Here’s Some Monday Morning Reading with Actual Fact-based Info on Social Security & Retirement

Here are two really wonderful pieces on Social Security and Retirement we highly recommend you read.My Faith-Based Retirement by Joe Nocera at the New York Times describes his all-too common personal experience with 401K?s while economist Jared Bernstein provides some desperately needed myth-busting in his Rolling Stone piece, Straight Talk on Social Security. While we don?t agree with his suggestion to move to a chained-CPI, he?s right about the need to push back on all the lies about Social Security?s fiscal health.

Busting Myths about the 2012 Social Security and Medicare Trustees Report

No doubt you’ve already seen the screaming headlines promising the immediate bankruptcy of Social Security and Medicare…it’s an annual Washington tradition tied to the release of the Social Security and Medicare Trustees report. Unfortunately, this tradition seldom stems from factual reporting of what’s actually in the trustees report. This year is no exception.To help you sort fact from fiction about the true health of Social Security and Medicare, here is our President/CEO Max Richtman’s reaction to the Trustees’ projections and some data you likely won’t see reported in this week’s news coverage:

?Projections in the 2012 Trustees Reports come as no surprise to anyone who understands how Social Security and Medicare work. The trust fund solvency date for Social Security has seen fluctuations many times in recent decades, from a depletion date as distant as 2048 in the 1988 report to as soon as 2029 in the 1994 and 1997 reports. This year?s report is well within that range. Contrary to the crisis myths perpetuated by fiscal conservatives and many in the media, the prevailing facts show once again that Social Security remains among the nation?s most successful and stable programs. The Trustees report there is now $2.7 trillion in the Social Security trust fund, which is $69 billion more than last year, and continues to grow. Payroll contributions and interest will fully cover benefits for decades to come.? Max Richtman, NCPSSM President/CEO

In the 2012 Trustees report:

- Trustees project Social Security will be able to pay full benefits until the year 2033. After that, Social Security will have sufficient revenue to pay about 75% of benefits.

- Social Security is still well funded. In 2012, with the economy showing slow signs of recovery, Social Security?s total income still exceeded its expenses by over $57 billion. In fact, the Trustees estimate that total annual income is expected to exceed program obligations until 2020.

- Beneficiaries will likely see a Cost of Living Allowance increase of 1.8% in 2013.

The 2012 Trustees report also shows Medicare?s Trust Fund solvency projection remains unchanged at 2024. This reflects the success that health care reform has had in improving Medicare?s solvency. If long-term solvency for Medicare is truly Congress? goal, then repealing health care reform is not an option as it would set back that progress immeasurably.

?The challenges facing Medicare are the same that we see in the broader health care system?the high cost of health care in America. Thanks to health care reform, Medicare will save $200 billion by 2016, but even those savings would be lost if opponents have their way and the Affordable Care Act is repealed. We must allow reform to be fully implemented in order to realize the projected savings.? Max Richtman

The National Committee believes that Congress can also improve the long-term outlook for Social Security with modest and manageable changes in revenue without enacting harmful benefit cuts for current or future retirees. Recent polling has shown that a majority of Americans support lifting the payroll tax cap to ensure Americans contribute at all income levels.

We Can’t Afford Medicare and Social Security but we Can Afford Tax Cuts for Millionaires

Last night Senate Republicans voted against the so-called ?Buffett Rule? killing this latest hope for tax fairness from Washington, once again. Seniors especially need to remember this vote when their elected leaders tell them that America ?can?t afford? Social Security and Medicare. During last night?s vote some GOP Senators even suggested the poor and middle-class aren?t suffering enough:

“The Joint Committee on Taxation estimates that 51 percent of all households, which includes both filers and nonfilers, had either zero or negative income tax liability in 2009,” Kyl said, suggesting it was the middle class and poor who were not sacrificing. “People who do not share in the sacrifice of paying taxes have little direct incentive to care whether the government is spending and taxing too much. Maybe that’s why the president has no problem with even more Americans getting a free ride.” Senator Jon Kyl (R-AZ)

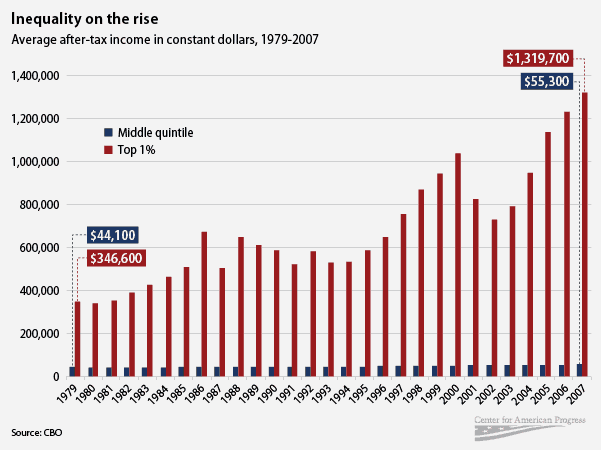

Most Americans understand that not earning enough income to have to pay income tax (even though they?re still paying plenty of other federal, state and local taxes) doesn’t mean working Americans are getting a free ride it just shows how much average Americans are suffering in this economy where unemployment, underemployment, and stagnant wages remain all-too-common. Nearly three-quarters of the American people support common-sense tax reform that returns some basic fairness to a system that has allows too many millionaires to pay a lower tax rate than middle class workers.However, conservatives in Washington, in vote after vote, have made it clear they will do whatever it takes to protect tax cuts for the wealthiest among us. In fact, they hope to persuade you that turning Medicare into Couponcare and privatizing Social Security is the kind of ?shared sacrifice? needed to preserve (and even expand) these tax cuts for the millionaires and corporations.Here are some graphs from Think Progress that clearly illustrate what?s at stake:

Busting the “Blame Social Security & Medicare” Myth

Top Ten Tax Facts

Ben PeckApril 16, 2012

Think you know a lot about government revenue? Think again.This piece is the fifth in a six-part series on taxation, and a joint project by The American Prospect and its publishing partner, Demos.1. The government has collected less in taxes as a proportion of the economy in the past three years than it has in any three-year period since World War II, and tax rates are at historic lows.2. One out of three multi-millionaires pays a lower percentage of their income in taxes than the vast majority of people making $60,000 a year.3. Chairman Paul Ryan?s budget proposal, which has been praised by Governor Romney, would deliver benefits to people with incomes over $1 million that are 10 times greater than the benefits to those earning $40,000 or less.4. Corporate income taxes for the past three years have hovered at just over 1 percent of GDP, lower than for any three-year period since World War II. The average for OECD countries is 3.5 percent.5. The Bush tax cuts added $1.7 trillion to the nation?s debt between 2001 and 2008, which is more than it would cost to send 25 million kids to four-year public universities.

You can see all 10 of the Tax Facts here.

Social Security & Medicare Benefits All Ages

Many of the arguments used by those who fundamentally do not believe the government should provide health insurance or retirement security for American?s seniors are as old as Social Security and Medicare themselves.The ?greedy geezer? myth is often used as part of a larger strategic goal pitting America?s young versus old in a battle to convince younger generations to give up on our nation?s most successful poverty prevention ![]()

![]()

![]()

Generations

It?s Not a Fight, It?s a Family.

In the April issue of Esquire magazine, an article entitled ?The War Against Youth,? by Stephen Marche emerges as the latest attempt to incite generational warfare while offering no constructive policy recommendations. As a result of the attention this piece has received, Generations United is issuing the following statement.Recent attempts in the media to fuel intergenerational conflict are a disservice to our country. This is particularly true in the midst of a polarizing political climate that threatens to cut critical safety net programs for children, youth, and older adults. Rather than pitting generations against one another, we should be working together to address our country?s most difficult challenges while still investing in each generation of our society.Marche?s article unjustly blames the baby boomer generation for our country?s problems and insinuates that generation?s callous indifference will forever stint the human potential of today?s youth. This narrow view devalues the capacity and contributions of both older and younger generations. To address the needs of our country, we must forge stronger connections among generations and engage the strengths unique at every age.Old and young Americans form a community of interest. It?s called family. According to Pew Research Center, 76% of adults report that family is the most important element of their life. And in these family units we demonstrate how much we care about each other.Take grandparents, for example. A survey by the MetLife Mature Market Institute found that two-thirds of grandparents provided an estimated $370 billion in financial support to grandchildren over a five-year period. This averaged out to $8,661 per grandparent household. They did this not out of duty, but out of concern and love for their young family members. Grandparents step in to provide child care, as well. According to the Census Bureau, among the 11.3 million children younger than five whose mothers are employed, 30 percent are cared for on a regular basis by a grandparent.Too often, Social Security is referred to as a retirement program. Tell that to the nearly 7 million children and youth who today receive a critical part of their family income from Social Security. In reality, it is a family protection program. It covers almost every child in America should they lose a parent to death or disability. Moreover, two-thirds of Americans support paying more for Social Security instead of reducing benefits. Most importantly, Social Security is fully funded through 2036. With modest changes to strengthen the program, it can be solvent for generations to come.Marche asserts today?s youth are on their own; he sees young people returning home as a negative. But that?s what families do: take care of their own in times of need. Today, more than 51 million?or one in six?Americans live in multigenerational households, including grandparents raising their grandchildren.Young people are not the only ones moving in with relatives. A recent survey conducted by Harris Interactive, found that 66% of adult respondents living in a multigenerational household reported that the current economic climate was a factor in their family becoming a multigenerational household, while 21% reported that it was the only factor. Most of the respondents expressed positive feelings about their new arrangement. In fact, 82% agreed that ?My family?s multigenerational household arrangement has enhanced bonds or relationships among family members.? If anything, our country is moving into a time when families are realizing once again we are interdependent and need each other. It?s not a sign of weakness but a tribute to enduring strengths of families.A recent study by the MetLife Mature Market found that respondents?across the generations?feel a sense of strong responsibility and obligation to:

- save enough for retirement to avoid having to ask family members for assistance

- have a parent live with them if they need help due to a major health or financial issue

- make sure a spouse or child would have enough money if a financial provider dies unexpectedly

- Help to pay for a child?s college education

- Provide strong and consistent emotional and non-financial support and contact

That doesn?t sound like a country whose generations are at war with each other. The majority of Americans care about each other. They strongly believe, as we do, that ?It is not a fight, it is a family.?Caring for and supporting people of every generation shouldn?t be an either/or proposition. We need to ensure our policies and programs benefit all Americans, whatever their age.We encourage intergenerational advocates to take action on this latest attempt by some to fuel intergenerational conflict. Here?s how you can help:TAKE ACTIONShare our statement. ?Like? our statement on Facebook. Post a comment on Marche?s blog.

- ?The War Against Youth? article unjustly blames the baby boomer generation for our country?s problems and insinuates that generation?s callous indifference will forever stint the human potential of today?s youth. This narrow view devalues the contributions of both older and younger generations and is an unfair accusation.

- There is not a ?Young America? and an ?Old America?. Falsely separating older and younger people into age-graded silos makes each generation more vulnerable and hurts our economy.

- The best way to put our country on a more productive path is to forge stronger connections among generations, engage the strengths unique at every age and address the needs of each.

Here’s Some Monday Morning Reading with Actual Fact-based Info on Social Security & Retirement

Here are two really wonderful pieces on Social Security and Retirement we highly recommend you read.My Faith-Based Retirement by Joe Nocera at the New York Times describes his all-too common personal experience with 401K?s while economist Jared Bernstein provides some desperately needed myth-busting in his Rolling Stone piece, Straight Talk on Social Security. While we don?t agree with his suggestion to move to a chained-CPI, he?s right about the need to push back on all the lies about Social Security?s fiscal health.

Busting Myths about the 2012 Social Security and Medicare Trustees Report

No doubt you’ve already seen the screaming headlines promising the immediate bankruptcy of Social Security and Medicare…it’s an annual Washington tradition tied to the release of the Social Security and Medicare Trustees report. Unfortunately, this tradition seldom stems from factual reporting of what’s actually in the trustees report. This year is no exception.To help you sort fact from fiction about the true health of Social Security and Medicare, here is our President/CEO Max Richtman’s reaction to the Trustees’ projections and some data you likely won’t see reported in this week’s news coverage:

?Projections in the 2012 Trustees Reports come as no surprise to anyone who understands how Social Security and Medicare work. The trust fund solvency date for Social Security has seen fluctuations many times in recent decades, from a depletion date as distant as 2048 in the 1988 report to as soon as 2029 in the 1994 and 1997 reports. This year?s report is well within that range. Contrary to the crisis myths perpetuated by fiscal conservatives and many in the media, the prevailing facts show once again that Social Security remains among the nation?s most successful and stable programs. The Trustees report there is now $2.7 trillion in the Social Security trust fund, which is $69 billion more than last year, and continues to grow. Payroll contributions and interest will fully cover benefits for decades to come.? Max Richtman, NCPSSM President/CEO

In the 2012 Trustees report:

- Trustees project Social Security will be able to pay full benefits until the year 2033. After that, Social Security will have sufficient revenue to pay about 75% of benefits.

- Social Security is still well funded. In 2012, with the economy showing slow signs of recovery, Social Security?s total income still exceeded its expenses by over $57 billion. In fact, the Trustees estimate that total annual income is expected to exceed program obligations until 2020.

- Beneficiaries will likely see a Cost of Living Allowance increase of 1.8% in 2013.

The 2012 Trustees report also shows Medicare?s Trust Fund solvency projection remains unchanged at 2024. This reflects the success that health care reform has had in improving Medicare?s solvency. If long-term solvency for Medicare is truly Congress? goal, then repealing health care reform is not an option as it would set back that progress immeasurably.

?The challenges facing Medicare are the same that we see in the broader health care system?the high cost of health care in America. Thanks to health care reform, Medicare will save $200 billion by 2016, but even those savings would be lost if opponents have their way and the Affordable Care Act is repealed. We must allow reform to be fully implemented in order to realize the projected savings.? Max Richtman

The National Committee believes that Congress can also improve the long-term outlook for Social Security with modest and manageable changes in revenue without enacting harmful benefit cuts for current or future retirees. Recent polling has shown that a majority of Americans support lifting the payroll tax cap to ensure Americans contribute at all income levels.

We Can’t Afford Medicare and Social Security but we Can Afford Tax Cuts for Millionaires

Last night Senate Republicans voted against the so-called ?Buffett Rule? killing this latest hope for tax fairness from Washington, once again. Seniors especially need to remember this vote when their elected leaders tell them that America ?can?t afford? Social Security and Medicare. During last night?s vote some GOP Senators even suggested the poor and middle-class aren?t suffering enough:

“The Joint Committee on Taxation estimates that 51 percent of all households, which includes both filers and nonfilers, had either zero or negative income tax liability in 2009,” Kyl said, suggesting it was the middle class and poor who were not sacrificing. “People who do not share in the sacrifice of paying taxes have little direct incentive to care whether the government is spending and taxing too much. Maybe that’s why the president has no problem with even more Americans getting a free ride.” Senator Jon Kyl (R-AZ)

Most Americans understand that not earning enough income to have to pay income tax (even though they?re still paying plenty of other federal, state and local taxes) doesn’t mean working Americans are getting a free ride it just shows how much average Americans are suffering in this economy where unemployment, underemployment, and stagnant wages remain all-too-common. Nearly three-quarters of the American people support common-sense tax reform that returns some basic fairness to a system that has allows too many millionaires to pay a lower tax rate than middle class workers.However, conservatives in Washington, in vote after vote, have made it clear they will do whatever it takes to protect tax cuts for the wealthiest among us. In fact, they hope to persuade you that turning Medicare into Couponcare and privatizing Social Security is the kind of ?shared sacrifice? needed to preserve (and even expand) these tax cuts for the millionaires and corporations.Here are some graphs from Think Progress that clearly illustrate what?s at stake:

Busting the “Blame Social Security & Medicare” Myth

Top Ten Tax Facts

Ben PeckApril 16, 2012

Think you know a lot about government revenue? Think again.This piece is the fifth in a six-part series on taxation, and a joint project by The American Prospect and its publishing partner, Demos.1. The government has collected less in taxes as a proportion of the economy in the past three years than it has in any three-year period since World War II, and tax rates are at historic lows.2. One out of three multi-millionaires pays a lower percentage of their income in taxes than the vast majority of people making $60,000 a year.3. Chairman Paul Ryan?s budget proposal, which has been praised by Governor Romney, would deliver benefits to people with incomes over $1 million that are 10 times greater than the benefits to those earning $40,000 or less.4. Corporate income taxes for the past three years have hovered at just over 1 percent of GDP, lower than for any three-year period since World War II. The average for OECD countries is 3.5 percent.5. The Bush tax cuts added $1.7 trillion to the nation?s debt between 2001 and 2008, which is more than it would cost to send 25 million kids to four-year public universities.

You can see all 10 of the Tax Facts here.

Social Security & Medicare Benefits All Ages

Many of the arguments used by those who fundamentally do not believe the government should provide health insurance or retirement security for American?s seniors are as old as Social Security and Medicare themselves.The ?greedy geezer? myth is often used as part of a larger strategic goal pitting America?s young versus old in a battle to convince younger generations to give up on our nation?s most successful poverty prevention ![]()

![]()

![]()

Generations

It?s Not a Fight, It?s a Family.

In the April issue of Esquire magazine, an article entitled ?The War Against Youth,? by Stephen Marche emerges as the latest attempt to incite generational warfare while offering no constructive policy recommendations. As a result of the attention this piece has received, Generations United is issuing the following statement.Recent attempts in the media to fuel intergenerational conflict are a disservice to our country. This is particularly true in the midst of a polarizing political climate that threatens to cut critical safety net programs for children, youth, and older adults. Rather than pitting generations against one another, we should be working together to address our country?s most difficult challenges while still investing in each generation of our society.Marche?s article unjustly blames the baby boomer generation for our country?s problems and insinuates that generation?s callous indifference will forever stint the human potential of today?s youth. This narrow view devalues the capacity and contributions of both older and younger generations. To address the needs of our country, we must forge stronger connections among generations and engage the strengths unique at every age.Old and young Americans form a community of interest. It?s called family. According to Pew Research Center, 76% of adults report that family is the most important element of their life. And in these family units we demonstrate how much we care about each other.Take grandparents, for example. A survey by the MetLife Mature Market Institute found that two-thirds of grandparents provided an estimated $370 billion in financial support to grandchildren over a five-year period. This averaged out to $8,661 per grandparent household. They did this not out of duty, but out of concern and love for their young family members. Grandparents step in to provide child care, as well. According to the Census Bureau, among the 11.3 million children younger than five whose mothers are employed, 30 percent are cared for on a regular basis by a grandparent.Too often, Social Security is referred to as a retirement program. Tell that to the nearly 7 million children and youth who today receive a critical part of their family income from Social Security. In reality, it is a family protection program. It covers almost every child in America should they lose a parent to death or disability. Moreover, two-thirds of Americans support paying more for Social Security instead of reducing benefits. Most importantly, Social Security is fully funded through 2036. With modest changes to strengthen the program, it can be solvent for generations to come.Marche asserts today?s youth are on their own; he sees young people returning home as a negative. But that?s what families do: take care of their own in times of need. Today, more than 51 million?or one in six?Americans live in multigenerational households, including grandparents raising their grandchildren.Young people are not the only ones moving in with relatives. A recent survey conducted by Harris Interactive, found that 66% of adult respondents living in a multigenerational household reported that the current economic climate was a factor in their family becoming a multigenerational household, while 21% reported that it was the only factor. Most of the respondents expressed positive feelings about their new arrangement. In fact, 82% agreed that ?My family?s multigenerational household arrangement has enhanced bonds or relationships among family members.? If anything, our country is moving into a time when families are realizing once again we are interdependent and need each other. It?s not a sign of weakness but a tribute to enduring strengths of families.A recent study by the MetLife Mature Market found that respondents?across the generations?feel a sense of strong responsibility and obligation to:

- save enough for retirement to avoid having to ask family members for assistance

- have a parent live with them if they need help due to a major health or financial issue

- make sure a spouse or child would have enough money if a financial provider dies unexpectedly

- Help to pay for a child?s college education

- Provide strong and consistent emotional and non-financial support and contact

That doesn?t sound like a country whose generations are at war with each other. The majority of Americans care about each other. They strongly believe, as we do, that ?It is not a fight, it is a family.?Caring for and supporting people of every generation shouldn?t be an either/or proposition. We need to ensure our policies and programs benefit all Americans, whatever their age.We encourage intergenerational advocates to take action on this latest attempt by some to fuel intergenerational conflict. Here?s how you can help:TAKE ACTIONShare our statement. ?Like? our statement on Facebook. Post a comment on Marche?s blog.

- ?The War Against Youth? article unjustly blames the baby boomer generation for our country?s problems and insinuates that generation?s callous indifference will forever stint the human potential of today?s youth. This narrow view devalues the contributions of both older and younger generations and is an unfair accusation.

- There is not a ?Young America? and an ?Old America?. Falsely separating older and younger people into age-graded silos makes each generation more vulnerable and hurts our economy.

- The best way to put our country on a more productive path is to forge stronger connections among generations, engage the strengths unique at every age and address the needs of each.