Reassurance & Warning at Social Security Town Hall in Las Vegas

The message at Thursday’s NCPSSM/AARP town hall in Las Vegas was: the government may temporarily shut down on September 30th, but Social Security is here to stay. The town hall, entitled “Social Security: Here Today, Here Tomorrow,” was an opportunity for nearly 100 Las Vegas residents to hear from some of the nation’s leading experts about the enduring value of Social Security — and to receive reassurance that benefits still will be paid during a shutdown.

“We believe it is especially important to be holding this town hall here in Las Vegas,” said AARP Nevada State Director, Maria Moore. “Nevada has 565,000 Social Security beneficiaries, including over 30,000 children.” Moore also pointed out that Social Security benefits inject $9 billion each year into the state’s economy.

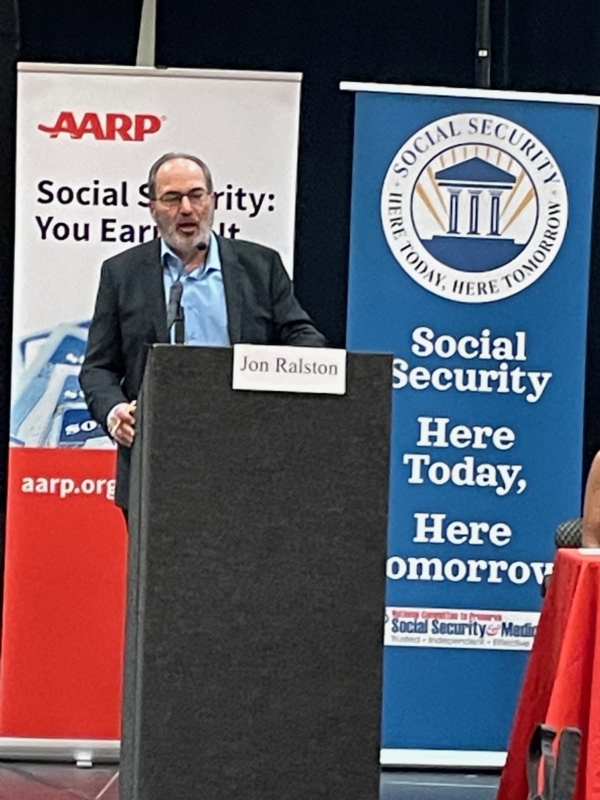

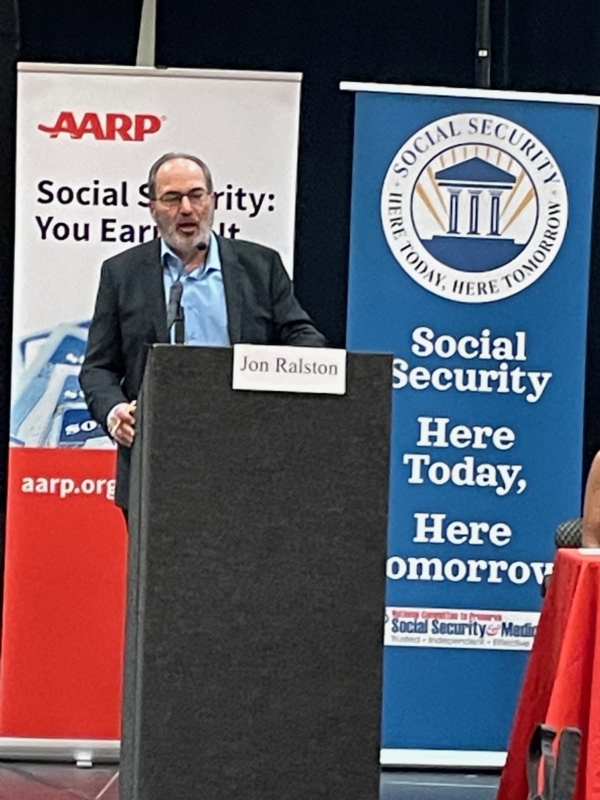

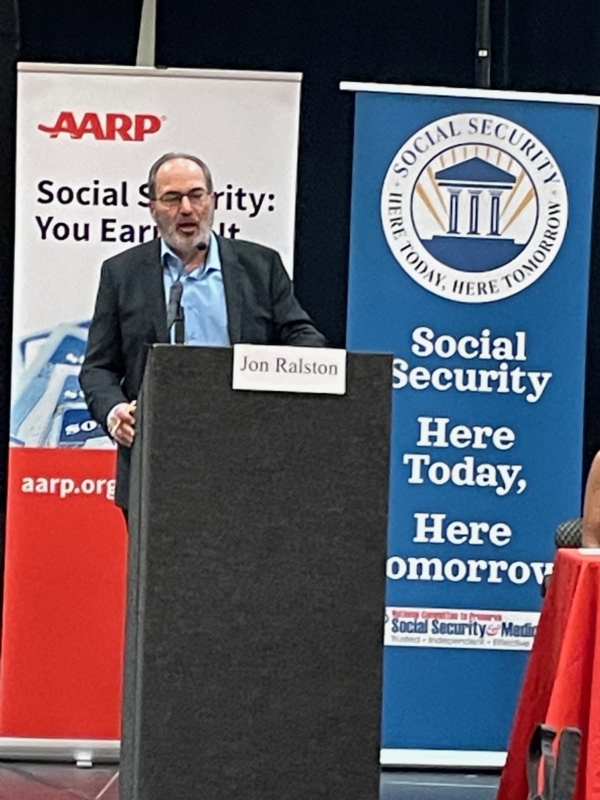

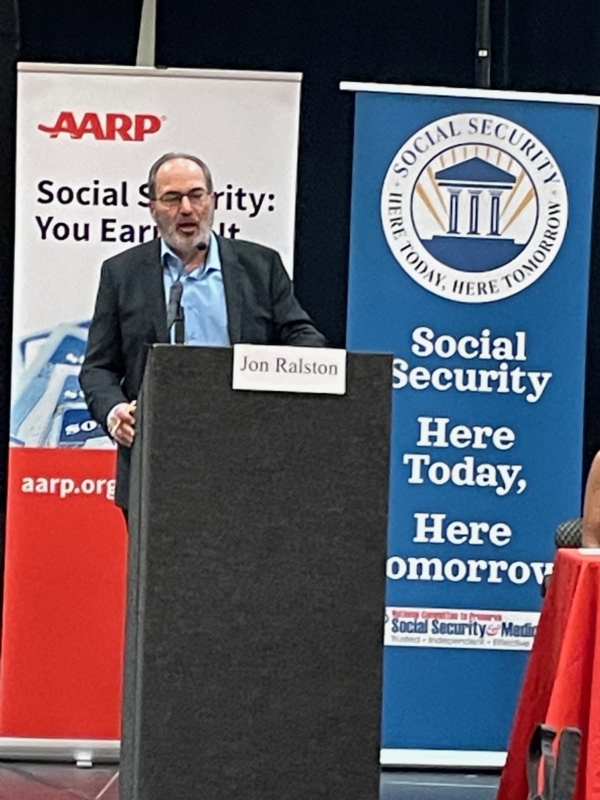

The Las Vegas event was one of a series of town halls that AARP and NCPSSM are holding across the country this year as part of a public education campaign to enhance Americans’ knowledge about the program. “Social Security isn’t only a retirement program,” said moderator Jon Ralston (of the Nevada Independent) in welcoming the audience to the town hall. “It is social insurance for families, providing financial support after the loss of a family breadwinner’s income through retirement, disability, or death.”

Jon Ralston, founder of the Nevada Independent, moderated the town hall

The town hall came as time was running short for Congress to avert a likely government shutdown on September 30. A shutdown would not directly impact Social Security benefits, but could put additional strain on the already underfunded Social Security Administration (SSA). Annie Walters, public affairs specialist at the SSA Nevada office and a panelist at the town hall, said that making sure benefits are paid is a “priority” for SSA. “Our plan is that benefits will go out,” she told the audience.

Walters said that SSA’s contingency plan is designed to ensure that critical customer service issues still are addressed during a shutdown. However, she said, it may be difficult for beneficiaries to obtain benefit verification letters if the government shuts down, because that is not considered a “critical” service.

SSA has been struggling to provide adequate customer service for more than a decade thanks to chronic underfunding that began with the Tea Party-fomented debt limit crisis in 2011. Former acting Social Security Commissioner Carolyn Colvin told the town hall audience that SSA needs more funding to better serve the public.

NCPSSM President and CEO Max Richtman busted several myths about Social Security, such as “Social Security is going bankrupt”; “Illegal immigrants are collecting Social Security”; or that Social Security is an “entitlement.” “It is not an ‘entitlement.’ It’s an earned benefit,” he said.

Richtman warned against proposals in Congress that would cut Social Security benefits, including raising the retirement age to 69 or 70. “Just because some people are living longer doesn’t mean all Americans can work longer. Raising the age is a benefit cut, plain and simple,” he said.

He also pushed back against Congressional proposals to create a special commission to scrutinize Social Security on the false assumption that it contributes to the debt. (Social Security is completely self-funded and does not add a penny to the debt.) Speaker Kevin McCarthy reportedly is including a fiscal commission in the House Republicans’ stopgap funding bill.

“If recommendations from a commission are bundled together and enacted quickly, it allows Congress to avoid political accountability,” Richtman told the audience. He said that some members of Congress want “political cover” to cut benefits, knowing that Social Security is enormously popular with voters.

Nearly 100 Nevadans attended the AARP/NCPSSM town hall in Las Vegas on 9/28/23

Attendees of the town hall included retirees and Nevadans who are still working. Rebecca McDuffie, an inventory control clerk, said she attended in hopes of finding out “What is the right time to claim benefits?” She also seeks reassurance that Social Security will be around by the time she retires.

Davina Koehler, a retired kitchen manager for the county school system, had questions about the amount of her Social Security survivor’s benefit. Others asked, “If I collect VA benefits, does it affect my Social Security benefits.” (The answer: no.) Also: “Do I get a lower benefit if I continue working?” (Before full retirement age, benefits can be reduced if you’re working; after full retirement age, there are no limits on how much you can earn through employment.)

Representatives from the offices of Senator Catherine Cortes Masto (D-NV) and Rep. Dina Titus’ (D-NV) were on hand to respond to attendees’ questions. Former Commissioner Colvin urged everyone to set up a My Social Security account for more information about their current or future benefits.

The final “Social Security: Here Today, Here Tomorrow” town hall will take place in Milwaukee, WI on November 1, 2023.

For more information about the campaign, visit www.socialsecurityheretoday.org

Would a Government Shutdown Affect Social Security and Medicare?

First, the good news. Even if the government shuts down at the end of this week because of House Republican intransigence, Social Security benefits will continue to be paid and customer service for retirees should not get significantly worse – in the short term, anyway. Medicare benefits would not be affected, either — but beneficiaries would be unable to obtain replacement Medicare cards during a shutdown. (Social Security cards would still be available, but benefit verifications will not.)

Now, the bad news. The impending shutdown is symptomatic of a disorder in Congress that seniors should care about: MAGA hardliners once again gumming up the works of a government which best serves the public when operating smoothly, without needless disruptions. (See last spring’s default crisis, promulgated by the House GOP.) Many of these are the same House Republicans who have proposed to cut Social Security. The MAGA faction also wants to slash the already underfunded Social Security Administration’s (SSA) budget by 8%, which could have devastating effects on customer service.

Fortunately, Social Security benefits would continue to be paid during a shutdown because they are considered by law to be mandatory spending. (It should be noted that GOP Senator Ron Johnson proposed in 2022 that Social Security and Medicare no longer be considered mandatory.) Any Social Security Administration employees with a role in administering Social Security benefits are considered “essential personnel” and would not be furloughed during a shutdown. But these workers will not be paid until the shutdown is over. Some 8,500 of SSA’s 62,000 employees would be furloughed as “non-essential,” according to NCPSSM’s senior Social Security analyst, Maria Freese.

“Anything that slows the process down, and makes it more challenging, is something that everybody ought to worry about. This is an agency with over 60,000 employees — none of whom is going to get paid during a shutdown. Yes, the agency will continue to function. But it costs the government money as the agency falls further behind” – Maria Freese, NCPSSM senior Social Security analyst

While retirement benefits should remain largely unscathed, Social Security Disability Insurance (SSDI) determinations could be affected by a shutdown. Kathleen Romig of the Center on Budget and Policy Priorities told CBS News that state-level offices that determine eligibility for disability benefits may close, as they have in the past. “Because there are already huge backlogs in SSDI disability decisions, a government shutdown could worsen delays,” Romig said.

The House and Senate are running out of time to pass legislation (known as a “continuing resolution” or CR) to keep the government open past the end of the fiscal year on September 30th. “Sometime between now and the end of the week, the House would have to pass a CR, and there’s no agreement on how to do that,” said Freese. This is largely because MAGA House Republicans have demanded painful spending cuts (along with several spurious and unrelated demands). House Speaker Kevin McCarthy does not have the support within his own caucus to pass a CR, and he has so far been unwilling to work with Democrats to amass enough votes to avoid a shutdown.

Last week, we asked Maria Freese why some House Republicans seem perfectly willing to shut the government down for ideological reasons, regardless of the impact on everyday Americans. “I like to hope that they are simply unaware of the hardships that shutdowns cause to their own constituents, as some Republicans have said publicly that they don’t believe anyone would notice or care if the government closed,” said Freese. ” I believe this kind of cavalier attitude about our government demonstrates a lack of understanding and appreciation for the many services agencies like SSA provide to the average American senior.”

House GOP Spending Proposal Would Slash Social Security Administration Funding

House Republicans have agreed on a short-term measure to avert a government shutdown. They propose a continuing resolution (CR) that would run through the end of October. The proposed CR includes an overall cut in spending of 1% for those 31 days, but fully protects defense, veterans and disaster relief funding. That means an 8% spending cut from current funding for all other agencies, including the Social Security Administration (SSA). We spoke to NCPSSM senior legislative representative, Maria Freese, about what this means for the beleaguered SSA and the millions of claimants who rely on it.

Q: What would an 8% cut in the operating budget of SSA do to the SSA? What impact would that have on customer service?

A: Of course we don’t know exactly what the impact of any cut will be on SSA, but we do know they have already requested an increase of $727 million above current funding, as a minimum, for FY 2024. Without this level of funding, they will be forced to reduce staffing and overtime, which will hurt the agency’s ability to serve the public. Without that minimum level of funding, SSA’s customers will wait significantly longer for field office services, disability decisions, and phone support. A cut in funding will only make the problem worse, especially as the agency will have little time to plan for and implement such a drastic cut.

Q: If anything, SSA Needs a funding BOOST, doesn’t it?

A: Absolutely. We still have an average of 10,000 baby boomers reaching retirement age every day, which means demand for services from SSA continues to increase. When combined with the impact of inflation, it’s clear the agency needs more money to operate. Not only do they need to keep up with an increasing current demand, but decades of underfunding have left the agency with significant backlogs that they need to address. About 110,000 Americans have already died over the last decade waiting for disability determinations from SSA, a problem which will only get worse if the agency continues to be underfunded.

Q: How much of a funding increase would NCPSSM like to see SSA receive?

A: At a minimum, we support the Administration’s request of $15.5 billion for FY 2024, an amount which would help the agency keep up with current demand while continuing to reduce backlogs and update its technology. This is still a billion dollars below what the agency itself believes it needs to do its job adequately, but well above any of the funding levels being considered by Congress.

Q: Also, isn’t SSA supposed to be funded mainly through payroll taxes? So why slash it? Haven’t workers already paid for these services, in effect?

A: Yes, that is one of the truly frustrating things about SSA’s funding conundrum. SSA is fully funded by workers’ payroll taxes but unfortunately, (for accounting purposes) the agency is technically ‘on budget.’ This means that although SSA operations have already been paid for by American workers with every paycheck, the agency still must compete with every other government service for funding.

Q: What does it say about House Republicans’ priorities that they want to exempt military spending from cuts but are anxious to slash domestic spending like SSA operations in exchange for keeping the government open?

A: I like to hope that they are simply unaware of the hardships that shutdowns cause to their own constituents, as some Republicans have said publicly that they don’t believe anyone would notice or care if the government closed. I believe this kind of cavalier attitude about our government demonstrates a lack of understanding and appreciation for the many services agencies like SSA provide to the average American senior.

Q: NCPSSM has previously said that a shutdown, if it happens, would negatively impact SSA services. Is that still the case?

A: Yes, though the extent of the impact will partly depend on the length of the shutdown. Most SSA employees are exempt from the furloughs required during a government shutdown because the law requires that Social Security checks continue to be paid. Any employee essential to ensuring that those benefits are paid remains on the job. But agency employees are limited in the functions they can perform during a shutdown, so some services, such as the processing of disability claims, inevitably would be impacted.

It’s Time to Repeal WEP & GPO, Says NCPSSM & National Task Force

NCPSSM participated in an event on the Capitol Grounds Wednesday to call for the repeal of the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), which prevent millions of public employees and their families from collecting full Social Security benefits. The event was organized by the National WEP/GPO Repeal Task Force — a coalition of advocates representing public sector workers.

Congress created the GPO in 1977 to help ensure that spousal and widow(er) benefits of those with covered or non-covered lifetime earnings would be roughly equal. The Windfall Elimination Provision (WEP), enacted in 1983, reduces the Social Security benefits of workers who receive pensions from a federal, state, or local government for employment not covered by Social Security.

Advocates argue that these provisions – originally intended to make Social Security benefits fairer – actually penalize public sector employees like teachers, firefighters, police officers, and federal workers.

“In enacting the WEP and GPO, Congress created a completely different set of inequities, slashing Social Security benefits for some even though their payroll contributions might be exactly the same as their fellow Americans whose work history was entirely within the Social Security system,” said NCPSSM President Max Richtman at the Wednesday event.

The WEP and GPO, Richtman said, leaves millions of retirees and their families with little or no Social Security benefits, despite decades of contributions in payroll taxes.

NCPSSM has endorsed legislation favored by the National WEP/GPO Repeal Task Force, the Social Security Fairness Act:

The bill eliminates the government pension offset, which in various instances reduces Social Security benefits for spouses, widows, and widowers who also receive government pensions of their own.

The bill also eliminates the windfall elimination provision, which in some instances reduces Social Security benefits for individuals who also receive a pension or disability benefit from an employer that did not withhold Social Security taxes.

The National WEP/GPO Repeal Task Force is leading a grassroots movement to spur Congress to enact the Social Security Fairness Act. “This is a serious issue that’s gone on way too long,” said Suzie Dixon, President of the California Retired Teachers Association and vice-chair of the task force. “It is time to let teachers, firefighters, police officers and other public sector employees live their senior years in dignity.”

NCPSSM also strongly endorses Rep. John Larson’s Social Security 2100 Act, which would repeal the WEP & GPO in addition to strengthening the program’s finances and boosting retirees’ benefits.

NCPSSM To Participate in Harkin Social Security Symposium in DC

The Harkin Institute’s Director of Retirement Security, Rayna Stoycheva, says the symposium, Preserving and Enhancing Social Security for All, comes at a crucial time for Social Security. “In the last couple of years, there has been an uptick in legislative proposals focused on balancing the trust fund and enhancing the Social Security program,” says Stoycheva. “We thought that a symposium that focuses on the program in more detail was timely — and would serve our mission to connect citizens with the policy making process.”

For the National Committee to Preserve Social Security and Medicare, the exchange of ideas with other advocates is crucial to its mission. “Senator Harkin is the chair of our advisory board and a true champion of Social Security, so we are especially honored to have a role in this symposium,” says Richtman.

“We applaud the Harkin Institute for bringing together so many thought leaders in this field at a time when Social Security faces considerable financial and political challenges. Events like this are crucial to ensure that the program is protected and expanded rather than cut and privatized, as some in Washington have proposed.” – Max Richtman, NCPSSM President and CEO

The keynote speakers for the symposium are Stephen Goss, Chief Actuary at the Social Security Administration and Rep. John Larson (D-CT), author of the Social Security 2100 Act to protect and expand the program.

Social Security Chief Actuary Stephen Goss & Rep. John Larson are keynote speakers

Registration is now open for up to 200 attendees. The intended audience for the symposium is: policymakers, researchers, practitioners, and retirement security professionals. “Anyone dedicated to improving retirement security and reducing poverty and inequality will find value in this symposium,” says Stoycheva. “The event will lay out what options we can consider in the coming years to achieve the mission of preserving Social Security.”

Specifically, the symposium will shed light on some important questions, including:

How has the Social Security program evolved over the years?

What role does it play for retirement security in the current retirement system?

What are the distributional effects of different proposals?

What is the outlook for specific legislative action in the next 10 years?

NCPSSM President Richtman will lead a panel entitled, “Public Opinion on Social Security Reform and Legislative Agenda,” featuring several speakers including Nancy LeaMond, Executive Vice President and Chief Advocacy & Engagement Officer at AARP.

Other VIP panelists at the symposium include: William Arnone (NASI), Rich Fiesta (Alliance for Retirement Americans), Monique Morrissey (Economic Policy Institute), Kathleen Romig (CBPP), Teresa Ghilarducci (New School for Social Research), Jeff Cruz (AFGE), Rebecca Vallas (Century Foundation), and Nancy Altman (Social Security Works).

“This is an amazing group of policy leaders in this space!” says Stoycheva. “Putting together the program has truly been a collaborative effort involving many different people.” Stoycheva credits, in particular, Alicia Munnell of the Center for Retirement Research at Boston College and William Arnone (Executive Director at the National Academy of Social Insurance) for helping put the program together, with additional input from Richtman and Social Security Works president, Nancy Altman.

There still is time to register for the symposium at: https://harkininstitute.drake.edu/2023/07/19/2023-harkin-retirement-security-symposium/

“There are still some spaces left,” says Stoycheva. “We encourage anyone in this field with a stake in the future of Social Security to avail themselves of this opportunity.”

Reassurance & Warning at Social Security Town Hall in Las Vegas

The message at Thursday’s NCPSSM/AARP town hall in Las Vegas was: the government may temporarily shut down on September 30th, but Social Security is here to stay. The town hall, entitled “Social Security: Here Today, Here Tomorrow,” was an opportunity for nearly 100 Las Vegas residents to hear from some of the nation’s leading experts about the enduring value of Social Security — and to receive reassurance that benefits still will be paid during a shutdown.

“We believe it is especially important to be holding this town hall here in Las Vegas,” said AARP Nevada State Director, Maria Moore. “Nevada has 565,000 Social Security beneficiaries, including over 30,000 children.” Moore also pointed out that Social Security benefits inject $9 billion each year into the state’s economy.

The Las Vegas event was one of a series of town halls that AARP and NCPSSM are holding across the country this year as part of a public education campaign to enhance Americans’ knowledge about the program. “Social Security isn’t only a retirement program,” said moderator Jon Ralston (of the Nevada Independent) in welcoming the audience to the town hall. “It is social insurance for families, providing financial support after the loss of a family breadwinner’s income through retirement, disability, or death.”

Jon Ralston, founder of the Nevada Independent, moderated the town hall

The town hall came as time was running short for Congress to avert a likely government shutdown on September 30. A shutdown would not directly impact Social Security benefits, but could put additional strain on the already underfunded Social Security Administration (SSA). Annie Walters, public affairs specialist at the SSA Nevada office and a panelist at the town hall, said that making sure benefits are paid is a “priority” for SSA. “Our plan is that benefits will go out,” she told the audience.

Walters said that SSA’s contingency plan is designed to ensure that critical customer service issues still are addressed during a shutdown. However, she said, it may be difficult for beneficiaries to obtain benefit verification letters if the government shuts down, because that is not considered a “critical” service.

SSA has been struggling to provide adequate customer service for more than a decade thanks to chronic underfunding that began with the Tea Party-fomented debt limit crisis in 2011. Former acting Social Security Commissioner Carolyn Colvin told the town hall audience that SSA needs more funding to better serve the public.

NCPSSM President and CEO Max Richtman busted several myths about Social Security, such as “Social Security is going bankrupt”; “Illegal immigrants are collecting Social Security”; or that Social Security is an “entitlement.” “It is not an ‘entitlement.’ It’s an earned benefit,” he said.

Richtman warned against proposals in Congress that would cut Social Security benefits, including raising the retirement age to 69 or 70. “Just because some people are living longer doesn’t mean all Americans can work longer. Raising the age is a benefit cut, plain and simple,” he said.

He also pushed back against Congressional proposals to create a special commission to scrutinize Social Security on the false assumption that it contributes to the debt. (Social Security is completely self-funded and does not add a penny to the debt.) Speaker Kevin McCarthy reportedly is including a fiscal commission in the House Republicans’ stopgap funding bill.

“If recommendations from a commission are bundled together and enacted quickly, it allows Congress to avoid political accountability,” Richtman told the audience. He said that some members of Congress want “political cover” to cut benefits, knowing that Social Security is enormously popular with voters.

Nearly 100 Nevadans attended the AARP/NCPSSM town hall in Las Vegas on 9/28/23

Attendees of the town hall included retirees and Nevadans who are still working. Rebecca McDuffie, an inventory control clerk, said she attended in hopes of finding out “What is the right time to claim benefits?” She also seeks reassurance that Social Security will be around by the time she retires.

Davina Koehler, a retired kitchen manager for the county school system, had questions about the amount of her Social Security survivor’s benefit. Others asked, “If I collect VA benefits, does it affect my Social Security benefits.” (The answer: no.) Also: “Do I get a lower benefit if I continue working?” (Before full retirement age, benefits can be reduced if you’re working; after full retirement age, there are no limits on how much you can earn through employment.)

Representatives from the offices of Senator Catherine Cortes Masto (D-NV) and Rep. Dina Titus’ (D-NV) were on hand to respond to attendees’ questions. Former Commissioner Colvin urged everyone to set up a My Social Security account for more information about their current or future benefits.

The final “Social Security: Here Today, Here Tomorrow” town hall will take place in Milwaukee, WI on November 1, 2023.

For more information about the campaign, visit www.socialsecurityheretoday.org

Would a Government Shutdown Affect Social Security and Medicare?

First, the good news. Even if the government shuts down at the end of this week because of House Republican intransigence, Social Security benefits will continue to be paid and customer service for retirees should not get significantly worse – in the short term, anyway. Medicare benefits would not be affected, either — but beneficiaries would be unable to obtain replacement Medicare cards during a shutdown. (Social Security cards would still be available, but benefit verifications will not.)

Now, the bad news. The impending shutdown is symptomatic of a disorder in Congress that seniors should care about: MAGA hardliners once again gumming up the works of a government which best serves the public when operating smoothly, without needless disruptions. (See last spring’s default crisis, promulgated by the House GOP.) Many of these are the same House Republicans who have proposed to cut Social Security. The MAGA faction also wants to slash the already underfunded Social Security Administration’s (SSA) budget by 8%, which could have devastating effects on customer service.

Fortunately, Social Security benefits would continue to be paid during a shutdown because they are considered by law to be mandatory spending. (It should be noted that GOP Senator Ron Johnson proposed in 2022 that Social Security and Medicare no longer be considered mandatory.) Any Social Security Administration employees with a role in administering Social Security benefits are considered “essential personnel” and would not be furloughed during a shutdown. But these workers will not be paid until the shutdown is over. Some 8,500 of SSA’s 62,000 employees would be furloughed as “non-essential,” according to NCPSSM’s senior Social Security analyst, Maria Freese.

“Anything that slows the process down, and makes it more challenging, is something that everybody ought to worry about. This is an agency with over 60,000 employees — none of whom is going to get paid during a shutdown. Yes, the agency will continue to function. But it costs the government money as the agency falls further behind” – Maria Freese, NCPSSM senior Social Security analyst

While retirement benefits should remain largely unscathed, Social Security Disability Insurance (SSDI) determinations could be affected by a shutdown. Kathleen Romig of the Center on Budget and Policy Priorities told CBS News that state-level offices that determine eligibility for disability benefits may close, as they have in the past. “Because there are already huge backlogs in SSDI disability decisions, a government shutdown could worsen delays,” Romig said.

The House and Senate are running out of time to pass legislation (known as a “continuing resolution” or CR) to keep the government open past the end of the fiscal year on September 30th. “Sometime between now and the end of the week, the House would have to pass a CR, and there’s no agreement on how to do that,” said Freese. This is largely because MAGA House Republicans have demanded painful spending cuts (along with several spurious and unrelated demands). House Speaker Kevin McCarthy does not have the support within his own caucus to pass a CR, and he has so far been unwilling to work with Democrats to amass enough votes to avoid a shutdown.

Last week, we asked Maria Freese why some House Republicans seem perfectly willing to shut the government down for ideological reasons, regardless of the impact on everyday Americans. “I like to hope that they are simply unaware of the hardships that shutdowns cause to their own constituents, as some Republicans have said publicly that they don’t believe anyone would notice or care if the government closed,” said Freese. ” I believe this kind of cavalier attitude about our government demonstrates a lack of understanding and appreciation for the many services agencies like SSA provide to the average American senior.”

House GOP Spending Proposal Would Slash Social Security Administration Funding

House Republicans have agreed on a short-term measure to avert a government shutdown. They propose a continuing resolution (CR) that would run through the end of October. The proposed CR includes an overall cut in spending of 1% for those 31 days, but fully protects defense, veterans and disaster relief funding. That means an 8% spending cut from current funding for all other agencies, including the Social Security Administration (SSA). We spoke to NCPSSM senior legislative representative, Maria Freese, about what this means for the beleaguered SSA and the millions of claimants who rely on it.

Q: What would an 8% cut in the operating budget of SSA do to the SSA? What impact would that have on customer service?

A: Of course we don’t know exactly what the impact of any cut will be on SSA, but we do know they have already requested an increase of $727 million above current funding, as a minimum, for FY 2024. Without this level of funding, they will be forced to reduce staffing and overtime, which will hurt the agency’s ability to serve the public. Without that minimum level of funding, SSA’s customers will wait significantly longer for field office services, disability decisions, and phone support. A cut in funding will only make the problem worse, especially as the agency will have little time to plan for and implement such a drastic cut.

Q: If anything, SSA Needs a funding BOOST, doesn’t it?

A: Absolutely. We still have an average of 10,000 baby boomers reaching retirement age every day, which means demand for services from SSA continues to increase. When combined with the impact of inflation, it’s clear the agency needs more money to operate. Not only do they need to keep up with an increasing current demand, but decades of underfunding have left the agency with significant backlogs that they need to address. About 110,000 Americans have already died over the last decade waiting for disability determinations from SSA, a problem which will only get worse if the agency continues to be underfunded.

Q: How much of a funding increase would NCPSSM like to see SSA receive?

A: At a minimum, we support the Administration’s request of $15.5 billion for FY 2024, an amount which would help the agency keep up with current demand while continuing to reduce backlogs and update its technology. This is still a billion dollars below what the agency itself believes it needs to do its job adequately, but well above any of the funding levels being considered by Congress.

Q: Also, isn’t SSA supposed to be funded mainly through payroll taxes? So why slash it? Haven’t workers already paid for these services, in effect?

A: Yes, that is one of the truly frustrating things about SSA’s funding conundrum. SSA is fully funded by workers’ payroll taxes but unfortunately, (for accounting purposes) the agency is technically ‘on budget.’ This means that although SSA operations have already been paid for by American workers with every paycheck, the agency still must compete with every other government service for funding.

Q: What does it say about House Republicans’ priorities that they want to exempt military spending from cuts but are anxious to slash domestic spending like SSA operations in exchange for keeping the government open?

A: I like to hope that they are simply unaware of the hardships that shutdowns cause to their own constituents, as some Republicans have said publicly that they don’t believe anyone would notice or care if the government closed. I believe this kind of cavalier attitude about our government demonstrates a lack of understanding and appreciation for the many services agencies like SSA provide to the average American senior.

Q: NCPSSM has previously said that a shutdown, if it happens, would negatively impact SSA services. Is that still the case?

A: Yes, though the extent of the impact will partly depend on the length of the shutdown. Most SSA employees are exempt from the furloughs required during a government shutdown because the law requires that Social Security checks continue to be paid. Any employee essential to ensuring that those benefits are paid remains on the job. But agency employees are limited in the functions they can perform during a shutdown, so some services, such as the processing of disability claims, inevitably would be impacted.

It’s Time to Repeal WEP & GPO, Says NCPSSM & National Task Force

NCPSSM participated in an event on the Capitol Grounds Wednesday to call for the repeal of the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), which prevent millions of public employees and their families from collecting full Social Security benefits. The event was organized by the National WEP/GPO Repeal Task Force — a coalition of advocates representing public sector workers.

Congress created the GPO in 1977 to help ensure that spousal and widow(er) benefits of those with covered or non-covered lifetime earnings would be roughly equal. The Windfall Elimination Provision (WEP), enacted in 1983, reduces the Social Security benefits of workers who receive pensions from a federal, state, or local government for employment not covered by Social Security.

Advocates argue that these provisions – originally intended to make Social Security benefits fairer – actually penalize public sector employees like teachers, firefighters, police officers, and federal workers.

“In enacting the WEP and GPO, Congress created a completely different set of inequities, slashing Social Security benefits for some even though their payroll contributions might be exactly the same as their fellow Americans whose work history was entirely within the Social Security system,” said NCPSSM President Max Richtman at the Wednesday event.

The WEP and GPO, Richtman said, leaves millions of retirees and their families with little or no Social Security benefits, despite decades of contributions in payroll taxes.

NCPSSM has endorsed legislation favored by the National WEP/GPO Repeal Task Force, the Social Security Fairness Act:

The bill eliminates the government pension offset, which in various instances reduces Social Security benefits for spouses, widows, and widowers who also receive government pensions of their own.

The bill also eliminates the windfall elimination provision, which in some instances reduces Social Security benefits for individuals who also receive a pension or disability benefit from an employer that did not withhold Social Security taxes.

The National WEP/GPO Repeal Task Force is leading a grassroots movement to spur Congress to enact the Social Security Fairness Act. “This is a serious issue that’s gone on way too long,” said Suzie Dixon, President of the California Retired Teachers Association and vice-chair of the task force. “It is time to let teachers, firefighters, police officers and other public sector employees live their senior years in dignity.”

NCPSSM also strongly endorses Rep. John Larson’s Social Security 2100 Act, which would repeal the WEP & GPO in addition to strengthening the program’s finances and boosting retirees’ benefits.

NCPSSM To Participate in Harkin Social Security Symposium in DC

The Harkin Institute’s Director of Retirement Security, Rayna Stoycheva, says the symposium, Preserving and Enhancing Social Security for All, comes at a crucial time for Social Security. “In the last couple of years, there has been an uptick in legislative proposals focused on balancing the trust fund and enhancing the Social Security program,” says Stoycheva. “We thought that a symposium that focuses on the program in more detail was timely — and would serve our mission to connect citizens with the policy making process.”

For the National Committee to Preserve Social Security and Medicare, the exchange of ideas with other advocates is crucial to its mission. “Senator Harkin is the chair of our advisory board and a true champion of Social Security, so we are especially honored to have a role in this symposium,” says Richtman.

“We applaud the Harkin Institute for bringing together so many thought leaders in this field at a time when Social Security faces considerable financial and political challenges. Events like this are crucial to ensure that the program is protected and expanded rather than cut and privatized, as some in Washington have proposed.” – Max Richtman, NCPSSM President and CEO

The keynote speakers for the symposium are Stephen Goss, Chief Actuary at the Social Security Administration and Rep. John Larson (D-CT), author of the Social Security 2100 Act to protect and expand the program.

Social Security Chief Actuary Stephen Goss & Rep. John Larson are keynote speakers

Registration is now open for up to 200 attendees. The intended audience for the symposium is: policymakers, researchers, practitioners, and retirement security professionals. “Anyone dedicated to improving retirement security and reducing poverty and inequality will find value in this symposium,” says Stoycheva. “The event will lay out what options we can consider in the coming years to achieve the mission of preserving Social Security.”

Specifically, the symposium will shed light on some important questions, including:

How has the Social Security program evolved over the years?

What role does it play for retirement security in the current retirement system?

What are the distributional effects of different proposals?

What is the outlook for specific legislative action in the next 10 years?

NCPSSM President Richtman will lead a panel entitled, “Public Opinion on Social Security Reform and Legislative Agenda,” featuring several speakers including Nancy LeaMond, Executive Vice President and Chief Advocacy & Engagement Officer at AARP.

Other VIP panelists at the symposium include: William Arnone (NASI), Rich Fiesta (Alliance for Retirement Americans), Monique Morrissey (Economic Policy Institute), Kathleen Romig (CBPP), Teresa Ghilarducci (New School for Social Research), Jeff Cruz (AFGE), Rebecca Vallas (Century Foundation), and Nancy Altman (Social Security Works).

“This is an amazing group of policy leaders in this space!” says Stoycheva. “Putting together the program has truly been a collaborative effort involving many different people.” Stoycheva credits, in particular, Alicia Munnell of the Center for Retirement Research at Boston College and William Arnone (Executive Director at the National Academy of Social Insurance) for helping put the program together, with additional input from Richtman and Social Security Works president, Nancy Altman.

There still is time to register for the symposium at: https://harkininstitute.drake.edu/2023/07/19/2023-harkin-retirement-security-symposium/

“There are still some spaces left,” says Stoycheva. “We encourage anyone in this field with a stake in the future of Social Security to avail themselves of this opportunity.”