How Many Times Do Americans Have To Say It: Cutting Social Security is Not an Option

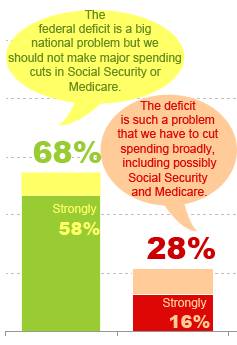

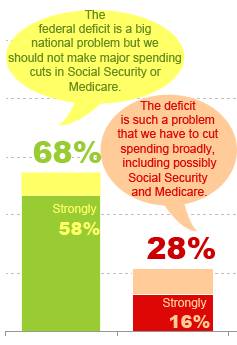

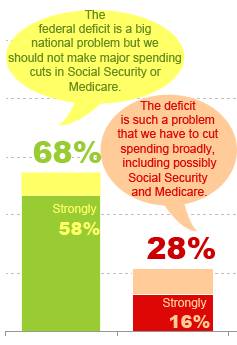

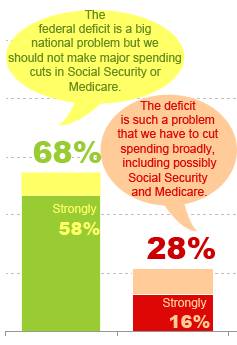

In poll after poll, the American people of all ages and political persuasions continue to send Washington a clear message?cutting Social Security in the name of deficit reduction is not ?fiscal responsibility?.Thelatest research survey on investment and deficit reduction was done by Greenberg Quinlan Rosner commissioned by the Campaign for America?s Future and Democracy Corps, with support from MoveOn.org; the American Federation of State, County and Municipal employees, and the Service Employees International Union.They describe their findings this way: ?Voters are united on this key point: Social Security and Medicare are off-limits as a way to reduce the deficit. It is the threat to Social Security that leads many voters to prioritize deficit reductions. Voters instead want to see higher taxes on top income earners and big corporations.As Social Security celebrates its 75th anniversary this week in the midst of this troubled economy, voters across the political divide want these programs defended.68 percent said they would oppose making major spending cuts in Social Security and Medicare to reduce the deficit, while 28 percent said they would favor cutting those programs. That included 61 percent of Republicans and 56 percent of independents.Strong majorities support progressive solutions for addressing the federal deficit: 63 percent back lifting the Social Security cap on incomes higher than $107,000 a year; 64 percent would favor eliminating tax breaks for corporations that outsource jobs; 62 percent would support a tax on excessive Wall Street bank profits.“These results mirror results of our National Committee Foundation poll conducted earlier this summer in which only 2% of Americans believe Social Security is a major cause of the deficit with 77% opposing any changes in Social Security as part of a deficit reduction plan.Theye also echo what Americans told AARP in another recent poll in which 85 percent of adults oppose cutting Social Security to reduce the deficit; 72 percent “strongly oppose” doing so.It?s clear the Washington Disconnect between working Americans and policy makers on the issue of Social Security couldn?t be larger.

?Voters are united on this key point: Social Security and Medicare are off-limits as a way to reduce the deficit. It is the threat to Social Security that leads many voters to prioritize deficit reductions. Voters instead want to see higher taxes on top income earners and big corporations.As Social Security celebrates its 75th anniversary this week in the midst of this troubled economy, voters across the political divide want these programs defended.68 percent said they would oppose making major spending cuts in Social Security and Medicare to reduce the deficit, while 28 percent said they would favor cutting those programs. That included 61 percent of Republicans and 56 percent of independents.Strong majorities support progressive solutions for addressing the federal deficit: 63 percent back lifting the Social Security cap on incomes higher than $107,000 a year; 64 percent would favor eliminating tax breaks for corporations that outsource jobs; 62 percent would support a tax on excessive Wall Street bank profits.“These results mirror results of our National Committee Foundation poll conducted earlier this summer in which only 2% of Americans believe Social Security is a major cause of the deficit with 77% opposing any changes in Social Security as part of a deficit reduction plan.Theye also echo what Americans told AARP in another recent poll in which 85 percent of adults oppose cutting Social Security to reduce the deficit; 72 percent “strongly oppose” doing so.It?s clear the Washington Disconnect between working Americans and policy makers on the issue of Social Security couldn?t be larger.

The Truth About Social Security

Seventy-five years ago this month, President Franklin Delano Roosevelt, spoke these words:“We can never insure one-hundred percent of the population against one-hundred percent of the hazards and vicissitudes of life. But we have tried to frame a law which will give some measure of protection to the average citizen and to his family against ? poverty-ridden old age. This law, too, represents a cornerstone in a structure which is being built, but is by no means complete…. It is…a law that will take care of human needs and at the same time provide for the United States an economic structure of vastly greater soundness.”My grandfather uttered these words on August 14, 1935, on the proud occasion of his signing the Social Security Act into law. They expressed a fundamental belief shared by him and my grandmother that all people should be free from fear of want and destitution. My grandparents possessed an almost boundless sense of optimism in the American people; freed from our fears, they had faith that we could move mountains. Thus, in 1933 President Roosevelt summoned the courage of the American people with the immortal words: ?the only thing we have to fear is fear itself.?While this anniversary is an occasion for celebration, I am also deeply troubled by the torrent of distortions, deceptions and falsehoods being unleashed by the enemies of Social Security. Their strategy is as simple as it is reprehensible: sow enough concern and fear about the program ? fears that Social Security is not working, is bankrupting the country and cannot be counted on in the future ? and you can convince people of the need for radical solutions.While there are currently no frontal assaults on Social Security akin to what President George W. Bush unleashed in 2005, there are more insidious dangers. There are ominous signs that the National Commission on Fiscal Responsibility and Reform (better known as the deficit commission) has set its sights on Social Security. It is deeply disturbing that the co-chairman of that commission, former Senator Alan Simpson, has been using this platform to put forward the same baseless claims about the program: that it?s ?insolvent, it?s paying out more than it?s taking in? or ?there is no surplus in there,? ?there? being the Social Security Trust Fund.Fear, my grandfather said, is ?nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance.? I believe that if we hold the distortions, deceptions and falsehoods up to the light of truth, we can convert retreat into advance.The truth about Social Security is that it has contributed to the financial wellbeing of almost every American family. It is completely solvent today because it has a dedicated income stream that covers its costs, and it is actuarially sound. Moreover, it will remain solvent for decades to come, with only minor adjustments. It has consistently run a surplus.The point is that Social Security should be “off the table” in the deficit commission’s deliberations.As Nancy Altman wrote in her book, The Battle for Social Security, ?Armed with the proper insight and understanding, we Americans can assert our will and demand that the program envisioned by Franklin Roosevelt remain his enduring legacy.?You can watch James Roosevelt’s full address at the National Press Club marking Social Security’s 75th anniversary here.

Social Security – An American Success Story

For the month of August we have been celebrating Social Security’s 75th anniversary with “Keeping the Promise” events each day of the month. Today we’re releasing the third video in our Anniversary series…”An American Success Story”.Take a moment to watch and then forward it to your friends.

The Truth about the Trustees Report

Here it is in a nutshell…the truth about the2010 Social Security and Medicare Trustees Report.Of course, the facts don’t fit the crisis calls from fiscal hawks and the main stream media so don’t be surprised when most of thesedetails don’t make the headlines in your local papers tomorrow.Social Security is still fully funded for 27 years, a COLA increase unlikely for the second year in a row, and health care reform extends Medicare?s solvency

- The 2010 Trustees report shows recently enacted health care reform will strengthen Medicare.

Trustees project that health care reform?s Medicare provisions will extend solvency 12 years, from 2017 to 2029.Health care reform was a vital first step; however, the work is not finished. Congress must continue to address long-range cost containment in private health care systems to avoid creating provider access problems for Medicare beneficiaries.The 2010 Trustees report shows Social Security is not facing an immediate threat.

- Trustees project Social Security will be able to pay full benefits until the year 2037. After that, Social Security will have sufficient revenue to pay about 78% of benefits.

- Low inflation means 2011 is likely to be the second year of no cost of living allowance for beneficiaries. By statute, zero COLA?s would also mean no Medicare Part B premium increase for about three-quarters of all beneficiaries. However, the remaining beneficiaries, including newly enrolled seniors and higher income seniors, will see larger premium hikes in Part B to cover the difference. Premiums for Part D, the prescription drug benefit, are not subject to this limitation and are expected to continue increasing.

- The change in short-term projections is a short-term fiscal problem, not a Social Security problem. What is happening is the annual cash surpluses collected in payroll taxes only (ignoring other revenue sources like trust fund interest) are projected to be down for 2010 and 2011, not surprising given the high unemployment rate that the country is experiencing. Fewer workers mean fewer contributions. But the economy will rebound, and in the meantime the program is able to rely on income from interest on the $2.5 trillion in reserves the Trust Fund has accumulated. Annual fluctuations such as these are anticipated in the long-term projections by the Trustees ? confirmed by the fact that the insolvency projection in 2037 has not changed.

- The Disability Trust Fund faces a more immediate threat. Trustees project the DI Trust Fund will be exhausted in 2018 and recommend a reallocation of the payroll tax rate between OASI and DI, as was done in 1994.

?The 2010 Social Security Trustees Report confirms that the Social Security program is weathering these difficult economic times, providing stability and security to millions of Americans rocked by the recession. In the face of this adversity, the Social Security program has stood its ground, and remains able to pay all benefits through 2037, the same date the Trustees projected last year. Americans should be encouraged by this good news from the Trustees? Report. And contrary to the doom and gloom crowd?s crisis calls, the Medicare Trustees confirm recently enacted Medicare reforms will add years to that program?s solvency.?…Barbara B. Kennelly, President/CEO, The National Committee to Preserve Social Security and Medicare

Dancing Grannies for Medicare

Here’s our favorite video of the month by far! More than 100 folks showed up in Manhattan on Medicare’s Anniversary to protest the Fiscal Commission’s targeting Medicare for cuts in the name of deficit control.

How Many Times Do Americans Have To Say It: Cutting Social Security is Not an Option

In poll after poll, the American people of all ages and political persuasions continue to send Washington a clear message?cutting Social Security in the name of deficit reduction is not ?fiscal responsibility?.Thelatest research survey on investment and deficit reduction was done by Greenberg Quinlan Rosner commissioned by the Campaign for America?s Future and Democracy Corps, with support from MoveOn.org; the American Federation of State, County and Municipal employees, and the Service Employees International Union.They describe their findings this way:

The Truth About Social Security

Seventy-five years ago this month, President Franklin Delano Roosevelt, spoke these words:“We can never insure one-hundred percent of the population against one-hundred percent of the hazards and vicissitudes of life. But we have tried to frame a law which will give some measure of protection to the average citizen and to his family against ? poverty-ridden old age. This law, too, represents a cornerstone in a structure which is being built, but is by no means complete…. It is…a law that will take care of human needs and at the same time provide for the United States an economic structure of vastly greater soundness.”My grandfather uttered these words on August 14, 1935, on the proud occasion of his signing the Social Security Act into law. They expressed a fundamental belief shared by him and my grandmother that all people should be free from fear of want and destitution. My grandparents possessed an almost boundless sense of optimism in the American people; freed from our fears, they had faith that we could move mountains. Thus, in 1933 President Roosevelt summoned the courage of the American people with the immortal words: ?the only thing we have to fear is fear itself.?While this anniversary is an occasion for celebration, I am also deeply troubled by the torrent of distortions, deceptions and falsehoods being unleashed by the enemies of Social Security. Their strategy is as simple as it is reprehensible: sow enough concern and fear about the program ? fears that Social Security is not working, is bankrupting the country and cannot be counted on in the future ? and you can convince people of the need for radical solutions.While there are currently no frontal assaults on Social Security akin to what President George W. Bush unleashed in 2005, there are more insidious dangers. There are ominous signs that the National Commission on Fiscal Responsibility and Reform (better known as the deficit commission) has set its sights on Social Security. It is deeply disturbing that the co-chairman of that commission, former Senator Alan Simpson, has been using this platform to put forward the same baseless claims about the program: that it?s ?insolvent, it?s paying out more than it?s taking in? or ?there is no surplus in there,? ?there? being the Social Security Trust Fund.Fear, my grandfather said, is ?nameless, unreasoning, unjustified terror which paralyzes needed efforts to convert retreat into advance.? I believe that if we hold the distortions, deceptions and falsehoods up to the light of truth, we can convert retreat into advance.The truth about Social Security is that it has contributed to the financial wellbeing of almost every American family. It is completely solvent today because it has a dedicated income stream that covers its costs, and it is actuarially sound. Moreover, it will remain solvent for decades to come, with only minor adjustments. It has consistently run a surplus.The point is that Social Security should be “off the table” in the deficit commission’s deliberations.As Nancy Altman wrote in her book, The Battle for Social Security, ?Armed with the proper insight and understanding, we Americans can assert our will and demand that the program envisioned by Franklin Roosevelt remain his enduring legacy.?You can watch James Roosevelt’s full address at the National Press Club marking Social Security’s 75th anniversary here.

Social Security – An American Success Story

For the month of August we have been celebrating Social Security’s 75th anniversary with “Keeping the Promise” events each day of the month. Today we’re releasing the third video in our Anniversary series…”An American Success Story”.Take a moment to watch and then forward it to your friends.

The Truth about the Trustees Report

Here it is in a nutshell…the truth about the2010 Social Security and Medicare Trustees Report.Of course, the facts don’t fit the crisis calls from fiscal hawks and the main stream media so don’t be surprised when most of thesedetails don’t make the headlines in your local papers tomorrow.Social Security is still fully funded for 27 years, a COLA increase unlikely for the second year in a row, and health care reform extends Medicare?s solvency

- The 2010 Trustees report shows recently enacted health care reform will strengthen Medicare.

Trustees project that health care reform?s Medicare provisions will extend solvency 12 years, from 2017 to 2029.Health care reform was a vital first step; however, the work is not finished. Congress must continue to address long-range cost containment in private health care systems to avoid creating provider access problems for Medicare beneficiaries.The 2010 Trustees report shows Social Security is not facing an immediate threat.

- Trustees project Social Security will be able to pay full benefits until the year 2037. After that, Social Security will have sufficient revenue to pay about 78% of benefits.

- Low inflation means 2011 is likely to be the second year of no cost of living allowance for beneficiaries. By statute, zero COLA?s would also mean no Medicare Part B premium increase for about three-quarters of all beneficiaries. However, the remaining beneficiaries, including newly enrolled seniors and higher income seniors, will see larger premium hikes in Part B to cover the difference. Premiums for Part D, the prescription drug benefit, are not subject to this limitation and are expected to continue increasing.

- The change in short-term projections is a short-term fiscal problem, not a Social Security problem. What is happening is the annual cash surpluses collected in payroll taxes only (ignoring other revenue sources like trust fund interest) are projected to be down for 2010 and 2011, not surprising given the high unemployment rate that the country is experiencing. Fewer workers mean fewer contributions. But the economy will rebound, and in the meantime the program is able to rely on income from interest on the $2.5 trillion in reserves the Trust Fund has accumulated. Annual fluctuations such as these are anticipated in the long-term projections by the Trustees ? confirmed by the fact that the insolvency projection in 2037 has not changed.

- The Disability Trust Fund faces a more immediate threat. Trustees project the DI Trust Fund will be exhausted in 2018 and recommend a reallocation of the payroll tax rate between OASI and DI, as was done in 1994.

?The 2010 Social Security Trustees Report confirms that the Social Security program is weathering these difficult economic times, providing stability and security to millions of Americans rocked by the recession. In the face of this adversity, the Social Security program has stood its ground, and remains able to pay all benefits through 2037, the same date the Trustees projected last year. Americans should be encouraged by this good news from the Trustees? Report. And contrary to the doom and gloom crowd?s crisis calls, the Medicare Trustees confirm recently enacted Medicare reforms will add years to that program?s solvency.?…Barbara B. Kennelly, President/CEO, The National Committee to Preserve Social Security and Medicare

Dancing Grannies for Medicare

Here’s our favorite video of the month by far! More than 100 folks showed up in Manhattan on Medicare’s Anniversary to protest the Fiscal Commission’s targeting Medicare for cuts in the name of deficit control.