America’s Wealth Divide Continues: Cutting Social Security & Medicare Will Make it Even Worse

It’s easy in this era of Washington deficit mania to focus solely on the numbers on a budget spreadsheet while losing sight of the fact that the austerity agenda pushed by those least likely to be impacted by their policies will have serious implications for America’s middle class families. This is especially true for those already struggling in this economic slowdown, especially communities of color. We’ve talked about this a lot during February’s Black History month coverage and NCPSSM will continue to address these issues throughout the ongoing budget and deficit debate. In case you missed it, here’s a wrap up of some of our February coverage:

National Advocates Join Forces to Urge Equal Access to Social Security Benefits

We were proud today to release a new report, co-authored with the Human Rights Campaign detailing how current law leaves America’s same sex couples and their families living outside the safety net.

Social Security is the keystone of most Americans’ retirement planning and provides valuable income protection to families in case of a worker’s disability or death. Yet, same-sex couples and many of their children are denied access to Social Security benefits, even though they have contributed to the program throughout their working lives. The National Committee to Preserve Social Security and Medicare Foundation and the Human Rights Campaign Foundation have issued a new report “Living Outside the Safety Net.” This report examines the impact this inequality has on millions of lesbian and gay families and offers legislative solutions.

“Social Security has a long tradition of evolving to more effectively protect America’s workers and their families as our nation changes. In fact, that is key to the program’s unparalleled success across generations. America’s same-sex couples and their families have earned Social Security’s protections the same as any other working American and they deserve the same retirement and economic security the program provides.” … Carroll Estes, NCPSSM Foundation Chair

“Social Security is a safety net for many, and the sole source of income for some. However, same-sex couples go completely unrecognized by Social Security and are routinely denied this benefit. As a result, many surviving same-sex spouses find themselves in a financial free-fall following the death or disability of a spouse.” said HRC Legislative Counsel for Administrative Advocacy Robin Maril. “This report provides an overview of the extent of the economic loss many families are experiencing today because the Social Security system fails to recognize them as a family. Congress must right this wrong by passing legislation that makes these vital benefits available to all Americans.”

The National Committee and HRC support legislation introduced by Congresswoman Linda Sanchez (D-CA) to expand Social Security spousal benefits to same-sex couples. The Social Security Equality Act of 2012 (H.R. 4609) would require the Social Security Administration to provide same-sex couples with the same spousal, survivor and death benefits their heterosexual counterparts receive.

“Same-sex couples pay into Social Security, and they should receive the full benefits they have earned. It is time for us to end discrimination in Social Security so that same-sex couples are not treated as second class citizens. I’m proud to say that I will be re-introducing the ‘Social Security Equality Act’ this Congress to make sure every American receives a benefit based upon their contribution to the program, not their sexual orientation.” Rep. Linda Sanchez (D-CA)

On average, a full retirement age same-sex household with one wage-earner forfeits $675 monthly or $8,100 annually in lost spousal retirement benefits. Blair Dottin-Haley, from Alexandria, Virginia, works for a local non-profit and has been married for nearly two years. His husband is HIV positive; however, even though they both have contributed to Social Security throughout their working lives they are not eligible for spousal benefits.

Blair Dottin-Haley who married his husband two years ago in DC also be joined the panel. “As a married man, it’s important that I protect my family and work to secure the rights and benefits that we’ve earned by joining our lives together.”

This report recommends that Congress:

- Amend the Social Security Act to include same-sex domestic partners as eligible to receive equal benefits following the death, retirement, or disability of their loved one.

- Include language within the Social Security Act’s definition of “child” to reflect the permanent relationship between a legally-unrecognized same-sex parent and his or her child to end the exclusion of many children under current law.

- Repeal the Defense of Marriage Act (DOMA) which currently prevents surviving same-sex spouses from receiving Social Security benefits they are otherwise entitled to.

You can read the full report on the NCPSSM Foundation website here.

Celebrating Black History Month and Some of Our Wonderful Activists

Geneva Burns, a Memphis resident, has been a volunteer with the National Committee for more than 10 years where she has done radio and at least 20 presentations. She has worked with the AGE STAGE Theatre Group with the Commission on Aging and served as Vice Chair on the Tennessee Commission on Aging. Burns was the only African American during her four year tenure. “Social Security & Medicare are worth fighting for!”

Ruth Cossey, East Palo Alto, CA, concentrates on providing information to seniors by managing the National Committee resource tables in the minority community and across her congressional district. She is always willing to support our efforts and to educate people about Social Security and Medicare issues. “Volunteering for NCPSSM, gives me the opportunity to share news and updates about Social Security and Medicare with seniors.”

Pat Cotton, Hyattsville, MD, has been a media star for NCPSSM, speaking at press conferences on Capitol Hill and interviews with national publications. Pat is also a Rally Corp member and works as a CAN. “I am an activist to preserve Social Security, Medicare & Medicaid for me and for my patients. These programs add to the quality of life!”

Alberta Gaskins, Washington, DC, another media star, she is a member of our Rally Corp and has helped with numerous petition deliveries to Congressional offices, press events and briefings. “I say I will fight for Social Security, Medicare and Medicaid because these are things that matter!!!”

Nettie Haile, Washington, DC, is a member of our Rally Corp. She was a speaker at the Summit on Social Security sponsored by Senator Bernie Sanders in November, 2012. Congresswoman Eleanor Holmes Norton, after hearing Nettie speak on Social Security at a briefing several years ago, declared Nettie her “poster child for Social Security”.“It’s very important that we do all we can to insure that benefits promised and worked hard for are not taken away.”

Celestine Johnson, Washington, DC, is an active member of our Rally Corps, participating in the majority of our “short notice” events on Capitol Hill. She arranges speaking opportunities for National Committee representatives with senior/retiree groups at her church. She has also recruited other local activists to join the Rally Corps. “I especially enjoy working with NCPSSM. I have learned so much.”

Jerry Johnson, Las Vegas, NV , a recent retiree of Clark County’s Senior Advocate Program, was as active participant in the National Committee’s Rapid Response Campaign during the 2012 election. He serves as a Grassroots District Team member. He brings a wealth of knowledge with respect to the aging network in the state and of senior issues in the communities. “As a boomer, I’ve embraced the reality of the safety net that Social Security and Medicare provides and this was my incentive to join as a volunteer to insure that it prevails.”

Godfrey Laws splits his time between Seattle WA and Roxboro NC each year and he volunteers in both communities. He has been involved in many local events and helps with our education and outreach. He works with many churches, and particularly likes to inform younger people about Social Security. “Social Security and Medicare are so important in the lives of some many people. We need to educate people of all ages about the value of these programs and work to maintain them for the health and well-being of seniors and their families.”

Reverend Julius Turnipseed, Memphis, TN, has given many educational sessions on Social Security and Medicare and disseminated our materials in communities throughout his area. “I am very proud to be an advocate for NCPSSM. We are able to get the truth to the people about what’s going on in Washington.”

Rosie Lee Woods, a resident from Richmond, VA, has recruited some terrific family and friends from GA and AR to be NCPSSM volunteers. She sets up community education meetings and makes visits to her local Congressional offices. “After joining NCPSSM, I have become better informed and more involved with politics, advocacy and helping others to get involved too.”

Bitter Pill – A Time Magazine Article Every Senior in Medicare Should Read

As we’ve said here repeatedly, America doesn’t face a Medicare crisis — we face a national health care crisis. Rather than targeting Medicare for cuts we should be using it as the model to improve out health care system nationwide. As Brill reports:

“Unless you are protected by Medicare, the health care market is not a market at all. It’s a crapshoot. They are powerless buyers in a seller’s market where the only sure thing is the profit of the sellers.”

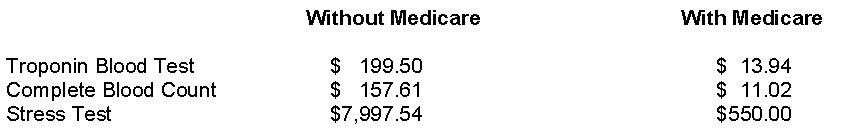

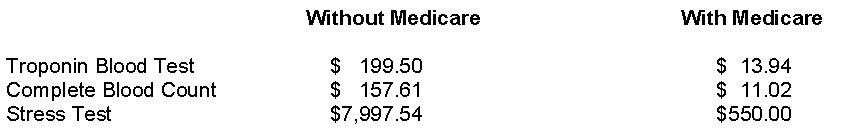

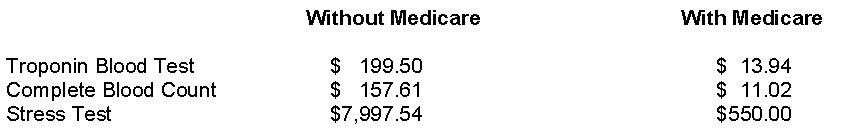

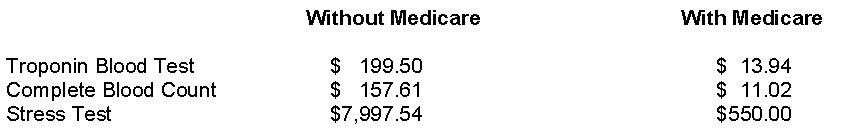

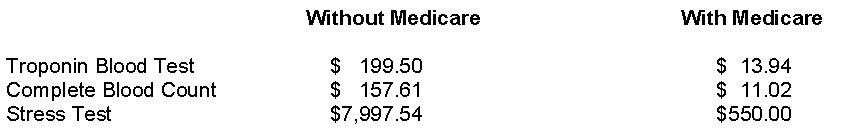

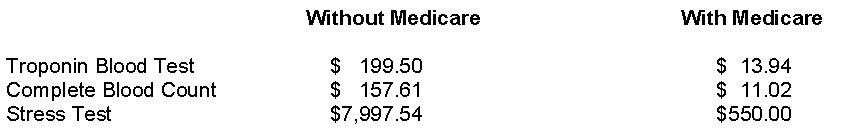

Consider Time’s example of Susan S. She was 64, one year away from qualifying for Medicare, when she went to the hospital with chest pains. Her bill for 3 hours of tests and a false alarm was $21,000. If she had Medicare she would have paid less than $500. Compare her costs:

Time’s survey of this same hospital found that in 2010 its total charges were 11 times its actual costs. And that’s not unusual in our current private profit and even non-profit health care system.

Not only does Medicare manage these outrages costs better than the private market, Medicare’s administrative costs are two-thirds of 1% or less than $3.80 per claim. Private Insurers administrative costs run much higher. Brill reports Aetna’s for example, run 29% or $30 for each claim.

However, Medicare isn’t immune from the skyrocketing costs that are burdening our economy. Brill points out that Congress has tied Medicare’s hands in many instances forcing the more efficient Medicare program to perform like the less efficient private market:

Our laws do more than prevent the government from restraining prices for drugs the way other countries do. Federal law also restricts the biggest single buyer — Medicare — from even trying to negotiate drug prices. As a perpetual gift to the pharmaceutical companies (and an acceptance of their argument that completely unrestrained prices and profit are necessary to fund the risk taking of research and development), Congress has continually prohibited the Centers for Medicare and Medicaid Services (CMS) of the Department of Health and Human Services from negotiating prices with drugmakers. Instead, Medicare simply has to determine that average sales price and add 6% to it.

Similarly, when Congress passed Part D of Medicare in 2003, giving seniors coverage for prescription drugs, Congress prohibited Medicare from negotiating.

Nor can Medicare get involved in deciding that a drug may be a waste of money. In medical circles, this is known as the comparative-effectiveness debate, which nearly derailed the entire Obamacare effort in 2009.

The health care industrial complex spends more than three times what the military industrial complex spends for Washington lobbying. Is it any wonder why so many in Congress have chosen to ignore the true system wide health care problem in favor of targeting Medicare for benefit cuts, arbitrary caps, cost-shifting, means-testing and privatization.

They know what the core problem is — lopsided pricing and outsize profits in a market that doesn’t work.

In spite of this, Congress appears ready to protect that broken health care market that is wrecking our economy in favor of targeting the program that works for cuts — all in the name of deficit reduction. Cutting benefits to seniors in Medicare not only ignores the real challenges we face as a nation but it also threatens the health security of millions of Americans.

Economic Recovery is Good for Americans – Bad for Anti-Social Security & Medicare Lobbyists’ Crisis Strategy

![]()

![]()

![]()

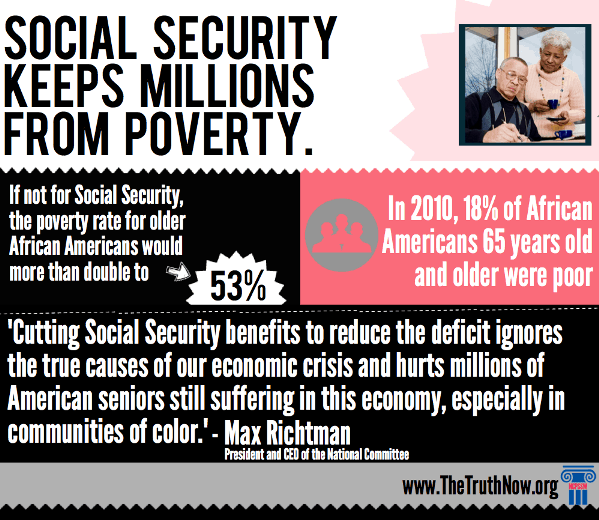

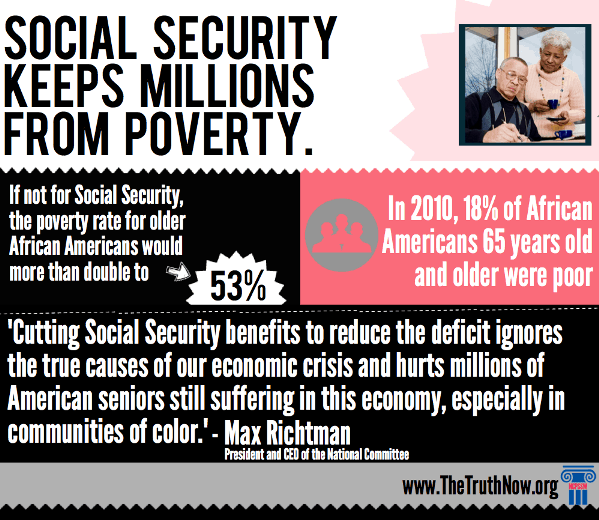

The deficit is going down, health care cost growth is slowing and the economy is finally showing signs of recovery. Deficit reduction isn’t the biggest challenge facing our nation in spite of years of doom-and-gloom prognostications from this well-financed anti-entitlement lobby. Time clearly isn’t on the side of deficit-hawks who’ve seen this recession as their best chance in a generation to force drastic cuts to Social Security, Medicare, and Medicaid. Kudos to the National Journal for recognizing this basic truth.

New Simpson-Bowles Plan Overstates the Deficit Problem – The National Journal

The country’s annual deficit is shrinking for now, but that hasn’t stopped the two most prominent deficit hawks from waging an ongoing campaign for the elusive grand bargain.

by Nancy Cook

Updated: February 20, 2013 | 4:17 p.m.

February 20, 2013 | 3:42 p.m.Deficit hawks Alan Simpson and Erskine Bowles just don’t quit.

The duo unveiled the latest iteration of their deficit-reduction plan on Tuesday, which calls for $2.4 trillion in cuts over 10 years — yet another chapter in their ongoing debt campaign that has not gained much political traction since 2010.

At first, Simpson and Bowles’ newest proposal comes across as innovative: they learned from the past, rejiggered their suggestions, and rolled out a new framework during a quiet week when Congress was out-of-town. The new framework acknowledges the elusiveness of the big budget deal and instead lays out incremental spending cuts and tax increases that could occur over the next few years and into 2018. “Just the idea of a ‘grand bargain’ is at best on life support,” said Erskine Bowles, the former chief-of-staff under President Bill Clinton, at a breakfast sponsored by Politico.

Such reasonableness attempts to cast the pair as aggressive, yet savvy deficit hawks who have taken a different, more nuanced tact that’s more in sync with the political reality of a very divided Congress and White House.

Yet, that’s not necessarily an accurate portrait of the current state of Simpson-Bowles. In fact, it appears to be doubling down on deficit-hawkishness just as the economy is improving and the deficit is shrinking.

The new plan calls for a 3:1 ratio of spending cuts to tax increases, whereas previous versions called for a more balanced ratio. That means that Simpson and Bowles are calling for the majority of future deficit reduction to come from spending cuts at a time when a wide swath of economists, including a prominent conservative economist from the American Enterprise Institute, have warned against sudden austerity measures.

Simpson-Bowles and like-minded hawks also uphold the belief that solving the deficit is the headline economic problem of 2013. Just check out the new website Debt Deniers, funded by Fix the Debt, a Simpson-Bowles sister organization run by the same web of alarmists.

The Debt Deniers site, unveiled late last week, calls out people “who claim America has no debt problem.” In ominous red, black, and white writing and graphics, the site criticizes “debt deniers” (cough, cough — like economist and New York Times‘ columnist, Paul Krugman) who argue that the debt will solve itself, thanks to the slowly recovering economy, tax increases from the fiscal cliff deal, and spending caps set by the Budget Control Act of 2011. There’s nothing wrong with this strategy politically, except that it does not jibe with current economic data.

The deficit is not the primary economic problem of 2013; it’s just at the forefront of the political battles. (See: long-term unemployment, stagnant wages, or a slow-to-recover housing sector if you want to see real economic problems). Through the year 2016, the annual deficit is expected to shrink. (The Congressional Budget Office predicts it will decrease to $476 billion in 2016, compared to $845 billion in 2013).

Part of the reason the deficit is going down, at least temporarily, is that the federal government is taking in more revenue (25 percent more in the next two years). The rate of health care spending has slowed down considerably, and the economy is recovering, which means that Americans can pay more in taxes and/or rely less on the federal government for costly social safety net programs such as unemployment insurance or food stamps.

The deficit will start to significantly rise again by 2021 — though that’s a demographic and health care spending problem rather than an all-out crisis involving just too much debt. By then, the baby boomers will start to sign up en masse for Medicare, and no one from either end of the political spectrum has figured out a way to constrain health care costs given the large spike in people who will suddenly take advantage of federal benefits.

Arguably, that’s where Simpson and Bowles should expend their energy instead of talking about a deficit crisis that has yet to arrive on Washington’s doorstep, or by rejiggering a well-worn plan that’s made them wise, talking heads in Washington who still lack political juice.

America’s Wealth Divide Continues: Cutting Social Security & Medicare Will Make it Even Worse

It’s easy in this era of Washington deficit mania to focus solely on the numbers on a budget spreadsheet while losing sight of the fact that the austerity agenda pushed by those least likely to be impacted by their policies will have serious implications for America’s middle class families. This is especially true for those already struggling in this economic slowdown, especially communities of color. We’ve talked about this a lot during February’s Black History month coverage and NCPSSM will continue to address these issues throughout the ongoing budget and deficit debate. In case you missed it, here’s a wrap up of some of our February coverage:

National Advocates Join Forces to Urge Equal Access to Social Security Benefits

We were proud today to release a new report, co-authored with the Human Rights Campaign detailing how current law leaves America’s same sex couples and their families living outside the safety net.

Social Security is the keystone of most Americans’ retirement planning and provides valuable income protection to families in case of a worker’s disability or death. Yet, same-sex couples and many of their children are denied access to Social Security benefits, even though they have contributed to the program throughout their working lives. The National Committee to Preserve Social Security and Medicare Foundation and the Human Rights Campaign Foundation have issued a new report “Living Outside the Safety Net.” This report examines the impact this inequality has on millions of lesbian and gay families and offers legislative solutions.

“Social Security has a long tradition of evolving to more effectively protect America’s workers and their families as our nation changes. In fact, that is key to the program’s unparalleled success across generations. America’s same-sex couples and their families have earned Social Security’s protections the same as any other working American and they deserve the same retirement and economic security the program provides.” … Carroll Estes, NCPSSM Foundation Chair

“Social Security is a safety net for many, and the sole source of income for some. However, same-sex couples go completely unrecognized by Social Security and are routinely denied this benefit. As a result, many surviving same-sex spouses find themselves in a financial free-fall following the death or disability of a spouse.” said HRC Legislative Counsel for Administrative Advocacy Robin Maril. “This report provides an overview of the extent of the economic loss many families are experiencing today because the Social Security system fails to recognize them as a family. Congress must right this wrong by passing legislation that makes these vital benefits available to all Americans.”

The National Committee and HRC support legislation introduced by Congresswoman Linda Sanchez (D-CA) to expand Social Security spousal benefits to same-sex couples. The Social Security Equality Act of 2012 (H.R. 4609) would require the Social Security Administration to provide same-sex couples with the same spousal, survivor and death benefits their heterosexual counterparts receive.

“Same-sex couples pay into Social Security, and they should receive the full benefits they have earned. It is time for us to end discrimination in Social Security so that same-sex couples are not treated as second class citizens. I’m proud to say that I will be re-introducing the ‘Social Security Equality Act’ this Congress to make sure every American receives a benefit based upon their contribution to the program, not their sexual orientation.” Rep. Linda Sanchez (D-CA)

On average, a full retirement age same-sex household with one wage-earner forfeits $675 monthly or $8,100 annually in lost spousal retirement benefits. Blair Dottin-Haley, from Alexandria, Virginia, works for a local non-profit and has been married for nearly two years. His husband is HIV positive; however, even though they both have contributed to Social Security throughout their working lives they are not eligible for spousal benefits.

Blair Dottin-Haley who married his husband two years ago in DC also be joined the panel. “As a married man, it’s important that I protect my family and work to secure the rights and benefits that we’ve earned by joining our lives together.”

This report recommends that Congress:

- Amend the Social Security Act to include same-sex domestic partners as eligible to receive equal benefits following the death, retirement, or disability of their loved one.

- Include language within the Social Security Act’s definition of “child” to reflect the permanent relationship between a legally-unrecognized same-sex parent and his or her child to end the exclusion of many children under current law.

- Repeal the Defense of Marriage Act (DOMA) which currently prevents surviving same-sex spouses from receiving Social Security benefits they are otherwise entitled to.

You can read the full report on the NCPSSM Foundation website here.

Celebrating Black History Month and Some of Our Wonderful Activists

Geneva Burns, a Memphis resident, has been a volunteer with the National Committee for more than 10 years where she has done radio and at least 20 presentations. She has worked with the AGE STAGE Theatre Group with the Commission on Aging and served as Vice Chair on the Tennessee Commission on Aging. Burns was the only African American during her four year tenure. “Social Security & Medicare are worth fighting for!”

Ruth Cossey, East Palo Alto, CA, concentrates on providing information to seniors by managing the National Committee resource tables in the minority community and across her congressional district. She is always willing to support our efforts and to educate people about Social Security and Medicare issues. “Volunteering for NCPSSM, gives me the opportunity to share news and updates about Social Security and Medicare with seniors.”

Pat Cotton, Hyattsville, MD, has been a media star for NCPSSM, speaking at press conferences on Capitol Hill and interviews with national publications. Pat is also a Rally Corp member and works as a CAN. “I am an activist to preserve Social Security, Medicare & Medicaid for me and for my patients. These programs add to the quality of life!”

Alberta Gaskins, Washington, DC, another media star, she is a member of our Rally Corp and has helped with numerous petition deliveries to Congressional offices, press events and briefings. “I say I will fight for Social Security, Medicare and Medicaid because these are things that matter!!!”

Nettie Haile, Washington, DC, is a member of our Rally Corp. She was a speaker at the Summit on Social Security sponsored by Senator Bernie Sanders in November, 2012. Congresswoman Eleanor Holmes Norton, after hearing Nettie speak on Social Security at a briefing several years ago, declared Nettie her “poster child for Social Security”.“It’s very important that we do all we can to insure that benefits promised and worked hard for are not taken away.”

Celestine Johnson, Washington, DC, is an active member of our Rally Corps, participating in the majority of our “short notice” events on Capitol Hill. She arranges speaking opportunities for National Committee representatives with senior/retiree groups at her church. She has also recruited other local activists to join the Rally Corps. “I especially enjoy working with NCPSSM. I have learned so much.”

Jerry Johnson, Las Vegas, NV , a recent retiree of Clark County’s Senior Advocate Program, was as active participant in the National Committee’s Rapid Response Campaign during the 2012 election. He serves as a Grassroots District Team member. He brings a wealth of knowledge with respect to the aging network in the state and of senior issues in the communities. “As a boomer, I’ve embraced the reality of the safety net that Social Security and Medicare provides and this was my incentive to join as a volunteer to insure that it prevails.”

Godfrey Laws splits his time between Seattle WA and Roxboro NC each year and he volunteers in both communities. He has been involved in many local events and helps with our education and outreach. He works with many churches, and particularly likes to inform younger people about Social Security. “Social Security and Medicare are so important in the lives of some many people. We need to educate people of all ages about the value of these programs and work to maintain them for the health and well-being of seniors and their families.”

Reverend Julius Turnipseed, Memphis, TN, has given many educational sessions on Social Security and Medicare and disseminated our materials in communities throughout his area. “I am very proud to be an advocate for NCPSSM. We are able to get the truth to the people about what’s going on in Washington.”

Rosie Lee Woods, a resident from Richmond, VA, has recruited some terrific family and friends from GA and AR to be NCPSSM volunteers. She sets up community education meetings and makes visits to her local Congressional offices. “After joining NCPSSM, I have become better informed and more involved with politics, advocacy and helping others to get involved too.”

Bitter Pill – A Time Magazine Article Every Senior in Medicare Should Read

As we’ve said here repeatedly, America doesn’t face a Medicare crisis — we face a national health care crisis. Rather than targeting Medicare for cuts we should be using it as the model to improve out health care system nationwide. As Brill reports:

“Unless you are protected by Medicare, the health care market is not a market at all. It’s a crapshoot. They are powerless buyers in a seller’s market where the only sure thing is the profit of the sellers.”

Consider Time’s example of Susan S. She was 64, one year away from qualifying for Medicare, when she went to the hospital with chest pains. Her bill for 3 hours of tests and a false alarm was $21,000. If she had Medicare she would have paid less than $500. Compare her costs:

Time’s survey of this same hospital found that in 2010 its total charges were 11 times its actual costs. And that’s not unusual in our current private profit and even non-profit health care system.

Not only does Medicare manage these outrages costs better than the private market, Medicare’s administrative costs are two-thirds of 1% or less than $3.80 per claim. Private Insurers administrative costs run much higher. Brill reports Aetna’s for example, run 29% or $30 for each claim.

However, Medicare isn’t immune from the skyrocketing costs that are burdening our economy. Brill points out that Congress has tied Medicare’s hands in many instances forcing the more efficient Medicare program to perform like the less efficient private market:

Our laws do more than prevent the government from restraining prices for drugs the way other countries do. Federal law also restricts the biggest single buyer — Medicare — from even trying to negotiate drug prices. As a perpetual gift to the pharmaceutical companies (and an acceptance of their argument that completely unrestrained prices and profit are necessary to fund the risk taking of research and development), Congress has continually prohibited the Centers for Medicare and Medicaid Services (CMS) of the Department of Health and Human Services from negotiating prices with drugmakers. Instead, Medicare simply has to determine that average sales price and add 6% to it.

Similarly, when Congress passed Part D of Medicare in 2003, giving seniors coverage for prescription drugs, Congress prohibited Medicare from negotiating.

Nor can Medicare get involved in deciding that a drug may be a waste of money. In medical circles, this is known as the comparative-effectiveness debate, which nearly derailed the entire Obamacare effort in 2009.

The health care industrial complex spends more than three times what the military industrial complex spends for Washington lobbying. Is it any wonder why so many in Congress have chosen to ignore the true system wide health care problem in favor of targeting Medicare for benefit cuts, arbitrary caps, cost-shifting, means-testing and privatization.

They know what the core problem is — lopsided pricing and outsize profits in a market that doesn’t work.

In spite of this, Congress appears ready to protect that broken health care market that is wrecking our economy in favor of targeting the program that works for cuts — all in the name of deficit reduction. Cutting benefits to seniors in Medicare not only ignores the real challenges we face as a nation but it also threatens the health security of millions of Americans.

Economic Recovery is Good for Americans – Bad for Anti-Social Security & Medicare Lobbyists’ Crisis Strategy

![]()

![]()

![]()

The deficit is going down, health care cost growth is slowing and the economy is finally showing signs of recovery. Deficit reduction isn’t the biggest challenge facing our nation in spite of years of doom-and-gloom prognostications from this well-financed anti-entitlement lobby. Time clearly isn’t on the side of deficit-hawks who’ve seen this recession as their best chance in a generation to force drastic cuts to Social Security, Medicare, and Medicaid. Kudos to the National Journal for recognizing this basic truth.

New Simpson-Bowles Plan Overstates the Deficit Problem – The National Journal

The country’s annual deficit is shrinking for now, but that hasn’t stopped the two most prominent deficit hawks from waging an ongoing campaign for the elusive grand bargain.

by Nancy Cook

Updated: February 20, 2013 | 4:17 p.m.

February 20, 2013 | 3:42 p.m.Deficit hawks Alan Simpson and Erskine Bowles just don’t quit.

The duo unveiled the latest iteration of their deficit-reduction plan on Tuesday, which calls for $2.4 trillion in cuts over 10 years — yet another chapter in their ongoing debt campaign that has not gained much political traction since 2010.

At first, Simpson and Bowles’ newest proposal comes across as innovative: they learned from the past, rejiggered their suggestions, and rolled out a new framework during a quiet week when Congress was out-of-town. The new framework acknowledges the elusiveness of the big budget deal and instead lays out incremental spending cuts and tax increases that could occur over the next few years and into 2018. “Just the idea of a ‘grand bargain’ is at best on life support,” said Erskine Bowles, the former chief-of-staff under President Bill Clinton, at a breakfast sponsored by Politico.

Such reasonableness attempts to cast the pair as aggressive, yet savvy deficit hawks who have taken a different, more nuanced tact that’s more in sync with the political reality of a very divided Congress and White House.

Yet, that’s not necessarily an accurate portrait of the current state of Simpson-Bowles. In fact, it appears to be doubling down on deficit-hawkishness just as the economy is improving and the deficit is shrinking.

The new plan calls for a 3:1 ratio of spending cuts to tax increases, whereas previous versions called for a more balanced ratio. That means that Simpson and Bowles are calling for the majority of future deficit reduction to come from spending cuts at a time when a wide swath of economists, including a prominent conservative economist from the American Enterprise Institute, have warned against sudden austerity measures.

Simpson-Bowles and like-minded hawks also uphold the belief that solving the deficit is the headline economic problem of 2013. Just check out the new website Debt Deniers, funded by Fix the Debt, a Simpson-Bowles sister organization run by the same web of alarmists.

The Debt Deniers site, unveiled late last week, calls out people “who claim America has no debt problem.” In ominous red, black, and white writing and graphics, the site criticizes “debt deniers” (cough, cough — like economist and New York Times‘ columnist, Paul Krugman) who argue that the debt will solve itself, thanks to the slowly recovering economy, tax increases from the fiscal cliff deal, and spending caps set by the Budget Control Act of 2011. There’s nothing wrong with this strategy politically, except that it does not jibe with current economic data.

The deficit is not the primary economic problem of 2013; it’s just at the forefront of the political battles. (See: long-term unemployment, stagnant wages, or a slow-to-recover housing sector if you want to see real economic problems). Through the year 2016, the annual deficit is expected to shrink. (The Congressional Budget Office predicts it will decrease to $476 billion in 2016, compared to $845 billion in 2013).

Part of the reason the deficit is going down, at least temporarily, is that the federal government is taking in more revenue (25 percent more in the next two years). The rate of health care spending has slowed down considerably, and the economy is recovering, which means that Americans can pay more in taxes and/or rely less on the federal government for costly social safety net programs such as unemployment insurance or food stamps.

The deficit will start to significantly rise again by 2021 — though that’s a demographic and health care spending problem rather than an all-out crisis involving just too much debt. By then, the baby boomers will start to sign up en masse for Medicare, and no one from either end of the political spectrum has figured out a way to constrain health care costs given the large spike in people who will suddenly take advantage of federal benefits.

Arguably, that’s where Simpson and Bowles should expend their energy instead of talking about a deficit crisis that has yet to arrive on Washington’s doorstep, or by rejiggering a well-worn plan that’s made them wise, talking heads in Washington who still lack political juice.