

Because Congressional leadership is forcing reckless tax cuts through the reconciliation process (where measures can pass the Senate with a simple majority), Democrats will be unable to impede this cruel juggernaut. As we saw in the Obamacare repeal battle, it will once again fall to a handful of Republicans of conscience to put the brakes on unfair tax and budget cuts. But they will do so only if they hear loudly and clearly from all of us.

Here’s One Way You May be Overpaying for Prescription Drugs – And How to Avoid It

Did you know that when you lay down $10, $20, or $30 for a copay at the pharmacy that you may be overpaying for the prescription itself — and a third party may be pocketing the difference? Or that you might save money by not going through insurance at all and paying a reduced cash price for the medication? Such is the head-spinning – and sometimes unethical – world of prescription drug benefits in the second decade of the 21st century.

Middlemen called Pharmacy Benefit Managers (PBMs) can skim extra profit by overcharging for medications. The PBMs’ ostensible purpose is to negotiate favorable pricing with pharmaceutical companies on behalf of insurers, including Medicare. But sometimes, especially with cheaper generic medicines, PBMs excessively mark up those prices and keep the remainder for themselves – causing consumers to pay more than they should. Unfortunately, this practice is especially costly for older Americans living on fixed incomes.

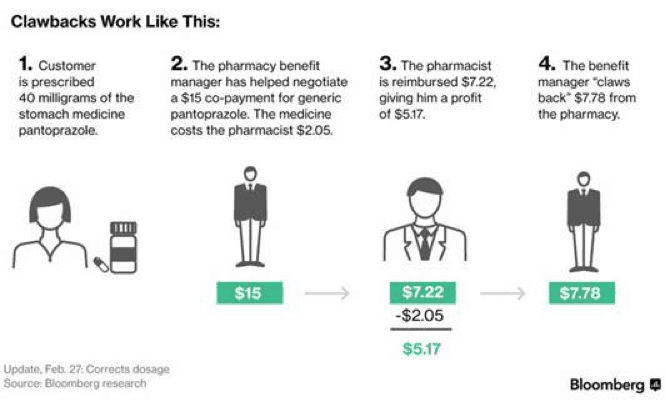

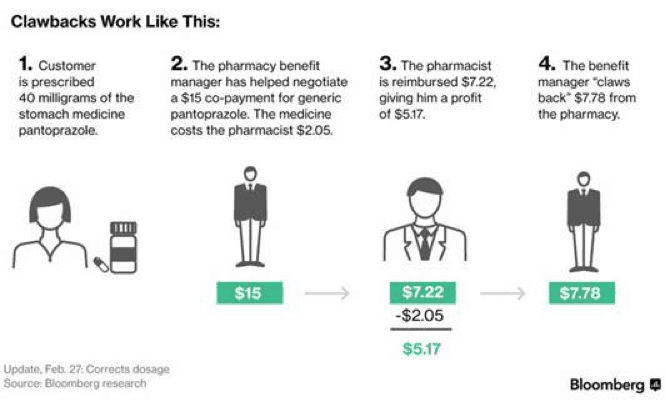

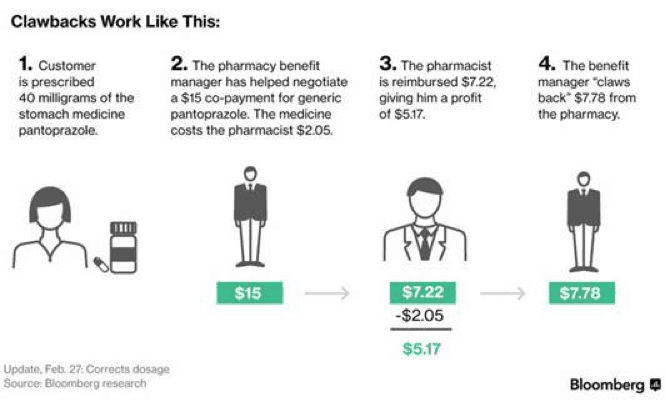

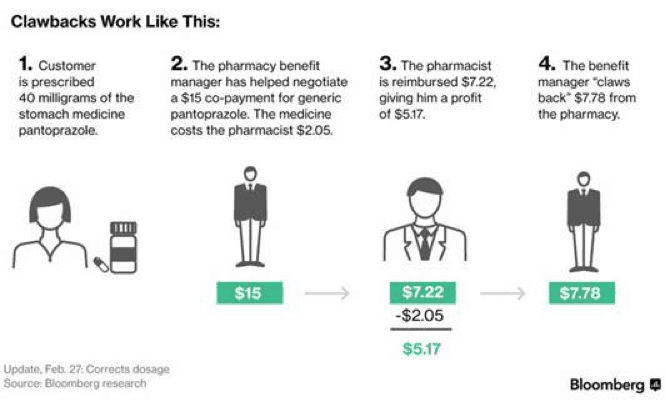

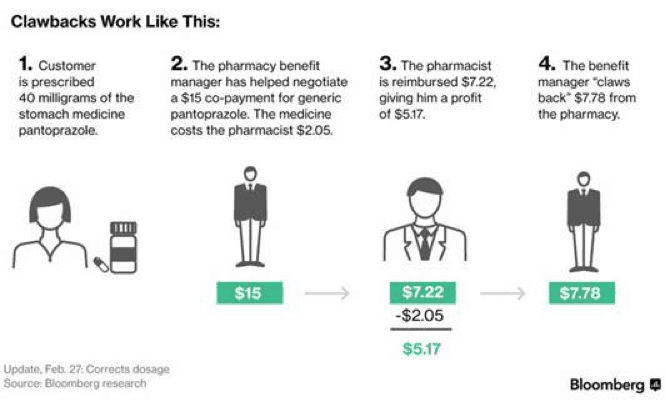

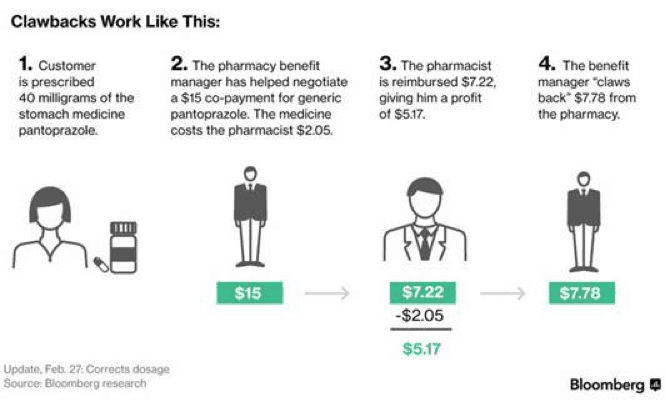

Unsuspecting customers are particularly vulnerable when paying co-pays at their local pharmacy, where PBMs can “claw back” excess profits. Here’s how it works:

A patient goes to a pharmacy and pays a co-pay amount — perhaps $10 — agreed to by the pharmacy benefits manager, or PBM, and the insurers who hire it. The pharmacist gets reimbursed for the price of the drug, say $2, and possibly a small profit. Then the benefits manager “claws back” the remainder. – Bloomberg, 2/24/17

(See also the graphic at the bottom of this post for a more detailed explanation of clawbacks.)

Though most customers are unaware of this practice, Bloomberg news reports that it is disturbingly common. More than 80% of independent pharmacists surveyed said that they have experienced clawbacks from PBMs at least 10 times a month.

In some cases, there is a simple way for customers to protect themselves from clawbacks. They can simply ask the pharmacist for the cash price of the prescription. If the cash price is lower than the co-pay, the customer can elect to pay it and bypass the insurance coverage for that medication. Consumers can also use prescription drug apps to determine the cash price (and available discounts) for various medications.

Unfortunately, PBMs do what they can to keep customers ignorant of this option. In fact, many PBMs (including one called OptumRx) contractually forbid pharmacists from educating customers about potential alternatives.

Pharmacists who contract with OptumRx in 2017 could be terminated for “actions detrimental to the provider network,” doing anything that “disparages” it or trying to “steer” customers to other coverage or discounted plans… – Bloomberg, 2/24/17

Some PBMs further restrict customers’ rights by mandating that enrollees in certain insurance plans use mail order and specialty pharmacies that they own, creating a conflict of interest.

Up to now, PBMs have operated with little transparency, so that no one really knows the inner workings of their deals with the drug companies or the details of their pricing structures. But pressure has been building on Capitol Hill. After all, the federal government is the largest health care provider in the country and is motivated to keep prescription drug costs under control. Hence, a bipartisan bill called the Prescription Drug Price Transparency Act (H.R. 1316) seeks to strengthen oversight of PBMs in the Medicare, Medicaid, and Federal Employee Health Benefit programs.

Three other bills – one in House and two in the Senate – have been introduced requiring greater transparency and accountability for PBMs. Meanwhile, New York State (under the leadership of Governor Andrew Cuomo) has unveiled new regulations for PBMs, and other states may do the same.

PBMs have also become the target of lawsuits (16 of them since October of last year) and have invited scrutiny from the U.S. Justice Department, which has alleged that the industry “is rife with conflicts of interests and undisclosed arrangements entered into at customers’ expense.”

Of course, the nascent clampdown on PBMs has to be seen in the context of soaring prescription drug prices overall, which are the main driver of rising medical costs. President Trump pledged to bring down drug prices, but so far has not delivered. Incremental measures to crack down on pricing abuses by PBMs are a good start. But until consumers receive actual deliverance from prescription price gouging, they will have to try their best to protect themselves.

*******************************************************************************************************************

Trump’s Executive Order on Healthcare is Bad Medicine

With all the skill of a surgeon wielding a machete, President Trump signed an executive order today that could undermine the affordability and quality of health insurance in America. Republicans in Congress couldn’t enact their ill-considered legislation to repeal Obamacare, so the President hastily reached for his pen, despite admitting earlier this year that he had no idea “healthcare could be so complicated.”

The executive order instructs Trump’s cabinet agencies to look at ways to allow insurers to sell health policies across state lines. The aim is to open-up association health plans (currently covering employees of various businesses and organizations) to people in the individual market. These insurance policies would not be subject to Obamacare rules mandating coverage for pre-existing conditions or essential benefits, in theory making them cheaper – but also skimpier.

These lower-cost, bare bones plans could siphon off younger and healthier enrollees, leaving older and sicker patients in the Obamacare exchanges and driving up their premiums. Ultimately, this could result in a death spiral for Obamacare, as we discussed on today’s Behind the Headlines Facebook Live broadcast. The administration’s own Centers for Medicare and Medicaid Services (CMS) says on its website:

Older Americans between ages 55 and 64 are at particular risk: 48 to 86 percent of people in that age bracket have some type of pre-existing condition.

To some, the idea of selling insurance across state lines sounds appealing. (Republicans have been proposing this scheme in one form or another since 2005.) Senator Rand Paul (R-KY) has been pushing it hard this year. But evidence – and history – indicate that the idea doesn’t work. This Kaiser Health News video briefly and crisply explains why.

Not only does the selling-across-state-lines concept undermine important patient protections and drive up premiums for the most vulnerable, it has never proven viable for insurers or the insured. According to today’s Hill newspaper:

A few states have opened their borders to out-of-state health insurers, and the response has been a uniform, “Thanks, but no thanks.”

One of Obamacare’s architects, Dr. Zeke Emanuel, told CNN today that, in addition to other concerns, association health plans have a “checkered history” and are especially vulnerable to fraud and scam artists. “Hundreds of thousands of people could be affected by fraud, unreimbursed medical bills,” he warned. Emanuel also cautioned that patients with employer-provided insurance could see their rates rise “significantly.”

The biggest problem of all, though, is that Trump’s executive order may well be illegal. The New York Times reports:

Several experts in healthcare and employment law said Trump’s plan could violate the U.S. Employee Retirement Income Security Act (ERISA), a federal law that governs large group plans that must be provided or maintained by employers or employee organizations.

In fact, a coterie of Democratic states attorneys general are poised to sue the administration if it enacts these harmful changes.

For all the Republicans’ talk of federalism, the executive order would actually weaken states’ power to regulate insurance markets, which is one of their primary responsibilities in the health care arena.

But as with the President’s trickle-down tax plan and other haphazard policies, history, precedent and data don’t seem to matter to this White House. That’s especially troubling when – once again – the most vulnerable members of society will pay the price.

Trump-GOP Tax Bill Would Trigger Devastating Cut to Medicare

Hundred Dollar Bill Being Cut With a Scissor

In the latest in a series of “oops” moments for the GOP, Congressional leaders apparently didn’t realize that their deficit-swelling tax scheme would trigger $136 billion in automatic cuts to mandatory spending programs. This includes a $25 billion reduction in Medicare spending, which would take effect almost immediately after passage of the tax bill. Needless to say, that large a cut could be devastating to the 57 million seniors and disabled who rely on Medicare. As a consequence of cutting taxes for the wealthy and big corporations, it would also be grossly unfair.

The automatic cuts would kick-in thanks to the little-known PAYGO law, which, according to the Congressional Budget Office, “requires that new legislation enacted during a term of Congress does not collectively increase estimated deficits.” If such legislation produces a net increase in the deficit, the federal government is required to sequester enough funds to eliminate the overage; hence, the massive and instant cut to Medicare.

As we discussed on today’s Behind the Headlines on Facebook Live, seniors’ advocates are understandably alarmed. National Committee President Max Richtman issued the following wake-up call this morning:

“In their rush to enact a reckless tax bill, Congressional Republicans have overlooked a provision in federal budgetary law that would have immediate and devastating consequences for Medicare. Left uncorrected, this would not only be a bald-faced admission that tax breaks for the wealthy and big corporations are more important than medical care for seniors, but also a betrayal of President Trump’s promise not to touch Medicare.” – Max Richtman, National Committee president, 11/15/17

Richtman sent a letter to the House of Representatives today urging members to oppose the GOP’s “Robin Hood in Reverse” tax plan in its entirety – or at least stop the imminent cut to Medicare while they have the chance. The Congress can stop the sequestration – including the $25 billion hit to Medicare – when it enacts the tax plan. House Democratic Whip Steny Hoyer (D-MD) says that GOP leadership should at least have the common sense to do that.

“While it is possible to avoid the PAYGO enforcement cuts triggered by their added deficits, Republicans would need Democratic votes to do it, requiring them to abandon their go-it-alone partisan strategy, which is only leading them on a path to failure and to putting our country in danger.” – House Minority Whip Steny Hoyer, 11/14/17

Of course, the entire tax scheme – which is being rushed through Congress without regular order – is harmful to seniors’ health and retirement security either way. It eliminates the deduction for medical expenses like chronic and long-term care and balloons the deficit so that future Congresses will feel justified in raiding Social Security, Medicare and Medicaid to make up the difference. In fact, the tax plan presumes passage of the Scrooge-like Republican budget, which calls for $500 billion in Medicare cuts and slashes Medicaid by a whopping $1 trillion. In effect, Republicans are asking seniors, the disabled, and the poor to pay for the lion’s share of a cut for the super-rich. Not to mention that some 36 million middle class Americans will actually see their taxes go up under the GOP plan.

None of these groups – the poor, the middle class, the disabled, or seniors – should be asked to shoulder this burden for a tax cut the wealthy and big corporations don’t need. As Max Richtman writes in his letter to Congress:

Medicare beneficiaries cannot afford to pay more for less coverage – particularly when half of them have incomes of less than $26,200 a year and spend 25 percent of their Social Security check to pay for Medicare Parts B and D out-of-pocket costs for premiums and cost-sharing amounts.

Regarding Medicaid, middle-class Americans often rely on the program for long-term services and supports when they exhaust their savings. Nearly two-thirds of all nursing home residents’ care is financed in whole or in part by Medicaid. In addition, Medicaid provides home and community-based services that allow seniors to stay in their homes. The fiscal crisis created by the tax bill is likely to result in a [trillion-dollar] cut to Medicaid that will limit seniors’ access to long-term care services. – Max Richtman’s Letter to Congress, 11/15/17

The public seems to grasp the gross unfairness of the Republican tax scheme. A just-released Quinnipiac poll indicates that only 25% favor the GOP plan while 52% oppose it. Meanwhile, GOP leadership has made it clear that they are not beholden to ordinary Americans, but their wealthy and powerful donors: a glaring case of backward priorities on Capitol Hill.

***************************************************************************************************

Our Digital Media department created this clever graphic for our Facebook and Twitter feeds about the true nature of the GOP Tax Scam and the PAYGO cuts:

National Committee President Warns Senators About GOP Tax & Budget Scheme

“The Republican budget and tax plans allow [Congress] to slash programs critical to older Americans and people with disabilities – all to pay for massive tax cuts for the very wealthy and profitable corporations.” – Max Richtman, 11/1/17

We analyzed the harm that the GOP proposals would wreak on older Americans in a post last week, entitled GOP Budget Resolution a “Lump of Coal” for Seniors, Middle Class. Among the more heinous measures, Republicans seek to cut nearly $500 billion from Medicare, $1.3 trillion from Medicaid, more than $600 billion from Social Security Disability Insurance (SSDI), and will likely slash billions from other programs that seniors rely on for financial and health security.

Richtman told the Senators that Medicare beneficiaries “cannot afford to pay more for less coverage” – particularly when half of them have incomes of less than $26,200 a year and spend 25 percent of their Social Security check to pay for Medicare premiums and cost-sharing. “And they cannot afford cuts to Medicare such as those assumed in the House budget – turning Medicare into a voucher program and raising the eligibility age from 65 to 67,” he explained.

What’s more, the tax plan will increase the national debt and compel Republicans to cut seniors’ earned benefits more aggressively in the future – even though Social Security and Medicare Part A are self-financed and do not contribute to federal budget deficits.

“By increasing the federal budget deficit by at least $1.5 trillion, this measure would leave Social Security, Medicare and Medicaid vulnerable to benefit cuts to make up the difference.” – Max Richtman, 11/1/17

Under the tax bill supported by President Trump and congressional Republicans, the nonpartisan Tax Policy Center estimates the top one percent of Americans would receive 80 percent of the tax cuts. For the top one percent, the average annual tax cut would be over $200,000 by 2027.

The bottom 80 percent of Americans would receive 13 percent of the tax cuts. In fact, 115 million households earning less than $75,000 a year would receive a tax cut of just $190 on average. But ultimately, most Americans would lose much more in program cuts than they would gain from tax cuts.

Richtman implored Congress to resist this reckless legislation:

“The National Committee urges all Senators and Representatives to oppose legislation to enact these ‘Robin Hood-in-Reverse’ budget and tax proposals and instead work together to protect the retirement and health security commitments made to generations of Americans.” – Max Richtman, 11/1/17

GOP Budget Resolution a “Lump of Coal” for Seniors, Middle Class

While the media have been largely consumed by the latest outrages from the White House, Republicans in Congress have been quietly working to radically redesign our tax code and cut trillions in spending that benefits ordinary Americans, including and especially seniors. With little fanfare, the Senate voted 51-49 last week to pass a cynical budget resolution that’s really a Trojan Horse for tax cuts for the wealthy and big corporations. Yesterday, the House followed suit by a vote of 216-212.

Had a few votes gone the other way, these plans would have been stopped dead in their tracks, as we witnessed with Obamacare repeal. But the public wasn’t paying much attention, and the pressure on Congress to vote in the public interest was nowhere near as intense.

Even if some of the more heinous budget cuts fall away, the resolution is an unsettling declaration of priorities that can only be described as mean-spirited and immoral. As Dylan Scott keenly observes in Vox:

The budget stands as a vision of what the Republican majority wants to do, and perhaps would do if it had eight or nine more votes in the Senate. It suggests that basically every Republican in each chamber (the only senator opposed was Rand Paul, who wanted deeper cuts) is comfortable aligning himself or herself with an agenda that radically cuts the social safety net for… retirees and the middle class. – Dylan Scott in Vox, 10/26/17

The GOP budget and tax scheme, which leadership would like to pass before the holidays, has been rightly described as a “lump of coal for the middle class.” Yes, the tax plan is a big, fat Christmas gift to the wealthy, wrapped in a package of distortions. Despite President Trump’s disingenuous claim that it helps middle income earners, 80% of the tax savings goes to the wealthiest 1% of the American people. The rest get only a trickle of tax relief.

Tax policy that benefits the middle class, including deductions for state and local taxes, goes out the window in this plan. So might existing exemptions for 401K contributions, currently set at $18,000 per year. GOP leaders have talked about significantly reducing the amount of pre-tax contributions people can make, reportedly to $2,400 per year. (The exact details are secret, of course, until the plan is unveiled on November 1st.) The party of personal responsibility is actually proposing to penalize Americans for saving for retirement – as some 50 million of us now do to the tune of $67 billion in tax savings per year.

The GOP would pay for massive tax breaks for the rich by cutting essential safety net programs for seniors and other vulnerable Americans. These are among the Scrooge-like proposals in the budget plan:

*Cuts nearly $500 billion from Medicare by privatizing the program and raising the eligibility age.

*Cuts $1.3 trillion from Medicaid over ten years, jeopardizing long term care services and supports for the elderly.

*Cuts $653 in Supplemental Security Income (SSI) for some 8 million low-income seniors and people with disabilities.

*Will likely require cuts in in Older Americans Act programs (e.g., Meals on Wheels), home heating assistance for seniors, and research into diseases affecting the elderly, including Alzheimer’s and cancer.

Meanwhile, the supposedly budget-conscious GOP has voted to allow itself to deficit-fund $1.5 trillion of the tax cut package. As the hole in the deficit grows, Republicans will then be able to come after Americans’ earned benefits – Social Security and Medicare – to try to close the gap, even though Social Security and Medicare Part A are self-funded and don’t affect general revenues.

Of course, the long-planned assault on Medicare has already begun – with new viability now that Republicans control all branches of government. The budget resolution contains oft-told prevarications about the program:

“Medicare spending is on an unsustainable course… Given this untenable situation, the budget resolution supports work by the authorizing committees to recommend legislative solutions extending Medicare’s solvency in the near term, while pursuing policies that place the program on a sustainable long-term path.” – GOP 2018 Budget Resolution

The way to strengthen Medicare now and for the future is to keep the Affordable Care Act in place (which is already saving Medicare hundreds of billions) and allow the government to negotiate prescription drug prices with drug companies, for starters.

Because Congressional leadership is forcing reckless tax cuts through the reconciliation process (where measures can pass the Senate with a simple majority), Democrats will be unable to impede this cruel juggernaut. As we saw in the Obamacare repeal battle, it will once again fall to a handful of Republicans of conscience to put the brakes on unfair tax and budget cuts. But they will do so only if they hear loudly and clearly from all of us.

Here’s One Way You May be Overpaying for Prescription Drugs – And How to Avoid It

Did you know that when you lay down $10, $20, or $30 for a copay at the pharmacy that you may be overpaying for the prescription itself — and a third party may be pocketing the difference? Or that you might save money by not going through insurance at all and paying a reduced cash price for the medication? Such is the head-spinning – and sometimes unethical – world of prescription drug benefits in the second decade of the 21st century.

Middlemen called Pharmacy Benefit Managers (PBMs) can skim extra profit by overcharging for medications. The PBMs’ ostensible purpose is to negotiate favorable pricing with pharmaceutical companies on behalf of insurers, including Medicare. But sometimes, especially with cheaper generic medicines, PBMs excessively mark up those prices and keep the remainder for themselves – causing consumers to pay more than they should. Unfortunately, this practice is especially costly for older Americans living on fixed incomes.

Unsuspecting customers are particularly vulnerable when paying co-pays at their local pharmacy, where PBMs can “claw back” excess profits. Here’s how it works:

A patient goes to a pharmacy and pays a co-pay amount — perhaps $10 — agreed to by the pharmacy benefits manager, or PBM, and the insurers who hire it. The pharmacist gets reimbursed for the price of the drug, say $2, and possibly a small profit. Then the benefits manager “claws back” the remainder. – Bloomberg, 2/24/17

(See also the graphic at the bottom of this post for a more detailed explanation of clawbacks.)

Though most customers are unaware of this practice, Bloomberg news reports that it is disturbingly common. More than 80% of independent pharmacists surveyed said that they have experienced clawbacks from PBMs at least 10 times a month.

In some cases, there is a simple way for customers to protect themselves from clawbacks. They can simply ask the pharmacist for the cash price of the prescription. If the cash price is lower than the co-pay, the customer can elect to pay it and bypass the insurance coverage for that medication. Consumers can also use prescription drug apps to determine the cash price (and available discounts) for various medications.

Unfortunately, PBMs do what they can to keep customers ignorant of this option. In fact, many PBMs (including one called OptumRx) contractually forbid pharmacists from educating customers about potential alternatives.

Pharmacists who contract with OptumRx in 2017 could be terminated for “actions detrimental to the provider network,” doing anything that “disparages” it or trying to “steer” customers to other coverage or discounted plans… – Bloomberg, 2/24/17

Some PBMs further restrict customers’ rights by mandating that enrollees in certain insurance plans use mail order and specialty pharmacies that they own, creating a conflict of interest.

Up to now, PBMs have operated with little transparency, so that no one really knows the inner workings of their deals with the drug companies or the details of their pricing structures. But pressure has been building on Capitol Hill. After all, the federal government is the largest health care provider in the country and is motivated to keep prescription drug costs under control. Hence, a bipartisan bill called the Prescription Drug Price Transparency Act (H.R. 1316) seeks to strengthen oversight of PBMs in the Medicare, Medicaid, and Federal Employee Health Benefit programs.

Three other bills – one in House and two in the Senate – have been introduced requiring greater transparency and accountability for PBMs. Meanwhile, New York State (under the leadership of Governor Andrew Cuomo) has unveiled new regulations for PBMs, and other states may do the same.

PBMs have also become the target of lawsuits (16 of them since October of last year) and have invited scrutiny from the U.S. Justice Department, which has alleged that the industry “is rife with conflicts of interests and undisclosed arrangements entered into at customers’ expense.”

Of course, the nascent clampdown on PBMs has to be seen in the context of soaring prescription drug prices overall, which are the main driver of rising medical costs. President Trump pledged to bring down drug prices, but so far has not delivered. Incremental measures to crack down on pricing abuses by PBMs are a good start. But until consumers receive actual deliverance from prescription price gouging, they will have to try their best to protect themselves.

*******************************************************************************************************************

Trump’s Executive Order on Healthcare is Bad Medicine

With all the skill of a surgeon wielding a machete, President Trump signed an executive order today that could undermine the affordability and quality of health insurance in America. Republicans in Congress couldn’t enact their ill-considered legislation to repeal Obamacare, so the President hastily reached for his pen, despite admitting earlier this year that he had no idea “healthcare could be so complicated.”

The executive order instructs Trump’s cabinet agencies to look at ways to allow insurers to sell health policies across state lines. The aim is to open-up association health plans (currently covering employees of various businesses and organizations) to people in the individual market. These insurance policies would not be subject to Obamacare rules mandating coverage for pre-existing conditions or essential benefits, in theory making them cheaper – but also skimpier.

These lower-cost, bare bones plans could siphon off younger and healthier enrollees, leaving older and sicker patients in the Obamacare exchanges and driving up their premiums. Ultimately, this could result in a death spiral for Obamacare, as we discussed on today’s Behind the Headlines Facebook Live broadcast. The administration’s own Centers for Medicare and Medicaid Services (CMS) says on its website:

Older Americans between ages 55 and 64 are at particular risk: 48 to 86 percent of people in that age bracket have some type of pre-existing condition.

To some, the idea of selling insurance across state lines sounds appealing. (Republicans have been proposing this scheme in one form or another since 2005.) Senator Rand Paul (R-KY) has been pushing it hard this year. But evidence – and history – indicate that the idea doesn’t work. This Kaiser Health News video briefly and crisply explains why.

Not only does the selling-across-state-lines concept undermine important patient protections and drive up premiums for the most vulnerable, it has never proven viable for insurers or the insured. According to today’s Hill newspaper:

A few states have opened their borders to out-of-state health insurers, and the response has been a uniform, “Thanks, but no thanks.”

One of Obamacare’s architects, Dr. Zeke Emanuel, told CNN today that, in addition to other concerns, association health plans have a “checkered history” and are especially vulnerable to fraud and scam artists. “Hundreds of thousands of people could be affected by fraud, unreimbursed medical bills,” he warned. Emanuel also cautioned that patients with employer-provided insurance could see their rates rise “significantly.”

The biggest problem of all, though, is that Trump’s executive order may well be illegal. The New York Times reports:

Several experts in healthcare and employment law said Trump’s plan could violate the U.S. Employee Retirement Income Security Act (ERISA), a federal law that governs large group plans that must be provided or maintained by employers or employee organizations.

In fact, a coterie of Democratic states attorneys general are poised to sue the administration if it enacts these harmful changes.

For all the Republicans’ talk of federalism, the executive order would actually weaken states’ power to regulate insurance markets, which is one of their primary responsibilities in the health care arena.

But as with the President’s trickle-down tax plan and other haphazard policies, history, precedent and data don’t seem to matter to this White House. That’s especially troubling when – once again – the most vulnerable members of society will pay the price.