Mr. President, Please Define “Slash”

Originally pos ted on Huffington Post by Max Richtman, NCPSSM President/CEO

ted on Huffington Post by Max Richtman, NCPSSM President/CEO

When I met with President Obama and other allied groups at the White House just after his reelection, his commitment to carry out the promises made during the campaign seemed clear and unambiguous. The President acknowledged Social Security should not be a part of the deficit debate. This was especially important to millions of American families still struggling in this economy who depend on Social Security’s modest benefit — the benefit they’ve contributed to throughout their working lives. Unfortunately, within months, President Obama’s unambiguous statement has taken a 180 degree turn and a proposal cutting Social Security benefits for both current and future retirees has once again become a deficit debate bargaining chip. However, as a consolation, the President promises he won’t “slash” benefits.

Mr. President, please define “slash”.

The Stealth Benefit Cut

There’s a political calculus behind cutting benefits to millions of seniors, veterans, people with disabilities and more by reducing the federal cost of living allowance. Cutting the COLA is being pitched as a simple “technical tweak” or “formula adjustment” that’s more accurate than the current COLA formula. Sounds reasonable, right? However, claims that the current COLA is too generous are demonstrably false. So much so, the White House is considering “protecting” millions of low-income Americans, some veterans and “older” beneficiaries from this COLA cut. If the chained-CPI really is a more accurate formula, why the exemption?

The Social Security COLA has averaged just over 2% over the past five years with 0% for two of those years, far below the largest expenditure increase for most seniors, health care. If accuracy, not cutting benefits, is the goal then we should be talking about the elderly formula (CPI-E) which factors in seniors’ health care costs and has been under review by the federal government for decades. However, that won’t happen because there’s no guarantee the CPI-E will cut benefits. The chained CPI, on the other hand, will. This COLA change is nothing more than a stealth benefit cut Washington politicians hope will fly under the radar of the millions of American families it targets. On behalf of the National Committee to Preserve Social Security and Medicare‘s millions of members and supporters I’ve written to the President about his COLA proposal:

“The ‘chained CPI’ is not a ‘technical tweak,’ and no amount of rationalization can make it so. In reality, the chained CPI is a benefit cut for the oldest and most vulnerable Americans who would be least able to afford it. To offer to trade it away outside the context of a comprehensive Social Security solvency proposal ignores the fact that Social Security does not even belong in this debate because it does not contribute to the deficit. Cutting Social Security benefits to reduce the deficit is unacceptable to the vast majority of Americans across all ages and political affiliation.”

Slash? You Decide

Cutting benefits by adopting the chained CPI, as proposed by the White House, would cut the COLA by 3% for workers retired for ten years and 6% for workers retired for twenty years. This translates to a benefit cut of $130 per year in Social Security benefits for a typical 65 year-old, including today’s retirees. The cumulative cut for that individual would be $4,631 or more than three months of benefits by age 75; $13,910 or nearly a year of benefits by age 85; and $28,004, more than a year and a half of benefits by age 95. Losing three months up to more than a year and half of income would count as “slashing benefits” by anyone’s standards, especially for America’s oldest retirees, veterans and people with disabilities living on modest incomes. These chained CPI cuts also deliver a larger percentage cut to seniors’ annual income than the tax increases on the wealthiest Americans passed earlier this year deliver to our nation’s millionaires. An analysis by Dean Baker with the Center for Economic and Policy Research shows the after tax income for wealthy Americans was reduced by less than 0.7 percent after January’s tax hike. By comparison, the percentage of income Social Security beneficiaries will lose would be three times as much if the chained CPI is adopted.

So Much for “Shared Sacrifice”

Requiring benefit cuts to Social Security, Medicare and Medicaid in the name of deficit reduction has always been the goal of the billion dollar corporate and Wall Street backed crisis campaign driving Washington’s deficit hysteria. These millionaires, billionaires and their supporters in Congress have used the economic recession to fuel their anti-Social Security and Medicare mission. The Obama administration and some Democrats in Congress have bought into the flawed idea that they must trade away middle-class benefits just to get Republicans to the table and further, if a millionaire loses a tax break then the middle class and poor most also lose their modest benefits in Medicare or Social Security. There’s nothing balanced about this type of deal. But it does explain how the deficit reduction passed since 2011 includes 75% cuts (mostly to programs serving the poor and middle-class) and only 25% revenue increases (not just from the wealthy). This mythological “shared sacrifice” continues as President Obama has now told Congress he’s “willing to back $2 in spending cuts for every $1 in tax revenue” in any future deal. Even that isn’t enough for Republicans who expect average Americans to foot the entire deficit reduction bill through program cuts rather than closing the trillion dollars of wasteful millionaire and corporate loopholes and tax breaks.

“In addition, we should not fool ourselves that your negotiating partners will be satisfied with lowering Social Security COLAs or raising the Medicare eligibility age. Each debt limit increase, Continuing Resolution or sequestration will give them a second, third and fourth ‘bite at the apple.’ In November, you won the confidence of the American people by defending the middle class. I urge you not to let them down now by supporting a deal that undermines the last remaining retirement security pillars for middle-class Americans.” Letter to President Obama, March 20, 2013

Americans Won’t Be Fooled

Inside the Beltway, members of Congress might also be able to kid themselves that middle-class families won’t notice a Social Security benefit cut here and a Medicare benefit cut there. However, they will find a very different truth when they go home to their Congressional districts. Not because America is a nation of “takers” or “greedy geezers” but because Americans understand the difference between harmful benefit cuts to the poor and middle-class and reasonable reforms, such as lifting the Social Security payroll tax cap and allowing Medicare to negotiate for lower drug prices. They don’t believe a dollar in millionaire taxes is the same as a dollar cut from the average annual $14,000 earned Social Security benefit. Most importantly, the American people are willing to pay to preserve and even strengthen these vital benefits. They’ve said this over and over again, most recently at the polls in November.

Will Congress listen now that the election is over? If not, they shouldn’t be surprised that voters deliver the same message when they return to the polls next time.

Celebrating Women’s History Month

As we celebrate Women’s History Month in March, we salute Frances Perkins. She was one of our nation’s strongest voices in support of America’s workers and programs like Social Security designed to provide economic security for American families.

About Frances Perkins (1882 – 1965)

In 1933, President Franklin D. Roosevelt appointed Ms. Perkins as his Secretary of Labor, making her the first woman to hold a cabinet position in the United States . She played a key role in writing the New Deal legislation including minimum wage laws. However, she is most recognized and remembered for her tireless efforts to establish Social Security and other social insurance programs to benefit all Americans.

As Chairman of the Committee on Economic Security, Perkins held a number of hearings on social insurance and later produced a report recommending both unemployment insurance and old-age insurance. She continued to campaign for social security until the Social Security Act was passed on August 15, 1935.

To recognize her distinguished achievements and honor her forward-thinking vision, the National Committee to Preserve Social Security and Medicare Foundation has created the Frances Perkins Legacy Society. Her efforts have helped improve the lives of millions of Americans and her vision provides continuing hope and strength for the future. To read more about her life, visit the Social Security website at www.ssa.gov

The National Committee to Preserve Social Security and Medicare Foundation has created the Frances Perkins Legacy Society to recognize those generous individuals who have included the National Committee to Preserve Social Security and Medicare Foundation in their will or other estate plans.By taking this important step, you help to ensure the financial security, health and well being of future generations of maturing Americans.For more information on how you can leave a legacy to the National Committee Foundation, please complete our Information Request Form or contact Ellen Morgenstern at [email protected] or 202-216-8369.

The National Committee: Our Story

As the battle to cut Social Security, Medicare and Medicaid benefits wages on we thought we’d go into the weekend on a happier note rather than providing the usual Capital Hill war stories and political intrigues. Here is a quick video we produced to give our community a look at the work the National Committee does here in Washington, D.C. each and every day. We’ve been fighting to strengthen the nation’s most successful retirement and health care programs for 30 years now.

Our mission has always been to educate, advocate and mobilize. These days, that’s been quite a challenge. However, thanks to ourmillions of members and supporters we have been successful in fightingefforts to destroy or privatize these programs.

So, this is our story…andyours.

GOP Budget Plan Released Today’Seniors Say Three Strikes You’re OUT

Today’s release of the GOP/Ryan budget reminds us of the famous line, “the definition of insanity is doing the same thing over and over again and expecting different results.” Today marks the third time House Republicans have released the Ryan budget, which in Rep. Paul Ryan’s Orwellian terms he’s also named a “Path to Prosperity.” Thankfully the result again this year will likely be the same. Dead on arrival. We say thankfully because, once again, this budget pretends deficit reduction alone is economic recovery, while ignoring the financial realities millions of America’s middle-class families still face in this slow economy. This plan also targets seniors in Medicaid with cuts, a “coupon care” plan for Medicare which would ultimately end traditional Medicare, and a fast-track plan to cut Social Security benefits:

“Once again, House Republicans have re-introduced the same flawed budget approach middle-class Americans have rejected in poll after poll and most importantly at the ballot box. Rather than deal with the true challenges facing this nation including, slow economic growth, high unemployment, and unprecedented income inequality, the GOP/Ryan budget targets middle-class seniors and their families with massive cuts to pay for tax cuts benefiting huge corporations and the wealthiest among us. Americans want a balanced approach to the national budget. This cuts-only plan isn’t it.

The Ryan plan would create vouchers in Medicare leaving seniors and the disabled – some of our most vulnerable Americans – hostage to the whims of private insurance companies. Over time, this will end traditional Medicare and make it harder for seniors to choose their own doctor. Vouchers are designed not to keep up with the increasing cost of health insurance… that is why they save money. If the GOP/Ryan budget becomes law, seniors would immediately lose billions in prescription drug savings, free wellness visits and preventative services provided in the ACA, and the Part D donut hole returns.

Destroying traditional Medicare and leaving millions of Americans without adequate health coverage is not a path to prosperity for anyone except for-profit insurers. The American people understand that.” Max Richtman, NCPSSM President/CEO

Senate Democrats have also prepared their budget plan which will be released tomorrow. According to Huffington Post, the Democratic Budget plan:

“… calls for $975 billion in additional revenues through closing loopholes and ending tax expenditures. The budget, unlike Ryan’s, doesn’t close the door on going beyond the fiscal cliff deal either; it calls for the continuation of current tax rates for middle and lower class Americans but does not specify whether current rates should be protected for high-end earners.

“While House Republicans are doubling down on the extreme budget that the American people already rejected, Senate Democrats are going to be working on a responsible budget that puts jobs and the economy first and reflects the values and priorities of middle class families across the country,” read a statement from Murray.

A top Senate Democratic aide said that the specifics — including where rates should be set, which loopholes should be closed, and which expenditures should be ended — would be left to the Senate Finance Committee. The Murray budget does give the Finance Committee some help, though, offering parliamentary instructions (known as reconciliation) to help ensure the tax reform bill it produces will be granted an up-or-down vote.

While the $975 billion figure is ambitious, the Senate aide pointed to a report by the Center for American Progress that showed $1 trillion in savings could be gained through “reducing or reforming tax breaks.”

On the spending side, Murray’s budget looks for $493 billion in domestic cuts, $275 billion of which will come from health care savings. The aide said that those health care savings, which will also be determined by the Finance Committee, would be felt solely on the provider side and not among beneficiaries. Additionally, the budget calls for $240 billion in defense spending cuts and $242 billion in reduced interest payments.

Those savings in total will replace the sequestration-related cuts that went into effect on March 1. Over a ten-year window, they will reduce the deficit by $1.95 trillion. But since Murray’s budget also sets aside $100 billion for economic stimulus measures — $50 billion on repairing highest transportation priorities, $10 billion on projects of major regional importance and the rest on other items like worker training — the total savings will be measured at $1.85 trillion.”

These budgets clearly lay out starkly different priority choices. Especially for middle-class families and retirees who understand first hand the value of programs like Social Security, Medicare and Medicaid, and who want those programs preserved for future generations.

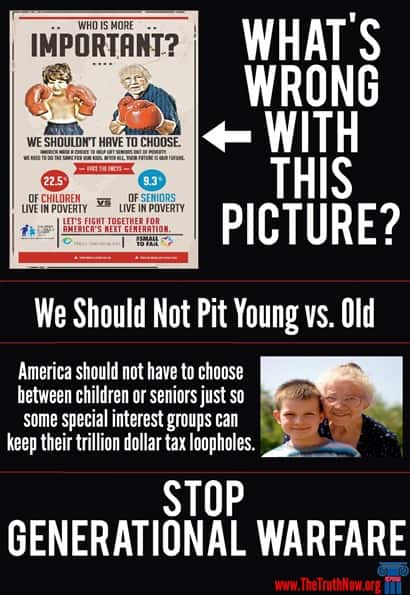

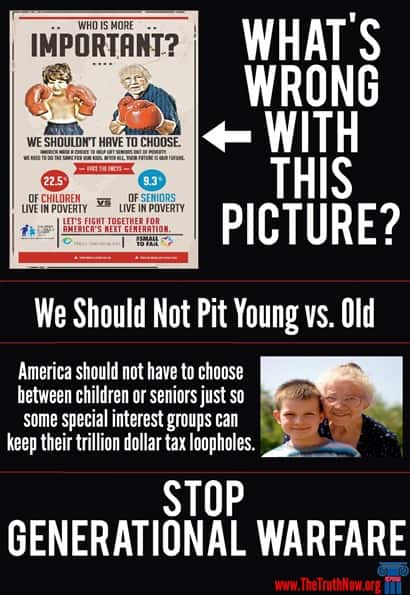

Corporate Lobbyists Launch Generational Warfare Campaign to Avoid Talking about the Real Problem…$1 Trillion in Tax Loopholes

If you listen to any of the hundreds of lobbyists and PR flaks who are part of a billion dollar corporate campaign to cut Social Security and Medicare benefits, our fiscal problems have nothing to do with economic collapse, Wall Street excess, or a trillion dollars in wasteful corporate tax loopholes. America’s real problem is grandma and grandpa. According to our nation’s wealthiest CEO’s and Wall Street millionaires, led by “Fix the Debt”, the Business Roundtable and countless other Pete Peterson backed organizations, the solution to our economic woes is to convince America’s young people that Social Security won’t be around for them. Then, make them believe that the “greedy geezers” (aka their parents/grandparents), who are trying to get-by on an average $14,000 annual Social Security benefit, really don’t care about the program’s future – just their own survival. It’s classic case of dodge and deflect — divide and conquer politics. Economist, Dean Baker explains:

“Peter Peterson, the Wall Street investment banker, has been most visible in this effort, committing over $1 billion of his fortune for this purpose. Recently he enlisted a group of CEOs in his organization, Fix the Debt, which quite explicitly hopes to divert concerns over income inequality into concerns over generational inequality. It argues that programs like Social Security and Medicare, whose direct beneficiaries are disproportionately elderly, are taking resources from the young.

It is easy to show the absurdity of this position. The amount of money that the young stand to lose from the upward redistribution of income is an order of magnitude larger than whatever hit to their after-tax income they might face due to the continuing drop in the ratio of workers to retirees. Also, older people generally have families. This means that when we cut the Social Security or Medicare benefits of middle and lower income beneficiaries we are often creating a gap that will be filled from the income of their children.”

This strategy is nothing new. In fact, it follows an especially cynical proposal (even by Washington standards) created in 1983, after conservatives were unsuccessful in their attempts to convince the Social Security Commission to privatize Social Security. The Los Angeles Times’ Michael Hiltzik describes the Cato Institute’s generational warfare strategy, now in full implementation here in Washington,

“The purest articulation of intergenerational warfare as a wedge to break up Social Security’s political coalition is a 1983 paper published by the libertarian Cato Journal. It was titled “Achieving a ‘Leninist’ Strategy,” an allusion to the Bolshevik leader’s supposed ideas about dividing and weakening his political adversaries.

The paper advocated making a commitment to honor Social Security’s commitment to the retired and near-retired as a tool to “detach, or at least neutralize” them as opponents of privatization or other changes. Meanwhile, doubts among the young about the survival of the program should be exploited so they could be “organized behind the private alternative.”

So when you hear a politician promising to exempt the retired and near retired from changes to Social Security, while offering to make it more “secure” for future generations, you now know the game plan.”

The real problem is this “game plan” will be devastating for America’s young people. The wealthy corporate “generals” of this generational warfare strategy claim to be “saving” the social safety net for future generations. In truth, it’s America’s young people who will face the biggest benefit cuts if they buy into this campaign. The fact is, the Recession Generation will need Social Security and Medicare just as much, if not more than the parents and grandparents these wealthy CEO’s are trying to demonize. The Center for Retirement Research of Boston College reports:

“Adults age 25 to 34 in 2008 will see their age-70 incomes fall by 4.9 percent (or $3,000 per person) as a result of the recession. Younger workers are especially hard hit since they lose the benefits of compounding interest. Compounding becomes an especially powerful force in a 401(k) when combined with pre-tax contributions and the fact that they do not pay taxes on their annual 401(k) account earnings.”

Not only couldl this generation face lower incomes but many younger households are also carrying more student loan debt after the recession than before: 40% had such debt in 2010, up from 34% in 2007 and 26% in 2001. Our nation’s seniors know that cutting already modest benefits for future generations will leave their children and grandchildren facing a retirement that could be just as financially difficult as the economic troubles they now face in their youth. That’s why the vast majority of Americans oppose cutting benefits under the guise of deficit reduction. In fact, a recent National Academy of Social Insurance poll shows most are willing to pay more to preserve and even improve benefits. That’s certainly doesn’t fit the “greedy geezer” propaganda offered by corporate lobbyists posing as deficit hawks.

Social Security and Medicare aren’t the problems. However, rising income inequality and Washington’s economic policies which have shifted income away from middle-class families (including the young and old alike) to America’s millionaires and corporations are the problems. That’s why groups like Fix the Debt, the Business Roundtable, the Peterson Foundation and the rest of Washington’s massive corporate lobby have made such a huge investment in slick messaging campaigns to convince America’s young people to focus on their grandparents’ $14,000 Social Security benefit rather than the trillion dollars in tax breaks and loopholes enjoyed by our nation’s wealthiest.

Mr. President, Please Define “Slash”

Originally pos

When I met with President Obama and other allied groups at the White House just after his reelection, his commitment to carry out the promises made during the campaign seemed clear and unambiguous. The President acknowledged Social Security should not be a part of the deficit debate. This was especially important to millions of American families still struggling in this economy who depend on Social Security’s modest benefit — the benefit they’ve contributed to throughout their working lives. Unfortunately, within months, President Obama’s unambiguous statement has taken a 180 degree turn and a proposal cutting Social Security benefits for both current and future retirees has once again become a deficit debate bargaining chip. However, as a consolation, the President promises he won’t “slash” benefits.

Mr. President, please define “slash”.

The Stealth Benefit Cut

There’s a political calculus behind cutting benefits to millions of seniors, veterans, people with disabilities and more by reducing the federal cost of living allowance. Cutting the COLA is being pitched as a simple “technical tweak” or “formula adjustment” that’s more accurate than the current COLA formula. Sounds reasonable, right? However, claims that the current COLA is too generous are demonstrably false. So much so, the White House is considering “protecting” millions of low-income Americans, some veterans and “older” beneficiaries from this COLA cut. If the chained-CPI really is a more accurate formula, why the exemption?

The Social Security COLA has averaged just over 2% over the past five years with 0% for two of those years, far below the largest expenditure increase for most seniors, health care. If accuracy, not cutting benefits, is the goal then we should be talking about the elderly formula (CPI-E) which factors in seniors’ health care costs and has been under review by the federal government for decades. However, that won’t happen because there’s no guarantee the CPI-E will cut benefits. The chained CPI, on the other hand, will. This COLA change is nothing more than a stealth benefit cut Washington politicians hope will fly under the radar of the millions of American families it targets. On behalf of the National Committee to Preserve Social Security and Medicare‘s millions of members and supporters I’ve written to the President about his COLA proposal:

“The ‘chained CPI’ is not a ‘technical tweak,’ and no amount of rationalization can make it so. In reality, the chained CPI is a benefit cut for the oldest and most vulnerable Americans who would be least able to afford it. To offer to trade it away outside the context of a comprehensive Social Security solvency proposal ignores the fact that Social Security does not even belong in this debate because it does not contribute to the deficit. Cutting Social Security benefits to reduce the deficit is unacceptable to the vast majority of Americans across all ages and political affiliation.”

Slash? You Decide

Cutting benefits by adopting the chained CPI, as proposed by the White House, would cut the COLA by 3% for workers retired for ten years and 6% for workers retired for twenty years. This translates to a benefit cut of $130 per year in Social Security benefits for a typical 65 year-old, including today’s retirees. The cumulative cut for that individual would be $4,631 or more than three months of benefits by age 75; $13,910 or nearly a year of benefits by age 85; and $28,004, more than a year and a half of benefits by age 95. Losing three months up to more than a year and half of income would count as “slashing benefits” by anyone’s standards, especially for America’s oldest retirees, veterans and people with disabilities living on modest incomes. These chained CPI cuts also deliver a larger percentage cut to seniors’ annual income than the tax increases on the wealthiest Americans passed earlier this year deliver to our nation’s millionaires. An analysis by Dean Baker with the Center for Economic and Policy Research shows the after tax income for wealthy Americans was reduced by less than 0.7 percent after January’s tax hike. By comparison, the percentage of income Social Security beneficiaries will lose would be three times as much if the chained CPI is adopted.

So Much for “Shared Sacrifice”

Requiring benefit cuts to Social Security, Medicare and Medicaid in the name of deficit reduction has always been the goal of the billion dollar corporate and Wall Street backed crisis campaign driving Washington’s deficit hysteria. These millionaires, billionaires and their supporters in Congress have used the economic recession to fuel their anti-Social Security and Medicare mission. The Obama administration and some Democrats in Congress have bought into the flawed idea that they must trade away middle-class benefits just to get Republicans to the table and further, if a millionaire loses a tax break then the middle class and poor most also lose their modest benefits in Medicare or Social Security. There’s nothing balanced about this type of deal. But it does explain how the deficit reduction passed since 2011 includes 75% cuts (mostly to programs serving the poor and middle-class) and only 25% revenue increases (not just from the wealthy). This mythological “shared sacrifice” continues as President Obama has now told Congress he’s “willing to back $2 in spending cuts for every $1 in tax revenue” in any future deal. Even that isn’t enough for Republicans who expect average Americans to foot the entire deficit reduction bill through program cuts rather than closing the trillion dollars of wasteful millionaire and corporate loopholes and tax breaks.

“In addition, we should not fool ourselves that your negotiating partners will be satisfied with lowering Social Security COLAs or raising the Medicare eligibility age. Each debt limit increase, Continuing Resolution or sequestration will give them a second, third and fourth ‘bite at the apple.’ In November, you won the confidence of the American people by defending the middle class. I urge you not to let them down now by supporting a deal that undermines the last remaining retirement security pillars for middle-class Americans.” Letter to President Obama, March 20, 2013

Americans Won’t Be Fooled

Inside the Beltway, members of Congress might also be able to kid themselves that middle-class families won’t notice a Social Security benefit cut here and a Medicare benefit cut there. However, they will find a very different truth when they go home to their Congressional districts. Not because America is a nation of “takers” or “greedy geezers” but because Americans understand the difference between harmful benefit cuts to the poor and middle-class and reasonable reforms, such as lifting the Social Security payroll tax cap and allowing Medicare to negotiate for lower drug prices. They don’t believe a dollar in millionaire taxes is the same as a dollar cut from the average annual $14,000 earned Social Security benefit. Most importantly, the American people are willing to pay to preserve and even strengthen these vital benefits. They’ve said this over and over again, most recently at the polls in November.

Will Congress listen now that the election is over? If not, they shouldn’t be surprised that voters deliver the same message when they return to the polls next time.

Celebrating Women’s History Month

As we celebrate Women’s History Month in March, we salute Frances Perkins. She was one of our nation’s strongest voices in support of America’s workers and programs like Social Security designed to provide economic security for American families.

About Frances Perkins (1882 – 1965)

In 1933, President Franklin D. Roosevelt appointed Ms. Perkins as his Secretary of Labor, making her the first woman to hold a cabinet position in the United States . She played a key role in writing the New Deal legislation including minimum wage laws. However, she is most recognized and remembered for her tireless efforts to establish Social Security and other social insurance programs to benefit all Americans.

As Chairman of the Committee on Economic Security, Perkins held a number of hearings on social insurance and later produced a report recommending both unemployment insurance and old-age insurance. She continued to campaign for social security until the Social Security Act was passed on August 15, 1935.

To recognize her distinguished achievements and honor her forward-thinking vision, the National Committee to Preserve Social Security and Medicare Foundation has created the Frances Perkins Legacy Society. Her efforts have helped improve the lives of millions of Americans and her vision provides continuing hope and strength for the future. To read more about her life, visit the Social Security website at www.ssa.gov

The National Committee to Preserve Social Security and Medicare Foundation has created the Frances Perkins Legacy Society to recognize those generous individuals who have included the National Committee to Preserve Social Security and Medicare Foundation in their will or other estate plans.By taking this important step, you help to ensure the financial security, health and well being of future generations of maturing Americans.For more information on how you can leave a legacy to the National Committee Foundation, please complete our Information Request Form or contact Ellen Morgenstern at [email protected] or 202-216-8369.

The National Committee: Our Story

As the battle to cut Social Security, Medicare and Medicaid benefits wages on we thought we’d go into the weekend on a happier note rather than providing the usual Capital Hill war stories and political intrigues. Here is a quick video we produced to give our community a look at the work the National Committee does here in Washington, D.C. each and every day. We’ve been fighting to strengthen the nation’s most successful retirement and health care programs for 30 years now.

Our mission has always been to educate, advocate and mobilize. These days, that’s been quite a challenge. However, thanks to ourmillions of members and supporters we have been successful in fightingefforts to destroy or privatize these programs.

So, this is our story…andyours.

GOP Budget Plan Released Today’Seniors Say Three Strikes You’re OUT

Today’s release of the GOP/Ryan budget reminds us of the famous line, “the definition of insanity is doing the same thing over and over again and expecting different results.” Today marks the third time House Republicans have released the Ryan budget, which in Rep. Paul Ryan’s Orwellian terms he’s also named a “Path to Prosperity.” Thankfully the result again this year will likely be the same. Dead on arrival. We say thankfully because, once again, this budget pretends deficit reduction alone is economic recovery, while ignoring the financial realities millions of America’s middle-class families still face in this slow economy. This plan also targets seniors in Medicaid with cuts, a “coupon care” plan for Medicare which would ultimately end traditional Medicare, and a fast-track plan to cut Social Security benefits:

“Once again, House Republicans have re-introduced the same flawed budget approach middle-class Americans have rejected in poll after poll and most importantly at the ballot box. Rather than deal with the true challenges facing this nation including, slow economic growth, high unemployment, and unprecedented income inequality, the GOP/Ryan budget targets middle-class seniors and their families with massive cuts to pay for tax cuts benefiting huge corporations and the wealthiest among us. Americans want a balanced approach to the national budget. This cuts-only plan isn’t it.

The Ryan plan would create vouchers in Medicare leaving seniors and the disabled – some of our most vulnerable Americans – hostage to the whims of private insurance companies. Over time, this will end traditional Medicare and make it harder for seniors to choose their own doctor. Vouchers are designed not to keep up with the increasing cost of health insurance… that is why they save money. If the GOP/Ryan budget becomes law, seniors would immediately lose billions in prescription drug savings, free wellness visits and preventative services provided in the ACA, and the Part D donut hole returns.

Destroying traditional Medicare and leaving millions of Americans without adequate health coverage is not a path to prosperity for anyone except for-profit insurers. The American people understand that.” Max Richtman, NCPSSM President/CEO

Senate Democrats have also prepared their budget plan which will be released tomorrow. According to Huffington Post, the Democratic Budget plan:

“… calls for $975 billion in additional revenues through closing loopholes and ending tax expenditures. The budget, unlike Ryan’s, doesn’t close the door on going beyond the fiscal cliff deal either; it calls for the continuation of current tax rates for middle and lower class Americans but does not specify whether current rates should be protected for high-end earners.

“While House Republicans are doubling down on the extreme budget that the American people already rejected, Senate Democrats are going to be working on a responsible budget that puts jobs and the economy first and reflects the values and priorities of middle class families across the country,” read a statement from Murray.

A top Senate Democratic aide said that the specifics — including where rates should be set, which loopholes should be closed, and which expenditures should be ended — would be left to the Senate Finance Committee. The Murray budget does give the Finance Committee some help, though, offering parliamentary instructions (known as reconciliation) to help ensure the tax reform bill it produces will be granted an up-or-down vote.

While the $975 billion figure is ambitious, the Senate aide pointed to a report by the Center for American Progress that showed $1 trillion in savings could be gained through “reducing or reforming tax breaks.”

On the spending side, Murray’s budget looks for $493 billion in domestic cuts, $275 billion of which will come from health care savings. The aide said that those health care savings, which will also be determined by the Finance Committee, would be felt solely on the provider side and not among beneficiaries. Additionally, the budget calls for $240 billion in defense spending cuts and $242 billion in reduced interest payments.

Those savings in total will replace the sequestration-related cuts that went into effect on March 1. Over a ten-year window, they will reduce the deficit by $1.95 trillion. But since Murray’s budget also sets aside $100 billion for economic stimulus measures — $50 billion on repairing highest transportation priorities, $10 billion on projects of major regional importance and the rest on other items like worker training — the total savings will be measured at $1.85 trillion.”

These budgets clearly lay out starkly different priority choices. Especially for middle-class families and retirees who understand first hand the value of programs like Social Security, Medicare and Medicaid, and who want those programs preserved for future generations.

Corporate Lobbyists Launch Generational Warfare Campaign to Avoid Talking about the Real Problem…$1 Trillion in Tax Loopholes

If you listen to any of the hundreds of lobbyists and PR flaks who are part of a billion dollar corporate campaign to cut Social Security and Medicare benefits, our fiscal problems have nothing to do with economic collapse, Wall Street excess, or a trillion dollars in wasteful corporate tax loopholes. America’s real problem is grandma and grandpa. According to our nation’s wealthiest CEO’s and Wall Street millionaires, led by “Fix the Debt”, the Business Roundtable and countless other Pete Peterson backed organizations, the solution to our economic woes is to convince America’s young people that Social Security won’t be around for them. Then, make them believe that the “greedy geezers” (aka their parents/grandparents), who are trying to get-by on an average $14,000 annual Social Security benefit, really don’t care about the program’s future – just their own survival. It’s classic case of dodge and deflect — divide and conquer politics. Economist, Dean Baker explains:

“Peter Peterson, the Wall Street investment banker, has been most visible in this effort, committing over $1 billion of his fortune for this purpose. Recently he enlisted a group of CEOs in his organization, Fix the Debt, which quite explicitly hopes to divert concerns over income inequality into concerns over generational inequality. It argues that programs like Social Security and Medicare, whose direct beneficiaries are disproportionately elderly, are taking resources from the young.

It is easy to show the absurdity of this position. The amount of money that the young stand to lose from the upward redistribution of income is an order of magnitude larger than whatever hit to their after-tax income they might face due to the continuing drop in the ratio of workers to retirees. Also, older people generally have families. This means that when we cut the Social Security or Medicare benefits of middle and lower income beneficiaries we are often creating a gap that will be filled from the income of their children.”

This strategy is nothing new. In fact, it follows an especially cynical proposal (even by Washington standards) created in 1983, after conservatives were unsuccessful in their attempts to convince the Social Security Commission to privatize Social Security. The Los Angeles Times’ Michael Hiltzik describes the Cato Institute’s generational warfare strategy, now in full implementation here in Washington,

“The purest articulation of intergenerational warfare as a wedge to break up Social Security’s political coalition is a 1983 paper published by the libertarian Cato Journal. It was titled “Achieving a ‘Leninist’ Strategy,” an allusion to the Bolshevik leader’s supposed ideas about dividing and weakening his political adversaries.

The paper advocated making a commitment to honor Social Security’s commitment to the retired and near-retired as a tool to “detach, or at least neutralize” them as opponents of privatization or other changes. Meanwhile, doubts among the young about the survival of the program should be exploited so they could be “organized behind the private alternative.”

So when you hear a politician promising to exempt the retired and near retired from changes to Social Security, while offering to make it more “secure” for future generations, you now know the game plan.”

The real problem is this “game plan” will be devastating for America’s young people. The wealthy corporate “generals” of this generational warfare strategy claim to be “saving” the social safety net for future generations. In truth, it’s America’s young people who will face the biggest benefit cuts if they buy into this campaign. The fact is, the Recession Generation will need Social Security and Medicare just as much, if not more than the parents and grandparents these wealthy CEO’s are trying to demonize. The Center for Retirement Research of Boston College reports:

“Adults age 25 to 34 in 2008 will see their age-70 incomes fall by 4.9 percent (or $3,000 per person) as a result of the recession. Younger workers are especially hard hit since they lose the benefits of compounding interest. Compounding becomes an especially powerful force in a 401(k) when combined with pre-tax contributions and the fact that they do not pay taxes on their annual 401(k) account earnings.”

Not only couldl this generation face lower incomes but many younger households are also carrying more student loan debt after the recession than before: 40% had such debt in 2010, up from 34% in 2007 and 26% in 2001. Our nation’s seniors know that cutting already modest benefits for future generations will leave their children and grandchildren facing a retirement that could be just as financially difficult as the economic troubles they now face in their youth. That’s why the vast majority of Americans oppose cutting benefits under the guise of deficit reduction. In fact, a recent National Academy of Social Insurance poll shows most are willing to pay more to preserve and even improve benefits. That’s certainly doesn’t fit the “greedy geezer” propaganda offered by corporate lobbyists posing as deficit hawks.

Social Security and Medicare aren’t the problems. However, rising income inequality and Washington’s economic policies which have shifted income away from middle-class families (including the young and old alike) to America’s millionaires and corporations are the problems. That’s why groups like Fix the Debt, the Business Roundtable, the Peterson Foundation and the rest of Washington’s massive corporate lobby have made such a huge investment in slick messaging campaigns to convince America’s young people to focus on their grandparents’ $14,000 Social Security benefit rather than the trillion dollars in tax breaks and loopholes enjoyed by our nation’s wealthiest.