84 Years Ago Today the First Social Security Beneficiary Got Her Check

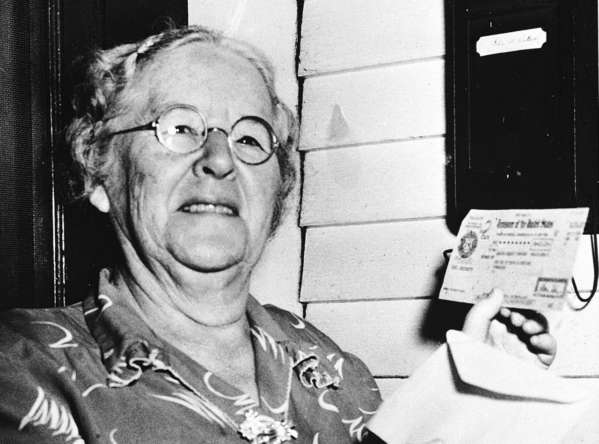

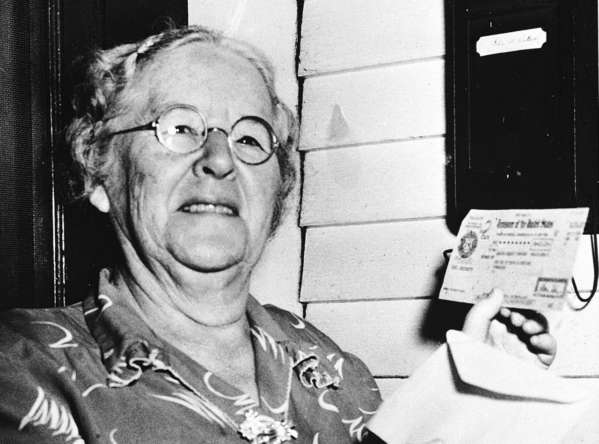

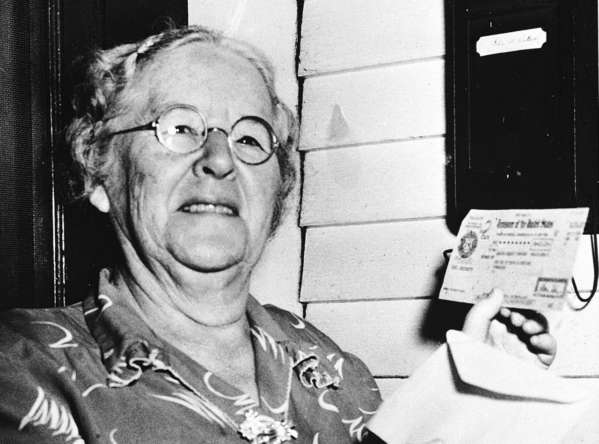

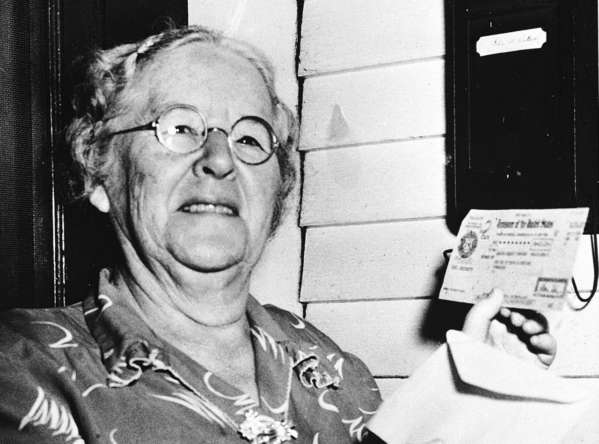

Ida Mae Fuller in 1940

The following article is reprinted from the Social Security Administration (SSA) website www.ssa.gov

The First Social Security Beneficiary

Ida May Fuller was the first beneficiary of recurring monthly Social Security payments. Miss Fuller (known as Aunt Ida to her friends and family) was born on September 6, 1874 on a farm outside of Ludlow, Vermont. She attended school in Rutland, Vermont where one of her classmates was Calvin Coolidge. In 1905, after working as a school teacher, she became a legal secretary. One of the partners in the firm, John G. Sargent, would later become Attorney General in the Coolidge Administration.

Ida May never married and had no children. She lived alone most of her life, but spent eight years near the end of her life living with her niece, Hazel Perkins, and her family in Brattleboro, Vermont.

Miss Fuller filed her retirement claim on November 4, 1939, having worked under Social Security for a little short of three years. While running an errand she dropped by the Rutland Social Security office to ask about possible benefits. She would later observe: “It wasn’t that I expected anything, mind you, but I knew I’d been paying for something called Social Security and I wanted to ask the people in Rutland about it.”

Her claim was taken by Claims Clerk, Elizabeth Corcoran Burke, and transmitted to the Claims Division in Washington, D.C. for adjudication. The case was adjudicated and reviewed and sent to the Treasury Department for payment in January 1940. The claims were grouped in batches of 1,000 and a Certification List for each batch was sent to Treasury. Miss Fuller’s claim was the first one on the first Certification List and so the first Social Security check, check number 00-000-001, was issued to Ida May Fuller in the amount of $22.54 and dated January 31, 1940.

The Spending Deal & Seniors: How Do Older Americans Fare in Agreement to Keep Gov’t Open?

What’s good and bad for seniors in the current spending deal on Capitol Hill? Our director of government relations and policy, Dan Adcock, tells us about how crucial programs for older Americans may fare for the rest of this fiscal year — and the latest on Republican plans for a fiscal commission that we fiercely oppose.

Q: Tell us about the deal on Capitol Hill that may avert a government shutdown — and how it might impact seniors.

Adcock: There seems to be a deal for an appropriations bill for FY 2024, which we’re already in by the way. It sounds like there’s finally been an agreement between key House and Senate negotiators on how much each of the appropriation committees will get to spend. These appropriations measures will probably be brought to the floor in bundles… making progress toward meeting the March 1 deadline for nailing down spending for military and veterans affairs — and March 8 for everything else, including most of the funding affecting seniors (Medicare, Medicaid, Social Security, and Older Americans Act programs).

Q: Are we happy with this deal?

Adcock: The deal basically means that the government likely won’t shut down, which is good news for everyone. And even though the FY 2024 budget is going to be fairly austere, funding for the programs we care about is going to be a lot better than it could have been. Originally, Republicans wanted flat funding for everything, and wanted to put any surplus funds toward deficit reduction rather than spending it on programs that help everyday people.

Q: How does this deal compare to previous spending agreements between the GOP and Democrats?

Adcock: This new deal is fairly close to the debt limit agreement between President Biden and congressional Republicans last year. It limits non-defense spending to FY 2023 levels, but claws back some money (including surplus Covid money and funding that was supposed to go to the IRS for greater enforcement) that can be put toward domestic priorities.

Q: We have been banging the drum that the Social Security Administration (SSA) has been grossly underfunded and needs an infusion of money for operations. What does this deal portend for SSA funding?

Adcock: Unfortunately, SSA is likely to be flat funded in FY 2024, which means the agency will continue to have to make due with insufficient resources for yet another year. But it’s not going to be as bad as if Republicans got their wishes. Relatively flat-funding will prevent SSA from radically improving wait times for customer service and may force further cutbacks, including additional field office closures.

Q: Is there anything to be done to get SSA more funding during this fiscal year?

Adcock: We are hoping for a separate piece of legislation like a supplemental appropriations bill that could include extra money for SSA that it won’t receive through the regular appropriations process. The President may ask for more funding for SSA in his FY 2025 budget, but he cannot submit a new budget until FY 2024 appropriations have been enacted.

Q: House Republicans are pushing for a fiscal commission (which we fiercely oppose) that could end up recommending cuts to Social Security and Medicare. Where does that stand right now?

Adcock: That’s still something that could still be included in a final spending deal. As a freestanding bill, it couldn’t get 60 votes in order to pass the Senate. But if a fiscal commission was inserted into the final spending deal, then it could pass along with everything else.

Q: Would Democrats vote for a spending pill that contains the ‘poison pill’ of a fiscal commission?

Adcock: They may accede to it. The thinking might go, “We’re not actually cutting anything by voting for this. So let the Republicans play their fiscal commission game and in the end it won’t matter.” But, in reality, it does matter. Because a fiscal commission’s recommendations could take on a life of their own. We have opposed a fiscal commission from the very beginning because the process could end up in benefit cuts. It’s a Pandora’s box that’s better not to open.

END

NCPSSM “Tremendously Disappointed” by House Budget Committee Vote

Rep. Jody Arrington (R-TX) chairs the House Budget Committee

The National Committee to Preserve Social Security and Medicare is tremendously disappointed in the House Budget Committee’s vote to favorably report the Fiscal Commission Act of 2023 out of committee. This is the final step in the legislative process before the bill comes to the House floor for a vote.

“A fiscal commission is designed to give individual members of Congress political cover for cutting Americans’ earned benefits. Any changes to Social Security and Medicare should go through regular order and not be relegated to a commission unaccountable to the public and rushed through the Congress. This bill should be opposed by any member of Congress who cares about Social Security, Medicare, and the constituents who depend on them. – Max Richtman, president and CEO, National Committee to Preserve Social Security and Medicare

This bill is designed to rush the Commission’s recommendations, which would inevitably prioritize deep cuts to Social Security and Medicare, through Congress so they can be enacted before the American people have a chance to study them and understand how they would be affected. The bill’s goal of avoiding political accountability is made clear as H.R. 5779 prohibits the issuance of the Commission’s recommendations prior to election day and provides that the ensuing legislation would come to the floor during the lame-duck Congress. In this scenario, representatives who are leaving Congress at the end of the year could vote to cut American’s earned benefits — without having to face voters again.

NCPSSM believes that Social Security and Medicare should be reformed. But the process must be deliberative and fully accessible to the public. The committees with jurisdiction over Social Security and Medicare should hold hearings, develop legislation that improves – not cuts – benefits. The future of these critical programs must not and should not be determined as part of a budget cutting exercise.

Members of Congress should understand that fiscal commissions that force changes to Americans’ hard-earned benefits will – and should not – fool the voters. President Biden has rightly called such commissions “death panels” for Social Security and Medicare. We urge all House members who claim to champion these vital programs for seniors to reject the Fiscal Commission Act.

Congress Shouldn’t Enact “Death Panels” for Social Security & Medicare

NCPSSM sent a letter to Congress today urging representatives to reject the Fiscal Commission Act of 2023. This bill would establish a commission that would circumvent Congress’ regular order for considering Social Security and Medicare changes. The bill will be marked up in the House Budget Committee on January 18.

Commissions of this kind are intended to squeeze every possible dollar of savings out of Social Security and Medicare without consideration for the adequacy of benefits during their deliberations. They are intended as a maneuver for enacting deep cuts to these critical programs that could never pass Congress through the normal legislative process because of their unpopularity with the voting public.

“A fiscal commission is designed to give individual members of Congress political cover for cutting Americans’ earned benefits. Any changes to Social Security and Medicare should go through regular order and not be relegated to a commission unaccountable to the public and rushed through the Congress.” – Max Richtman, president and CEO, National Committee to Preserve Social Security and Medicare

This bill is designed to rush the Commission’s recommendations, which would inevitably prioritize deep cuts to Social Security and Medicare, through Congress so they can be enacted before the American people have a chance to study them and understand how they would be affected. The bill’s goal of avoiding political accountability is made clear as H.R. 5779 prohibits the issuance of the Commission’s recommendations prior to election day and provides that the ensuing legislation would come to the floor during the lame-duck Congress. In this scenario, representatives who are leaving Congress at the end of the year could vote to cut American’s earned benefits — without having to face voters again.

NCPSSM believes that Social Security and Medicare should be reformed. But the process must be deliberative and fully accessible to the public. The committees with jurisdiction over Social Security and Medicare should hold hearings, develop legislation that improves – not cuts – benefits. The future of these critical programs must not and should not be determined as part of a budget cutting exercise.

Members of Congress should understand that fiscal commissions that force changes to Americans’ hard-earned benefits will – and should not – fool the voters. President Biden has rightly called such commissions “death panels” for Social Security and Medicare. As NCPSSM’s president and CEO, Max Richtman, said, “The Fiscal Commission Act of 2023 should not have a mark-up, come to the floor for a vote, or, frankly, see the light of day.”

NCPSSM Endorses Tim Kaine for Re-election to U.S. Senate

On behalf of our 28,000 members and supporters in Virginia, the National Committee to Preserve Social Security and Medicare today proudly endorsed Tim Kaine for re-election to the U.S. Senate in Fredericksburg, VA on Friday. Senator Kaine has proven himself time and again as a leader on issues affecting Virginia seniors. He earns a 100% rating on our legislative scorecard for his steadfast championing of Social Security, Medicare, and lower prescription drug prices.

“I have known Tim Kaine for over 15 years now, and I have been consistently impressed by his commitment to working families and seniors. He has always been close to his own elderly parents — and understands the importance of retirement and health security for all Virginia families. Underpinning all of this are the values of hard work, fairness, and family that he has demonstrated so well during his first two terms in Washington.” – Max Richtman, President and CEO, National Committee to Preserve Social Security and Medicare

Senator Kaine accepted NCPSSM’s endorsement Friday morning at a town hall at Chancellor’s Village, a senior living facility in Fredericksburg. National Committee president and CEO Max Richtman handed the Senator a pair of NCPSSM’s signature boxing gloves to recognize his championing of seniors.

“I’m honored to receive the endorsement of the National Committee to Preserve Social Security and Medicare because I am determined to stand up for Virginia seniors and lower costs. Virginians should have access to affordable health care and be able to retire with dignity – which has been and will continue to be my priority in the U.S. Senate.” – Senator Tim Kaine

Virginians can continue to count on Senator Kaine to protect their hard-earned benefits. There are some 1.6 million Social Security beneficiaries in Virginia. The average benefit for Virginia retirees is nearly $1,900 per month, or about $23,000 a year. Senator Kaine knows that Virginians living on fixed incomes cannot afford cuts to their hard-earned benefits, which key Republicans (including contenders for the GOP presidential nomination) have proposed.

Senator Kaine greets supporters at town hall event in Fredericksburg, VA

Senator Kaine also will continue to fight prescription drug price gouging by Big Pharma, as he has during the 118th Congress. He supported the Inflation Reduction Act, which finally allows Medicare to negotiate drug prices with pharmaceutical companies — and caps seniors’ out-of-pocket drug costs under Medicare Part D at $2,000 per year. Virginians are now beginning to see those benefits realized, including a $35 cap on monthly insulin costs.

The Inflation Reduction Act passed the Senate by one vote. Without the vote of Senator Kaine, Virginians would not have the benefits of this historic drug pricing reform. There is plenty more work to be done in the next Congress — and that is why we need Tim Kaine in the Senate to fight for older Virginians and their families.

84 Years Ago Today the First Social Security Beneficiary Got Her Check

Ida Mae Fuller in 1940

The following article is reprinted from the Social Security Administration (SSA) website www.ssa.gov

The First Social Security Beneficiary

Ida May Fuller was the first beneficiary of recurring monthly Social Security payments. Miss Fuller (known as Aunt Ida to her friends and family) was born on September 6, 1874 on a farm outside of Ludlow, Vermont. She attended school in Rutland, Vermont where one of her classmates was Calvin Coolidge. In 1905, after working as a school teacher, she became a legal secretary. One of the partners in the firm, John G. Sargent, would later become Attorney General in the Coolidge Administration.

Ida May never married and had no children. She lived alone most of her life, but spent eight years near the end of her life living with her niece, Hazel Perkins, and her family in Brattleboro, Vermont.

Miss Fuller filed her retirement claim on November 4, 1939, having worked under Social Security for a little short of three years. While running an errand she dropped by the Rutland Social Security office to ask about possible benefits. She would later observe: “It wasn’t that I expected anything, mind you, but I knew I’d been paying for something called Social Security and I wanted to ask the people in Rutland about it.”

Her claim was taken by Claims Clerk, Elizabeth Corcoran Burke, and transmitted to the Claims Division in Washington, D.C. for adjudication. The case was adjudicated and reviewed and sent to the Treasury Department for payment in January 1940. The claims were grouped in batches of 1,000 and a Certification List for each batch was sent to Treasury. Miss Fuller’s claim was the first one on the first Certification List and so the first Social Security check, check number 00-000-001, was issued to Ida May Fuller in the amount of $22.54 and dated January 31, 1940.

The Spending Deal & Seniors: How Do Older Americans Fare in Agreement to Keep Gov’t Open?

What’s good and bad for seniors in the current spending deal on Capitol Hill? Our director of government relations and policy, Dan Adcock, tells us about how crucial programs for older Americans may fare for the rest of this fiscal year — and the latest on Republican plans for a fiscal commission that we fiercely oppose.

Q: Tell us about the deal on Capitol Hill that may avert a government shutdown — and how it might impact seniors.

Adcock: There seems to be a deal for an appropriations bill for FY 2024, which we’re already in by the way. It sounds like there’s finally been an agreement between key House and Senate negotiators on how much each of the appropriation committees will get to spend. These appropriations measures will probably be brought to the floor in bundles… making progress toward meeting the March 1 deadline for nailing down spending for military and veterans affairs — and March 8 for everything else, including most of the funding affecting seniors (Medicare, Medicaid, Social Security, and Older Americans Act programs).

Q: Are we happy with this deal?

Adcock: The deal basically means that the government likely won’t shut down, which is good news for everyone. And even though the FY 2024 budget is going to be fairly austere, funding for the programs we care about is going to be a lot better than it could have been. Originally, Republicans wanted flat funding for everything, and wanted to put any surplus funds toward deficit reduction rather than spending it on programs that help everyday people.

Q: How does this deal compare to previous spending agreements between the GOP and Democrats?

Adcock: This new deal is fairly close to the debt limit agreement between President Biden and congressional Republicans last year. It limits non-defense spending to FY 2023 levels, but claws back some money (including surplus Covid money and funding that was supposed to go to the IRS for greater enforcement) that can be put toward domestic priorities.

Q: We have been banging the drum that the Social Security Administration (SSA) has been grossly underfunded and needs an infusion of money for operations. What does this deal portend for SSA funding?

Adcock: Unfortunately, SSA is likely to be flat funded in FY 2024, which means the agency will continue to have to make due with insufficient resources for yet another year. But it’s not going to be as bad as if Republicans got their wishes. Relatively flat-funding will prevent SSA from radically improving wait times for customer service and may force further cutbacks, including additional field office closures.

Q: Is there anything to be done to get SSA more funding during this fiscal year?

Adcock: We are hoping for a separate piece of legislation like a supplemental appropriations bill that could include extra money for SSA that it won’t receive through the regular appropriations process. The President may ask for more funding for SSA in his FY 2025 budget, but he cannot submit a new budget until FY 2024 appropriations have been enacted.

Q: House Republicans are pushing for a fiscal commission (which we fiercely oppose) that could end up recommending cuts to Social Security and Medicare. Where does that stand right now?

Adcock: That’s still something that could still be included in a final spending deal. As a freestanding bill, it couldn’t get 60 votes in order to pass the Senate. But if a fiscal commission was inserted into the final spending deal, then it could pass along with everything else.

Q: Would Democrats vote for a spending pill that contains the ‘poison pill’ of a fiscal commission?

Adcock: They may accede to it. The thinking might go, “We’re not actually cutting anything by voting for this. So let the Republicans play their fiscal commission game and in the end it won’t matter.” But, in reality, it does matter. Because a fiscal commission’s recommendations could take on a life of their own. We have opposed a fiscal commission from the very beginning because the process could end up in benefit cuts. It’s a Pandora’s box that’s better not to open.

END

NCPSSM “Tremendously Disappointed” by House Budget Committee Vote

Rep. Jody Arrington (R-TX) chairs the House Budget Committee

The National Committee to Preserve Social Security and Medicare is tremendously disappointed in the House Budget Committee’s vote to favorably report the Fiscal Commission Act of 2023 out of committee. This is the final step in the legislative process before the bill comes to the House floor for a vote.

“A fiscal commission is designed to give individual members of Congress political cover for cutting Americans’ earned benefits. Any changes to Social Security and Medicare should go through regular order and not be relegated to a commission unaccountable to the public and rushed through the Congress. This bill should be opposed by any member of Congress who cares about Social Security, Medicare, and the constituents who depend on them. – Max Richtman, president and CEO, National Committee to Preserve Social Security and Medicare

This bill is designed to rush the Commission’s recommendations, which would inevitably prioritize deep cuts to Social Security and Medicare, through Congress so they can be enacted before the American people have a chance to study them and understand how they would be affected. The bill’s goal of avoiding political accountability is made clear as H.R. 5779 prohibits the issuance of the Commission’s recommendations prior to election day and provides that the ensuing legislation would come to the floor during the lame-duck Congress. In this scenario, representatives who are leaving Congress at the end of the year could vote to cut American’s earned benefits — without having to face voters again.

NCPSSM believes that Social Security and Medicare should be reformed. But the process must be deliberative and fully accessible to the public. The committees with jurisdiction over Social Security and Medicare should hold hearings, develop legislation that improves – not cuts – benefits. The future of these critical programs must not and should not be determined as part of a budget cutting exercise.

Members of Congress should understand that fiscal commissions that force changes to Americans’ hard-earned benefits will – and should not – fool the voters. President Biden has rightly called such commissions “death panels” for Social Security and Medicare. We urge all House members who claim to champion these vital programs for seniors to reject the Fiscal Commission Act.

Congress Shouldn’t Enact “Death Panels” for Social Security & Medicare

NCPSSM sent a letter to Congress today urging representatives to reject the Fiscal Commission Act of 2023. This bill would establish a commission that would circumvent Congress’ regular order for considering Social Security and Medicare changes. The bill will be marked up in the House Budget Committee on January 18.

Commissions of this kind are intended to squeeze every possible dollar of savings out of Social Security and Medicare without consideration for the adequacy of benefits during their deliberations. They are intended as a maneuver for enacting deep cuts to these critical programs that could never pass Congress through the normal legislative process because of their unpopularity with the voting public.

“A fiscal commission is designed to give individual members of Congress political cover for cutting Americans’ earned benefits. Any changes to Social Security and Medicare should go through regular order and not be relegated to a commission unaccountable to the public and rushed through the Congress.” – Max Richtman, president and CEO, National Committee to Preserve Social Security and Medicare

This bill is designed to rush the Commission’s recommendations, which would inevitably prioritize deep cuts to Social Security and Medicare, through Congress so they can be enacted before the American people have a chance to study them and understand how they would be affected. The bill’s goal of avoiding political accountability is made clear as H.R. 5779 prohibits the issuance of the Commission’s recommendations prior to election day and provides that the ensuing legislation would come to the floor during the lame-duck Congress. In this scenario, representatives who are leaving Congress at the end of the year could vote to cut American’s earned benefits — without having to face voters again.

NCPSSM believes that Social Security and Medicare should be reformed. But the process must be deliberative and fully accessible to the public. The committees with jurisdiction over Social Security and Medicare should hold hearings, develop legislation that improves – not cuts – benefits. The future of these critical programs must not and should not be determined as part of a budget cutting exercise.

Members of Congress should understand that fiscal commissions that force changes to Americans’ hard-earned benefits will – and should not – fool the voters. President Biden has rightly called such commissions “death panels” for Social Security and Medicare. As NCPSSM’s president and CEO, Max Richtman, said, “The Fiscal Commission Act of 2023 should not have a mark-up, come to the floor for a vote, or, frankly, see the light of day.”

NCPSSM Endorses Tim Kaine for Re-election to U.S. Senate

On behalf of our 28,000 members and supporters in Virginia, the National Committee to Preserve Social Security and Medicare today proudly endorsed Tim Kaine for re-election to the U.S. Senate in Fredericksburg, VA on Friday. Senator Kaine has proven himself time and again as a leader on issues affecting Virginia seniors. He earns a 100% rating on our legislative scorecard for his steadfast championing of Social Security, Medicare, and lower prescription drug prices.

“I have known Tim Kaine for over 15 years now, and I have been consistently impressed by his commitment to working families and seniors. He has always been close to his own elderly parents — and understands the importance of retirement and health security for all Virginia families. Underpinning all of this are the values of hard work, fairness, and family that he has demonstrated so well during his first two terms in Washington.” – Max Richtman, President and CEO, National Committee to Preserve Social Security and Medicare

Senator Kaine accepted NCPSSM’s endorsement Friday morning at a town hall at Chancellor’s Village, a senior living facility in Fredericksburg. National Committee president and CEO Max Richtman handed the Senator a pair of NCPSSM’s signature boxing gloves to recognize his championing of seniors.

“I’m honored to receive the endorsement of the National Committee to Preserve Social Security and Medicare because I am determined to stand up for Virginia seniors and lower costs. Virginians should have access to affordable health care and be able to retire with dignity – which has been and will continue to be my priority in the U.S. Senate.” – Senator Tim Kaine

Virginians can continue to count on Senator Kaine to protect their hard-earned benefits. There are some 1.6 million Social Security beneficiaries in Virginia. The average benefit for Virginia retirees is nearly $1,900 per month, or about $23,000 a year. Senator Kaine knows that Virginians living on fixed incomes cannot afford cuts to their hard-earned benefits, which key Republicans (including contenders for the GOP presidential nomination) have proposed.

Senator Kaine greets supporters at town hall event in Fredericksburg, VA

Senator Kaine also will continue to fight prescription drug price gouging by Big Pharma, as he has during the 118th Congress. He supported the Inflation Reduction Act, which finally allows Medicare to negotiate drug prices with pharmaceutical companies — and caps seniors’ out-of-pocket drug costs under Medicare Part D at $2,000 per year. Virginians are now beginning to see those benefits realized, including a $35 cap on monthly insulin costs.

The Inflation Reduction Act passed the Senate by one vote. Without the vote of Senator Kaine, Virginians would not have the benefits of this historic drug pricing reform. There is plenty more work to be done in the next Congress — and that is why we need Tim Kaine in the Senate to fight for older Virginians and their families.