Will the President’s Commitment to Middle-Class Agenda Protect Social Security too?

There is always plenty of Monday morning quarterbacking after each year’s State of the Union. However, reading the commentary on last night’s speech was especially interesting since President Obama has clearly decided to take the gloves off in pursuing a popular middle-class economic agenda the American people support but the GOP-controlled Congress has no intention of passing:

“Republicans said that they were caught off guard by a major component of the president’s 2015 agenda, which he announced over the weekend and detailed further in his speech, to raise taxes and fees on the wealthiest taxpayers and the largest financial firms to pay for, among other things, tax breaks for the middle class and free community college. While these programs may prove popular with many Americans, Republicans said that they hoped the American public would see them as a ploy from a president who knows Congress will never pass them.” The New York Times

What the Republican leadership has supported is more tax cuts for huge corporations and the wealthy plus cuts to Social Security and Medicare. While the President didn’t emphasize Social Security and Medicare in last night’s State of the Union, he did highlight their importance to American families’ economic and health security. Truth is, you simply can’t improve the financial outlook for average Americans without protecting these programs. But of course, these days “protect” has very different meanings depending on whom you talk to in Washington.

Remember all those Congressional campaign promises about “protecting” Social Security? For the newly sworn-in GOP House what that actually meant was voting just hours after taking their oaths of office to put Social Security benefits cuts at the top of the Congressional agenda. You’ve got to give the House leadership credit for stealth. No one, outside a small circle of Republican Rules Committee members and GOP leadership, even knew this Social Security attack was coming. Slipped inside what’s usually a routine administrative start to each Congressional session was an unprecedented change to House rules that would allow a 20% benefit cut for millions of disabled Americans unless there are broader Social Security benefit cuts or tax increases. Of course, House Republicans have no intention of passing tax increases so guess what’s left? Benefit cuts to millions of Americans who receive Social Security.

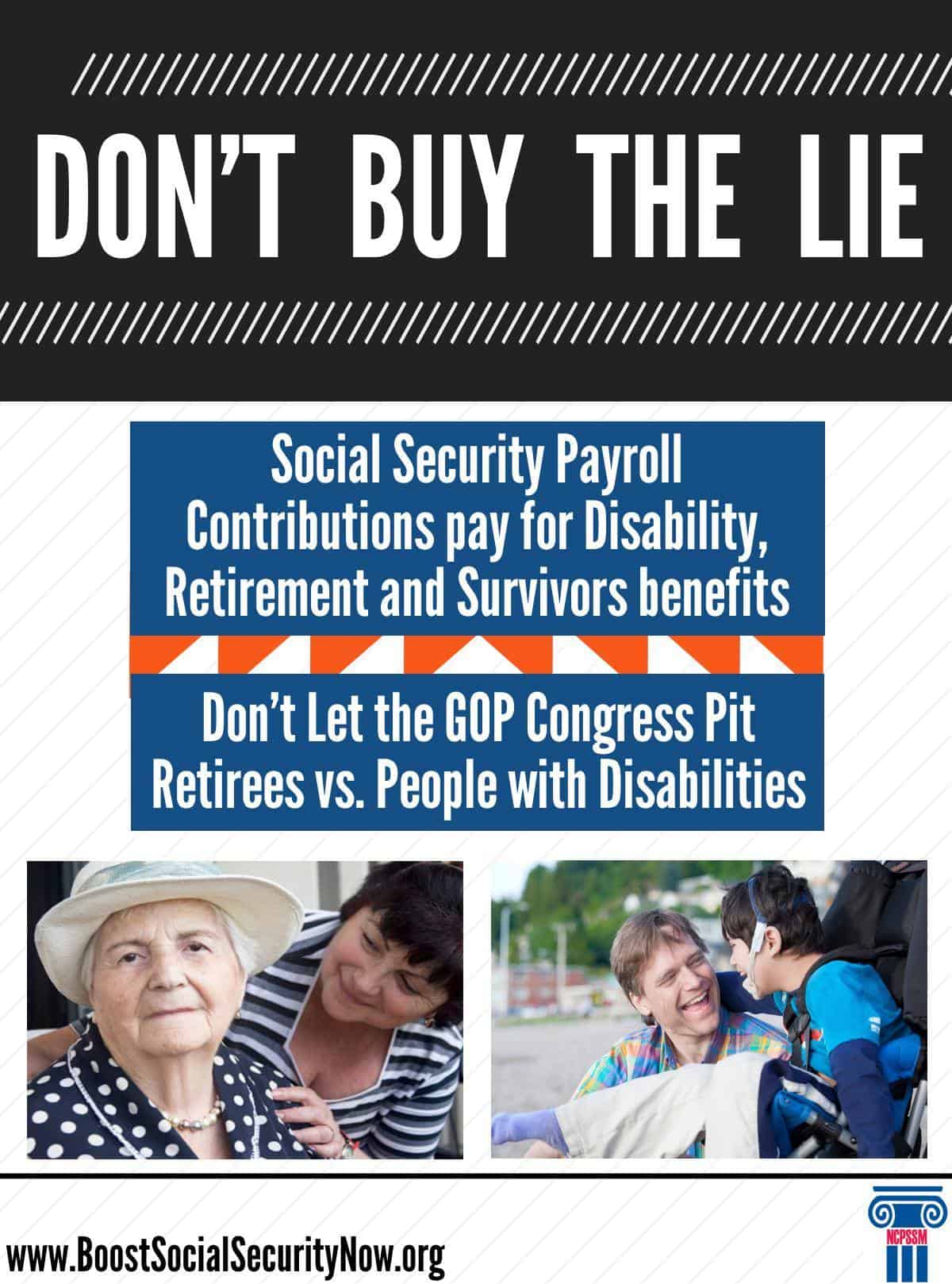

This House vote illustrates the increasingly Orwellian nature of our political discourse, where words have little meaning because “save” means “slash” and “protect” means “privatize.” What’s even more noxious about this particular assault on Social Security is the ongoing effort to pit beneficiaries – retirees, the disabled, survivors and their families – against each other. Proponents of this stealth rule change in the House claim seniors will somehow suffer if the disabled are allowed access to the benefits they too have contributed to throughout their working years. That’s a particularly absurd notion since the majority of disability recipients are also older Americans. However, the divide and conquer politics of fear all-too-often work. This latest Social Security attack is built on a foundation of lies intended to demonize America’s disabled community.

No doubt, you’ve already heard the messaging, most recently espoused in an especially candid way by Senator and Presidential hopeful Rand Paul that: Social Security disability fraud is rampant because it’s so easy to receive benefits and people would rather collect a hefty check from the government than work. It’s the 2015 incarnation of “our nation is full of ‘welfare queens’ and ‘greedy geezers.’” It also suffers from the same basic problem…it’s simply not true.

So let’s break down a few of these Disability Myths.

MYTH: “Disability has become a form of permanent welfare for a lot of folks. It’s not that hard to prove a mental illness, or mental issues, or pain issues.”

Not that hard? So, why are the vast majority of claims denied?

FACT: “Nearly 80 percent of applicants are denied at the initial level, and fewer than 4 in 10 are approved after all levels of appeal. Underscoring the strictness of the disability standard, thousands of applicants die each year while waiting for benefits. And one in five male and nearly one in six female beneficiaries die within five years of being approved for benefits. Disability Insurance beneficiaries have death rates three to six times higher than other people their age.” Center for American Progress

It’s seems pretty ridiculous to claim the system’s being widely-abused when so many die just years after receiving benefits or while they’re still waiting for an answer.

MYTH: Growth in Social Security disability claims is “astonishing”, an “epidemic” and “startling.”

Actually, it’s called demographics. Ever heard of the baby boomers? Former SSA Commissioners from both Republican and Democratic administrations have taken issue with this fact-free, hysteria-laden portrayal of the disability program’s growth.

FACT: “It is true that DI has grown significantly in the past 30 years. The growth that we’ve seen was predicted by actuaries as early as 1994 and is mostly the result of two factors: baby boomers entering their high-disability years, and women entering the workforce in large numbers in the 1970s and 1980s so that more are now “insured” for DI based on their own prior contributions.” Open Letter from former SSA Commissioners

“As Baby Boomers retire, the program’s growth has already leveled off and is projected to decline further in the coming years.” Center for American Progress

MYTH: The entire system is “broken,” rife with “fraud” and “rubber-stamping judges” bankrupting the entire Social Security program.

FACT: The Government Accountability Office found that improper payments of Social Security benefits that include Disability Insurance had an error rate of just 0.6 percent. Government Accountability Office

Social Security touches the lives of virtually every American family and has unparalleled support across all ages, political parties and demographics. The GOP led House clearly hopes to drive a wedge through that coalition, pitting seniors against people with disabilities, young versus old and workers versus retirees. So much for a new Congress that “works together.”

President Obama’s economics agenda for the middle-class is not only popular but desperately needed for millions of Americans left behind in this recovery…including Social Security beneficiaries of all ages. Of course, the GOP Congress won’t pass it but there’s always 2016.

Will the President Fight for Social Security & Medicare?

President Obama’s State of the Union address to Congress next Tuesday should provide some desperately-needed insight into just how far this administration will go to defend and strengthen America’s two most successful income and health security programs. The new GOP Congress has made their intentions clear by attacking Social Security on Day One of the new session. The White House; however, remains silent on the GOP’s latest move:

President Obama’s State of the Union address to Congress next Tuesday should provide some desperately-needed insight into just how far this administration will go to defend and strengthen America’s two most successful income and health security programs. The new GOP Congress has made their intentions clear by attacking Social Security on Day One of the new session. The White House; however, remains silent on the GOP’s latest move:

“TPM asked multiple times last week for the White House’s position on the House action, but never received a formal response, a stark contrast to the loud public pronouncements of Brown, Warren, and others. It also invokes the uneasy relationship between the White House and Social Security advocates, who were dismayed by Obama’s willingness to accept cuts to the program during the 2011 grand bargain talks with House Speaker John Boehner (R-OH).”

{Update: The White House did respond after our initial post . A spokesperson told TPM “Generally speaking, the Administration strongly opposes any efforts to undermine Congress’ ability to reallocate funds between the Social Security retirement and disability trust funds,” a White House spokesperson told TPM, “as they have done with bipartisan support numerous times in the past in both directions.”}

NCPSSM has urged the President to support reallocation, as has happened without controversy 11 previous times, to avoid a massive benefit cut Americans with disabilities simply cannot afford.

“We applaud you for making middle-class mobility and economic equality one of your top priorities. Social Security helps to provide a lifetime of economic equality by insuring millions of Americans against the risks of retirement, disability and survivorship.

For that reason, the National Committee urges you to support the reallocation from the OASI Trust Fund to the DI Trust Fund and oppose the House majority’s demand to cut benefits in exchange for addressing the Disability Insurance program’s financing. Your State of the Union address would be an ideal opportunity to reaffirm your support for Social Security.” Max Richtman, NCPSSM President/CEO

In truth, the White House could have invested an entire week just responding to all of the attacks launched by GOP Congress in its opening days (so much for working together) so it’s hard to read too much into this silence on Social Security. However, Tuesday’s State of the Union address should change that. President Obama must set the tone and make it clear to the House and Senate that cutting benefits to families who depend on Social Security and Medicare is simply not an option.

While Republicans certainly didn’t campaign on cutting benefits to middle-class families, now that they’re elected, GOP leaders in the House have made it clear that’s exactly their intention. President Obama’s State of the Union provides an important opportunity to set the record straight and push back on all of the falsehoods currently being used to justify cutting benefits to the middle class.

Here are just some of the more outrageous claims:

The new Chairman of the House Budget Committee, Rep. Tom Price (R-GA), went so far as to create his own set of Social Security numbers to justify the GOP attack by claiming Social Security:

“is a program that right now on its current course will not be able to provide 75 or 80 percent of the benefits that individuals have paid into in a relatively short period of time …”

There’s nothing about this statement that is true. Even if Congress does absolutely nothing to improve Social Security’s long-term solvency (and no one believes that will happen) the program would be forced to reduce benefits by about 25% two decades from now. Any benefit cut is unacceptable; however, it’s not too much to expect Congressional Committee Chairmen to stick to the facts. Another House Committee Chairman, the head of the Social Security subcommittee Rep. Sam Johnson (R-Texas), led recent House the effort to hold the Disability program hostage in order to extract cuts program-wide. He claims:

the program is “plagued by fraud” and that “the public is fast losing faith in Social Security, and I don’t blame them, because I have too.”

Neither are true.

The Government Accountability Office found that improper payments of Social Security benefits that include Disability Insurance had an error rate of just 0.6 percent. SSA’s Inspector General reports less than 1% fraud in the disability program. Any fraud is too much but what reasonable person would consider less than 1% of anything a “plague.”

Far from losing faith in Social Security, the American people of all ages and political parties continue to show unparalleled support for the program in spite of Congressional conservatives’ campaign to undermine it. Not only do they support Social Security in its current form, by large margins they’re willing to pay more to improve it and boost benefits. The latest National Academy of Social Insurance survey of Americans found:

Seven out of 10 participants prefer a package that would eliminate Social Security’s long-term financing gap without cutting benefits. The preferred package would:

- Gradually, over 10 years, eliminate the cap on earnings taxed for Social Security. With this change, the 6% of workers who earn more than the cap would pay into Social Security all year, as other workers do. In return, they would get somewhat higher benefits.

- Gradually, over 20 years, raise the Social Security tax rate that workers and employers each pay from 6.2% of earnings to 7.2%. A worker earning $50,000 a year would pay about 50 cents a week more each year, matched by the employer.

- Increase Social Security’s cost-of-living adjustment to reflect the inflation experienced by seniors.

- Raise Social Security’s minimum benefit so that a worker who pays into Social Security for 30 years or more can retire at 62 or later and have benefits above the federal poverty line.

With this State of the Union, President Obama has an opportunity to provide some truth-telling on Social Security and Medicare while also sending a clear message that the White House will not aide and abet conservatives who intend to cut middle-class benefits to pay for tax cuts for huge corporations and the wealthy.

We hope the President will join the American people and be bold in the defense and expansion of Social Security and Medicare rather than leave the door open to continued hostage-taking and deal-making designed to unravel the economic security so many Americans depend on.

Social Security Targeted on Day One of New Congress

Members of the new 114th Congress had barely taken their oaths of office today when they passed a proposal threatening millions of Americans

“Buried in the new rules that the House Republican majority {adopted} for the 114thCongress is a provision that could threaten Disability Insurance (DI) beneficiaries — a group of severely impaired and vulnerable Americans — with a sudden, one-fifth cut in their benefits by late 2016. The provision bars the House from replenishing the DI trust fund simply by shifting some payroll tax revenues from Social Security’s retirement trust fund.”

As NCPSSM’s Max Richtman explains, this move was pure politics:

“Today’s unprecedented House vote preventing a routine rebalancing of the Social Security Disability Trust Funds puts politics ahead of policy and partisanship ahead of people. This House Rules change would allow a 20% benefit cut for millions of disabled Americans unless there are broader Social Security benefit cuts or tax increases improving the solvency of the combined trust funds. It is difficult to believe that there is any purpose to this unprecedented change to House Rules other than to cut benefits for Americans who have worked hard all their lives, paid into Social Security, and rely on their Social Security benefits, including Disability, in order to survive.

A modest and temporary reallocation of part of the 6.2 percent Social Security tax rate to the DI Trust Fund would put the entire Social Security program on an equal footing, with all benefits payable at least until 2033. Democrats and Republicans have authorized this same strategy eleven times without controversy (including four times during the Reagan administration); however, this new House majority would rather play politics with the livelihoods of millions of Americans than solve this important funding issue. This sends a clear message to middle-class families about the House majority’s priorities — targeting Social Security for cuts clearly ranks high on their list.”

We’ve written before about the GOP strategy to force broad Social Security benefit cuts while simultaneously demonizing America’s disabled. Senator Sherrod Brown (D-OH) raised the alarm about attempts to politicize what has always been a routine and non-partisan legislative solution to balance the Social Security Trust Funds:

“Reallocation has never been controversial, but detractors working to privatize Social Security will do anything to manufacture a crisis out of a routine administrative function. Modest reallocation of payroll taxes would ensure solvency of both trust funds until 2033. But if House Republicans block reallocation, insurance for disabled Americans, veterans, and children could face severe cuts once the trust fund is exhausted in 2016.”

Not only does this proposal threaten benefit cuts to people with disabilities but it also creates a false either-or scenario that pits retirees and disabled beneficiaries against each other. That’s a particularly absurd notion since the majority of disability recipients are also older, as CBPP explains:

“A reallocation would have only a tiny effect on the retirement program’s solvency. Reallocating taxes to put the two trust funds on an even footing would prolong the DI trust fund by 17 years (from 2016 to 2033), while advancing the OASI fund’s depletion by just one year (from 2034 to 2033). The reason is simple: OASI is much bigger than DI, so a modest reallocation barely dents OASI. And before then, policymakers will almost surely address Social Security solvency in a comprehensive fashion.

Most DI recipients are older people, so helping DI helps seniors. The risk of disability rises with age, and most DI beneficiaries are older. Seventy percent of disabled workers are age 50 or older, 30 percent are 60 or older, and 20 percent are 62 or older and would actually qualify as early retirees under Social Security.”

Changing the rules of the game to target Social Security in the very first hours of a new Congress sends a clear message to seniors, people with disabilities, survivors and their families – a message that certainly wasn’t shared with voters before Election Day – American families who count on Social Security in any way should beware.

Congress Goes Home Leaving Social Security Administration Without a Director, Again

Let’s take quick stock of what this lame duck Congressional session has meant for middle-class Americans, especially seniors and their families:

- Legislation that reversed 40 years of federal law protecting retirees’ pensions was tucked quietly into the massive spending bill. The change will allow benefit cuts for more than 1.5 million workers; many of them part of a shrinking middle-class workforce in businesses such as construction and trucking.

2. $42 billion in largely corporate tax breaks was passed without the “pay-fors” demanded by Congress for virtually every other spending provision. According to the Congressional Budget Office, if Congress keeps passing short-terms extensions every year or two, the tax breaks will cost $700 billion over the coming decade. As Citizens for Tax Justice so aptly put it: “If our government has $700 billion to spare, it should be devoted to paying for things we really need, not wasted on corporate tax giveaways.”

3. Congress has headed home for the holidays without confirming a Director of the Social Security Administration. This is after nearly 18 months without a permanent agency head at a time when the agency faces the largest workload increase and budgets cuts it’s faced in its history.

Since we’ve already written about the first two items, we’re going to fill in the details on the third, including why it matters so much to Social Security beneficiaries. Social Security expert, Eric Laursen provides this recap:

“Republican senators are upset about delays and cost overruns on a new computer system at the Social Security Administration—so upset, they have blocked President Obama’s nominee for commissioner. The only the trouble is, the new computer system was planned and ordered up by the prior commissioner—a George W. Bush appointee.”

“A lot of this is simply hyperventilating. It’s not clear that the GOP senators “received information from whistleblowers,” as they claim. What happened for sure was that an interim report from the Social Security Administration’s inspector general said that officials at the SSA may have misled Congress about aspects of the $300 million computer system. The report stems from an investigation that Colvin herself ordered after she took over from Astrue early last year. And when the senators point their fingers at “the activities of certain members of your immediate office” in their letter, they would be referring to officials who were in place under Astrue as well. Yet the tone of their letter suggests, misleadingly, that Colvin herself may be under suspicion.”

“It’s been an article of faith for Republicans from the early days of the Reagan administration that the heads of agencies like the SSA must not come from within the agency itself. If at all possible, they must be strongly conservative critics who are committed to “reforming” it by shrinking it and pushing back against its unionized workforce. The less experience they have with the day-to-day running of a big, complex agency like the SSA, the better. Astrue fit that bill. Colvin, by contrast, represents the so-called “permanent government” Republicans are determined to break. That they were ready to exploit any chink in her armor, however unfair, should have been foreseeable.”

Colvin’s qualifications to be SSA’s Director are undeniable, as NCPSSM’s President/CEO, Max Richtman, told the Senate in a letter last week:

“Ms. Colvin has extensive experience with the Social Security Administration (SSA) that makes her uniquely qualified to provide leadership to this vitally important agency. She has been Acting Commissioner of SSA for more than a year and, before that, had served since 2010 as the agency’s Deputy Commissioner. In addition, she has in the past held a number of other key executive positions at Social Security headquarters, including Deputy Commissioner for Programs and Policy and Deputy Commissioner for Operations.

The broad-ranging nature of Ms. Colvin’s experience has provided her with the knowledge and the temperament to lead SSA through the years that lie ahead. We personally know her to be a woman of great integrity and respect the compassionate leadership she has displayed throughout a long and distinguished career.”

Why does this matter to beneficiaries? Because the Social Security Administration needs a leader in place to tackle the challenges ahead. Leaving the agency in limbo leaves it vulnerable to even further attacks virtually guaranteed with the new Congress:

… as Social Security faces the sharpest increase in its workload and its most bitter political challenges since its creation in 1935, it will continue to chug along without an official commissioner. Colvin, 72, will stay on as acting commissioner, a post she has held since February 2013.”

“…there’s no reason to doubt Colvin’s commitment to Social Security, which she served as a high-level executive from 1994 to 2001, returning in 2010 as deputy commissioner. As Paul Van de Water of the Center on Budget and Policy Priorities observes, Colvin has to work with the budget cards she’s dealt: “She been doing a good job under very difficult circumstances, with a continually shrinking real budget,” he said.

Indeed, the problem is Social Security’s budget — and the Democrats’ failure to safeguard it. The crisis emerged in 2011, when Congress started to pare the president’s budget requests for the Social Security Administration. From then through fiscal 2013, Social Security got $2.7 billion less than the president sought. Some of the shortfall was restored this year, but most of the increase was designated for anti-fraud programs, not pure administration.”

Michael Hiltzik at the Los Angeles Times asks, “Are the Democrats allowing Social Security to Twist in the Wind?” We think that’s a very good question.

Will the President’s Commitment to Middle-Class Agenda Protect Social Security too?

There is always plenty of Monday morning quarterbacking after each year’s State of the Union. However, reading the commentary on last night’s speech was especially interesting since President Obama has clearly decided to take the gloves off in pursuing a popular middle-class economic agenda the American people support but the GOP-controlled Congress has no intention of passing:

“Republicans said that they were caught off guard by a major component of the president’s 2015 agenda, which he announced over the weekend and detailed further in his speech, to raise taxes and fees on the wealthiest taxpayers and the largest financial firms to pay for, among other things, tax breaks for the middle class and free community college. While these programs may prove popular with many Americans, Republicans said that they hoped the American public would see them as a ploy from a president who knows Congress will never pass them.” The New York Times

What the Republican leadership has supported is more tax cuts for huge corporations and the wealthy plus cuts to Social Security and Medicare. While the President didn’t emphasize Social Security and Medicare in last night’s State of the Union, he did highlight their importance to American families’ economic and health security. Truth is, you simply can’t improve the financial outlook for average Americans without protecting these programs. But of course, these days “protect” has very different meanings depending on whom you talk to in Washington.

Remember all those Congressional campaign promises about “protecting” Social Security? For the newly sworn-in GOP House what that actually meant was voting just hours after taking their oaths of office to put Social Security benefits cuts at the top of the Congressional agenda. You’ve got to give the House leadership credit for stealth. No one, outside a small circle of Republican Rules Committee members and GOP leadership, even knew this Social Security attack was coming. Slipped inside what’s usually a routine administrative start to each Congressional session was an unprecedented change to House rules that would allow a 20% benefit cut for millions of disabled Americans unless there are broader Social Security benefit cuts or tax increases. Of course, House Republicans have no intention of passing tax increases so guess what’s left? Benefit cuts to millions of Americans who receive Social Security.

This House vote illustrates the increasingly Orwellian nature of our political discourse, where words have little meaning because “save” means “slash” and “protect” means “privatize.” What’s even more noxious about this particular assault on Social Security is the ongoing effort to pit beneficiaries – retirees, the disabled, survivors and their families – against each other. Proponents of this stealth rule change in the House claim seniors will somehow suffer if the disabled are allowed access to the benefits they too have contributed to throughout their working years. That’s a particularly absurd notion since the majority of disability recipients are also older Americans. However, the divide and conquer politics of fear all-too-often work. This latest Social Security attack is built on a foundation of lies intended to demonize America’s disabled community.

No doubt, you’ve already heard the messaging, most recently espoused in an especially candid way by Senator and Presidential hopeful Rand Paul that: Social Security disability fraud is rampant because it’s so easy to receive benefits and people would rather collect a hefty check from the government than work. It’s the 2015 incarnation of “our nation is full of ‘welfare queens’ and ‘greedy geezers.’” It also suffers from the same basic problem…it’s simply not true.

So let’s break down a few of these Disability Myths.

MYTH: “Disability has become a form of permanent welfare for a lot of folks. It’s not that hard to prove a mental illness, or mental issues, or pain issues.”

Not that hard? So, why are the vast majority of claims denied?

FACT: “Nearly 80 percent of applicants are denied at the initial level, and fewer than 4 in 10 are approved after all levels of appeal. Underscoring the strictness of the disability standard, thousands of applicants die each year while waiting for benefits. And one in five male and nearly one in six female beneficiaries die within five years of being approved for benefits. Disability Insurance beneficiaries have death rates three to six times higher than other people their age.” Center for American Progress

It’s seems pretty ridiculous to claim the system’s being widely-abused when so many die just years after receiving benefits or while they’re still waiting for an answer.

MYTH: Growth in Social Security disability claims is “astonishing”, an “epidemic” and “startling.”

Actually, it’s called demographics. Ever heard of the baby boomers? Former SSA Commissioners from both Republican and Democratic administrations have taken issue with this fact-free, hysteria-laden portrayal of the disability program’s growth.

FACT: “It is true that DI has grown significantly in the past 30 years. The growth that we’ve seen was predicted by actuaries as early as 1994 and is mostly the result of two factors: baby boomers entering their high-disability years, and women entering the workforce in large numbers in the 1970s and 1980s so that more are now “insured” for DI based on their own prior contributions.” Open Letter from former SSA Commissioners

“As Baby Boomers retire, the program’s growth has already leveled off and is projected to decline further in the coming years.” Center for American Progress

MYTH: The entire system is “broken,” rife with “fraud” and “rubber-stamping judges” bankrupting the entire Social Security program.

FACT: The Government Accountability Office found that improper payments of Social Security benefits that include Disability Insurance had an error rate of just 0.6 percent. Government Accountability Office

Social Security touches the lives of virtually every American family and has unparalleled support across all ages, political parties and demographics. The GOP led House clearly hopes to drive a wedge through that coalition, pitting seniors against people with disabilities, young versus old and workers versus retirees. So much for a new Congress that “works together.”

President Obama’s economics agenda for the middle-class is not only popular but desperately needed for millions of Americans left behind in this recovery…including Social Security beneficiaries of all ages. Of course, the GOP Congress won’t pass it but there’s always 2016.

Will the President Fight for Social Security & Medicare?

“TPM asked multiple times last week for the White House’s position on the House action, but never received a formal response, a stark contrast to the loud public pronouncements of Brown, Warren, and others. It also invokes the uneasy relationship between the White House and Social Security advocates, who were dismayed by Obama’s willingness to accept cuts to the program during the 2011 grand bargain talks with House Speaker John Boehner (R-OH).”

{Update: The White House did respond after our initial post . A spokesperson told TPM “Generally speaking, the Administration strongly opposes any efforts to undermine Congress’ ability to reallocate funds between the Social Security retirement and disability trust funds,” a White House spokesperson told TPM, “as they have done with bipartisan support numerous times in the past in both directions.”}

NCPSSM has urged the President to support reallocation, as has happened without controversy 11 previous times, to avoid a massive benefit cut Americans with disabilities simply cannot afford.

“We applaud you for making middle-class mobility and economic equality one of your top priorities. Social Security helps to provide a lifetime of economic equality by insuring millions of Americans against the risks of retirement, disability and survivorship.

For that reason, the National Committee urges you to support the reallocation from the OASI Trust Fund to the DI Trust Fund and oppose the House majority’s demand to cut benefits in exchange for addressing the Disability Insurance program’s financing. Your State of the Union address would be an ideal opportunity to reaffirm your support for Social Security.” Max Richtman, NCPSSM President/CEO

In truth, the White House could have invested an entire week just responding to all of the attacks launched by GOP Congress in its opening days (so much for working together) so it’s hard to read too much into this silence on Social Security. However, Tuesday’s State of the Union address should change that. President Obama must set the tone and make it clear to the House and Senate that cutting benefits to families who depend on Social Security and Medicare is simply not an option.

While Republicans certainly didn’t campaign on cutting benefits to middle-class families, now that they’re elected, GOP leaders in the House have made it clear that’s exactly their intention. President Obama’s State of the Union provides an important opportunity to set the record straight and push back on all of the falsehoods currently being used to justify cutting benefits to the middle class.

Here are just some of the more outrageous claims:

The new Chairman of the House Budget Committee, Rep. Tom Price (R-GA), went so far as to create his own set of Social Security numbers to justify the GOP attack by claiming Social Security:

“is a program that right now on its current course will not be able to provide 75 or 80 percent of the benefits that individuals have paid into in a relatively short period of time …”

There’s nothing about this statement that is true. Even if Congress does absolutely nothing to improve Social Security’s long-term solvency (and no one believes that will happen) the program would be forced to reduce benefits by about 25% two decades from now. Any benefit cut is unacceptable; however, it’s not too much to expect Congressional Committee Chairmen to stick to the facts. Another House Committee Chairman, the head of the Social Security subcommittee Rep. Sam Johnson (R-Texas), led recent House the effort to hold the Disability program hostage in order to extract cuts program-wide. He claims:

the program is “plagued by fraud” and that “the public is fast losing faith in Social Security, and I don’t blame them, because I have too.”

Neither are true.

The Government Accountability Office found that improper payments of Social Security benefits that include Disability Insurance had an error rate of just 0.6 percent. SSA’s Inspector General reports less than 1% fraud in the disability program. Any fraud is too much but what reasonable person would consider less than 1% of anything a “plague.”

Far from losing faith in Social Security, the American people of all ages and political parties continue to show unparalleled support for the program in spite of Congressional conservatives’ campaign to undermine it. Not only do they support Social Security in its current form, by large margins they’re willing to pay more to improve it and boost benefits. The latest National Academy of Social Insurance survey of Americans found:

Seven out of 10 participants prefer a package that would eliminate Social Security’s long-term financing gap without cutting benefits. The preferred package would:

- Gradually, over 10 years, eliminate the cap on earnings taxed for Social Security. With this change, the 6% of workers who earn more than the cap would pay into Social Security all year, as other workers do. In return, they would get somewhat higher benefits.

- Gradually, over 20 years, raise the Social Security tax rate that workers and employers each pay from 6.2% of earnings to 7.2%. A worker earning $50,000 a year would pay about 50 cents a week more each year, matched by the employer.

- Increase Social Security’s cost-of-living adjustment to reflect the inflation experienced by seniors.

- Raise Social Security’s minimum benefit so that a worker who pays into Social Security for 30 years or more can retire at 62 or later and have benefits above the federal poverty line.

With this State of the Union, President Obama has an opportunity to provide some truth-telling on Social Security and Medicare while also sending a clear message that the White House will not aide and abet conservatives who intend to cut middle-class benefits to pay for tax cuts for huge corporations and the wealthy.

We hope the President will join the American people and be bold in the defense and expansion of Social Security and Medicare rather than leave the door open to continued hostage-taking and deal-making designed to unravel the economic security so many Americans depend on.

Social Security Targeted on Day One of New Congress

Members of the new 114th Congress had barely taken their oaths of office today when they passed a proposal threatening millions of Americans

“Buried in the new rules that the House Republican majority {adopted} for the 114thCongress is a provision that could threaten Disability Insurance (DI) beneficiaries — a group of severely impaired and vulnerable Americans — with a sudden, one-fifth cut in their benefits by late 2016. The provision bars the House from replenishing the DI trust fund simply by shifting some payroll tax revenues from Social Security’s retirement trust fund.”

As NCPSSM’s Max Richtman explains, this move was pure politics:

“Today’s unprecedented House vote preventing a routine rebalancing of the Social Security Disability Trust Funds puts politics ahead of policy and partisanship ahead of people. This House Rules change would allow a 20% benefit cut for millions of disabled Americans unless there are broader Social Security benefit cuts or tax increases improving the solvency of the combined trust funds. It is difficult to believe that there is any purpose to this unprecedented change to House Rules other than to cut benefits for Americans who have worked hard all their lives, paid into Social Security, and rely on their Social Security benefits, including Disability, in order to survive.

A modest and temporary reallocation of part of the 6.2 percent Social Security tax rate to the DI Trust Fund would put the entire Social Security program on an equal footing, with all benefits payable at least until 2033. Democrats and Republicans have authorized this same strategy eleven times without controversy (including four times during the Reagan administration); however, this new House majority would rather play politics with the livelihoods of millions of Americans than solve this important funding issue. This sends a clear message to middle-class families about the House majority’s priorities — targeting Social Security for cuts clearly ranks high on their list.”

We’ve written before about the GOP strategy to force broad Social Security benefit cuts while simultaneously demonizing America’s disabled. Senator Sherrod Brown (D-OH) raised the alarm about attempts to politicize what has always been a routine and non-partisan legislative solution to balance the Social Security Trust Funds:

“Reallocation has never been controversial, but detractors working to privatize Social Security will do anything to manufacture a crisis out of a routine administrative function. Modest reallocation of payroll taxes would ensure solvency of both trust funds until 2033. But if House Republicans block reallocation, insurance for disabled Americans, veterans, and children could face severe cuts once the trust fund is exhausted in 2016.”

Not only does this proposal threaten benefit cuts to people with disabilities but it also creates a false either-or scenario that pits retirees and disabled beneficiaries against each other. That’s a particularly absurd notion since the majority of disability recipients are also older, as CBPP explains:

“A reallocation would have only a tiny effect on the retirement program’s solvency. Reallocating taxes to put the two trust funds on an even footing would prolong the DI trust fund by 17 years (from 2016 to 2033), while advancing the OASI fund’s depletion by just one year (from 2034 to 2033). The reason is simple: OASI is much bigger than DI, so a modest reallocation barely dents OASI. And before then, policymakers will almost surely address Social Security solvency in a comprehensive fashion.

Most DI recipients are older people, so helping DI helps seniors. The risk of disability rises with age, and most DI beneficiaries are older. Seventy percent of disabled workers are age 50 or older, 30 percent are 60 or older, and 20 percent are 62 or older and would actually qualify as early retirees under Social Security.”

Changing the rules of the game to target Social Security in the very first hours of a new Congress sends a clear message to seniors, people with disabilities, survivors and their families – a message that certainly wasn’t shared with voters before Election Day – American families who count on Social Security in any way should beware.

Congress Goes Home Leaving Social Security Administration Without a Director, Again

Let’s take quick stock of what this lame duck Congressional session has meant for middle-class Americans, especially seniors and their families:

- Legislation that reversed 40 years of federal law protecting retirees’ pensions was tucked quietly into the massive spending bill. The change will allow benefit cuts for more than 1.5 million workers; many of them part of a shrinking middle-class workforce in businesses such as construction and trucking.

2. $42 billion in largely corporate tax breaks was passed without the “pay-fors” demanded by Congress for virtually every other spending provision. According to the Congressional Budget Office, if Congress keeps passing short-terms extensions every year or two, the tax breaks will cost $700 billion over the coming decade. As Citizens for Tax Justice so aptly put it: “If our government has $700 billion to spare, it should be devoted to paying for things we really need, not wasted on corporate tax giveaways.”

3. Congress has headed home for the holidays without confirming a Director of the Social Security Administration. This is after nearly 18 months without a permanent agency head at a time when the agency faces the largest workload increase and budgets cuts it’s faced in its history.

Since we’ve already written about the first two items, we’re going to fill in the details on the third, including why it matters so much to Social Security beneficiaries. Social Security expert, Eric Laursen provides this recap:

“Republican senators are upset about delays and cost overruns on a new computer system at the Social Security Administration—so upset, they have blocked President Obama’s nominee for commissioner. The only the trouble is, the new computer system was planned and ordered up by the prior commissioner—a George W. Bush appointee.”

“A lot of this is simply hyperventilating. It’s not clear that the GOP senators “received information from whistleblowers,” as they claim. What happened for sure was that an interim report from the Social Security Administration’s inspector general said that officials at the SSA may have misled Congress about aspects of the $300 million computer system. The report stems from an investigation that Colvin herself ordered after she took over from Astrue early last year. And when the senators point their fingers at “the activities of certain members of your immediate office” in their letter, they would be referring to officials who were in place under Astrue as well. Yet the tone of their letter suggests, misleadingly, that Colvin herself may be under suspicion.”

“It’s been an article of faith for Republicans from the early days of the Reagan administration that the heads of agencies like the SSA must not come from within the agency itself. If at all possible, they must be strongly conservative critics who are committed to “reforming” it by shrinking it and pushing back against its unionized workforce. The less experience they have with the day-to-day running of a big, complex agency like the SSA, the better. Astrue fit that bill. Colvin, by contrast, represents the so-called “permanent government” Republicans are determined to break. That they were ready to exploit any chink in her armor, however unfair, should have been foreseeable.”

Colvin’s qualifications to be SSA’s Director are undeniable, as NCPSSM’s President/CEO, Max Richtman, told the Senate in a letter last week:

“Ms. Colvin has extensive experience with the Social Security Administration (SSA) that makes her uniquely qualified to provide leadership to this vitally important agency. She has been Acting Commissioner of SSA for more than a year and, before that, had served since 2010 as the agency’s Deputy Commissioner. In addition, she has in the past held a number of other key executive positions at Social Security headquarters, including Deputy Commissioner for Programs and Policy and Deputy Commissioner for Operations.

The broad-ranging nature of Ms. Colvin’s experience has provided her with the knowledge and the temperament to lead SSA through the years that lie ahead. We personally know her to be a woman of great integrity and respect the compassionate leadership she has displayed throughout a long and distinguished career.”

Why does this matter to beneficiaries? Because the Social Security Administration needs a leader in place to tackle the challenges ahead. Leaving the agency in limbo leaves it vulnerable to even further attacks virtually guaranteed with the new Congress:

… as Social Security faces the sharpest increase in its workload and its most bitter political challenges since its creation in 1935, it will continue to chug along without an official commissioner. Colvin, 72, will stay on as acting commissioner, a post she has held since February 2013.”

“…there’s no reason to doubt Colvin’s commitment to Social Security, which she served as a high-level executive from 1994 to 2001, returning in 2010 as deputy commissioner. As Paul Van de Water of the Center on Budget and Policy Priorities observes, Colvin has to work with the budget cards she’s dealt: “She been doing a good job under very difficult circumstances, with a continually shrinking real budget,” he said.

Indeed, the problem is Social Security’s budget — and the Democrats’ failure to safeguard it. The crisis emerged in 2011, when Congress started to pare the president’s budget requests for the Social Security Administration. From then through fiscal 2013, Social Security got $2.7 billion less than the president sought. Some of the shortfall was restored this year, but most of the increase was designated for anti-fraud programs, not pure administration.”

Michael Hiltzik at the Los Angeles Times asks, “Are the Democrats allowing Social Security to Twist in the Wind?” We think that’s a very good question.