The Trump administration has relented to pressure from seniors’ advocates and members of Congress, reversing course on what would have been an unjust policy toward older Americans struggling through the Coronavirus crisis. The Treasury Department announced last night that Social Security recipients do not have to file tax returns in order to receive COVID-19 stimulus payments. Instead, Treasury will use beneficiaries’ annual 1099 statements to generate stimulus checks.

Earlier this week, in direct contravention of the CARES relief act, the I.R.S. published guidelines that seemed to require seniors and the disabled receiving Social Security to file tax returns if they wanted stimulus checks. Advocacy groups and several members of Congress pushed back hard, demanding that Treasury reverse course and respect the letter of the law.

The administration succumbed to that pressure in less than one day, with Treasury Secretary Mnuchin announcing:

“Social Security recipients who are not typically required to file a tax return need to take no action, and will receive their payment directly to their bank account.” – Treasury Secretary Steven Mnuchin

The new IRS guidelines would have imposed an undue hardship on seniors and the disabled, who do not always have the internet access or technical acumen to file taxes online — and are limited in other means of filing during the COVID-19 pandemic.

As we insisted in yesterday’s edition of Entitled to Know:

“The Trump Treasury Department and the I.R.S. must immediately clear up any doubt — and relieve America’s most vulnerable citizens of the obligation to file tax returns to get the cash payments they so badly need during this pandemic.” – National Committee to Preserve Social Security and Medicare, 4/1/20

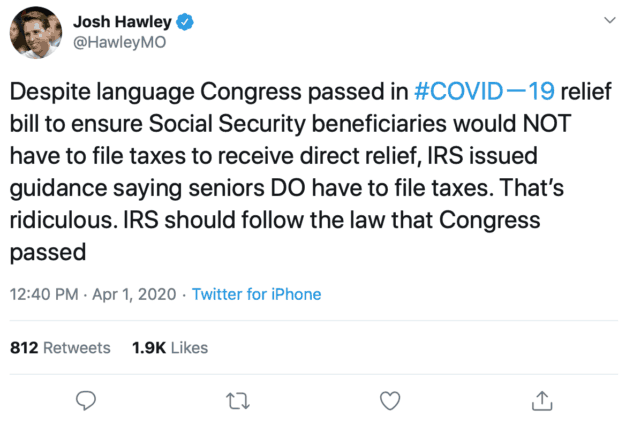

More than forty members of Congress sent a letter to Treasury Secretary Steven Mnuchin demanding a reversal of the new guidelines. Republican Senator Josh Hawley, not known as a moderate by any means, tweeted Wednesday that the administration’s announced policy was “ridiculous.”

One of Social Security’s leading champions in the U.S. House, Rep. John Larson (D-CT), released a statement today hailing the administration’s about-face:

“The Treasury Department made the right decision to reverse its misguided proposal and ensure that Social Security beneficiaries will automatically receive their economic impact payments as Congress had intended.”

The reversal capped an intense 24 hours of resistance from advocates who demanded that the administration adhere to the just-enacted CARES Act:

“The drafters of the CARES Act were clearly trying to correct the mistakes of the 2008 stimulus payments. Lawmakers that year required roughly 15 million Social Security beneficiaries and veterans to file tax returns to get their stimulus payments, even though they had no other need to file a return and the federal government already had the necessary information to send them payments directly.” – Center for Budget and Policy Priorities, 3/31/20

The administration’s original position – that Social Security beneficiaries would have to file taxes to get stimulus payments – no matter how ill-considered, was not out of character. Trump’s Social Security Administration (SSA) and Centers for Medicare and Medicaid Services (CMS) have been actively trying to undermine Americans’ earned benefits through a variety of measures over the past three years. The President’s budgets have sought to cut Social Security, Medicare, and Medicaid by trillions of dollars. His advisors and his allies in Congress have called for “entitlement reform” in order to pay for the Trump/GOP tax cuts of 2017. Although the administration reversed course this week amid intense pressure, seniors and their advocates will continue to insist that this administration stop asking seniors – who have done so much for this country – to make disproportionate sacrifices during times of crisis.