Legislation just introduced in the U.S. House would put extra money in Social Security beneficiaries’ pockets while keeping the system solvent through the rest of this century. Rep. John Larson’s Social Security 2100 Act does all of that and something more: It gives lie to the myth that Social Security is going bankrupt and the only way to fix it is by cutting benefits.

Larson’s solution is simple… and fair. It asks the wealthy to pay their fair share of Social Security payroll taxes. In exchange, the legislation ensures Social Security stays solvent through the year 2100 – with no benefit cuts and no turning over the program to Wall Street, which budget hawks have long dreamed of doing.

The Act provides much needed relief to seniors who are having a difficult time paying for basic expenses like healthcare, housing, and utilities. The bill includes a modest 2% benefit increase for all beneficiaries, higher cost of living adjustments (COLAs), and a tax break for 11 million seniors. Since 2014, the National Committee’s Boost Social Security Now campaign has lobbied Congress to pass expansion legislation on behalf of its millions of members and supporters.

In a Facebook Live interview with the National Committee, Congressman Larson says he hopes his bill will ride the wave of grassroots energy that defeated the GOP healthcare plan last month. “What we saw was people saying, ‘Wait a minute, keep your hands off my healthcare.’ It’s the same with Social Security. We want to continue to build a groundswell in this country.” Larson says the bill has already attracted more than 150 cosponsors in the House. The Congressman calls on President Trump to support it, based on his campaign promises to “protect” Social Security.

In order to keep the system solvent through the year 2100, the Larson bill would apply the Social Security payroll tax to wages above $400,000, which only would affect the top 0.4% of wage earners. (Currently, earnings above $127,200 are exempt from the payroll taxes.) Eventually, the cap would be phased out completely. In addition, the legislation would gradually raise the overall payroll tax rate by 1% over 25 years – an increase of only 50 cents per week for a worker making $50,000 per year (or, as Larson himself is fond of pointing out, the price of one Starbucks coffee drink every nine weeks). These financing changes would not only keep Social Security flush, they would allow for a modest 2% benefit increase for all beneficiaries — and a tax break for 11 million seniors earning under $50,000 a year (or $100,000 for older married couples).

The Larson bill not only provides an increase in benefits, it would help retirees better keep up with inflation by linking cost of living adjustments (COLAs) to an index called the CPI-E (Consumer Price Index for the Elderly). The CPI-E takes into consideration what seniors really spend for crucial goods and services, including housing and medical costs.

The National Committee has enthusiastically endorsed the Social Security 2100 Act. As President and CEO Max Richtman explains, “This bill is a win-win for beneficiaries and the entire country, because it protects the commitment to hard working Americans who pay into the system and enhances benefits.”

**************************************************************

Watch Congressman Larson’s full Facebook Live interview here.

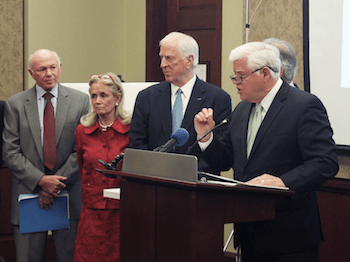

Watch the Social Security 2100 Act event on Capitol Hill Facebook Live here.