Senator Bernie Sanders and Rep. Peter DeFazio introduced landmark legislation yesterday to keep Social Security solvent for the next six decades — without cutting anyone’s benefits. The National Committee endorses the bill, titled the Social Security Expansion Act, introduced on the day when the average millionaire reaches the payroll tax income cap of $127,000 per year.

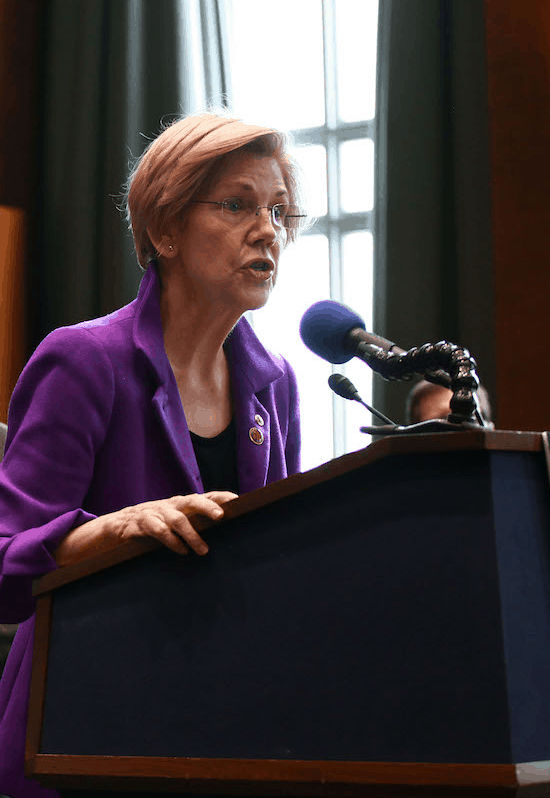

National Committee President Max Richtman joined Senator Sanders, Senator Elizabeth Warren, Rep DeFazio and other dignitaries and advocacy groups on Capitol Hill to mark the day and support the new legislation, which would require high-earners to pay Social Security taxes on annual income over $250,000.

National Committee President Max Richtman joined Senator Sanders, Senator Elizabeth Warren, Rep DeFazio and other dignitaries and advocacy groups on Capitol Hill to mark the day and support the new legislation, which would require high-earners to pay Social Security taxes on annual income over $250,000.

The bill doesn’t “scrap the cap” right away; but for now only income between $127,000 and $250,000 would be exempt from payroll taxes. Eventually the cap would phased out and completely scrapped. The expanded payroll taxes (which only affect the top 1.5% of earners) would keep the Social Security Trust Fund flush until at least 2078.

“We can expand the life of Social Security for 61 years, if we have the guts to tell millionaires and billionaires they’re going to have to pay more in taxes.” – Sen. Bernie Sanders

Senator Warren passionately defended the bill, saying it is necessary because, under current law:

Senator Warren passionately defended the bill, saying it is necessary because, under current law:

“…Once [the wealthy] hit the cap, they can earn and earn and earn without paying into the system. We want a Social Security system that works of all America, not just the millionaires and billionaires.” – Sen. Elizabeth Warren

NCPSSM President Max Richtman referred to a favorite metaphor involving a high-earning NBA superstar paying into Social Security. “He’s already hit the cap and is done contributing before the first quarter of the first game of the season is over.” On a more serious note, he continued, “We are here today to say that for those who have so much, it is only right that they pay their fair share into the Social Security program.”

Richtman used the occasion to recall the words of President Franklin D. Roosevelt, who started the Social Security system:

“The test of our progress is not whether we add more to the abundance of those who have much, it is whether we provide enough for those who have little.” – FDR

In addition to lifting the cap, the Sanders-DeFazio bill increases Social Security benefits by an estimated $65 a month, improves the Special Minimum Benefit by making it easier for low-income workers to qualify for benefits, and links the cost-of-living adjustment (COLA) formula to a new Consumer Price Index for the Elderly (CPI-E) to factor in costs seniors traditionally face such as prescription drugs, utility bills and property taxes.