Here They Go Again: The Latest Bowles Simpson Proposal tells Seniors “Pay More and Get Less”

While touted as a “new” plan by the mainstream media, the latest Bowles/Simpson (BS) deficit reduction proposal is really just more of the same — requiring middle-class benefit cuts and tax hikes to reduce the deficit.

“Their plan once again calls for cuts that are out of sync with middle class American’s priorities. Adopting the chained CPI, as Bowles Simpson propose, would mean an immediate benefit cut of $130 per year for the typical 65-year old retiree and would grow exponentially to a $1,400 cut after 30 years of retirement. This chained CPI proposal isn’t a “tweak” or an “adjustment,” it’s designed to cut benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts. That’s a lot of money…out of the pockets of those who can least afford to sacrifice even more. “…Max Richtman, President/CEO

While BS claims a goal of “shared sacrifice” let’s not forget that already 75% of deficit reduction has come from benefit cuts. Their latest version simply doubles-down on that formula asking for $2.4 trillion dollars more in savings, again largely from middle class Americans. Think Progress breaks it down:

Between the budget deals in the spring of 2011 and the Budget Control Act, which averted the debt ceiling crisis that same year, spending has been cut by $1.5 trillion and interest payments reduced by another $200 billion. Then the American Taxpayer Relief Act, which solved the impasse over the “fiscal cliff,” raised $600 billion in new tax revenue.

So if Simpson-Bowles are interested in “building upon” what lawmakers have already achieved, the logical thing to propose is another $1.4 trillion in spending cuts plus another $2 trillion in additional tax revenue. Or if they’re happy with their new $4.8 trillion target — rather than the original $6.3 trillion — their new proposal should heavily favor tax increases, since deficit reduction so far has favored spending cuts by three to one. Instead, Simpson and Bowles are proposing $1.8 trillion in new spending cuts and reduced interest payments, and only $600 billion in additional revenue.

It’s also worth noting that the additional revenue, once again, does not target those who’ve benefited most in this economy. Instead, BS will hit middle-class Americans with higher taxes while lowering tax rates for corporations and the wealthy:

“They’re still singing the gospel of revenue increases funded by “closing loopholes,” an amorphous plan that’s likely to hit the middle class with much more force than it would higher earners. They claim that the tax code is “riddled with well over $1 trillion of tax expenditures – which really are just spending by another name.”

And then they repeat their call for lowering tax rates for corporations and the highest-earning individuals.

Their $1-trillion-plus target for “tax expenditure” elimination can only be reached by targeting employer health plans, home mortgage interest deductions, and other policies that would disproportionately hit the already-beleaguered middle class.

Their approach would convert a social insurance program into a welfare program – but one which is solely funded on income below the payroll tax cap (roughly $110,000 at the moment). That plan targets everyone BUT the wealthy in the name of deficit reduction. That fact, coupled with Simpson and Bowles’ continued insistence on lowering tax rates for corporations and the wealthy, illustrates the right-wing thinking that underlies this supposedly “bipartisan” approach.” Richard Eskow, Our Future Blog

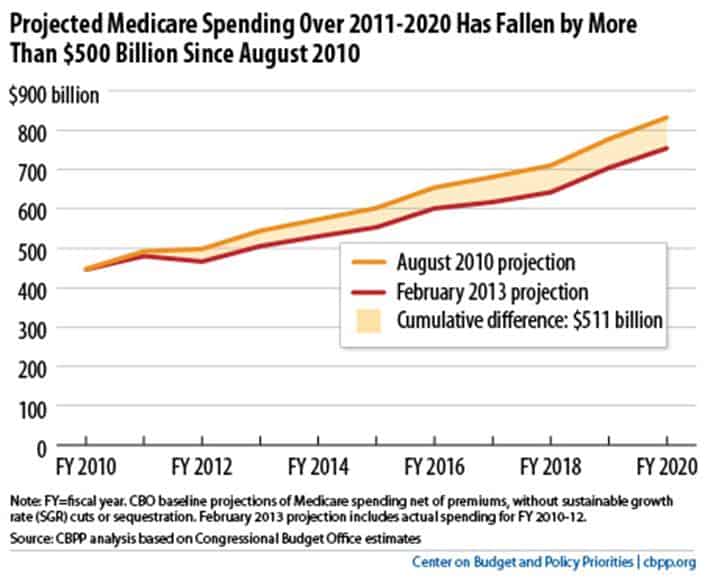

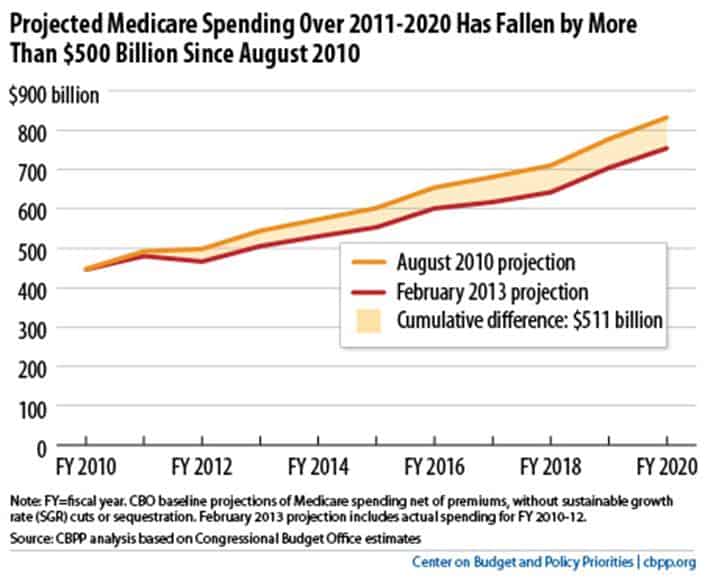

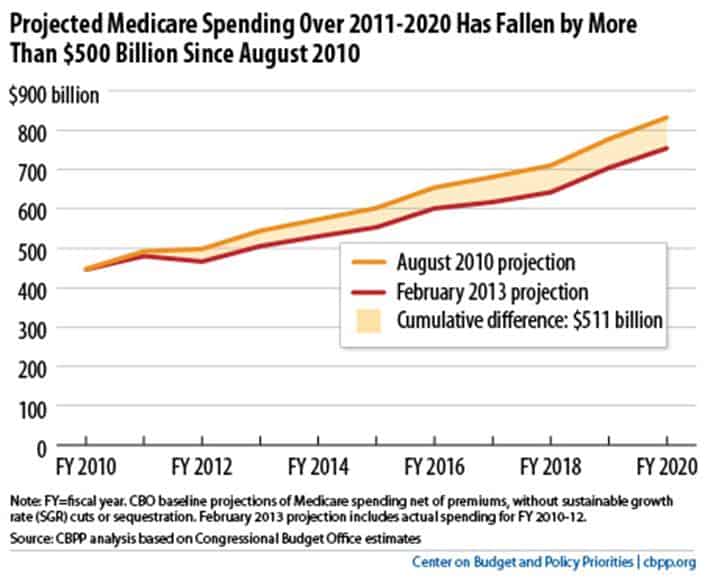

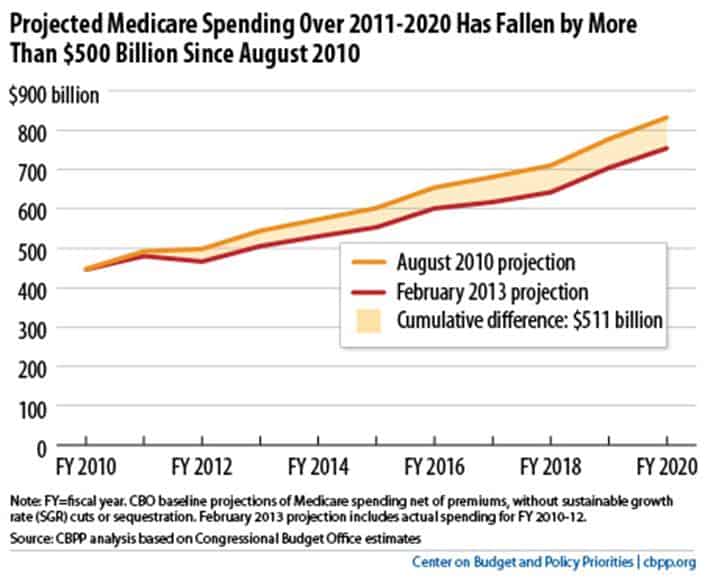

Once again, BS ignores the fact that according to the latest Congressional Budget Office (CBO) projections, Medicare spending over the 2011-2020 period has already fallen by more than $500 billion since late 2010. This inconvenient truth undermines the Bowles/Simpson meme that Medicare must be radically overhauled and seniors’ benefits slashed to lower costs. Allowing time for health care reform’s full implementation, given the lower spending costs already reported, is only reasonable. However, it simply doesn’t fit the BS frame that the only way to cut the deficit is to cut seniors’ benefits. The deficit reduction debate and Congress’ many self-induced fiscal crises provide anti-entitlement crusaders the best opportunity they’ve had in a lifetime to radically overhaul America’s retirement and health safety net. They know time is of the essence because reports of economic recovery and federal health savings undermine their campaign to blame our nation’s economic woes on Social Security, Medicare and Medicaid.

Once again, BS ignores the fact that according to the latest Congressional Budget Office (CBO) projections, Medicare spending over the 2011-2020 period has already fallen by more than $500 billion since late 2010. This inconvenient truth undermines the Bowles/Simpson meme that Medicare must be radically overhauled and seniors’ benefits slashed to lower costs. Allowing time for health care reform’s full implementation, given the lower spending costs already reported, is only reasonable. However, it simply doesn’t fit the BS frame that the only way to cut the deficit is to cut seniors’ benefits. The deficit reduction debate and Congress’ many self-induced fiscal crises provide anti-entitlement crusaders the best opportunity they’ve had in a lifetime to radically overhaul America’s retirement and health safety net. They know time is of the essence because reports of economic recovery and federal health savings undermine their campaign to blame our nation’s economic woes on Social Security, Medicare and Medicaid.

We don’t have to slash benefits to the middle-class and poor Americans to reduce the deficit. The BS plan to cut COLA’s and raise taxes through the chained-CPI, cutting Medicare benefits by further means testing and eliminating Medicare eligibility for millions of younger retirees is not shared sacrifice. It’s not fiscal responsibility and it’s certainly does not represent the economic priorities of the vast majority of Americans of all ages and political parties.

Social Security & Medicare: So Much More than Numbers on a Spreadsheet

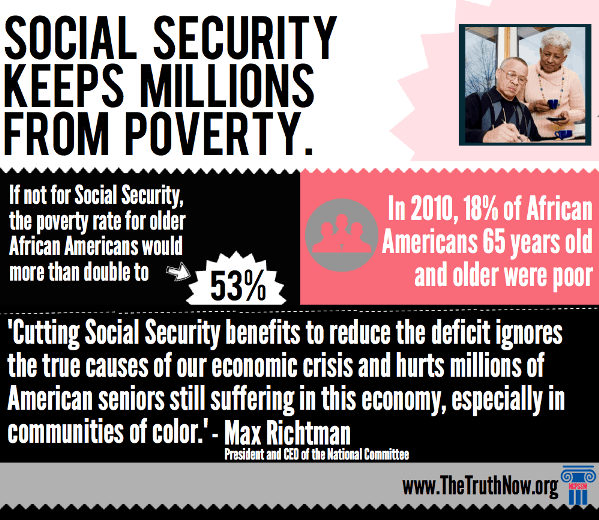

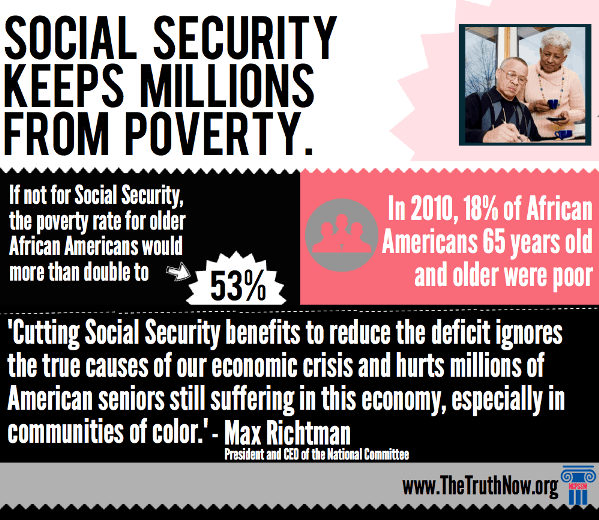

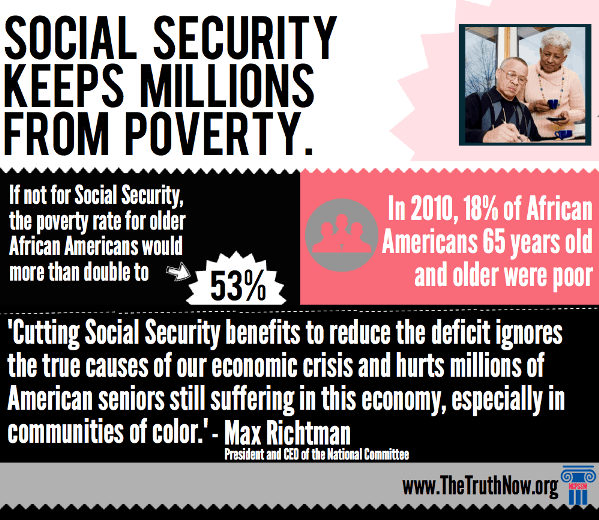

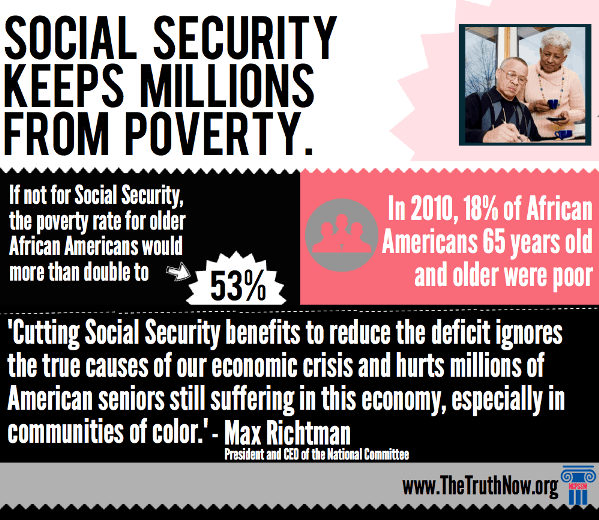

The National Committee to Preserve Social Security & Medicare is commemorating Black History Month with blog posts from a number of the nation’s leading policy analysts, lawmakers, and community leaders. We’ll examine the importance of programs like Social Security, Medicare, and Medicaid to the African American community while also paying tribute to generations of African Americans who have struggled with adversity to achieve full citizenship in American society.

Nevada Congressman Steven Horsford comes to the 113th Congress as a strong advocate for Social Security and Medicare based on his own personal experience with the vital role these programs play in the lives of American families.

Rep. Steven Horsford – (D) Nevada’s 4th District

Medicare and Social Security are sometimes referred to as “entitlements.” In reality, they are promises. They are social insurance programs that prevent poverty in our golden years and they help our parents and grandparents live the comfortable and dignified retirement they deserve. These programs keep America’s promise to our seniors and protect the health of the most vulnerable.

The debate over funding for our social insurance programs can sometimes get lost in spreadsheets and numbers. Ultimately, however, these programs are about people. I know this all too well.

When I was a young boy, my grandmother suffered a stroke and fell into a coma. When she awoke, half of her body was paralyzed, and from there on out she spent the final 27 years of her life moving from nursing home to nursing home, depending on where beds and resources were available. At a young age, I had no idea that Social Security, Medicare, and Medicaid were a crucial part of my grandmother’s life support. But they were.

I visited her every week. Those trips to her bedside are still with me today, and they are a constant reminder that when we cut the budget, we are not just talking about numbers. We are talking about people. We are talking about our families and the ones we love. We are talking about my grandmother.

So, we will get our debt under control, but we will not cut our way to prosperity, and we will not neglect our most vulnerable citizens in the process. We will not take a hatchet to our safety net. It’s just not right, especially while corporations continue to receive trillions of dollars in special tax breaks.

Members of my district are also uniquely affected by proposals to defund Medicare and Social Security. Hispanics make up 27% of the population in Nevada’s 4th Congressional District, and African-Americans make up 16%. Devastating cuts to social insurance programs would be amplified for many of my constituents. Two-thirds of African-Americans and Hispanics have incomes below $22,500 post-retirement, and many rely solely on Medicare to receive health services. How can we say that these constituents, who live with so little and receive the bare minimum in benefits, are part of a “spending problem?”

Medicare and Social Security serve as important and necessary programs to keep seniors healthy. We cannot go back on a promise for safe retirement and health benefits. Our seniors have built their future around the existence of programs they have paid into for years. For my grandmother and my constituents, I vow to fight to protect these programs.

Join the conversation with Congressman Horsford online via:

Parsing the State of the Union – Plans for Social Security & Medicare

President Barack Obama State of the Union, January 12, 2013

“It is our unfinished task to restore the basic bargain that built this country.”

“Most Americans Democrats, Republicans, and Independents understand that we can’t just cut our way to prosperity.”

“The greatest nation on Earth cannot keep conducting its business by drifting from one manufactured crisis to the next.”

“Deficit reduction alone is not an economic plan.”

“We’ll reduce taxpayer subsidies to prescription drug companies…We’ll bring down costs by changing the way our government pays for Medicare.”

“Our government shouldn’t make promises we cannot keep but we must keep the promises we’ve already made.“

NCSSM President Max Richtman was invited to watch the State of the Union along with other national advocates last night and meet with White House staff in a post-speech briefing. He was encouraged by the President’s focus on economic recovery:

“President Obama is right to keep his focus on economic recovery, including job creation and economic investment. His promise to restore the basic bargain that built this country must include preserving and strengthening the nation’s retirement and health security programs, Social Security and Medicare. There are Medicare reforms that can save money such as reducing taxpayer subsidies to prescription drug companies as the President proposed tonight. We can also allow Medicare to negotiate for lower drug prices, allow prescription drug re-importation in Part D and lift the payroll tax cap in Social Security.” NCPSSM President/CEO, Max Richtman

However, the news wasn’t all good for seniors who depend on Medicare and Social Security as the President, once again, urged increased means-testing for Medicare and left the door open for Social Security benefit cuts by changing the cost of living allowance formula.

“Reform proposals such as Medicare means testing, as the President proposed tonight, or cutting the annual COLA through the adoption of a chained CPI as the President has said remains on the table, will violate his promise not to ‘damage a secure retirement’.

We urge the President to stick to his previously stated views that Social Security’s long-term solvency should not be a part of the deficit debate since it’s not a driver of our deficits. Contrary to the political spin, changing the cost of living formula for millions, including; veterans, retirees, and people with disabilities isn’t a “technical change” it’s an immediate benefit cut. For seniors it means $130 per year for the typical 65-year old retiree that would grow exponentially to a $1,400 cut after 30 years of retirement.

While we welcome President Obama’s continued efforts to move Congress toward a path of fiscal responsibility, America’s seniors know that in Washington, so-called ‘sensible reforms’ can mean virtually anything. We urge the President to remember that reducing already modest benefits to seniors isn’t the path to economic growth.”…Max Richtman, NCPSSM President/CEO

It certainly sounds reasonable to “ask more from the wealthiest seniors,” as the President proposed last night, right? But that’s already happened in Medicare. Medicare is already means-tested with beneficiaries who earn above $85,000 already paying higher premiums. So, if that’s not enough, who does the President actually consider as a “wealthy senior?” How about someone earning $47,000? The truth is current proposals to increase Medicare means testing would hit far more than “wealthy” seniors. In fact the Kaiser Foundation found that middle-class retirees earning just $47,000 would be hit with higher costs. Increased Medicare means-testing is simply another way to pass costs to middle-class seniors…not the “wealthy” receiving Medicare.

“And those of us who care deeply about programs like Medicare must embrace the need for modest reforms otherwise, our retirement programs will crowd out the investments we need for our children, and jeopardize the promise of a secure retirement for future generations.” …President Obama

This intergenerational warfare argument attempts to pits America’s young versus old and is a favorite of the Pete Peterson/anti-Social Security crowd. It also ignores the reality that seniors aren’t “greedy geezers” who are only interested in preserving their own benefits at the expense of their children and grandchildren. Quite the opposite. Seniors understand the value of these programs and know future generations will depend on them, as much or even more than they do. Seniors have a unique perspective, having participated in the private healthcare system and in Medicare. They know, first hand, that Medicare isn’t the problem. Instead, Medicare should be used as a model to guide the improvement of our entire American health care system. Medicare remains more efficient than private health care and many of the quality driven reforms the President touted last night are already happening in Medicare. The growing aging population isn’t news but it does provide opportunities for innovation that could lead to meaningful reform of America’s private health care system that still costs more and provides less than health care in other industrialized countries. It’s time for Washington to stop blaming the program for a problem it didn’t create, while pitting young versus old at the same time.

But we can’t ask senior citizens and working families to shoulder the entire burden of deficit reduction while asking nothing more from the wealthiest and most powerful. . . After all, why would we choose to make deeper cuts to education and Medicare just to protect special interest tax breaks? How is that fair? How does that promote growth?…President Obama

It’s clearly not fair, especially when you consider that 75% of deficit reduction has already come from cuts impacting average Americans.

For too long, many in Washington have pretended that “shared sacrifice” means that if a millionaire loses a tax break then the middle-class and poor must also lose their modest benefits in Medicare or Social Security. This false equivalency pretends that a tax dollar lost to a millionaire or huge corporation is the same as a benefit dollar lost to a retiree living on $14,000 a year from Social Security. America’s seniors know that’s not a fair and balanced approach, it’s not sensible reform and it’s not the path to economic recovery…Max Richtman, NCPSSM President/CEO

And I am open to additional reforms from both parties, so long as they don’t violate the guarantee of a secure retirement…President Obama

Cutting Social Security benefits by $130 each year starting immediately with the adoption of the Chained CPI and shifting costs to middle-class seniors in Medicare will absolutely threaten the secure retirement for millions of American seniors. The average retiree receives only $14,000 per year in Social Security yet 75% of seniors paid $10,000 in out of pocket health care costs, even with Medicare.

Seniors received an average COLA of 1.3% over 4 years with no increases in two of those years. Arguing that these benefits are too generous and seniors have to sacrifice even more in the name of deficit reduction shows how out of touch Washington has become with the real-world economic realities facing average Americans, especially seniors.

Social Security Double-Speak and the State of the Union

That news? The President has flip-flopped yet again on Social Security. As of yesterday, it now appears the President is once again willing to cut Social Security benefits immediately, even though he’s said Social Security isn’t a driver of the debt and should not be a part of the deficit debate.

Here’s the how the flip has flopped over the past three months:

“Over the past two years, the White House had made it clear in budget negotiations that it was open to Social Security benefit reductions as part of a larger deal that included tax hikes. Yet on Monday, White House spokesman Jay Carney appeared to back up Durbin’s position, suggesting a “separate track” be used to reform Social Security. “We should address the drivers of the deficit, and Social Security currently is not a driver of the deficit,” he said.”… Huffington Post, November 2012

This “I support a separate track because Social Security isn’t the problem” perspective is also what President Obama told NCPSSM President, Max Richtman, and other advocates in a November White House meeting.

But here are yesterday’s White House comments on Social Security:

“Q: But I just want to be clear what you said at the beginning of that answer, which is the President —

MR. CARNEY: It is not our —

Q: — as part of an overall balanced approach, he does not rule out effectively reducing benefits for Social Security recipients?

MR. CARNEY: He has put forward a technical change as part of a big deal — and it’s on the table — that he put forward to the Speaker of the House. The Speaker of the House, by the way, walked away from that deal even though it met the Republicans halfway on revenues and halfway on spending cuts and included some tough decisions by the President on entitlements. The Speaker walked away from that deal.

But as part of that deal, the technical change in the so-called CPI is possible in his own offer as part of a big deal.”

For those who don’t speak politician, that means even though we know cutting Social Security benefits as a part of a deficit deal makes no sense, we’re going to do it anyway in the name of “shared sacrifice”.

“How do you explain to a senior that we’re doing this, asking you to sacrifice, but we’re not saying that corporate jet owners should lose their special tax incentive; we’re not saying to oil and gas companies who are making record profits that they should forego these huge subsidies that taxpayers provide? That’s not fair and it’s not good economics.” Jay Carney, White House spokesman

Catch what’s being done here? The White House is repeating the same flawed logic offered by Washington’s billion dollar anti-entitlement lobby that “shared sacrifice” means retired veterans, people with disabilities and retirees living on the average $14,000 Social Security benefit (which they contributed throughout their working lives) must see benefit cuts before Washington will even talk about trillions of dollars in corporate tax loopholes and giveaways to multimillionaires.

This false equivalency pretends that a tax dollar lost to a millionaire or huge corporation is the same as a benefit dollar lost to a retiree living on $14,000 a year from Social Security. America’s seniors know that’s not a fair and balanced approach, it’s not sensible reform and it’s not the path to economic recovery”…Max Richtman, NCPSSM President/CEO

Let’s be clear what this so-called “technical change” really is. The “Chained CPI”, will cut the annual cost of living allowance (COLA) by 3% for workers retired for ten years and 6% for workers retired for twenty years. This translates to a benefit cut of $130 per year in Social Security benefits for a typical 65 year-old. By the time that senior reaches 95, the annual benefit cut will be almost $1,400. This COLA change would also take effect immediately, impacting retirees now and in the future.

These reductions disproportionately impact Social Security’s oldest beneficiaries. These are often women who have outlived their other sources of income, depleted their assets, and rely on Social Security as their only lifeline to financial stability. Claims that the current COLA is too generous are false. The COLA has averaged just 2% over the past five years with 0% for two of those years.

There is a formula that more accurately measures expenses retirees incur. The CPI-E was developed in 1987 to reflect the different spending patterns of consumers age 62 and older. This formula acknowledges health costs have been rising much faster than other expenses, and that those costs represent a much larger percentage of seniors’ monthly spending than is the case with other demographic groups. The CPI-E is a more accurate measure of the real-world expenses retirees face than the current COLA formula and far more accurate than the proposed Chained CPI which would cut projected benefits over time.

Contrary to the political spin, this chained CPI proposal isn’t a “tweak” or an “adjustment,” it cuts benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts.

Sound fair, equitable or reasonable to you?

We’ve created a number of graphics to help explain the Chained CPI and how it cuts benefits for millions of seniors, the disabled, veterans and more.

Is Social Security all that’s Left of Retirement’s “3-legged stool”

USA Today has a must read analysis of the failure of 401K’s to provide retirement security. For baby boomers, promised that their 401K’s terrific returns would replace pensions which largely disappeared during their working lifetimes, the economic reality has been a disaster.

According to the Center for Retirement Research at Boston College, the median household retirement account balance in 2010 for workers between the ages of 55-64 was just $120,000. For people expecting to retire at around age 65, and to live for another 15 years or more, this will provide for only a trivial supplement to Social Security benefits.

And that’s for people who actually have a retirement account of some kind. A third of households do not. For these people, their sole retirement income, aside from potential aid from friends and family, comes from Social Security, for which the current average monthly benefit is $1,230.

Which segues to those who don’t have any type of retirement account. Boston College’s Financial Security Project has an interesting blog post today touching on all of the reasons Social Security has become especially important to African American retirees. In addition to their average reduced longevity and lower incomes, as we’ve reported here before, the loss of the traditional retirement “3-legged stool” hits communities of color especially hard:

Social Security is now more critical than ever to whether retirees can make it financially, because traditional pensions are becoming rare. African-Americans and Latinos who are 65 or older were less likely to work for an employer that offered its employees a traditional pension, according to SSA data.

African-Americans and Latinos are behind the retirement 8 ball in another way that’s related to their income and their greater difficulty generating wealth: only about one in four African-Americans and Latinos over 65 receives income from investments, while more than half of whites do.

The Center on Budget and Policy Priorities’ Social Security fact sheet also provides 10 important facts about the program.

Here They Go Again: The Latest Bowles Simpson Proposal tells Seniors “Pay More and Get Less”

While touted as a “new” plan by the mainstream media, the latest Bowles/Simpson (BS) deficit reduction proposal is really just more of the same — requiring middle-class benefit cuts and tax hikes to reduce the deficit.

“Their plan once again calls for cuts that are out of sync with middle class American’s priorities. Adopting the chained CPI, as Bowles Simpson propose, would mean an immediate benefit cut of $130 per year for the typical 65-year old retiree and would grow exponentially to a $1,400 cut after 30 years of retirement. This chained CPI proposal isn’t a “tweak” or an “adjustment,” it’s designed to cut benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts. That’s a lot of money…out of the pockets of those who can least afford to sacrifice even more. “…Max Richtman, President/CEO

While BS claims a goal of “shared sacrifice” let’s not forget that already 75% of deficit reduction has come from benefit cuts. Their latest version simply doubles-down on that formula asking for $2.4 trillion dollars more in savings, again largely from middle class Americans. Think Progress breaks it down:

Between the budget deals in the spring of 2011 and the Budget Control Act, which averted the debt ceiling crisis that same year, spending has been cut by $1.5 trillion and interest payments reduced by another $200 billion. Then the American Taxpayer Relief Act, which solved the impasse over the “fiscal cliff,” raised $600 billion in new tax revenue.

So if Simpson-Bowles are interested in “building upon” what lawmakers have already achieved, the logical thing to propose is another $1.4 trillion in spending cuts plus another $2 trillion in additional tax revenue. Or if they’re happy with their new $4.8 trillion target — rather than the original $6.3 trillion — their new proposal should heavily favor tax increases, since deficit reduction so far has favored spending cuts by three to one. Instead, Simpson and Bowles are proposing $1.8 trillion in new spending cuts and reduced interest payments, and only $600 billion in additional revenue.

It’s also worth noting that the additional revenue, once again, does not target those who’ve benefited most in this economy. Instead, BS will hit middle-class Americans with higher taxes while lowering tax rates for corporations and the wealthy:

“They’re still singing the gospel of revenue increases funded by “closing loopholes,” an amorphous plan that’s likely to hit the middle class with much more force than it would higher earners. They claim that the tax code is “riddled with well over $1 trillion of tax expenditures – which really are just spending by another name.”

And then they repeat their call for lowering tax rates for corporations and the highest-earning individuals.

Their $1-trillion-plus target for “tax expenditure” elimination can only be reached by targeting employer health plans, home mortgage interest deductions, and other policies that would disproportionately hit the already-beleaguered middle class.

Their approach would convert a social insurance program into a welfare program – but one which is solely funded on income below the payroll tax cap (roughly $110,000 at the moment). That plan targets everyone BUT the wealthy in the name of deficit reduction. That fact, coupled with Simpson and Bowles’ continued insistence on lowering tax rates for corporations and the wealthy, illustrates the right-wing thinking that underlies this supposedly “bipartisan” approach.” Richard Eskow, Our Future Blog

We don’t have to slash benefits to the middle-class and poor Americans to reduce the deficit. The BS plan to cut COLA’s and raise taxes through the chained-CPI, cutting Medicare benefits by further means testing and eliminating Medicare eligibility for millions of younger retirees is not shared sacrifice. It’s not fiscal responsibility and it’s certainly does not represent the economic priorities of the vast majority of Americans of all ages and political parties.

Social Security & Medicare: So Much More than Numbers on a Spreadsheet

The National Committee to Preserve Social Security & Medicare is commemorating Black History Month with blog posts from a number of the nation’s leading policy analysts, lawmakers, and community leaders. We’ll examine the importance of programs like Social Security, Medicare, and Medicaid to the African American community while also paying tribute to generations of African Americans who have struggled with adversity to achieve full citizenship in American society.

Nevada Congressman Steven Horsford comes to the 113th Congress as a strong advocate for Social Security and Medicare based on his own personal experience with the vital role these programs play in the lives of American families.

Rep. Steven Horsford – (D) Nevada’s 4th District

Medicare and Social Security are sometimes referred to as “entitlements.” In reality, they are promises. They are social insurance programs that prevent poverty in our golden years and they help our parents and grandparents live the comfortable and dignified retirement they deserve. These programs keep America’s promise to our seniors and protect the health of the most vulnerable.

The debate over funding for our social insurance programs can sometimes get lost in spreadsheets and numbers. Ultimately, however, these programs are about people. I know this all too well.

When I was a young boy, my grandmother suffered a stroke and fell into a coma. When she awoke, half of her body was paralyzed, and from there on out she spent the final 27 years of her life moving from nursing home to nursing home, depending on where beds and resources were available. At a young age, I had no idea that Social Security, Medicare, and Medicaid were a crucial part of my grandmother’s life support. But they were.

I visited her every week. Those trips to her bedside are still with me today, and they are a constant reminder that when we cut the budget, we are not just talking about numbers. We are talking about people. We are talking about our families and the ones we love. We are talking about my grandmother.

So, we will get our debt under control, but we will not cut our way to prosperity, and we will not neglect our most vulnerable citizens in the process. We will not take a hatchet to our safety net. It’s just not right, especially while corporations continue to receive trillions of dollars in special tax breaks.

Members of my district are also uniquely affected by proposals to defund Medicare and Social Security. Hispanics make up 27% of the population in Nevada’s 4th Congressional District, and African-Americans make up 16%. Devastating cuts to social insurance programs would be amplified for many of my constituents. Two-thirds of African-Americans and Hispanics have incomes below $22,500 post-retirement, and many rely solely on Medicare to receive health services. How can we say that these constituents, who live with so little and receive the bare minimum in benefits, are part of a “spending problem?”

Medicare and Social Security serve as important and necessary programs to keep seniors healthy. We cannot go back on a promise for safe retirement and health benefits. Our seniors have built their future around the existence of programs they have paid into for years. For my grandmother and my constituents, I vow to fight to protect these programs.

Join the conversation with Congressman Horsford online via:

Parsing the State of the Union – Plans for Social Security & Medicare

President Barack Obama State of the Union, January 12, 2013

“It is our unfinished task to restore the basic bargain that built this country.”

“Most Americans Democrats, Republicans, and Independents understand that we can’t just cut our way to prosperity.”

“The greatest nation on Earth cannot keep conducting its business by drifting from one manufactured crisis to the next.”

“Deficit reduction alone is not an economic plan.”

“We’ll reduce taxpayer subsidies to prescription drug companies…We’ll bring down costs by changing the way our government pays for Medicare.”

“Our government shouldn’t make promises we cannot keep but we must keep the promises we’ve already made.“

NCSSM President Max Richtman was invited to watch the State of the Union along with other national advocates last night and meet with White House staff in a post-speech briefing. He was encouraged by the President’s focus on economic recovery:

“President Obama is right to keep his focus on economic recovery, including job creation and economic investment. His promise to restore the basic bargain that built this country must include preserving and strengthening the nation’s retirement and health security programs, Social Security and Medicare. There are Medicare reforms that can save money such as reducing taxpayer subsidies to prescription drug companies as the President proposed tonight. We can also allow Medicare to negotiate for lower drug prices, allow prescription drug re-importation in Part D and lift the payroll tax cap in Social Security.” NCPSSM President/CEO, Max Richtman

However, the news wasn’t all good for seniors who depend on Medicare and Social Security as the President, once again, urged increased means-testing for Medicare and left the door open for Social Security benefit cuts by changing the cost of living allowance formula.

“Reform proposals such as Medicare means testing, as the President proposed tonight, or cutting the annual COLA through the adoption of a chained CPI as the President has said remains on the table, will violate his promise not to ‘damage a secure retirement’.

We urge the President to stick to his previously stated views that Social Security’s long-term solvency should not be a part of the deficit debate since it’s not a driver of our deficits. Contrary to the political spin, changing the cost of living formula for millions, including; veterans, retirees, and people with disabilities isn’t a “technical change” it’s an immediate benefit cut. For seniors it means $130 per year for the typical 65-year old retiree that would grow exponentially to a $1,400 cut after 30 years of retirement.

While we welcome President Obama’s continued efforts to move Congress toward a path of fiscal responsibility, America’s seniors know that in Washington, so-called ‘sensible reforms’ can mean virtually anything. We urge the President to remember that reducing already modest benefits to seniors isn’t the path to economic growth.”…Max Richtman, NCPSSM President/CEO

It certainly sounds reasonable to “ask more from the wealthiest seniors,” as the President proposed last night, right? But that’s already happened in Medicare. Medicare is already means-tested with beneficiaries who earn above $85,000 already paying higher premiums. So, if that’s not enough, who does the President actually consider as a “wealthy senior?” How about someone earning $47,000? The truth is current proposals to increase Medicare means testing would hit far more than “wealthy” seniors. In fact the Kaiser Foundation found that middle-class retirees earning just $47,000 would be hit with higher costs. Increased Medicare means-testing is simply another way to pass costs to middle-class seniors…not the “wealthy” receiving Medicare.

“And those of us who care deeply about programs like Medicare must embrace the need for modest reforms otherwise, our retirement programs will crowd out the investments we need for our children, and jeopardize the promise of a secure retirement for future generations.” …President Obama

This intergenerational warfare argument attempts to pits America’s young versus old and is a favorite of the Pete Peterson/anti-Social Security crowd. It also ignores the reality that seniors aren’t “greedy geezers” who are only interested in preserving their own benefits at the expense of their children and grandchildren. Quite the opposite. Seniors understand the value of these programs and know future generations will depend on them, as much or even more than they do. Seniors have a unique perspective, having participated in the private healthcare system and in Medicare. They know, first hand, that Medicare isn’t the problem. Instead, Medicare should be used as a model to guide the improvement of our entire American health care system. Medicare remains more efficient than private health care and many of the quality driven reforms the President touted last night are already happening in Medicare. The growing aging population isn’t news but it does provide opportunities for innovation that could lead to meaningful reform of America’s private health care system that still costs more and provides less than health care in other industrialized countries. It’s time for Washington to stop blaming the program for a problem it didn’t create, while pitting young versus old at the same time.

But we can’t ask senior citizens and working families to shoulder the entire burden of deficit reduction while asking nothing more from the wealthiest and most powerful. . . After all, why would we choose to make deeper cuts to education and Medicare just to protect special interest tax breaks? How is that fair? How does that promote growth?…President Obama

It’s clearly not fair, especially when you consider that 75% of deficit reduction has already come from cuts impacting average Americans.

For too long, many in Washington have pretended that “shared sacrifice” means that if a millionaire loses a tax break then the middle-class and poor must also lose their modest benefits in Medicare or Social Security. This false equivalency pretends that a tax dollar lost to a millionaire or huge corporation is the same as a benefit dollar lost to a retiree living on $14,000 a year from Social Security. America’s seniors know that’s not a fair and balanced approach, it’s not sensible reform and it’s not the path to economic recovery…Max Richtman, NCPSSM President/CEO

And I am open to additional reforms from both parties, so long as they don’t violate the guarantee of a secure retirement…President Obama

Cutting Social Security benefits by $130 each year starting immediately with the adoption of the Chained CPI and shifting costs to middle-class seniors in Medicare will absolutely threaten the secure retirement for millions of American seniors. The average retiree receives only $14,000 per year in Social Security yet 75% of seniors paid $10,000 in out of pocket health care costs, even with Medicare.

Seniors received an average COLA of 1.3% over 4 years with no increases in two of those years. Arguing that these benefits are too generous and seniors have to sacrifice even more in the name of deficit reduction shows how out of touch Washington has become with the real-world economic realities facing average Americans, especially seniors.

Social Security Double-Speak and the State of the Union

That news? The President has flip-flopped yet again on Social Security. As of yesterday, it now appears the President is once again willing to cut Social Security benefits immediately, even though he’s said Social Security isn’t a driver of the debt and should not be a part of the deficit debate.

Here’s the how the flip has flopped over the past three months:

“Over the past two years, the White House had made it clear in budget negotiations that it was open to Social Security benefit reductions as part of a larger deal that included tax hikes. Yet on Monday, White House spokesman Jay Carney appeared to back up Durbin’s position, suggesting a “separate track” be used to reform Social Security. “We should address the drivers of the deficit, and Social Security currently is not a driver of the deficit,” he said.”… Huffington Post, November 2012

This “I support a separate track because Social Security isn’t the problem” perspective is also what President Obama told NCPSSM President, Max Richtman, and other advocates in a November White House meeting.

But here are yesterday’s White House comments on Social Security:

“Q: But I just want to be clear what you said at the beginning of that answer, which is the President —

MR. CARNEY: It is not our —

Q: — as part of an overall balanced approach, he does not rule out effectively reducing benefits for Social Security recipients?

MR. CARNEY: He has put forward a technical change as part of a big deal — and it’s on the table — that he put forward to the Speaker of the House. The Speaker of the House, by the way, walked away from that deal even though it met the Republicans halfway on revenues and halfway on spending cuts and included some tough decisions by the President on entitlements. The Speaker walked away from that deal.

But as part of that deal, the technical change in the so-called CPI is possible in his own offer as part of a big deal.”

For those who don’t speak politician, that means even though we know cutting Social Security benefits as a part of a deficit deal makes no sense, we’re going to do it anyway in the name of “shared sacrifice”.

“How do you explain to a senior that we’re doing this, asking you to sacrifice, but we’re not saying that corporate jet owners should lose their special tax incentive; we’re not saying to oil and gas companies who are making record profits that they should forego these huge subsidies that taxpayers provide? That’s not fair and it’s not good economics.” Jay Carney, White House spokesman

Catch what’s being done here? The White House is repeating the same flawed logic offered by Washington’s billion dollar anti-entitlement lobby that “shared sacrifice” means retired veterans, people with disabilities and retirees living on the average $14,000 Social Security benefit (which they contributed throughout their working lives) must see benefit cuts before Washington will even talk about trillions of dollars in corporate tax loopholes and giveaways to multimillionaires.

This false equivalency pretends that a tax dollar lost to a millionaire or huge corporation is the same as a benefit dollar lost to a retiree living on $14,000 a year from Social Security. America’s seniors know that’s not a fair and balanced approach, it’s not sensible reform and it’s not the path to economic recovery”…Max Richtman, NCPSSM President/CEO

Let’s be clear what this so-called “technical change” really is. The “Chained CPI”, will cut the annual cost of living allowance (COLA) by 3% for workers retired for ten years and 6% for workers retired for twenty years. This translates to a benefit cut of $130 per year in Social Security benefits for a typical 65 year-old. By the time that senior reaches 95, the annual benefit cut will be almost $1,400. This COLA change would also take effect immediately, impacting retirees now and in the future.

These reductions disproportionately impact Social Security’s oldest beneficiaries. These are often women who have outlived their other sources of income, depleted their assets, and rely on Social Security as their only lifeline to financial stability. Claims that the current COLA is too generous are false. The COLA has averaged just 2% over the past five years with 0% for two of those years.

There is a formula that more accurately measures expenses retirees incur. The CPI-E was developed in 1987 to reflect the different spending patterns of consumers age 62 and older. This formula acknowledges health costs have been rising much faster than other expenses, and that those costs represent a much larger percentage of seniors’ monthly spending than is the case with other demographic groups. The CPI-E is a more accurate measure of the real-world expenses retirees face than the current COLA formula and far more accurate than the proposed Chained CPI which would cut projected benefits over time.

Contrary to the political spin, this chained CPI proposal isn’t a “tweak” or an “adjustment,” it cuts benefits and raises taxes, largely on the poor and middle class, totaling $208 billion over ten years. $112 billion of those benefits cuts come from Social Security alone with up to $24 billion coming from VA benefits and civilian and military retirement pay cuts.

Sound fair, equitable or reasonable to you?

We’ve created a number of graphics to help explain the Chained CPI and how it cuts benefits for millions of seniors, the disabled, veterans and more.

Is Social Security all that’s Left of Retirement’s “3-legged stool”

USA Today has a must read analysis of the failure of 401K’s to provide retirement security. For baby boomers, promised that their 401K’s terrific returns would replace pensions which largely disappeared during their working lifetimes, the economic reality has been a disaster.

According to the Center for Retirement Research at Boston College, the median household retirement account balance in 2010 for workers between the ages of 55-64 was just $120,000. For people expecting to retire at around age 65, and to live for another 15 years or more, this will provide for only a trivial supplement to Social Security benefits.

And that’s for people who actually have a retirement account of some kind. A third of households do not. For these people, their sole retirement income, aside from potential aid from friends and family, comes from Social Security, for which the current average monthly benefit is $1,230.

Which segues to those who don’t have any type of retirement account. Boston College’s Financial Security Project has an interesting blog post today touching on all of the reasons Social Security has become especially important to African American retirees. In addition to their average reduced longevity and lower incomes, as we’ve reported here before, the loss of the traditional retirement “3-legged stool” hits communities of color especially hard:

Social Security is now more critical than ever to whether retirees can make it financially, because traditional pensions are becoming rare. African-Americans and Latinos who are 65 or older were less likely to work for an employer that offered its employees a traditional pension, according to SSA data.

African-Americans and Latinos are behind the retirement 8 ball in another way that’s related to their income and their greater difficulty generating wealth: only about one in four African-Americans and Latinos over 65 receives income from investments, while more than half of whites do.

The Center on Budget and Policy Priorities’ Social Security fact sheet also provides 10 important facts about the program.