The 2013 Trustees report shows, once again, Social Security is not facing a crisis.

The 2013 Trustees report shows, once again, Social Security is not facing a crisis.

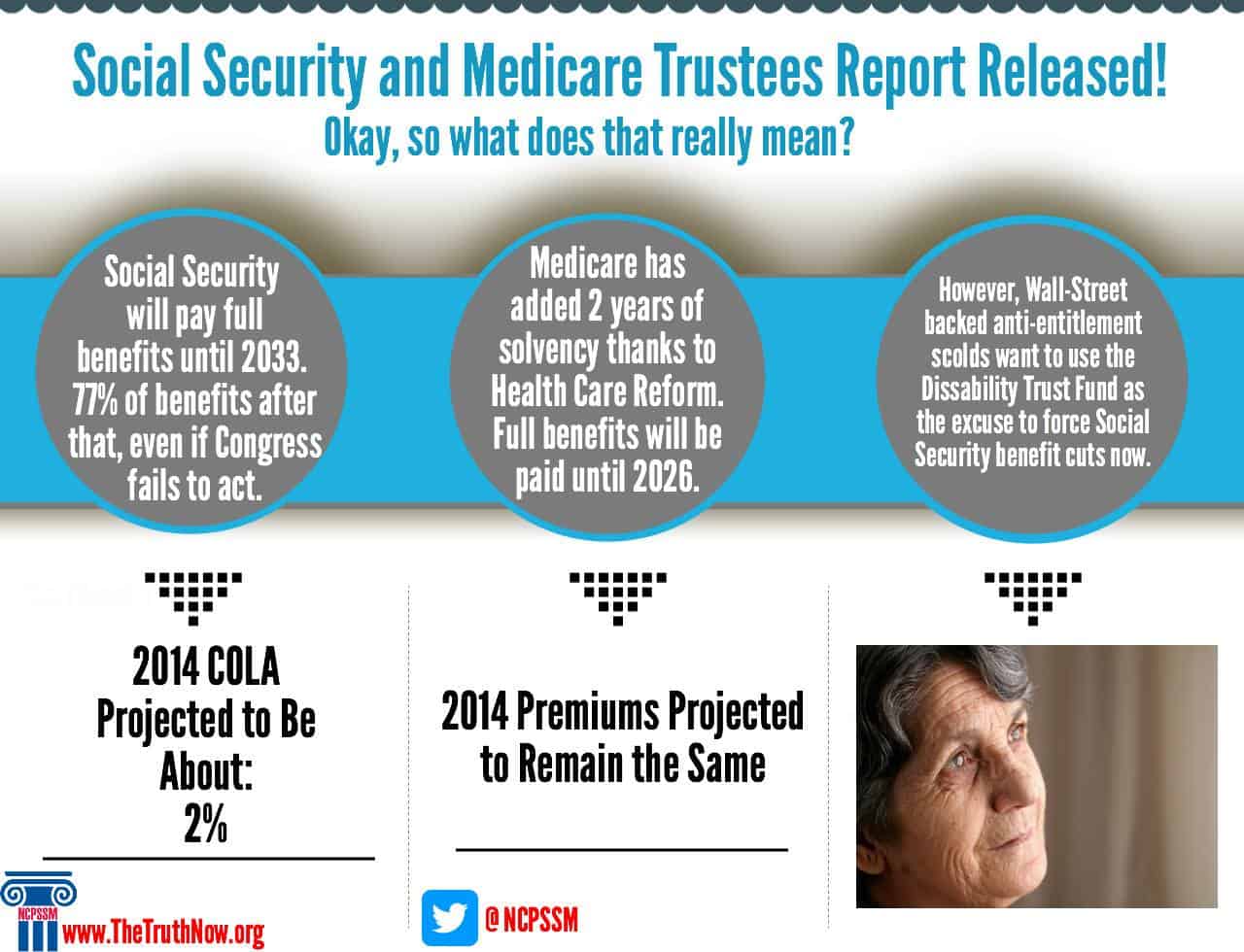

- Trustees project Social Security will be able to pay full benefits until the year 2033. After that, Social Security will have sufficient revenue to pay 77% of benefits.

- Social Security is still well funded. In 2013, as the economy regains its footing, Social Security’s total income is projected to exceed its expenses. In fact, the Trustees estimate that total annual income will exceed program obligations until 2020.

- Trustees project a Cost of Living Adjustment increase of 1.5% to 2.5% in 2014.

With so little bad news to report in this 2013 Trustees report, critics have now shifted their attention to Social Security Disability, which faces a more immediate fiscal challenge

- Trustees project the Disability Trust fund will be depleted in 2016, the same year projected in last year’s report. This projected shortfall is not a surprise and Congress should reallocate income across the Social Security Trust funds, as it has done 11 times before, to cover the anticipated shortfall. Disability expenditures have increased primarily due to demographic trends. The increase in full retirement age from 65 to 66 has also contributed to the increase in disability expenditures, as people remain on the disability rolls longer before shifting to retirement. However, when Congress took action in 1994 to address a then-reported shortfall in DI, it knew that it would have to take action again in 2015 or 2016.

The 2013 Trustees report shows slowing the growth of health care costs has improved Medicare’s Trust Fund.

- Medicare solvency remains greatly improved thanks to passage of healthcare reform, with the program paying full benefits until 2026, two years later than the 2012 report. Health care spending has also grown much more slowly. Since late 2010, CBO has reduced its projection of cumulative Medicare and Medicaid spending over the 2011-2020 period by $900 billion – or nearly 10 percent.

- Medicare Part B premiums are not projected to increase in 2014.

Here’s reaction from NCPSSM’s President/CEO, Max Richtman:

“As we emerge from the worst economic downturn since the Great Depression, it’s clear our nation’s retirement security programs, Social Security and Medicare, continue to do their jobs admirably by protecting millions of Americans during these troubled times. Unfortunately, for too many in Washington, this annual Trustees report is little more than an opportunity to re-issue the same doom-and-gloom news releases and renewed calls to cut these programs in order to ‘save’ them, regardless of the fiscal facts. The truth is the Trustees 2013 report shows Social Security has a $2.7 trillion surplus which continues to grow. Social Security isn’t bankrupt; it hasn’t contributed a dime to our fiscal woes and, in fact, has performed its mission without fail.

On the Medicare front, the good news is health care reform has extended the solvency of the Medicare Trust Fund and health care cost growth is slowing. The Affordable Care Act is making a difference not just in Medicare, but is also slowing the rising cost of health care for all Americans.”