Posted on 12/6/2017 3:55 PM By NCPSSM

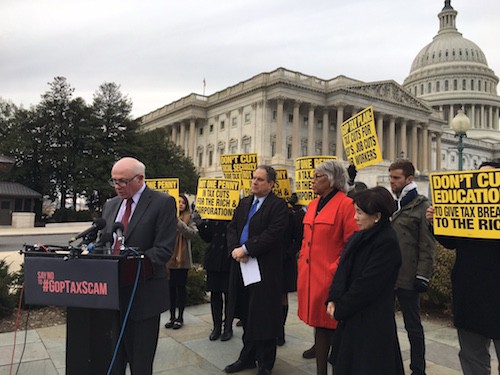

As Republicans remain indifferent – or in denial – about the impact of the Trump/GOP tax scam on older Americans, seniors’ defenders are sounding the alarm. National Committee president and CEO Max Richtman joined House Minority Leader Nancy Pelosi and other Democratic representatives in front of the U.S. Capitol today to warn of the dangers the tax plan poses to seniors’ retirement and health security. Richtman called the tax bill a “con game that should be called the ‘Washington two-step.’”

“Step one is cutting taxes for top-earning households and profitable corporations. Step two: use the higher deficits the tax bill will create to cut critical programs, like Medicare, Medicaid and Social Security.” – Max Richtman, NCPSSM president and CEO, 12/6/17

Senator Marco Rubio (R-FL) let the cat out of the bag when he acknowledged that Republicans will come after seniors’ earned benefit programs as soon as the tax cut passes. In fact, the tax bill will trigger an immediate $25 billion cut to Medicare unless Congress quickly waives the PAYGO provision of federal budget law. (Both Medicare and Medicaid – which helps seniors afford long-term care – are targeted for deep cuts in the GOP budget plan.) The tax scam also hurts older Americans by zeroing out the Obamacare coverage mandate penalty (which could result in higher premiums for 50-64 year-olds). It also imposes the paltry “Chained CPI” as an inflation index for taxes, which could later bleed over into Social Security cost-of-living adjustments and shrink badly needed increases in retirees’ checks.

Congresswoman Jan Schakowsky (D-IL) called the tax bill “the first step in the Republican plan to undermine the financial and health security of older Americans.”

Rep. Doris Matsui (D-CA) observed that the threat to seniors from the GOP tax legislation “keeps getting worse and worse” and said the bill would have “cruel and dire” consequences. She slammed the House bill’s repeal of the medical expense deduction, which millions of seniors use to mitigate high out-of-pocket medical and long-term care costs.

Republican members of a House-Senate conference committee are currently meeting behind closed doors to work out the differences between each chamber’s version of the tax bill. Leadership hopes to pass a final bill and send it to President Trump for signature before Christmas – perhaps the worst holiday gift Congress could possibly give to the American people. Seniors and their advocates are right to be concerned about this legislation, which is deeply unpopular with the public (only 29% of Americans support it in the most recent polling). But after years of dreaming about slashing Social Security, Medicare, and Medicaid, Republicans are now in a position to carry out their craven plans – without apparent regard for public opinion, fairness, or decency.

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]